The IRS requires employers to send the Form W-2 to each employee by the end of the year. This form contains the employee’s wage and salary information, as well as the taxes withheld from their paychecks . Form W-2 is used by employees to report their income and tax obligations on their federal tax returns. It also shows the amount of Social Security and Medicare taxes paid by both the employer and the employee. Employees should receive Form W-2 from their employers by January 31 of each year.

Table of Content

- 1 What is Form W-2: Wage and Tax Statement?

- 2 Who Files Form W-2: Wage and Tax Statement?

- 3 How to File Form W-2: Wage and Tax Statement

- 4 What Information Does Form W-2: Wage and Tax Statement Include?

- 5 How to Read Form W-2: Wage and Tax Statement?

- 6 Tax Related Documents

- 7 Conclusion

- 8 Frequently Asked Questions

- 8.1 What will happen if in any case I will lose my W-2 Wage and Tax Statement Form?

- 8.2 What is the Difference Between the Form W-2 Wage and Tax Statement and W-4?

- 8.3 How can I have my W-2 Wage and Tax Statement Form?

- 8.4 What Amount I Require in Order to get my W-2 Wage and Tax Statement Form?

- 8.5 What are the Benefits Which are Received by W-2 Wage and Tax Statement Employees?

What is Form W-2: Wage and Tax Statement?

W-2 Wage and Tax Statement Form is the form which is paid at the end of the year by a business. It is important for every business to send Form W-2 Wage and Tax statement. Form W-2 Wage and Tax Statement is generally known as the Wage and Tax Statement which is important to give each of the employee and the Internal Revenue Service (IRS).

A W-2 Wage and Tax Statement contain an annual salary of all employees’ and the taxes are also deducted from their paychecks. Employers who withhold taxes from employee’s paychecks and provide all this information to the government are known as W-2 Wage and Tax Statement employers.

Key Features of the W-2 Wage and Tax Statement Form

- Your preceding year’s income which is earned and the taxes withheld are must shown on Form W-2 Wage and Tax Statement and then it will be shown on your income tax returns also.

- W-2 Wage and Tax Statement are used by the employers to report FICA taxes which are paid by employees.

- The IRS also keeps the track of the taxpayer’s tax obligations that are using W-2 Wage and Tax Statement forms.

Who Files Form W-2: Wage and Tax Statement?

The employees must receive a W-2 Wage and Tax Statement Form from their employers is they are receiving a salary, wage or any other kind of payment. It is legally important to receive a W-2 Wage and Tax Statement form from their employer by an employee. Contract or self-employed workers mainly report their income on various tax forms so they are not included here. The employer must send the W-2 Wage and Tax Statement form to the employee by January 31 of each year so that the employees have enough time to file their taxes before the deadline and they can avoid any type of penalty. The deadline date is April 15 in the most of the years.

Federal Insurance Contributions Act (FICA) taxes for employees must also be reported on W-2 Wage and Tax Statement forms by employers at various points during the year. Employers must submit Form W-2 Wage and Tax Statement and Form W-3 to the Social Security Administration by the end of January for the preceding year for each employee (SSA). The data of these forms is used by the Social Security Administration (SSA) to determine the Social Security benefits to which each worker is entitles. You must submit the previous year tax returns of your.

How to File Form W-2: Wage and Tax Statement

The W-2 Wage and Tax Statement Form is given to an every employee of a business; which is send by your employers automatically in each year which is required by you for your income taxes. The copy of your W-2 Wage and Tax Statement must be sent by your employer to the IRS.

Your employer uses the information on Form W-4 and on Form W-9 if required which is provided to you on your first day of work to keep the benefits like track of your income, tax withholding, employer-provided benefits and pre-tax contributions to items like a 401(k) retirement plan. The W-4 form informs the employer that how much tax should be deducted from an employee’s paycheck which is depend on the person’s marital status, the number of allowances and dependents, and other considerations.

You can fill out a Form 1040 which is individual tax return, manually or electronically with the information on your W-2 Wage and Tax Statement form while preparing your income taxes. In many of the cases, online tax preparation software is now provides you to simply import the data on your W-2 Wage and Tax Statement from your payroll provider.

