Form 8938 is formally known as your Statement of Specified Foreign Financial Assets and is among the documents which are used by expats to inform the IRS of the financial assets whom they have in foreign countries.

It’s usual for Americans to acquire various forms of foreign financial assets while they live and work in abroad, such as having a foreign pension plan or shares of a foreign corporation. As a U.S. taxpayer whom you must disclose such overseas assets in your yearly taxes and one way to do so is by submitting Form 8938.

Some U.S. taxpayers who possess foreign assets above a specific threshold, including businesses, partnerships, and trusts, utilize IRS Form 8938 as their tax form.

Key Points

- Depending on their filing status, certain U.S. taxpayers and organizations utilize Form 8938 to report overseas assets that exceed a specific threshold.

- It’s a component of FATCA, a law that the Obama administration established in 2010 to deter tax evasion abroad.

- If Form 8938 is necessary, you have until Tax Day to submit it with your annual tax return. Typically, this occurs on April 15.

- If you are obligated to submit Form 8938 but fail to do so by the deadline, you could face fines of $10,000 to $50,000.

- If you have foreign assets, you may also be required to file the FBAR separately with the Treasury Department.

Table of Content

- 1 IRS Form 8938 Definition and Sample

- 2 Those Who Must Submit IRS Form 8938 (Who Needs to File?)

- 3 Reporting thresholds for Form 8938

- 4 Where To Get a Form 8938

- 5 Threshold & Requirements

- 6 Requirement of Filing

- 7 Deadline of Filing Form 8938

- 8 Penalties Related to Form 8938

- 9 Exception for Justifiable Cause of Late Filing

- 10 Frequently Asked Questions

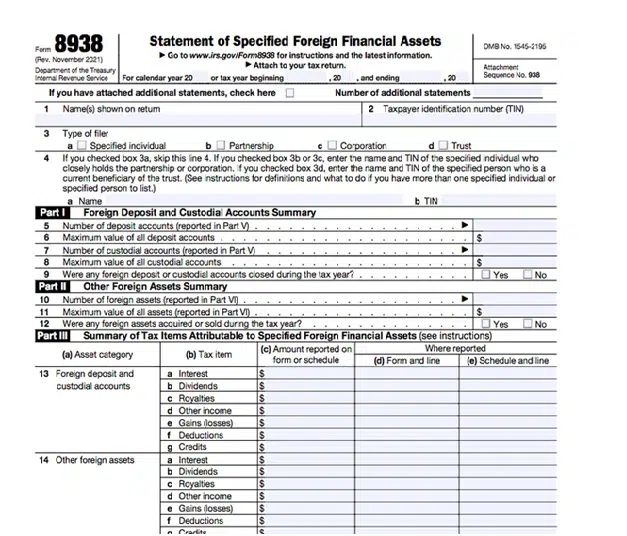

IRS Form 8938 Definition and Sample

On March 18, 2010, President Obama signed FATCA into law with the intention of tightening the standards for taxpayers disclosing foreign assets and reducing the government’s losses from offshore tax evasion. One Form 8939 must be included with the tax return of any taxpayer, corporation, or Partnership with foreign assets that are equal to or greater than the thresholds.

Foreign Financial Asset

Foreign financial assets are referred to as a specified foreign financial asset by the IRS. They comprise:

- Financial records kept by organizations outside of the United States, including bank accounts, investment accounts, retirement accounts, deferred compensation plans, and mutual funds.

- Securities not owned through an investment account, such as stocks, bonds, or other assets issued by a non-U.S. person.

- A foreign person’s notes or bonds.

- Any stake in a foreign company, partnership, trust, inheritance, or other type of foreign entity.

- Any financial product or agreement with a non-American as the issuer or counter party.

- Rental properties and private homes, but only if they are owned by a foreign partnership, corporation, trust, or estate.

Those Who Must Submit IRS Form 8938 (Who Needs to File?)

A U.S. taxpayer who use to reside outside of the country and has a total combined value of foreign assets worth more than $300,000 at any time during the year or $200,000 on the last day of the year, they are required to report it on Form 8938. The thresholds are $600,000 at any point during the year or $400,000 on the last day of the year if you’re filing a joint return.

It’s important to pay attention that when the tax year begins and ends if you are residing in the United States and have qualified assets such as any bank, investment, or retirement accounts which are held in abroad. Of course, in the United States it runs from January 1 to December 31, but not everywhere. In some countries, the thresholds are lower for foreign stock, ownership interests in foreign entities, and other foreign financial instruments.

