Small business wants to use Form 8995 to reduce their tax burden. The Qualified Business Income Tax (QBIT) deduction was incorporated into the final TCJA. In order to reduce their taxable income, eligible pass-through organizations may subtract up to 20% of their qualified business income. Taxpayers need just include IRS Form 8995 with their individual tax returns in order to benefit from this.

Major alterations to the tax system were made by the 2017 Tax Cuts and Jobs Act (TCJA). The corporate tax rate was specifically lowered by this legislation from 35% to 21%. As small businesses are not corporations, when this reduction was first proposed as they are pass-through companies like sole proprietorships, partnerships, and other businesses those who are not aided by the reduction of the corporate tax rate.

In this article we will provide you detail information for the both a primer for IRS Form 8995 and an explanation of the QBIT deduction. You will get detail information so that it is easy for you to understand and save on taxes with the help of form 8995.

Table of Content

What is IRS Form 8995

Owners of pass-through businesses such as sole proprietorships, partnerships, LLCs, or S corporations must file IRS Form 8995 so that they can claim the qualifying business income (QBI) deduction which is also known as the pass-through or Section 199A deduction.

After the 14% corporate tax rate which was the lowered as part of the Tax Cuts and Jobs Act (TCJA) in 2017 from which the QBI deduction was created. The tax cut is only resulted in savings for C-corporations in which the account for 5% is of small firms. Other small companies, such sole proprietorships and LLC did not gain anything from the TCJA. Legislators created QBID in reaction to the fact that C-corporations are the only commercial entities that can be benefit from the tax reductions.

Now, if you can run a pass-through company and generated $150,000 in the qualifying business income as a single proprietor in 2022, and the QBI deduction enables you to lower your taxable income by 20%, your taxable business income for that year is $120,000.

You are eligible for the QBI deduction if you file Form 1040 Individual Income Tax Return and are self-employed or the owner of a small business. You must finish Form 8995 or Form 8995-A in order to compute and honor this deduction.

- Form 8995: The majority of taxpayers claiming the QBI deduction just need to complete Form 8995, a quite straight forward one-page document.

- Form 8995-A: A smaller set of people with higher incomes are required to complete Form 8995-A, an enlarged and more complicated form of Form 8995. Users of this form must fill out four extremely extensive sections and schedules that are intended to help you in calculating your deduction in addition to the information which is needed for Form 8995.

Who can use Form 8995?

A few requirements must be met in order to qualify for the QBI deduction. These criteria mainly concentrate on the firm structure and revenue.

Prerequisites for the business structure

For individuals those who qualify for the QBI deduction, they must possess at least one of the following pass-through business structures:

- Sole Proprietorships: The most fundamental type of business form in the US is a sole proprietorship or in short you can call it sole prop. They are the default entity. With a few exceptions, you can start acting as a sole proprietor as soon as you start your own business. Due to these reasons, small business owners prefer the sole prop business structure the most.

- Partnerships: A partnership is a legal agreement between two or more parties to run a business and split the profits. Partnership contracts come in a wide variety of forms. In particular, although under other circumstances partners may have limited liability, all partners in a partnership business share earnings and liabilities equally. There is also the so-called silent partner. They are the one party who does not participate in the daily operations of the company.

- Limited Liability Companies (LLCs): Small enterprises frequently choose LLCs as their corporate form. They allow you freedom, liability protection and perhaps also provide lesser tax obligations. A limited liability company (LLC) is a type of business entity that operates like a corporation in states but it is taxed on a partnership or sole proprietorship basis on the federal level. As an LLC offers business owners limited responsibility, which shields them from legal action or bankruptcy as it functions similarly to a corporation.

- S Corporations: Subchapter S corporation or Small Business Corporation is refers to the acronym S corporation. The Internal Revenue Service (IRS) has given corporations of a special tax status that enables them to pass on their shareholders that is the corporate income, credits, and deductions. Federal income taxes are not due by S corporations. They fit the definition of a pass-through entity. Their gains or losses are transferred to the company’s individual shareholders to be divided among them and reported on a Form K-1 before being reported on the shareholders individual income tax returns.