What Information Does Form W-2: Wage and Tax Statement Include?

W-2 Wage and Tax Statement has the same fields for each and every company. Since employees must submit taxes in both the state and the federal level. A W-2 Wage and Tax Statement form is separated in two sections that is for state and the federal level. The federal Employer Identification Number (EIN) of the business and the state ID number of the employer are the two pieces of information which is provided in some fields. Details about the employee’s earnings from the prior year are mainly contained in the remaining of the fields.

The amount of taxes which is held from the employee’s paychecks are broken down into withholding for federal Income Tax, Social Security tax, and other taxes and as well as the employee’s total earnings from the employer for the year which all are noted. If the employee additionally accepts tips, a field will display how much they were paid in tips during the course of the year. If you are holding numerous of jobs that can issue each other then you must enter each W-2 Wage and Tax Statement separately.

When an employee files their taxes, the gross tax liability is reduced by the amount of tax withheld in accordance with the W-2 Wage and Tax Statement form. If the tax which is given is by you is more than the due, so in such case a refund will be given to you.

The Form W-2 Wage and Tax Statement s also used by the IRS to track an employee’s earnings and the tax obligations. The IRS may audit the taxpayer if the income reported on the employee’s taxes and the income reported on the Form W-2 Wage and Tax Statement is different. Taxpayers are required to submit any of the salary, wage, and a tip income even if it is not reported on a W-2 Wage and Tax Statement.

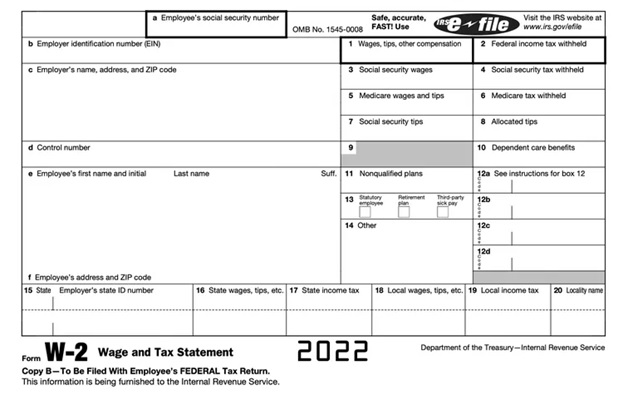

How to Read Form W-2: Wage and Tax Statement?

Employers need to fill all types of boxes which include numbered and lettered boxes on W-2 Wage and Tax Statement forms. W-2 Wage and Tax Statement Form shows your earnings and the amount of taxes which is deducted on behalf of you.

A to F Box

In these boxes you have to entre Social Security number, your employer’s EIN and your state ID number. These all are to be listed in the lettered boxes on your W-2 Wage and Tax Statement form along with your name, address and your contact information.

1st and 2nd Box

Your taxable income must include your earnings, salary, tips and bonuses these all are to be displayed in the First Box and the amount of federal income tax which is taken from your pay that is to be displayed in second Box.

3rd and 4th Box

In third and forth box you have to enter the amount of Social Security tax which has to be withheld from your earnings.

5th and 6th Box

Your pay’s Medicare tax rate is stated in the fifth Box along with the sixth Box which shows that how much was withheld with it. There is a 1.45% employee share of the Medicare tax.

7th and 8th Box

If there are tips in your income then these boxes will display the amount which you reported in tips and these tips are to be entre in seventh Box and the amount of your employer recorded in tips which you paid is to be entre in eighth Box.

9th Box

Ninth box was used to represent the benefit of tax which is no longer available so it is empty.

10th Box

In tenth Box you have to show that how much in dependent care benefits are received by you from your employer.

11th Box

Your employer’s non-qualified plan’s of deferred compensation amount is to be shown in eleventh box.

12th Box

Box twelfth lists pay additional or deductions from your taxable income along with the single- or double-letter codes that which will apply to each. In this box like a Contribution to a 401(k) plan can be fall under this category. The lists of codes are included in W-2 Wage and Tax Statement instructions from.

