Table of Content

- 1 What is Form 1099-H: Health Coverage Tax Credit Advance Payments?

- 2 Who Can File Form 1099-H: Health Coverage Tax Credit Advance Payments?

- 3 How to File Form 1099-H: Health Coverage Tax Credit Advance Payments

- 4 Download Form 1099-H: Health Coverage Tax Credit Advance Payments

- 5 Consideration for Form 1099-H: Health Coverage Tax Credit Advance Payments

- 6 Frequently Asked Questions

- 6.1 How can You Report For Form 1099-H on Your Tax Returns?

- 6.2 When will You Receive Your Copy of Form 1099-H: Health Coverage Tax Credit Advance Payments?

- 6.3 For What Purpose Form 1099-H: Health Coverage Tax Credit Advance Payments is used?

- 6.4 What do You Understand by Insurance Premium?

- 6.5 What do You Understand by Tax Credits?

What is Form 1099-H: Health Coverage Tax Credit Advance Payments?

The IRS which is known as Internal Revenue Service uses Form 1099-H: Health Coverage Tax Credit Advance Payments for the tracking of advance payments of qualified health insurance which are made to qualified taxpayers and members of their families by the Department of the Treasury. The recipients of the payments are those people who are qualified for the trade adjustment assistance which is known as TAA, alternative TAA (ATAA), reemployment TAA (RTAA) or Pension Benefit Guaranty Corporation (PBGC) payees as well as their qualified relatives.

A copy of the form is to be submitted by the health insurance companies and another copy is to be delivered to the taxpayer and the IRS. In 2021, the HCTC program came to an end.

Key Features of Form 1099-H: Health Coverage Tax Credit Advance Payments

• The IRS used to demand you that you have to file Form 1099-H as a federal income tax document.

• Health insurance companies that are the recipients of TAA, ATAA, RTAA or PBGC must file the form if they are receiving the advance payments on the behalf of the taxpayer.

• Recipients of the TAA, ATAA, RTAA and PBGC benefits would be qualify for the health coverage tax credit which can enable you to minimize the health insurance prices.

• If you receive the form then you can save a copy for yourself but fill out Form 8885 with the data so that you may submit it with your annual tax returns.

• On December 31, 2021, the HCTC scheme was discontinued.

Who Can File Form 1099-H: Health Coverage Tax Credit Advance Payments?

Advance payments are a component of the HCTC, a federal tax credit that greatly reduces the monthly costs for the people and the family’s health insurance. Some of the program’s eligibility requirements are as follows:

- Due to a Qualifying Job Loss and Eligible for TAA Benefits.

- Beneficiary of an ATAA or RTAA.

- While You were between the Ages of 55 and 64, the PBGC took over to Your Defined-Benefit Pension Plan.

The program was finished on December 31, 2021.

The Department of the Treasury provided the advance payments of the HCTC in order to qualified health insurance providers, who then reported those payments which are used by IRS for Form 1099-H on behalf of eligible recipients. Every time the health insurance provider for a taxpayer accepts advanced payments for any of the aforementioned reasons, these organizations file Form 1099-H.

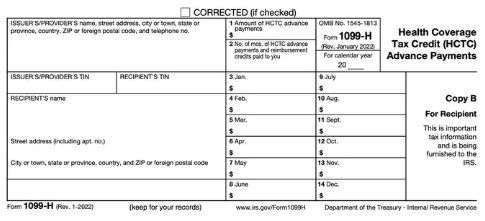

For Form 1099-H you have to maintain three copies of it. Copies A and B are forwarded to the IRS and the taxpayer, respectively while Copies C are kept by the issuer. The issuer or the providers are those which is your health insurance provider and the recipient. Who is you; you are the taxpayer, who is identified on both sides that is on the left side of the form by their respective names, addresses and tax identification numbers (TINs). Fourteen boxes are located on the right side of the form.

- First Box: Amount of Advance Payment of HCTC. The entire amount of the HCTC advance payments for the eligible health insurance expenditures that were made on your behalf is shown in this first box. A maximum of 72.5% of your annual health insurance premiums may be used in this.

- Second Box: Number of MOS of Advance Payment of HCTC and Reimbursement Credits Which are Paid to you. Your total number of HCTC payment months is displayed in the second box.

- From Third Box to Fourteenth Box. The amount of HCTC advance payments were made on your behalf for the each month of the year is shown in the third boxes through Fourteenth Box. The sum of the figures displayed in these boxes should be equal to the sum of the figures which are displayed in First Box.

