Payments made by a trade or a business to third parties that are other than nonemployee compensation are reported on Form 1099 MISC. In this article, you will get detailed information about it:

Table of Content

- 1 About Form 1099 MISC Income

- 2 Form 1099-MISC is Filed BY:

- 3 Way of Filing Form 1099-MISC

- 4 Changes in New 1099-MISC

- 5 How to File of the IRS Form 1099-MISC

- 6 Some Important Facts About Form 1099 MISC:

- 7 When to File 1099- MISC Form

- 8 How to File Form 1099-MISC is done

- 9 What Details must be included on the Form 1099-MISC?

- 10 Frequently Asked Questions

About Form 1099 MISC Income

The IRS Form 1099 MISC is an information return used to document any miscellaneous payments made to self-employed people for services rendered during the calendar year. Each Form 1099-MISC must be prepared and submitted to the IRS by the business owner/payer on behalf of each individual.

An Internal Revenue Service (IRS) form is known as Form 1099-MISC. It is also known as Miscellaneous Income or Miscellaneous Information, which is used to report specific types of miscellaneous compensation, including rent, prizes and awards, healthcare payments, and payments to attorneys. The payer is required to provide recipients with copies B of Form 1099-MISC after reporting payments.

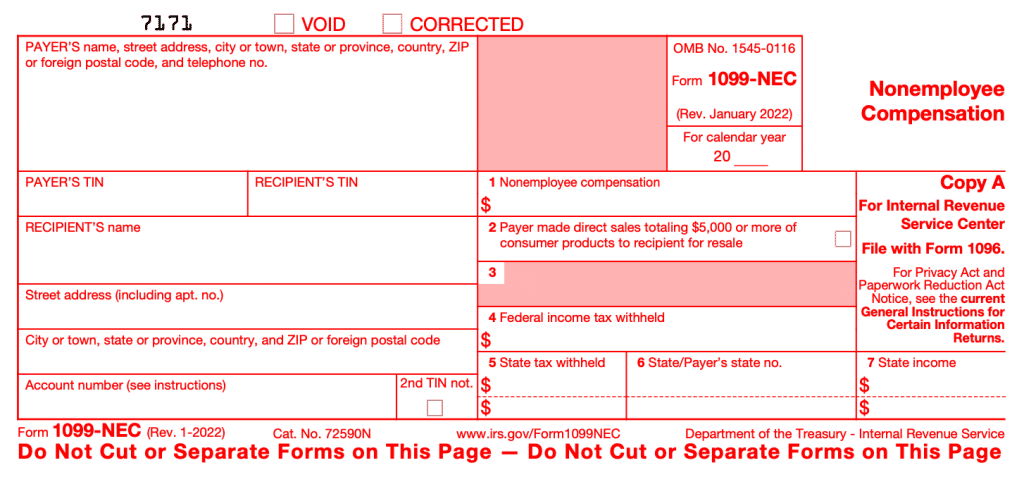

Prior to the 2020 tax year, Form 1099-MISC was also used to report non-employee compensation for independent contractors, freelancers, sole proprietors, and self-employed people.

This non-employee compensation will be reported on Form 1099-NEC, or Nonemployee Compensation, beginning in 2020. These reports typically only include company payments, not personal ones.

- Miscellaneous compensation, Including rent, Prizes, and awards, Payments for medical and healthcare, and payments to attorneys, are reported using Form 1099-MISC.

- The income of taxpayers who are not employees, Such as independent contractors, freelancers, sole proprietors, and self-employed people, was also reported using this method until 2020.

- Form 1099-NEC is now used to report compensation for independent contractors.

- If you paid a taxpayer $10 or more in royalties or $600 or more in other kinds of supplemental income throughout a calendar year, they would get a Form 1099-MISC in return.

