|

|

The reconciliation of accounts is the feature of QuickBooks that users widely look up to. Through reconciliation, you can save time and gets your accounts managed effectively. This is the best and most useful feature of the Accounting Software.

Dancing Numbers helps small businesses, entrepreneurs, and CPAs to do smart transferring of data to and from QuickBooks Online. Utilize import, export, and delete services of Dancing Numbers software.

In QuickBooks accounting software, While you do the reconciliation of accounts sometimes discrepancies can occur. While doing that, there are chances of having a mismatch in balance. An inaccurate review of the report is not the only reason of the QuickBooks reconciliation discrepancy error. If you match the report forcefully that can also be the reason of the QuickBooks reconciliation discrepancy error. We suggest to discover new changes to get rid of the discrepancy. There should be no mismatch in the balance because of the changes.

What is Reconcile Discrepancies in QuickBooks?

QuickBooks is not the software that helps you with your accounting and Transaction Detailing Processes. It is also about the management of the financial data in a proper way. This feature helps you to ensure that whatever transactions are made for the business are accurately stored and managed.

It reconciles the data properly to indicate tallied data. However, there are times when you find that the accounts, after reconciliation, show different balances. These are called reconciliation discrepancies.

Reasons for Reconciliation Discrepancy in QuickBooks Online

Mentioning a few of the prevalent reasons of the reconciliation discrepancies in QuickBooks Online, QuickBooks Desktop, and other versions of QuickBooks accounting software:

- If Inaccurate Ending Balance has been Entered in the beginning of the Reconciliation

- If the Transactions are Already Reconciled are Edited or Deleted

- If the Transactions are Missing or there is any Duplicate Transactions

- If the Non-cleared Banking Transactions are Entered into QuickBooks

- If any Adjustment Made to the Previous Reconciliation with a Journal Entry

- If there is any Change or Deletion in the Former Reconciled Transaction

Why do we Need to Resolve it?

When discrepancies occur, the data stored and managed in QuickBooks gets affected and shows incorrect data, which is more likely to affect the business transaction detail and your decision-making based on inaccurate reconciliation data.

Thus, it is important to resolve the issues as soon as possible. However, before the issue is resolved, it is important to understand the reasons that cause it. Some of the possible reasons are given below:

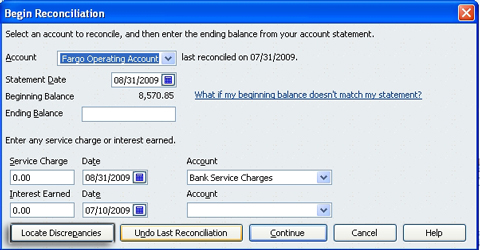

Steps to Resolve the Reconciliation Discrepancy issue in QuickBooks Desktop

It is a very common practice to make amendments in the QuickBooks report. If the amendments are inaccurate, a mismatch in the balance issue may crop up. It is advisable to view these changes. These changes are required to be viewed in reports like the Reconciliation Discrepancy report, Transaction Detail report, etc. Along with this, you can get rid of the reconciliation discrepancies in the account in QuickBooks by reverting the adjustments too.

To fix the Reconciliation Issue, It is important to find the discrepancy first. As a result, Users are expected to run a few reports and see where the issues are. Once the discrepancies are found, you can modify or make changes in the data to remove the discrepancy.

Estimated Reading Time: 6 minutes

Run Reconciliation Discrepancy Report

When you run this report, You will get to identify the data that were modified since your last reconciliation. The data is filtered as per the statement dates and hence makes it easy to identify the discrepancy. The steps to run the reports are as follows:

Navigate to the Reports menu.

Navigate to the Reports menu. Take your cursor to the Banking Option.

Take your cursor to the Banking Option. Choose Reconciliation Discrepancy.

Choose Reconciliation Discrepancy. Choose the Account to be Reconciled.

Choose the Account to be Reconciled. Click OK.

Click OK. Check the report to Detect Discrepancy if any.

Check the report to Detect Discrepancy if any. Edit the Transaction only if you find it inappropriate [Know the reason why the change was done, if it was required or done by mistake]

Edit the Transaction only if you find it inappropriate [Know the reason why the change was done, if it was required or done by mistake]

Run Missing Checks Report

This report is generated to give you an idea about the missing checks. To run this report, follow the below-mentioned steps:

Navigate to the Reports menu.

Navigate to the Reports menu. Take your cursor to the Banking Option.

Take your cursor to the Banking Option. Choose Missing Checks.

Choose Missing Checks. Select the Account to be Reconciled.

Select the Account to be Reconciled. Click OK.

Click OK. Check the report to Identify the Discrepancy.

Check the report to Identify the Discrepancy. If there is any record that is not present in your Bank Account Record, It should not be stored in the Reconciliation Report.

If there is any record that is not present in your Bank Account Record, It should not be stored in the Reconciliation Report. Remove if anything as such is there.

Remove if anything as such is there.

Run Transaction Detail Report

This will help you identify the data if anything has changed. The steps to run this report are listed below:

Navigate to the Reports menu.

Navigate to the Reports menu. Take your cursor over Custom Reports.

