Table of Content

What is Form 1098: Mortgage Interest Statement?

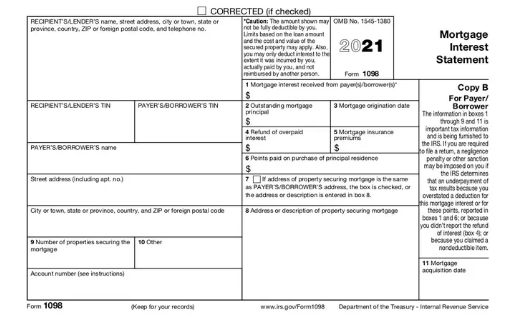

When the amount paid for interest and related charges on a mortgage during the tax year totals $600 or more, taxpayers must file a Mortgage Interest Statement with the Federal Revenue Service (IRS). Points paid on the property’s purchase are an example of related expenses. In order to lower the rate on the mortgage the lending institution is offering points are prepaid interest payments made on a house loan.

Form 1098 is used for two things: It is used by lenders to report interest payments that total more than $600 for the year. The IRS gathers this data to guarantee accurate financial reporting for lenders and other organizations that are paid interest. When calculating their mortgage interest deduction for their yearly tax returns, homeowners utilize it to determine the total amount of interest they paid for the year.

Key Features of Form 1098: Mortgage Interest Statement

• Mortgage interest paid for the year is reported using form 1098.

• If a homeowner paid $600 or more in mortgage interest during the tax year, the lender must produce Form 1098.

• You must be the principal borrower on the loan and be actively making payments in order to deduct mortgage interest.

• Form 1098 makes it easier for you to determine how much of your mortgage payments have gone towards interest if you are itemizing your deductions and want to claim a mortgage interest deduction.

• Forms 1098-C (Charitable Contributions), 1098-T (Payments for Education Credits), and Form 1098-E are additional 1098 tax forms (Student Loan Interest Payments).

Who Can File Form 1098: Mortgage Interest Statement?

- Your lender is required to mail you Form 1098 if you spent $600 or more in interest and points on a mortgage during the previous tax year.

- You won’t get Form 1098 if your payment was under $600. These costs may be deducted from income on Schedule A of a federal income tax return, which lowers the amount of taxable income and total tax due to the IRS. The lender-or other entity receiving the interest-issues and mails Form 1098 to you, the borrower.

- If your property is regarded as real property by the IRS, the mortgage lender must give you a copy of Form 1098. Real property includes both the land itself and anything erected on, grown on, or joined to it.

- The property must meet IRS requirements, which define a “house” as a place with the essentials of daily living, including a place for cooking, a bathroom, and a place to sleep. According to the IRS, a residence includes houses, condominiums, mobile homes, boats, cooperatives, and house trailers.

- The mortgage itself must also be eligible. First and second mortgages, home equity loans, and refinanced mortgages are all considered qualifying mortgages by the IRS.

Mortgage Interest Deduction Regulations

Whether or not you want to itemize your deductions on Schedule A determines whether you need to complete Form 1098. Your overall taxable income can be lowered by claiming a deduction for mortgage interest paid in the past. But, there are a few guidelines to be aware of when deducting mortgage interest.

- You must be the main borrower on the loan and be current on your payments.

- If the loan was incurred on or after December 16, 2017, you are only allowed to deduct interest on a total mortgage obligation of $750,000 or less. (The maximum amount owed on earlier mortgages is $1 million.)

If you can identify with all of them, you’ll need Form 1098 to claim the mortgage interest you paid on your home loan for the most recent tax year. A different Form 1098 will be provided if you have more than one eligible mortgage.

On the IRS website, all copies of Form 1098 are accessible.

How to File Form 1098 for the Deduction of Mortgage Interest

Since the IRS has already received the information on Form 1098, taxpayers are not required to include it with their tax returns. Instead, if a taxpayer wants to deduct their mortgage payments, they should use the data on Form 1098. In order to record your interest deduction information in your tax return, you must enter the data from the form into the relevant areas if you intend to file your tax return electronically. If you’ve never seen a Form 1098 before, you might be unsure of how to interpret it. When studying your statement, be sure to pay attention to the eleven boxes.