Form 1099-MISC is Filed BY:

Those who have given at least $10 in royalties, broker fees in place of dividends, or tax-exempt interest to another person must fill out and send out Form 1099-MISC:

Miscellaneous Income (also known as Miscellaneous Information). Additionally, it is emailed to everyone you paid at least $600 to in the following categories throughout the calendar year:

- Additional income payments

- Rents (agents and managers of real estate and property report rent paid to property owners or you report the office space rent that you have paid)

- Money transferred to an individual, partnership, or estate from a contract with a hypothetical principle

- Payment to a lawyer

- Payment in cash for fish (or other aquatic life) obtained from anyone who earns a living by fishing

- Healthcare and medical expenses (made in the course of your trade or business)

- Awards and rewards

- Insurance payments for crops

- Any fishing vessel continues

Additionally, the form is used to report direct sales of at least $5,000 worth of consumer goods to a buyer for resale outside of a regular retail location.

By February 1st, the payer must send the receiver the form, and by March 1st, they must file it with the IRS (March 31 if filing electronically). The document can be affixed to the recipient’s tax return.

Way of Filing Form 1099-MISC

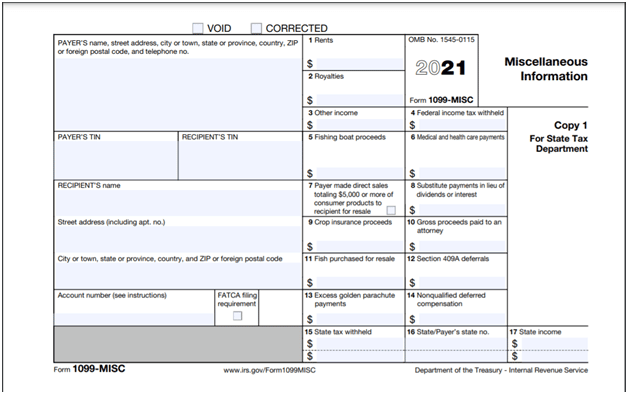

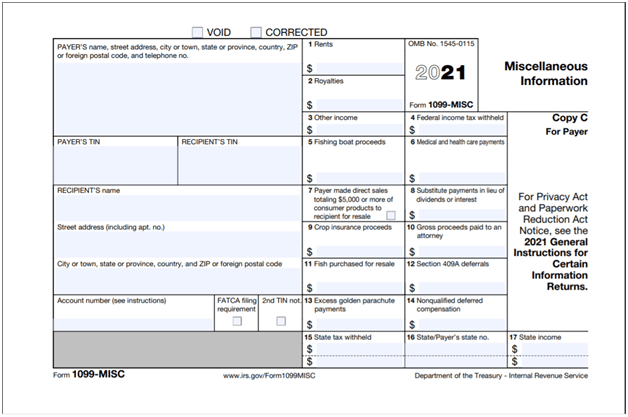

The IRS website offers a multipart fill able Form 1099-MISC.