Take your cursor over Custom Reports. Choose Transaction Detail.

Choose Transaction Detail. Click on the Display tab.

Click on the Display tab. Go to the Date From field, choose the earliest date available or leave it blank.

Go to the Date From field, choose the earliest date available or leave it blank. Go to the Date to field, choose the date when you reconciled data the last time.

Go to the Date to field, choose the date when you reconciled data the last time. Click on the Filters tab.

Click on the Filters tab. Go to the Account field.

Go to the Account field. Choose the account to be reconciled.

Choose the account to be reconciled. Click on Entered/Last Modified option.

Click on Entered/Last Modified option. Set the Date From and choose the date you performed the last reconciliation.

Set the Date From and choose the date you performed the last reconciliation. In the Date To field, choose the present date.

In the Date To field, choose the present date. Click OK.

Click OK. Check the discrepancies in the report generated.

Check the discrepancies in the report generated. Edit the transaction if you feel the entered data is inapt.

Edit the transaction if you feel the entered data is inapt.

Check for Reconciliation Adjustments

You can check for discrepancies here but you cannot make the changes yourself. It is important to have an expert for fixing the adjustments because one error or mistake might lead to major accounting issues in your business.

Navigate to the Lists menu.

Navigate to the Lists menu. Choose Chart of Accounts.

Choose Chart of Accounts. Click and open the Reconciliation Discrepancies account.

Click and open the Reconciliation Discrepancies account. Go to the Dates Field and Choose the Dates for a couple of Last Reconciliations Performed.

Go to the Dates Field and Choose the Dates for a couple of Last Reconciliations Performed. In case, You find Forced Adjustments that seem Inaccurate, Communicate with the one who made the Changes.

In case, You find Forced Adjustments that seem Inaccurate, Communicate with the one who made the Changes. It might be an Updated Data required to be Adjusted.

It might be an Updated Data required to be Adjusted. Decide Accordingly Whether to Fix the Error or keep it as is.

Decide Accordingly Whether to Fix the Error or keep it as is.

How to Fix Reconciliation Discrepancies in QuickBooks Online?

The reconciliation discrepancy error in QuickBooks accounting software occurs when the QuickBooks account is reconciled, which may showcase the different balances while checking up the upcoming reconciliation.

At the time of preparation of the financial report in QuickBooks Online, an opening balance needs to be entered and also, the starting balance needs to be included. You also need to check if you have entered the balance accurately post entering the balances because an inaccurate balance can also be the reason of the error of QuickBooks Online reconciliation discrepancy in the report. Also, you can review the report, that all the balances are entered correctly. And if there is any error happened while entering the balance you can correct in earliest.

Step 1: Review the Opening and Beginning Balances

The opening and beginning balances, are must be accurate. Once you have confirmed that the balances are correct, you can proceed to find out the further issues.

Step 2: Need to Verify What Changes are Made, What Entries are been Deleted, or Added:

There are several reports in QuickBooks which reflects you if anything has been changed, deleted, or added:

By Running a Reconciliation Discrepancy Report:

This report reflects the entries which are amended since the previous reconciliation. These entries can be sorted by statement dates.

- Navigate to the Reports menu and move to the Banking and Choose the Reconciliation Discrepancy.

- After that, Choose the Account Which you need to Reconcile and then Choose OK.

- Now, You need to Review the Report and Check if there is any Discrepancies.

- You can Consult with the User who made these Changes. There might be Some Reason that the Changes are made by them. Once you Identify the Reason, you can amend the entry as required.

By Running a Missing Checks Report:

This report reflects the checks which are missing. These may be throwing off the ending balance of the reconciliation.

- In the first step, Navigate to the Reports menu and move to the Banking and choose the Missing Checks.

- After that, You need to select the account you are reconciling and then press OK.

- Now, You need to review the report. Here just have a look for any transactions on the report which are not on the Bank Statement. If they are not on the bank statement, they should not reflect on the reconciliation statement.

By Running a Transaction Detail Report:

- You can use this report to verify id any transactions is changed.

- You need to navigate to the Reports menu. Move to the Custom Reports and choose the Transaction Detail.

- After that, Choose the Display tab.

- You need to select the earliest date in QuickBooks for the account in the Date From field. Also you can keep this field blank.

- Choose the date of the last reconciliation in the Date to field.

- Navigate to the Filters tab.

- Now, Here you need to choose the account you are reconciling in the Account field.

- Now, Set the Date from to the date of the last reconciliation in the Entered/Last Modified field. After that, Set the Date to field to present date and click OK to run the report.

- You also need to view for any discrepancies or entries on the bank statement which are not matching.

- You can consult with the use who made these changes. There might be some reason that the changes are made by them. Once you identify the reason, you can amend the entry as required.

- If further assistance is required you can consult to the accountant.

Step 3: You Need to Look for Reconciliation Adjustments

Sometimes users match their books of accounts by making an adjustment in reconciliation to force an account in QuickBooks. However, Without consulting your accountant you should not do a reconciliation adjustment. Adjustments do not help you to get rid of the errors and can cause the issues in the business in future.

Review the account and make sure no one made an inaccurate adjustment.