- Box 1: Mortgage interest received from the borrower. This box displays the annual interest payment you made to your lender.

- Box 2: Outstanding loan balance. The amount owed on the loan’s principle is displayed in this box.

- Box 3: Mortgage’s start date. This displays the day your mortgage was created.

- Box 4: Refund of interest that was owed. This is where it would be mentioned if you overpaid on your mortgage interest and got a refund.

- Box 5: Premiums for mortgage insurance. The amounts put here are for any mortgage insurance premiums or private mortgage insurance that you are paying for the loan.

- Box 6: Points purchased when buying the primary residence. You may be eligible to subtract mortgage points in the box below.

- Box 7 through 11: They comprise details concerning the loan and the actual property.

Note: It’s crucial to confirm the accuracy of all of your personal data on Form 1098, including your name, address, and tax identification number.

Additional 1098 Tax Forms

There are four forms bearing the number 1098, one of which being Form 1098: Mortgage Interest Deduction. All 1098 forms deal with deductions in some way. Forms 1098-C, -E, and -T are the additional three variations of Form 1098.

1. Form 1098-C

Form 1098-C lists the vehicles donated to charitable organizations that either give them to the needy or sell them for less than market value. It includes the date of donation, the kind of vehicle, the vehicle identifying number (VIN), and the value of the car. It is submitted and reported by the beneficiary organization.

2. Form 1098-E

The interest paid on qualifying student loans throughout the tax year is reported on Form 1098-E. The taxpayer, who will receive the document outlining how much interest was paid that year, may deduct the amount of interest paid. Although the taxpayer may receive a form for amounts less than $600, it is sent by the lending institution if at least $600 in interest was paid.

3. Form 1098-T

Information about post-secondary tuition and associated fees for the year is available on Form 1098-T. It is submitted by the educational institution and is used to compute tax credits and deductions linked to education, including the American Opportunity Tax Credit (AOTC) and the Lifelong Learning Credit (LLC). The form also lists any awards and scholarships the student may have received from the institution, which could lower the amount of the taxpayer’s eligible deduction or credit.

Conclusion

This article contains all the detailed information you need to comprehend Form 1098- Mortgage Interest Statement and process to file it. We advise you to read it properly for a better understanding. We really hope that the information provided above regarding the Form 1098 will be helpful to you. But, if you have any questions, get in touch with one of our specialists. Our dedicated team of knowledgeable professionals can handle any concerns you might be having with your Form 1098. We only advise you to call our toll-free helpline as soon as you realize that you need assistance regardless of the situation.

Frequently Asked Questions

What is the Purpose of a 1098 Tax Form?

The total amount of interest paid on a mortgage over the course of the preceding year is reported on Form 1098. It is used by taxpayers to figure out how much, if any, mortgage interest can be written off during that tax year.

Should I Submit Form 1098?

No, you are not required to file Form 1098, i.e., to include it with your tax return. You simply need to specify the interest amount that was recorded on the form. Moreover, you typically only need to disclose this interest on your tax return if you itemize your deductions.

How Can I Obtain My Form 1098?

By the end of January of the filing year, your mortgage lender will send you a copy of your Form 1098.

Does the Student or the Parent File a 1098-T Claim?

Either one can carry it out (but not both). In general, it depends on who is footing the bill for the tuition and if the student is still claimed as a dependent on the parent’s tax return. If so, the parent often requests the education credit based on the information from the Form 1098-T.

How Can I Understand a College 1098 Tax Form?

Colleges and universities utilize Form 1098-T to track payments made to students for eligible tuition and other costs, such as grants and scholarships. The educational institution files it with the IRS, and the student is given a copy of it. The information on Form 1098-T is used by taxpayers to claim an education credit on Form 1040.