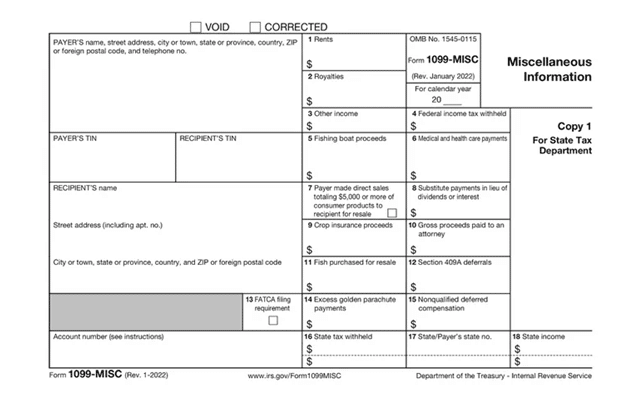

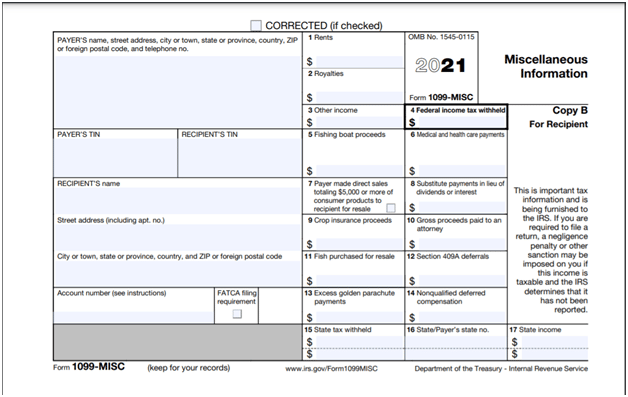

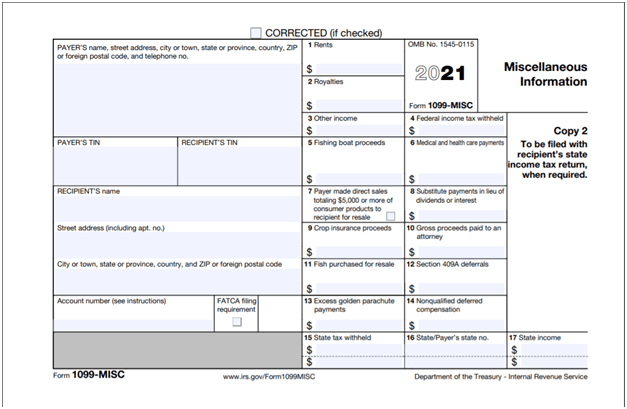

Copy A of the 1099-MISC is highlighted in red. This version of the form is only for use by the IRS; printing is not permitted.

You can fill out, download, and print the form’s black portions.

- Copies 1 and 2 are sent to the recipient’s state tax office.

- The recipient receives copies B and 2, which are for their state tax return.

- The payer keeps Copy C for record-keeping purposes.

Along with the recipient’s name, address, and Social Security number, the payer also supplies their own name, address, and tax identification number.

Different box numbers on the updated 1099-MISC form are used to report various sorts of payments, such as rents in box 1 and royalties in box 2. You should also complete Box 4: Federal Income Tax Withheld and Box 16: State Tax Withheld, as necessary.

Changes in New 1099-MISC

The following things are normally reported to you on Form 1099-MISC if you received payments above specified thresholds for your trade or business unrelated to nonemployee remuneration.

- Royalties (box 2) of at least $10, broker payments in lieu of dividends, or tax-free interest (box 8).

- Minimum of $600 in

- Rent (box 1)

- Prizes and awards (box 3)

- Other income payments (box 3)

- Generally, the money paid from a notional principal contract to a person, partnership, or estate (box 3)

- Any proceeds from the sale of a fishing boat (box 5)

- Health and Medical Payments (box 6)

- Crop Insurance proceeds (box 9)

- Payments to an attorney (box 10)

- Section 409A deferrals (box 12)

- Nonqualified deferred compensation (box 14).

Any company or person that withheld federal income tax on your behalf in accordance with backup withholding regulations, regardless of the amount withheld or the amount paid, must also send you a Form 1099-MISC.

Form 1099-MISC or Form 1099-NEC must be used to report direct sales of $5,000 or more. The latter must be filed and given to you by January 31 if it is used.

How to File of the IRS Form 1099-MISC

Steps of Filing of Form 1099-MISC are:

- Name, Location, and contact information for you

- You TIN (Taxpayer Identification Number)

- Receiver’s TIN

- Address and name of the recipient

- if necessary, your account number

- Amount paid throughout the tax year to the recipient

Some Important Facts About Form 1099 MISC:

- The Internal Revenue Service (IRS) form 1099-MISC, Miscellaneous Income, is used to report specific types of miscellaneous compensation, including rent, prizes and awards, healthcare payments, and payments to attorneys.

- Every time you pay an unincorporated independent contractor, such as a sole owner or partner, you must submit a 1099-MISC form.

- LLC-$600 or more each year for services rendered in the course of your business, paid by cash or direct transfer.

- But keep in mind that you only need to file a 1099-MISC when an independent contractor provides services for your trade or business.

- For payments made for services not related to your business, you are not required to file a 1099-MISC.

- Anyone who has given another person at least $10 in royalties, broker payments in place of dividends, or tax-exempt interest is required to file and send out Form 1099-MISC revenue.

- The direct sale of at least $5,000 worth of consumer goods to a customer for resale outside of a fixed retail location is also reported on the form 1099 MISC.

- By February 1st, the payer must provide the form to the receiver, and by March 1st, it must be filed with the IRS.

- By submitting IRS Form 8809, you can automatically receive a 30-day extension on the deadline for submitting 1099s.

- The amounts on Form 1099-MISC are frequently identical in terms of federal and state taxes.