Though only under specific situations, FATCA technically applies to all U.S. taxpayers. When reporting is necessary it identifies individuals and specific domestic entities all are mentioned in the IRS Form 8938 guidelines.

The people who fall under this category include American citizens, resident aliens, nonresident aliens who choose to be regarded as resident aliens for tax reasons, and nonresident aliens who live in American Samoa or Puerto Rico.

Any closely held corporation or partnership that satisfies the subsequent criteria is a specified domestic entity.

- On the closing day of the tax year, one individual holds 80% of the voting power, shares, or capital.

- Its passive income accounts for 50% of its total revenue or 50% of its assets are held to generate passive income.

This also holds true for domestic trusts with at least one designated current beneficiary for the relevant tax year.

Reporting thresholds for Form 8938

Additionally, A taxpayer must meet a set of criteria in order to be required to file Form 8938. For various taxpayer classes, the IRS has established different thresholds. These are all the total foreign assets that you have:

- If the market value of an unmarried person’s overseas financial assets is more than $50,000 on the last day of the year or more than $75,000 at any point throughout the year, they must file Form 8938.

- If the market value of their overseas financial assets is larger than $100,000 on the year’s last day or greater than $150,000 at any time during the year, married individuals filing jointly and residing in the United States who are obliged to file the Form 8938.

- If the market value of their overseas financial assets exceeds $50,000 on December 31 or $75,000 at any time throughout the year, married persons filing separate returns and residing in the United States.

- If the market value of their foreign financial assets is greater than $200,000 on December 31 or greater than $300,000 at any time during the year, unmarried individuals who are physically present outside the United States and who meet either the bona fide resident or physical presence tests are required to file Form 8938.

- If the market value of their foreign financial assets is greater than $400,000 on the last day of the year or greater than $600,000 at any time during the year, married individuals filing jointly who are residing outside the United States and satisfy either the physical presence or bona fide resident tests are required to file Form 8938.

- If the market value of their foreign financial assets is greater than $200,000 on December 31 or greater than $300,000 at any time during the year, married individuals filing separately who are living outside of the United States and who pass either the physical presence or bona fide resident tests are required to file Form 8938.

- Corporations, partnerships, and trusts that fall under the aforementioned parameters and have a total value of specified foreign financial assets of at least $50,000 as of the year’s end or at any time throughout the year.

Where To Get a Form 8938

Form 8938 is available for download from the IRS website or from your accountant. Many libraries, post offices, grocery stores, office supply stores, and print shops also stock the majority of IRS Tax Forms. If you file your return by using the online software, such as TurboTax, and if you are required to file the form, it will typically be done automatically.

Threshold & Requirements

Those U.S. taxpayers who fall under the Form 8938 threshold and are required to file a tax return are also obligated to report certain foreign assets. Depending on the taxpayer’s filing status and whether they are a resident of the United States or another country, different threshold requirements apply. It’s crucial to understand that Form 8938 and the FBAR is not the same thing (FinCEN Form). Some taxpayers may be obliged to file both the Form 8938 and the FBAR, while others are only needed to file one of the forms. Still other taxpayers may not be subject to the Form 8938 or FBAR Filing obligations.

Filing Requirement of Threshold

The following factors are used to calculate the filing requirements of Threshold:

- Position as a U.S. resident vs a non-resident

- Filing Married or Separated versus Jointly

- Return of Joint Income Tax (U.S. Residents): Only if the total worth of your designated foreign financial assets is greater than $100,000 on the last day of the tax year or greater than $150,000 at any time during the tax year can you satisfy the reporting requirement if you are married and file a joint Income Tax Return with your spouse.

- Separate or No-Marriage Tax Return (U.S. Residents): Only if the total worth of your designated foreign financial assets is greater than $50,000 on the last day of the tax year or greater than $75,000 at any time during the tax year can you satisfy the reporting requirement if you are married and file a separate income tax return from your spouse.

- Separate or Explicit Tax Return (Non-U.S. Residents): If you are single and do not file a joint tax return, you only meet the reporting requirement if the total value of your designated foreign financial assets is greater than $200,000 on the last day of the tax year or it could be $300,000 at any point in the tax year.

- Tax Return Filed Jointly (Non-U.S. Residents): If you are married and file a joint tax return with your spouse, you will only meet the reporting requirement if the total value of your designated foreign financial assets is greater than $400,000 on the last day of the tax year or greater than $600,000 at any time throughout the tax year.