How to File Form 1099-H: Health Coverage Tax Credit Advance Payments

Your insurance company will send you a copy of Form 1099-H: Health Coverage Tax Credit Advance Payments in case if you are receiving health coverage tax credit advance payments to help you for paying to your health insurance premiums. It is possible that you will need to fill out IRS Form 8885 with a part of the data on Form 1099-H. When you will file your annual tax return then the latter will be attached to it and sent with the Form 1040 or Form 1040-SR.

It is important to note that there is no need to include a copy of Form 1099-H with your tax returns. The original should be kept with your tax records with it till end.

Download Form 1099-H: Health Coverage Tax Credit Advance Payments

The IRS website had the copies of every Form 1099-H: Health Coverage Tax Credit Advance Payments which is the most recent version and its link is available for download on the site.

Consideration for Form 1099-H: Health Coverage Tax Credit Advance Payments

If you want to be qualified for the HCTC then you must have the following criteria:

- In someone else’s Federal Income Tax Returns, they could be listed as a defendant in that.

- Had a valid enrollment in one of the following programs that are Medicare, Medicaid, Children’s Health Insurance Program (CHIP), and Federal Workers Health Benefits Program or were qualified to receive benefits under the American military health system (TRICARE).

- Possessed a Health Insurance Plan through the Affordable Care Act (ACA) in the marketplace.

You also have the option of making monthly payments to the HCTC program in exchange for a portion of your health insurance premiums. The HCTC program is added to the remaining sum and delivered to your health plan to the entire payment. The HCTC was also available to you as an annual tax credit if you paid your health plan in full in each month.

You may find all the relevant information which you need in this page to comprehend Form 1099-H: Health Coverage Tax Credit Advance Payments. We advise you to read it in its entirety for a clearer understanding. We really hope that the information provided above about the Form 1099-H: Health Coverage Tax Credit Advance Payments will be helpful to you. But if you have any questions, don’t hesitate to ask one of our professionals. Our dedicated team of knowledgeable experts can answer any query you may have about your Form 1099-H: Health Coverage Tax Credit Advance Payments.

Whatever the situation, we just ask you to contact our toll-free hotline as soon as you realize that you require assistance. Work with our tax specialist who is knowledgeable with independent contractors and freelancers. Your tax professional will take care of your taxes and research 500 deductions and credits to make sure you don’t miss anything. If you require then you can easily file your own self-employment taxes with us. We will research in every sector by specific deduction if you are eligible for and fight for every cent that you are due.

Frequently Asked Questions

How can You Report For Form 1099-H on Your Tax Returns?

If you are receiving Form 1099-H then you might need to report some of the information to the IRS. So, now you have to fill out Form 8885 and include it with your Form 1040, 1040-SR or comparable form which is to be accomplish to this.

There is no need to submit Form 1099-H: Health Coverage Tax Credit Advance Payments with your tax return but you should keep it for your records.

When will You Receive Your Copy of Form 1099-H: Health Coverage Tax Credit Advance Payments?

Taxpayers should receive the copies of Form 1099-H: Health Coverage Tax Credit Advance Payments from the issuers by the date of January 31. Hence, if you are qualified and received an HCTC benefit in 2021 then you ought to receive the form by January 31, 2022.

For What Purpose Form 1099-H: Health Coverage Tax Credit Advance Payments is used?

Form 1099-H: Health Coverage Tax Credit Advance Payments is sent to the taxpayers by the qualified health insurance providers who are receiving advance payments for the coverage on a behalf of an eligible insured individual from the Department of the Treasury.

What do You Understand by Insurance Premium?

An insurance premium is the amount of money of an individuals or business which pays for an insurance policy. Insurance premiums are mainly paid for the policies that cover healthcare, auto, home and life insurance. The insurance company will receive income from the premium once it is earned by you. It also constitutes a liability, as the insurer must pay coverage for claims being made against the insurance. If you are failure to pay the premium on the individual or the business may result in the cancellation of the policy.

What do You Understand by Tax Credits?

Tax credits are the sums of money that taxpayers can deduct right away from the taxes that they owe. This is distinct from tax deductions, which is reducing a person’s taxable income.

A tax credit’s worth varies according to its type. Various sorts of the tax credits are awarded to the individuals or for the businesses in specified locations, classifications or industries.