Table of Content

- 1 What is Form 1040-X, Amended U.S. Individual Income Tax Return?

- 2 Who Can File Form 1040-X, Amended U.S. Individual Income Tax Return?

- 3 How to File Form 1040-X, Amended U.S. Individual Income Tax Return?

- 4 What Are the Benefits of Filing Form 1040-X?

- 5 Frequently Asked Questions

- 5.1 In Which Situation and When you should Receive Your Amended Tax Return?

- 5.2 Where the Taxpayer need to Send his/her Form 1040-X, Amended U.S. Individual Income Tax Return?

- 5.3 Is there need of Filing Form 1040-X with Form 1040?

- 5.4 Can the Taxpayer Direct Deposit the Form 1040-X?

- 5.5 What is the Use of Form 1040-X?

What is Form 1040-X, Amended U.S. Individual Income Tax Return?

Form 1040-X, Amended U.S. Individual U.S. Income Tax Return is needed by the taxpayer whenever the taxpayer wants to fix a mistake which he done previously and submitted to the federal tax return. The most frequent problems which are fixed with this form and it involve the taxpayer’s filing status, the number of dependents and the omission of credits or deductions. As the Internal Revenue Service (IRS) frequently fixes such type of problems while processing the returns, Form 1040-X shouldn’t be utilized to fix the simple mathematical errors in a tax return.

Key Features of Form 1040-X, Amended U.S. Individual Income Tax Return

• Taxpayers must be submitted by the IRS Form 1040-X so that the modification can be done easily in a previously submitted annual tax return.

• In order to receive a refund, the form must be submitted no later than three years by following the filing of the initial return or two years by following the payment of the tax in any case in which it comes first.

• Form 1040-X should be used to make substantive adjustments and it is not to remedy calculations mistakes.

• If ever you also e-filed the related tax return then you can e-file the form. You can also send it by mail to the IRS.

• All incomplete forms and other materials should be sent with the form.

Who Can File Form 1040-X, Amended U.S. Individual Income Tax Return?

Any taxpayers who can already filed a tax return and the taxpayer also needs to update it for any of the following reasons due to which you should submit a 1040-X form:

- For the amendment of the Forms 1040, 1040-SR or 1040-NR. The majority of people will submit their yearly tax returns by using the one of these three formats.

- Taxpayer must cast a ticket after the cutoff. For the better understanding we can take example of a married taxpayer who has the option of filing the return either alone or jointly with their spouse.

- Taxpayer must alter a sum that the IRS had previously revised to file a carry back claim due to a loss or unused credit.

How to File Form 1040-X, Amended U.S. Individual Income Tax Return?

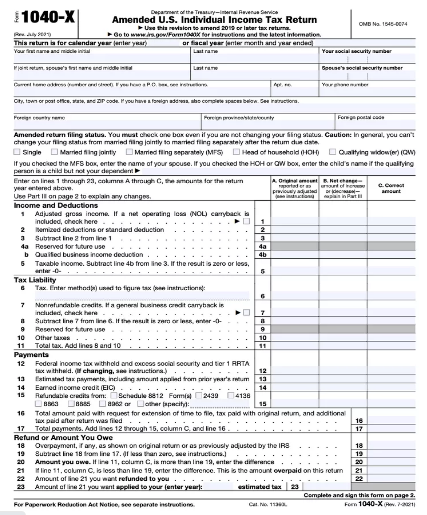

Form 1040-X, Amended U.S. Individual Income Tax Return contains a explain detailed information which is written in line-by-line description of all potential modifications which allows the taxpayer to precisely record each of the amendment kind, amount and a justification.

It is not only the filer who has to submit the Form 1040-X, but also an updated copy of the whole 1040 or 1040-SR, together with any attached forms and schedules that even if they weren’t changed. A Form 1040-X can be mailed or electronically filed with the IRS. An annual return must first be submitted before submitting Form 1040-X.

Make sure to submit the necessary paperwork along with your updated return:

- Income-related documents which are not submitted, like W-2s or 1099.

- Your revised income tax returns with a supporting paperwork.

The taxpayers are the one who must submit a Form 1040-X within three years of their original return’s filing date or within the two years of the tax payment. It can be a later so that you can be eligible for a credit.

Regarding Form 1040-X, the IRS advises taxpayers as the following:

- If a refund was due, hold off until it comes. Then while submitting Form 1040-X, you should hold off on filing it until you get any refunds that were the part of your initial tax return.

- Taxpayer can cash the first check since the IRS will only issue a second as a separate refund if it is necessary.

- Within three years of the original filing you have to submit a Form 1040-X. You must file the form within three years of the original tax return’s due date or within two years of the tax payment date, whichever comes first

- If the change would influence how much of a refund you will receive then the formal tax filing deadline, which is typically dated as April 15 of each year and it will be used to determine whether any early returns were submitted.

What Are the Benefits of Filing Form 1040-X?

Taxpayer must be sure for the checking of any exemptions, deductions or credits which you may have overlooked whenever you are filing Form 1040-X. That exemption could be intimidating and you might fear that if you make any mistakes then it would result in punishment. Yet, there are many benefits which are associated with filing an amended income tax return, such as:

- Adding Further Tax Deductions

- Making Further Deductions

- Obtaining a Larger Refund

Taxpayer must keep in mind that he might also be required to record extra income that you did not include on your initial return. Your taxable income will rise if this occurs and you might owe the money. This implies that you are in charge of making good on the debt as well as any associated costs and penalties.

You may find all the important information which ever you need on this page to comprehend Form 1040-X, Amended U.S. Individual Income Tax Return. We are advising you to read this page in its entirety for your clearer understanding. The information provided above regarding the Form 1040-X, Amended U.S. Individual Income Tax Return and it is provided in the sincere hope that it will be helpful to you. But if you have any questions then there is no need to hesitate of asking question from one of our professionals. Our dedicated team of knowledgeable specialists can answer any query you may have regarding your Form 1040-X, Amended U.S. Individual Income Tax Return. No matter what the situation, we just advise you to call our toll-free hotline as soon as you realize that you need assistance.

Frequently Asked Questions

In Which Situation and When you should Receive Your Amended Tax Return?

Whenever the taxpayer amended return then it is filed electronically, according to the IRS by processing it and it can take up to 16 weeks to 20 weeks starting in 2023 owing to delays brought due to the corona virus pandemic. You can start monitoring the status of your filing on the IRS website about three weeks after you file the 1040-X.

Where the Taxpayer need to Send his/her Form 1040-X, Amended U.S. Individual Income Tax Return?

If you are trying to submit your annual return electronically then you may do it. As now for filing form 1040-X electronically you can use the professional tax preparation software. If you owe someone money then that is the quickest way to pay it back to them. If you’d rather, you can send it via mail. For usage by inhabitants of various locations and by Americans who are abroad, the IRS provides four alternative addresses.

Is there need of Filing Form 1040-X with Form 1040?

Form 1040-X must be submitted after submitting the Forms 1040, 1040-SR or 1040-NR. You have to modify your prior tax return with the updated information.

Can the Taxpayer Direct Deposit the Form 1040-X?

Direct payment is not yet an option in case of the refunds which are based on modified returns. The Internal Revenue Service will mail you a check for it.

What is the Use of Form 1040-X?

A taxpayer may modify or alter a previously filed tax return by submitting Form 1040-X. This form should be used if you forgot to submit a credit claim or record a deduction. Ignore any calculations mistakes you may have made. That kind of inaccuracy is always checked for and fixed by the IRS.