13th Box

In thirteenth box there are three sub boxes which include:

- It report the salary which is not a subject to federal income tax withholding

- It indicates whether you participated in an employer-sponsored retirement plan or not

- It indicates whether you received the sick pay from a third party for instance an insurance policy etc.

14th Box

Any other supplementary tax information that would not fit into the other parts of a W-2 Wage and Tax Statement form might be reported by the employer in Fourteenth Box. State taxes are to be deducted from disability insurance and union dues are a couple of instances of this box data.

15th to 20th Box

The following six sections on a W-2 Wage and Tax Statement all are related to state and local taxes and includes that how much of your salary is to be deducted from it and how much is subjected to them.

Tax Related Documents

For the process of withholding every employee must file Form W-4. The data which is used by the employer in order to calculate the amount of tax which deduct from the paycheck of the employee’s. Whenever the employee start working for a company first time then most workers are to be required to complete W-2 Wage and Tax Statement form.

A 1099 form contains the earnings and the deductions which are provided to an employee who receives $600 or more amounts in pay from the employer during the course of the year. By the end of January the following year will be on average.

If you received gains from gambling in the previous year, a gaming establishment, such as a casino may give you a tax form which is known as a W-2 Wage and Tax Statement.

In the event that interest was paid on a federal student loan, students will receive a 1098-E statement. Also the students receive a 1098-T statement detailing their college tuition costs that could be qualifying them for tax credits or deductions.

Conclusion

Every year companies are required to deliver Form W-2 Wage and Tax Statement to all the employees as well as the IRS. The form contains the annual salary of an employee as well as the deducted taxes. Each year, employees use this form to file their taxes.

In this article, we have covered all the crucial information which you need to know about W-2 Wage and Tax Statement Form. We advise you to read it completely in order to understand it better. In this post, we try to cover the W-2 Wage and Tax Statement Form for tax payment in great depth as we can. We really hope that you will find the information on the W-2 Wage and Tax Statement Form which is described above to be helpful.

But in any case, you have any questions regarding W-2 Wage and Tax Statement Form then get in touch with one of our professionals. Our committed group of qualified specialists with great knowledge can address any problems you might be facing with your tax payment. You merely offered the advice to call our toll-free helpline right away in this situation.

Frequently Asked Questions

What will happen if in any case I will lose my W-2 Wage and Tax Statement Form?

You can easily access your W-2 Wage and Tax Statement as many times which you want if it is online. You can frequently ask for the automated password for the recovery in case if you lose your login information or password for an online site. You must contact your payroll or HR supervisor if you require any more assistance with the online access for your records or if you require a fresh physical copy.

What is the Difference Between the Form W-2 Wage and Tax Statement and W-4?

An employee’s tax ID number often with their SSN, marital status, the number of allowances and dependents and the amount of tax to be deducted from each paycheck which all are listed on the W-4 form, which is to be complete by the employer. The W-4 for is completed when an employee is employed for the first time or if there are any type of adjustments to be made in their filing status or withholding. At the end of the tax year, employers complete the W-2 Wage and Tax Statement form and send it to the employees for them in order to include in their tax returns.

How can I have my W-2 Wage and Tax Statement Form?

In case, If you are qualified to get one of your employers which must give you a copy of your W-2 Wage and Tax Statement Form in the end of each year. Usually by the end of January or the beginning of February after the tax year which is just concluded then businesses must submit this form. W-2 Wage and Tax Statement Form can be obtained either online or mailed by mail as hard copies, either directly from the employer or through their payroll provider.

What Amount I Require in Order to get my W-2 Wage and Tax Statement Form?

If you earn at least $600 in a given year then your employer will provide you a W-2 Wage and Tax Statement form. If your employer withheld taxes from any income which you received then you will also receive a W-2 Wage and Tax Statement Form. You just need to remember that if you were a contractor rather than an employee then you were likely to receive a form 1099 rather than a W-2 Wage and Tax Statement form.

What are the Benefits Which are Received by W-2 Wage and Tax Statement Employees?

Form W-2 Wage and Tax Statement workers are entitled to all types of legal protections like minimum wage, overtime, family and medical leave etc. Also, they have a right to take advantage of your benefits, such as health and dental insurance, which are frequently more advantageous than what they might get on their own.