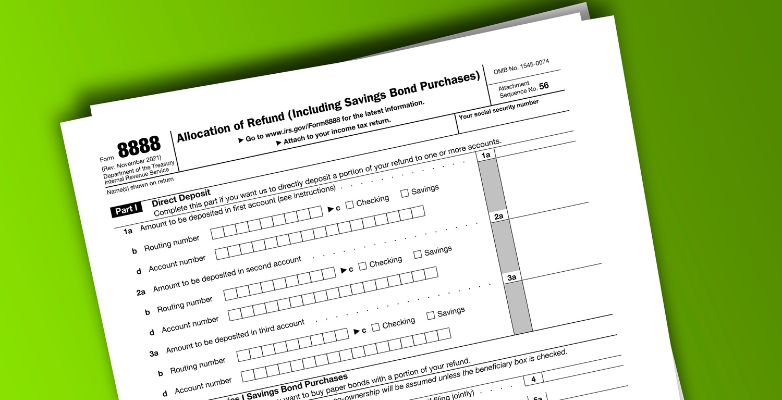

When it comes to taxes in the United States, folks have some choices about what to do with their tax refunds. You know that extra money you sometimes get back? Well, you can decide to put it in a savings account, buy savings bonds, or even send out checks for payments. To make this happen, there’s a form you fill out called IRS Form 8888, also known as the Allocation of Refund form. This form is handed out by the IRS, which is like the tax boss.

With Form 8888, you can split your tax refund into a maximum of three different places. Like, you can put some in your checking account, some in your savings account, and maybe even buy some bonds if you want. These bonds can be for you or someone else, like a gift. If you owe any taxes, you can also use this form to take care of that debt with part of your refund.

Now, who can use IRS Form 8888? Well, anyone who’s getting a tax refund can use it. But here’s the catch: if you have some things you owe money for, like student loans or unpaid taxes, your plans to divide your refund might not work out as you hoped.

Table of Content

- 1 What Is IRS Form 8888?

- 2 Key Features of IRS Form 8888

- 3 How to Fill Out IRS Form 8888: Allocation of Refund (Including Savings Bond Purchases)?

- 4 E-Filing vs. Paper Filing

- 5 Conclusion

- 6 Frequently Asked Questions

- 6.1 Where to Get IRS Form 8888?

- 6.2 Can You E-File IRS Form 8888?

- 6.3 Where to Mail IRS Form 8888?

- 6.4 Can I allocate my tax refund to any account I like using Form 8888?

- 6.5 Can I use Form 8888 if I’m expecting a tax refund that is subject to garnishment or offset for outstanding debts?

- 6.6 How to track the status of my tax refund after using Form 8888?

- 6.7 Is it better to e-file or mail Form 8888 with my tax return?

- 7 Download IRS Form 8888

What Is IRS Form 8888?

Alright, let’s break down the Form 8888. It’s a thing the IRS cooked up to help you handle your tax refund smartly. You can divide your refund into three different money spots. But it’s not just about that. You can also use it to buy special savings bonds, like these paper ones called series I savings bonds. They let you buy up to $5,000 worth.

This form isn’t just about regular bank accounts. You can also choose to put your refund into stuff like a mutual fund brokerage, a credit union, or even a retirement account. It’s like you’ve got more choices than ever.

Quick takeaways:

- You can use Form 8888 to split your refund into different accounts.

- If you want all your money in one place, just ask for a direct deposit.

- The accounts must be yours, your partner’s, or a joint account.

- If you’re using Form 8379 (Injured Spouse Allocation) or making changes to your tax return, IRS Form 8888 won’t work.

- Want your refund faster? E-file with IRS Form 8888.

Now, let’s talk about who can play with Form 8888. The good news? Anyone can use it. But here’s the deal: If you’re aiming to put all your refunds into just one place, don’t bother with this form. Just ask for direct deposit.

Also, keep in mind, that you can’t use Form 8888 to toss money into someone else’s account. It has to be yours, your partner’s, or a shared account with you. And if you’re using Form 8379 (Injured Spouse Allocation) or fixing up your tax return, Form 8888 won’t be a good option for you!

Key Features of IRS Form 8888

- Quick Deposits: Instead of waiting for a paper check in the mail, you can have your refund sent right to your bank. It’s faster and safer, they say.

- Savings Bonds: You can also decide to buy something called U.S. Series I Savings Bonds. These are like investments that help you save for the future. You can use part or all your refund to get these bonds, but there’s a limit to how much – up to $5,000 each year.

- Dealing with Debts: If you owe taxes, you can use Form 8888 to take care of that. The IRS allows you to sort out your tax debts with your refund money, which might be a big help.

Advantages of Using Form 8888

You know, dealing with tax refunds has become a whole lot easier these days. And guess what? Using this handy Form 8888, which you can fill out right here, you can decide where the IRS should send your tax refund. It’s like telling them where to drop off your money. Plus, this form gives you some smart choices on what to do with your refund.

Let’s talk about why it’s useful:

- Simple Savings: With Form 8888, you can stash your tax refund in different places. This means you can have some cash ready for special stuff, like emergencies, retirement plans, or your kid’s education. You can put it in your bank or even somewhere like a mutual fund or a credit union. It’s like sorting your money into different jars.

- Boosts Your Financial Goals: When you use Form 8888, you’re not just getting money; you’re getting closer to your dreams. By splitting your refund between different places or buying savings bonds, you can reach your financial goals quickly. Think about saving up for a house down payment or making sure your kid gets a good education. This form helps you get there faster.