- Estates and Trusts: For the purposes of income taxation, trusts and estates are different fiduciary entities. The fiduciary-the trustee or executor-reports the income received by the trust or estate on a fiduciary income tax return on Form 1041 and pays any taxes that are owed. By utilising any available deductions, credits, or exemptions, a trust or estate might reduce its tax obligation. Either the trust or estate can pay the income tax or it can pass the income on to the beneficiaries. The distribution of the tax burden between the trust or estate and its beneficiaries is governed by certain laws. The principle that establishes the quantity and nature of the revenue a trust or estate retains or distributes is known as distributable net income (DNI).

- Agricultural or Horticultural Cooperative (must use Form 8995-A): Co-ops are particular businesses that are run and owned by the members of the organization. Single growers are brought together by agricultural cooperatives to maximize productivity and yields in their businesses. Utility, finance, and other rural co-ops are available in addition to those that deal with agricultural output. Telecommunications and electricity are provided by utility cooperatives. Financial cooperatives offer loans and additional financial services.

Qualities Based on Income

Form 8995 only accepts specific types of income. They consist of taxed earnings from:

- Business Income that is Passive

- Dividends on Qualified REITs (REIT stands for real estate investment trust)

- PTP Revenue or Loss that is Eligible (PTP stands for publicly traded partnership)

- Property for Rent

A Minimum Income

If they want to qualify for the QBI deduction, owners of pass-through business organizations must earn enough money.

The QBID eligibility income level for 2022 that is the tax year for which you are now filing is $170,050 for single filers, $340,100 for married couples filing jointly.

The upper limit rises to $364,200 for married couples by filing jointly in 2023 and to $182,100 for married couples filing separately, single individuals, and heads of household with pass-through businesses.

Qualifying for the entire deduction if your taxable business income is below the cap set for your filing status and you meet the requirements for the QBID business structure.

The Federal Revenue Agency has additional standards to help assess whether the QBI deduction may qualify you for a partial deduction even if your income exceeds the threshold, so you are not automatically barred from using the deduction.

The deduction benefit phases out if your taxable income in 2022 exceeds $440,100 for married couples filing jointly or $220,050 for other filing statuses. The deduction benefit phases out if your taxable income in 2023 exceeds $464,200 for married couples filing jointly or $232,100 for other filing statuses.

Types of Income that are Excluded from the QBI Deduction

You should not count certain sorts of income when calculating your deduction since they do not qualify for the pass-through deduction. The following are a few of these sources of income:

- Dividends, Capital Losses, or Both

- Interest Earnings Which is not Connected to a Business

- Wages Earned

- Annuities unconnected to Your Company

- Income not Derived from a US-based Company

- Profits or Losses in International Markets

- Profit, Loss, or Deductions from Contracts with Fictitious Principals

How Do I Calculate a Pass-through Deduction?

You must determine your actual Qualified Business Income before you can determine your pass-through deduction (QBI). The IRS describes QBI as the total of all the qualifying gains, losses, deductions, and income from any type of legal trade or business that includes profits from partnerships, S companies, sole proprietorships and specific trusts. Deductions for contributions to qualifying retirement plans, self-employment health insurance, and the deductible portion of self-employment tax are a few examples of what is typically included in this.

The next step is to calculate the pass-through deduction for business owners whose income is below the threshold by multiplying their QBI by 20%. In order to prevent pass-through corporations from taking advantage of this deduction, the IRS has also listed a number of things that are not eligible for QBI. The following things shouldn’t be included in your QBI calculation, while this is not an exhaustive list:

- Things that shouldn’t be included in Taxable Income

- Dividends, Capital Gains or Losses and other investment-related things

- Unsuitable Allocation of Interest Income to a Trade or Enterprise

- Wages Earned

- Earnings that are not directly related to doing Business in the United States

- Gains or Losses from Commodity Transactions or Foreign Exchange

- Certain Dividends and Dividend Replacement Payments

- Profit, Loss, or Deductions from Contracts with Fictitious Principals

- Unless they are Received in Conjunction with a trade or Business, Annuities

- Amounts that a S Corporation Pays out as Fair Compensation

- Amounts that a Partnership has Guaranteed to Pay you

- Payments made to a Partner for work Performed outside of their Role as Partners

- Qualified Dividends on REITs

- PTP Earnings

How to Claim the Pass-through Deduction using Form 8995

You may determine your eligibility for QBI and automatically compute your savings using the same online tax services that the majority of Americans use. If you select this option, be sure to enter your data accurately to avoid missing out on potential savings or having to resubmit your taxes as a result of errors.