Requirement of Filing

The physical Form 8938 can be filled out and mailed along with the remainder of your tax return and payment by the yearly federal tax filing deadline. Additionally, you can e-file it alongside the rest of your electronic tax return.

The information that needs to be submitted to the IRS is detailed in Form 8938. It is divided into six parts:

- Financial accounts, such as a deposit or custodial account with a financial institution, all are covered in Part I.

- Stocks, bonds, and other financial instruments are included in Part II list of other financial asset categories.

- The summary in Part III identifies the other parts of the tax return where foreign financial asset income is reported.

- Part IV contains a breakdown of specific financial asset categories that are exempt from reporting on Form 8938 because their details are included elsewhere on the tax return.

- The information you supply in sections I through IV is simply expanded upon in parts V and VI.

Deadline of Filing Form 8938

The day of your tax return is supposed to be filed is also the FATCA reporting deadline. The Form 8938 deadlines for people are as follows:

- April for the U.S. Residents

- June for Foreign Residents

- October is Extension in December due to Special Circumstance extension.

Transpires if You Fail to File

If you are required to file Form 8938 but fail to do so then you risk a $10,000 fee and a penalty of up to $50,000 for persistent failure after IRS notification. The IRS further warns that underpayments of tax resulting from hidden foreign financial assets will incur a 40% extra severe underpayment penalty.

Penalties Related to Form 8938

If Form 8938 is not submitted before the tax return’s deadline, including any extensions, or if it is submitted incorrectly or incompletely then the IRS may levy a $10,000 penalty. Additionally, if the Form 8938 is not filed within 90 days of receiving a formal notice from the IRS then the IRS may impose additional penalties of $10,000 for each 30-day period or portion thereof that passes without being filed. $50,000 is the maximum fine which is imposed.

If a Form 8938 isn’t submitted and the IRS decides that a taxpayer possesses one or more foreign financial assets that need to be declared but none have been, it will assume that the foreign financial asset has enough value to meet the thresholds for reporting. If the taxpayer can prove that there was a valid reason why an asset wasn’t reported on Form 8938, penalties may be waived.

Exception for Justifiable Cause of Late Filing

While Reasonable Cause may reduce penalties, the IRS places restrictions on what constitutes reasonable cause: The IRS is quick to include a significant barrier for you to overcome in seeking to qualify for reasonable cause, with their refusal to state precisely which exact facts and circumstances will qualify for such case and the restriction doesn’t seem like it should be there.

For instance, if you’re from a nation where it’s against the laws to reveal your financial information to another government are like the United States, that won’t be enough of an excuse for you to ignore the form 8938 requirements.

In fact, the IRS has explicitly said that the example of breaking your own country’s law which is provided above is insufficient to satisfy the fair cause requirement.

- Effect of laws from other jurisdictions.

- It is not reasonable cause if you would face a civil or criminal penalty from a foreign country in case if you disclosed the needed information.

You can get in touch with our expertise if you have any questions or query regarding this article. Finding the correct specialists does not have to be an expensive or time-consuming procedure; by contacting our expertise, you will learn that not only have they amassed a wealth of information, but they have also developed a strong network of tax and legal experts. Others in like circumstances might find this to be of great use.

Please don’t hesitate to get in touch with our free and obligation-free knowledge.

Frequently Asked Questions

Where to Mail Form 8938?

If you choose to file by mail, you must deliver Form 8938 to the state’s IRS processing office together with Form 1040, your tax payment, and any other necessary tax forms, all of which must be postmarked on or before the annual filing date. On the IRS website, you can locate these locations.

What do You Understand by Foreign Financial Asset?

Specific foreign financial assets which come in a wide variety of forms, and they may all need to be disclosed to the IRS. Although there are a few applicable exceptions, exclusions, and limitations and the list is very extensive.

Here are a few typical Form 8938 asset examples:

• Bank Accounts abroad

• Savings accounts abroad

• Accounts for Foreign Investment

• Accounts for Foreign Securities

• Mutual Funds from Abroad

• Overseas trusts

• Plans for Foreign Retirement

• Foreign corporate or business accounts

• Policies for Foreign Life Insurance

Is Form 8938 E-Filing Compatible?

Using your preferred tax filing program, you can electronically submit Form 8938 together with the rest of your annual tax return. If you don’t file for an extension, make sure to do it by the tax deadline, which is often April 15.