- You are required to navigate to the Lists menu and then select the Chart of Accounts.

- Post that navigate to the Reconciliation Discrepancies account.

- Now, Adjust the dates from the past reconciliation in the Dates field.

- If you see the adjustments which are making the account balance inaccurate, you should consult with the person who have made this adjustment. Kindly ensure that the corrections should not be in conflict with the adjustment.

- Once all the above steps are done you can complete the reconciliation process.

- If there is no issues found in the accounts, until the reconciliation is correct you can undo the previous reconciliation.

- There might be a requirement to undo the reconciliations for the past few years to get to where the opening balance is accurate if someone edited or deleted a transaction from years ago.

It is very normal to get the discrepancies in their reports in QuickBooks Accounting Software. An incorrect balance calculation is the biggest reason for this error. You should verify that no error are there while doing the calculating the opening balance. Also, if you need any further information or assistance related to this lease do not hesitate to connect with Dancing Numbers team of experts via LIVE CHAT.

The above-mentioned steps are clear and the instructions are quite easy to follow. However, there are instances where you might find yourself stuck and would like to have someone to assist you.

Looking for a professional expert to get the right assistance for your problems? Here, we have a team of professional and experienced team members to fix your technical, functional, data transfer, installation, update, upgrade, or data migrations errors. We are here at Dancing Numbers available to assist you with all your queries. To fix these queries you can get in touch with us via a toll-free number

+1-800-596-0806 or chat with experts.

Frequently Asked Questions (Faqs)

What are Reconcile Discrepancies in QuickBooks?

The reconciliation discrepancies affect the data stored and managed in QuickBooks and show incorrect data, Which misleads the decision-making of the businesses.

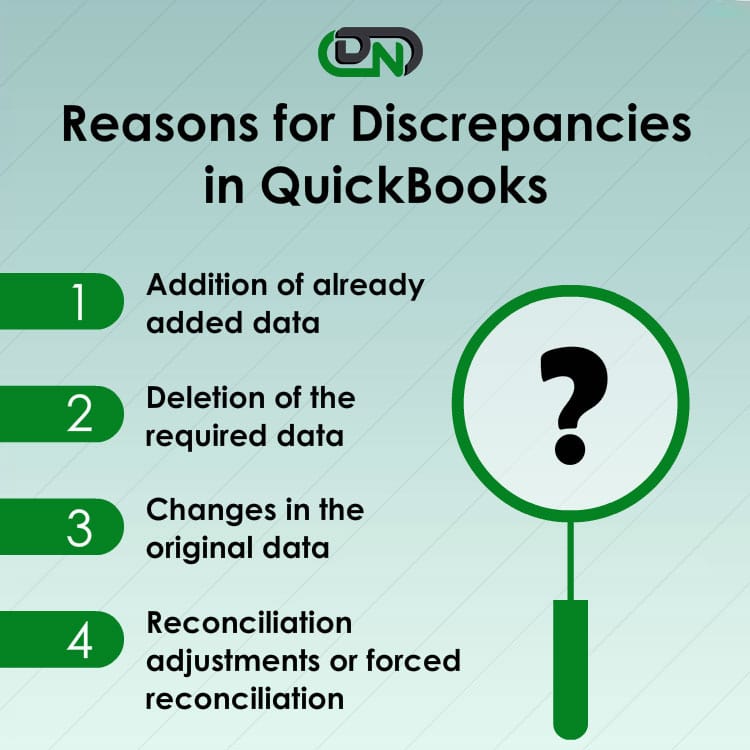

How is this Reconcile Discrepancy Caused?

Some of the reasons are listed below:

Addition of Already Added Data

Addition of Already Added Data Deletion of the Required Data

Deletion of the Required Data Changes in the Original Data

Changes in the Original Data Reconciliation Adjustments or Forced Reconciliation

Reconciliation Adjustments or Forced Reconciliation

How to Find out the Reconciliation Discrepancy?

To find out the reconciliation discrepancies, it is advisable to run reports and detect the places where the discrepancies exist. As a user, you should try running Reconciliation Discrepancies Report, Transaction Detail Report, Missing Checks Report, etc.

Can you Tackle the Reconciliation Adjustments by Yourself?

No. If you find an issue with reconciliation adjustments, make modifications only when your accountant is present.

How can you Describe the QuickBooks Online Reconciliation Discrepancy Report?

This as a report in where all the details of discrepancies are shown. When the financial records are compared, the information related to the discrepancies can be stored and used later to resolve the errors.

What is the Way to Get rid of the Reconciliation Discrepancies in QuickBooks?

While running the QuickBooks accounting software, You will get a “Reports” tab. By making the selection of it, you can view “Banking“. Here, you are able to get the option for “Reconciliation Discrepancy“. As you select it, QuickBooks will start going through the report for which you wish to clear the reconciliation discrepancies.

What is the Way to Know about the Reconciliation Discrepancies in QuickBooks Online?

By adhering the manual approach you might not be able to know about the proper way to know about the discrepancies in QuickBooks Online but you can initially find the financial report in it. You are required to verify the starting and opening balance.

+1-800-596-0806

+1-800-596-0806