You must first record your business income and expenses on Schedule C and your adjusted gross income on Form 1040 in order to start claiming the QBI deduction on Form 8995. Be aware that you may deduct this expense regardless of whether you itemize or claim the standard deduction.

Despite of the tools which are available to streamline the filing process and lower the amount of IRS worksheets must be completed by you, it is always a good idea to have a basic understanding of the pass-through deduction and the variables that influence whether and how much you save.

Let’s examine how to calculate your pass-through deduction and complete Form 8995 in more detail.

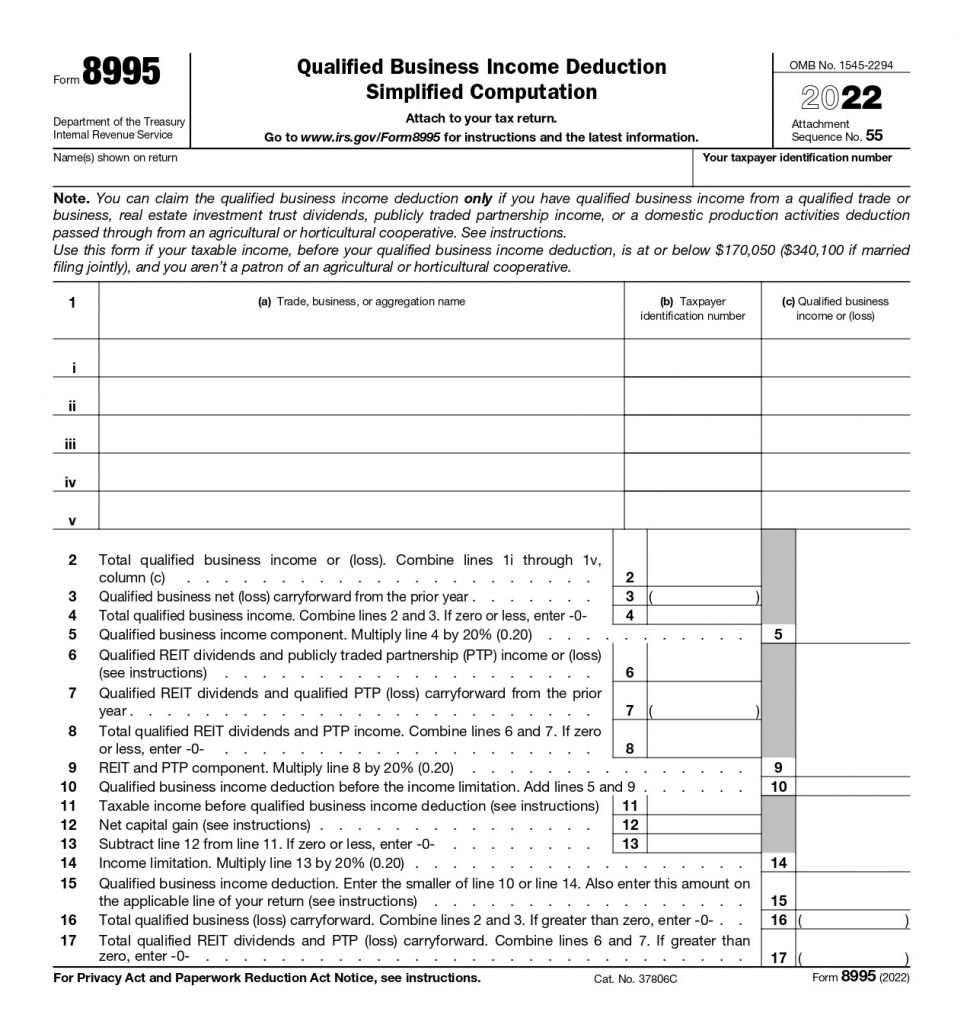

Line 1 to Line 4

The name of your business, its taxpayer identification number is up to five businesses and the eligible income or loss suffered by each firm during that tax year should all appear on Line 1 of Form 8995. Add up the qualified business income or loss from the one to five businesses which you indicated in Line 1 and then enter it in Line 2. (i to v).