- Money Smarts: Form 8888 is like a gentle nudge towards being responsible with your cash. Instead of blowing it all in one go, it encourages you to save and invest your tax refund wisely. It’s like having a financial coach, reminding you to think long-term.

How to Fill Out IRS Form 8888: Allocation of Refund (Including Savings Bond Purchases)?

Let’s chat about how to deal with IRS Form 8888, the one that helps you decide what to do with your tax refund. It might sound a bit official but don’t worry, it’s not too complicated. You can grab all the pages you need from the IRS website.

Alright, let’s break it down:

Part I: Getting Money Directly in Your Accounts:

Here’s where you say where you want your refund to go. You can choose up to three places. Each account needs at least $1, but be careful. If things get delayed, your whole refund could go to the first account. You’ve got options like checking, savings, credit union, and more. Oh, and don’t forget the routing number – it’s got to be nine digits and start with certain numbers.

Part II: Buying U.S. Series I Savings Bonds:

Ever thought about buying savings bonds? With Form 8888, you can use your refund for that too. You can get up to three bonds, but the total can’t be more than $5,000 or your refund. You can buy bonds for yourself, your partner if you’re married, or even someone else.

Part III: Want a Paper Check?

If you’ve still got some refund left after all this, you can ask for a paper check to be sent with the remaining money.

Part IV: Making Sure Everything Adds Up

At the end, you need to make sure all the numbers match up. The total on line 8 has to be the same as your refund and the totals you put on the form. If it’s different, they’ll send you a paper check instead.

E-Filing vs. Paper Filing

Let’s talk about the two ways you can tackle Form 8888: e-filing and paper filing. Each has its perks and quirks, so let’s break it down.

E-Filing Form 8888:

E-filing is like a speedy road. You fill out Form 8888 online, and boom – it’s sent straight to the IRS. Here’s the deal: it’s quick. Like, you can get your refund in around 21 days. Plus, if you’re into tracking stuff, you can easily check your refund status.

| Advantages | Disadvantages |

|---|---|

| Speedy delivery of your form to the IRS. | Need reliable internet access. |

| Faster refund, usually within 21 days. | Some might find the online process a bit confusing. |

| Ability to track your refund’s progress. | Limited to certain software or websites. |

| Reduces the chance of errors in your submission. |

Paper Filing Form 8888:

Paper filing is like the classic route. You print out Form 8888, fill it in by hand, and then mail it to the IRS. It’s a bit slower, but some folks prefer the old-school vibe.

| Advantages | Disadvantages |

|---|---|

| No need for internet access or specific software. | Takes longer for the IRS to receive and process. |

| May be more comfortable for those who prefer physical forms. | Slower refund delivery compared to e-filing. |

| You’ve got a hard copy for your records. | Potential for mistakes in handwriting or mailing address. |

Hence, e-filing Form 8888 offers speed, accuracy, and convenience but requires technical resources. Paper filing is accessible but tends to be slower and more prone to errors. The choice depends on an individual’s preference, technical capabilities, and urgency for a refund.

Conclusion

In conclusion, IRS Form 8888 offers a practical way to manage your tax refund wisely. It allows you to divide your refund into multiple accounts or invest in savings bonds, catering to your financial goals. While it provides flexibility, there are essential considerations, such as ensuring accounts are in your name and restrictions when using other tax forms. To maximize efficiency, consider e-filing for a quicker refund. If you still have questions or face challenges while navigating Form 8888 or any other tax-related matters, don’t hesitate to reach out to our experts for guidance and assistance. Your financial well-being is our priority.

Frequently Asked Questions

Where to Get IRS Form 8888?

You can snag Form 8888 online at the IRS Forms, Instructions & Publications website. Just pop “8888” in the search box, and you’ll find it. But there are other places too. Swing by your local IRS Taxpayer Assistance Centre, or check out your friendly neighborhood library, post office, bank, or even some of those big grocery stores that might have it.

Can You E-File IRS Form 8888?

Absolutely! If you’re into e-filing, good news: you can use Form 8888 for that too. IRS e-file and popular tax software like TurboTax and TaxAct all support split refunds using this form. When you e-file, you can directly deposit your money into multiple accounts, and the IRS says you can expect your refund in about 21 days or less.

Where to Mail IRS Form 8888?

If you prefer the old paper way of doing things, you can mail Form 8888 along with your return. To find out exactly where to send it, you’ll want to check the “Where to File Paper Tax Returns With or Without a Payment” section. They’ll tell you the scoop on where to send it in your area.

Can I allocate my tax refund to any account I like using Form 8888?

Form 8888 allows you to allocate your tax refund to various types of accounts, including checking, savings, credit union, mutual fund, IRA, HSA, MSA, ESA, or Treasury Direct online accounts. However, there are restrictions, such as the account must be in your name, your spouse’s name, or a joint account.

Can I use Form 8888 if I’m expecting a tax refund that is subject to garnishment or offset for outstanding debts?

If your tax refund is subject to garnishment, offset, or levy due to outstanding debts like student loans, child support, or unpaid taxes, using IRS Form 8888 to allocate your refund as desired might not be possible. The government may redirect the funds to cover these obligations.

How to track the status of my tax refund after using Form 8888?

You can check the status of your refund by contacting Treasury Retail Securities at (844) 284-2676. They can provide information about the progress of your request.

Is it better to e-file or mail Form 8888 with my tax return?

E-filing is generally faster and more convenient. It allows you to receive your refund in as little as 21 days. If you prefer a paper return, make sure to check the IRS website for information on where to mail it.