When to File 1099- MISC Form

The main rule is that whenever you pay an unincorporated independent contractor, or an independent contractor who is a sole proprietor, partner, or LLC member, $600 or more in a year for work performed in the course of your trade or business, by direct deposit or cash, you must file a 1099-MISC. Payments made electronically are not subject to reporting requirements.

However, keep in mind that you only need to file a 1099-MISC when an independent contractor provides services for your trade or business. An activity carried out for gain or profit is referred to as a trade or business. For payments made for services not related to your business, you are not required to file a 1099-MISC. paying independent contractors for personal or domestic services falls under this category.

How to File Form 1099-MISC is done

The form 1099-MISC has multiple parts. Here are the components of the form and the addresses for each:

Copy B and Copy 2 must be delivered by January 31 to the independent contractor.

- The IRS must receive Copy ‘A’ no later than January 31.

- If your state has a state income tax, copy 1 should be given to the taxing authorities there. The deadline for filing in most states is probably January 31, but check with your state’s tax office.

- You should keep Copy C in your files.

By submitting IRS Form 8809, Extension of Time to File Information Returns, you can automatically receive a 30-day extension on the deadline for submitting 1099s. By January 31st, the paperwork must be sent to the IRS. The deadline to deliver copies of the forms to the contractors hired the previous year is not extended by this extension; it just extends the time you have to file your 1099 Forms with the IRS.

Most firms now submit their 1099s electronically to the IRS rather than on paper. If you must submit 250 or more information returns to the IRS, you must do so electronically. With accounting software like Deskera, electronic filing is a simple process. These papers can also be filed through payroll tax services.

A paper copy of the 1099-MISC must be given to independent contractors unless they consent to receiving an electronic copy.

You cannot simply photocopy the 1099-MISC form from the IRS website if you need to file a paper copy. You require an original copy of the multi-part form, which you can get from the IRS or office supply or stationery shops.

The payer’s information is on the left top side of the document, whereas your information is on the left lower side of Form 1099-MISC. You should expect your Social Security Number (SSN), either in full or just the final few digits, to be printed there as well.

Although your complete SSN is required for some other forms, such the W-2, the first few digits of your SSN may be omitted from the 1099-MISC in order to preserve your privacy. Regardless of what is written on the form, the lender submits Copy A of the document to the IRS along with your full Social Security number.

Under ticking the relevant box on Form 1099-MISC, some payers are now required by new laws to adhere to the requirements of the Foreign Account Tax Compliance Act (FATCA).

It’s possible that FATCA reporting is necessary if the box for it is checked. At your own risk, disregard the checkbox. Failure to comply with FATCA might result in substantial penalties, including criminal charges.

If you received more than USD 600 in rent during the course of the year, that amount will be included in:

BOX 1: This includes both equipment rentals and rent for coin-operated amusements.

BOX 2: contains information about royalties that total greater than US$10 gross. Gas, oil, or mineral property royalties are examples of this. Surface royalties (which are disclosed in the Box 1 amount), working interest gas or oil payments (which are disclosed in Form 1099-NEC), and royalties from timber pay-as-cut contracts are not included (which have their own form). Box 2 also includes information on royalty payments from intangibles including patents, trade names, copyrights, and trademarks.

BOX 3: Included in this are earnings from Indian gambling, honoraria, rewards, prizes (including any winnings from fantasy sports), taxable damages, and any other income that exceeds USD 600. Box 3 also lists the money beneficiaries of dead employees received.

Although it might appear strange, keep in mind that Box 3 is used to report revenue that cannot be reported in any other boxes or on any other forms. Typically, the value from Box 3 will appear on line 8 of your 1040, under “Other Income.” On the other hand, if the money came from a business or trade, it needs to be reported on a Schedule C and/or Schedule F.

BOX 4: Any federal taxes that are withheld will be included in the amount in BOX 4. The majority of the time, this is due to backup withholding for those who failed to provide their tax ID number (TIN) or who had another backup withholding requirement.

BOX 5: The revenues from fishing boats will be in BOX 5, albeit it is unlikely that many will be affected. For vessels with typically less than ten crew members, this box includes any portion of the catch’s revenues as well as the fair market value of any disbursements in kind.