Line 3 should reflect this sum if you are carrying a net business loss from the prior year.

Then, add the figures from Lines 2 and 3 to get the total of your company’s carrying forward and current-year income/loss. This is how you’ll arrive at the answer for Line 4.

To get 20% on Line 5, Multiply Your Response from Line 4 by 20.

Line 6 to Line 10

Your revenue from Real Estate Investment Trusts (REIT) and Publicly Traded Partnerships is covered in lines 6 through 10. Next, you should start by stating how much money you made from these kinds of investments in the most recent year. Next double their total by anything you need to carry forward from the previous year, add the amount, and divide the result by 0.2 to get the percentage you’ll list as 20%.

Line 11 to Line 15

The income cap we previously spoke about is addressed in lines 11 to 15. When calculating your QBI deduction for 2022, if your total taxable business income before the pass-through deduction is less than $170,050 and $340,100 for joint filers, choose the amount that is 20% less of the following:

- Your Net Capital Gains less Your Taxable Income

- Your Legitimate Business Revenue

Your taxable business income and net capital gains must be included on Lines 11 and 12. The sum of Line 3A and Line 7 would be on your Form 1040.

Then, it’s time to perform the calculation- In order to calculate your net capital gains, first calculate your qualified business income. Then, remove your net capital gains from that amount. To acquire 20%, multiply your result from Line 13 by 0.2 and enter the result in Line 14. Line 15: Finally, compare Line 10 and Line 14 and enter the amount for the line that has the lower value. This is your deduction for QBI.

Line 16 to Line 17

You compute your carryover loss using Lines 16 through 17. Your net qualified business loss is when your net qualified business income is less than zero. Whilst you cannot deduct it from your return for the current year, you can carry it over to use as a credit against income in a later successful year.

What’s a Loss Carryforward?

Small enterprises are not always profitable. Many businesses experience losses each year. The IRS treats losses differently depending on whether you own additional pass-through enterprises and to be more exact.

If a person is a multi-business owner:

The taxpayer’s QBI from various trades or companies, including losses, must be netted which includes aggregated trades or businesses also. As a result, qualified business losses from one firm will be offset by qualified business income (QBI) from other businesses including combined enterprises in proportion to the net income of the businesses with QBI.

So, if you don’t have another company to offset your losses. Then in such circumstances the carried forward negative QBI will be regarded as negative QBI from a separate trade or activity for the purpose of calculating the QBI Component in the next taxable year.

In other words, a loss never truly disappears. The IRS instead permits businesses to roll QBI losses over to succeeding years.

Small business owners stand to benefit greatly from the Qualified Business Income Tax deduction. But, completing IRS Form 8995 can be very challenging. Don’t let the difficulty of completing this form. It can stop you from taking advantage of these fantastic tax savings.

We can take care of your tax filing so you can concentrate on running your business. You won’t have to worry about accurately completing Form 8995 or missing out on potential savings when your taxes are completed by our specialists.

Frequently Asked Questions

How do I Determine If I am Eligible for the Qualifying Business Income Deduction?

You may be eligible for the 20% deduction on your taxable business income if your total taxable income in 2022 is at or below $170,050 for single filers and $340,100 for joint filers. Total taxable income includes both your business income and other income.

Why Would You use a Form 8995?

For a qualified business income deduction calculation, you have to use Form 8995.

Who is Eligible for 8995?

The pass-through deduction is typically accessible to business owners whose 2022 taxable income before the qualified business income deduction is less than $340,100 for married couples filing jointly and $170,050 for single filers.

Is Form 8995 Federal or State-Specific?

Owners of pass-through businesses, such as sole proprietorships, partnerships, LLCs, or S corporations, must file IRS Form 8995 in order to claim the qualifying business income (QBI) deduction, also known as the pass-through or Section 199A deduction.

What Details Should you Bear in Mind While Completing Form 8995?

The IRS is reevaluating that how it determines the legitimacy of QBI deductions in 2022 as a result of unconfirmed and potentially incorrect deduction claims made by people looking to take advantage of the system. In light of the foregoing, be on the lookout for more detailed deduction restrictions in the upcoming year.