Also reported in Box 5 are cash payments of less than $100 per trip that are subject to minimum catches and are made only to fulfill additional tasks. But instead of the 1099-MISC, wages will appear on the W-2.

BOX 6: Payments you received as a doctor or other healthcare practitioner or supplier totaling at least USD 600 will be included in the BOX 6 amount. Only payments made in the course of business are covered by this (not things like personal visits). It also covers payments made by insurers under health, accident, and sickness insurance plans.

There may be exceptions to the reporting requirements for payments made through Flexible Spending Arrangements (FSAs) or Health Reimbursement Arrangements (HRAs). Payments for medical or healthcare services made to businesses, including professional corporations, are not exempt from the requirement to issue Form 1099-MISC.

BOX 7: If you sold someone $5,000 or more worth of consumer goods on a buy-sell, deposit-commission, or other commission basis for resale elsewhere other than in a permanent retail establishment, check BOX 7. This box is not for entering monetary values. Giving the recipient a report for direct sales does not need the use of the official form. It should be sufficient to provide this information in a letter along with commissions, accolades, prizes, and so forth.

BOX 8: It is rare for these boxes to have an amount for the majority of people.

BOX 14: Since Section 409A reporting could be done on other forms, Box 14 can be left empty.

BOX 15, 16, 17: Information on one or more states. If you live in a state where there is an income tax, even though the IRS does not mandate it, this information will still be helpful to you (as most do).

The amounts on Form 1099-MISC are frequently the same for federal and state tax purposes. Even though it’s not very frequent, if any money was withheld for the state tax, it will be reflected in the Box 15 amount.

What Details must be included on the Form 1099-MISC?

In Boxes 1–17, a payer must disclose their business information, the contractor’s information, and finally the payment information.

Name, street address, city or town, state or province, nation, ZIP code or other international postal code, and phone number of the payee

- A payer’s TIN

- Beneficiary’s TIN

- Beneficiary’s Name

- Dwelling address

- Choose the FATCA filing required checkbox.

The payer is required to declare all payments and tax withheld from Box 1 through Box 18.

- Box 1: Rents

- Box 2: Fees for use

- Box 3: Extra Revenue

- Box 4: Federal Income Tax withheld

- Box 5: Progress of Fishing Boat

- Box 6: Payments for Medical and Health Services

- Box 7: The payer made direct sales of consumer goods to a beneficiary for resale totaling $5,000 or more (Check this box, if required)

- Box 8: Payments Substituted for Dividends or Interest

- Box 9: Refunds from Crop Insurance

- Box 10: Gross Revenues paid to an attorney

- Box 11: Fish purchased for resale

- Box 12: Deferrals under Section 409A

- Box 13: FATCA Filing Requirement

- Box 14: Extra payouts under the golden parachute

- Box 15: Deferred compensation that is not qualifying

- Box 16: State tax deducted

- Box 17: State/state Payer’s number

- Box 18: State income

Businesses that give out certain types of miscellaneous remuneration, such as rent, prizes, and awards, healthcare payments, and payments to attorneys, must utilize Form 1099-MISC to report these payments to the IRS and to the receivers of them. The recipients must include the amounts as income on their tax filings.

Nonemployee compensation is now reported on Form 1099-NEC instead of Form 1099-MISC, starting with the 2020 tax year. The aim of Form 1099-MISC is to keep track of stated payments and account for them as income for payees and a business deduction for payers.

Frequently Asked Questions

What is the Function of 1099-MISC Form?

Various types of compensation, such as rent, royalties, prizes, and awards, healthcare payments, and payments to attorneys, are reported using Form 1099-MISC.

Should I Include a 1099-MISC in my Tax Return?

Any income that appears on your 1099-MISC must be included in your tax return. The form is optional, but you should save it for your records even if you don’t submit your taxes with it. Any taxes that were withheld, including state and local taxes, can be written off on the relevant form.

Who is Required to File Form 1099-MISC?

Payments of at least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest to another person and at least $600 for certain rent paid, prizes and awards, and other listed income payments, as required by the IRS, must be completed and filed on Form 1099-MISC with the Internal Revenue Service (IRS), along with sending a copy to the payee. Sending the form to the receiver by February 1 and filing it with the IRS by March 1 are the deadlines (March 31 if filing electronically).