Table of Content

What is Form 1099-SA: Distributions From an HSA, Archer MSA, or Medicare Advantage MSA?

An IRS form is also known as Form 1099-SA. It distributes from an HSA, Archer MSA or Medicare Advantage MSA which is used to record distributions from various health accounts. They all include withdrawals from a Medicare Advantage (MA) MSA, an Archer medical savings account or a health savings account (HSA). It also offers reporting details on how estates, non-spouses, and spouses inherit the accounts. The federal income tax return for the taxpayer must include the sums which is listed on Form 1099-SA.

Key Features of IRS 1099-SA

• All the single taxpayers who get the distributions from Medicare Advantage, medical savings and health savings accounts will receive a form 1099-SA in their respective mail.

• On any one of Form the two forms the information from Form 1099-SA is reported and the two form are Form 8853 or Form 8889.

• HSA distributions which are unused, they must be declared as income.

• The health savings account distribution which are made in error, it is the responsibility of your that you should clear or pay it until April 15.

• There are certain guidelines in which you will receive an account from your deceased spouse.

Who Can File Form 1099-SA?

A HSA or MSA provider both includes Archer and Medicare MSAs they are required to submit Form 1099-SA. All the single account holders and the IRS will receive these papers. The issuing entity must be sent it to the taxpayer by the end of January in every year as same as other 1099 forms.

It is required by you that you will file a specific tax forms after receiving the Form 1099-SA. Depending on the kind of distributions which you received and the kind of account from which they came so you must use the forms which all are described below. Remember you must have HSA, Archer MSA, or MA MSA which probably let you to avoid paying of taxes.

Whenever you used for qualified medical expenditures for the account beneficiary, the beneficiary’s spouse or dependents, withdrawals all are frequently tax-free and they can be deducted from your income in the year which you make them. Contributions are also tax deductible in the year in which you make them.

Tax Free Distribution

The term distribution is used in the field of finance which means the majority of the payment of assets from a fund, account or individual security to an investor or beneficiary which you have to do.

Whenever the account holder reaches to a particular age the payouts from retirement accounts are chosen among the most frequent and they all are very necessary. A payment of stock, cash, other rewards which are given to the shareholders by a company or mutual fund all are referred to as a distribution.

Regardless of the source, distribution payments both are typically go straight to the beneficiary and can be made by check or electronically from a variety of financial products.

Following are the distributions which are not taxable:

- The payout which is from an HSA or an Archer MSA in both cases if you transferred the funds to another account or utilized them to cover the eligible account holder’s or a family member’s who are qualifying the medical costs. While an Archer MSA may be rolled over to an HSA or another Archer MSA so that the HSA cannot be rolled over to an Archer MSA.

- A MA MSA is not a taxable if it is used only to cover the account holder’s eligible medical costs.

A distribution from one of these accounts must be reported on the IRS Form 8889 that is Health Savings Accounts (HSAs) or IRS Form 8853. An Archer MSAs and Long-Term Care Insurance Contracts both comes under this even if the distribution is not taxable.

When Distributions Are Taxable

If you received a payout from an HSA, Archer MSA or MA MSA but they did not utilize it to cover all the eligible medical costs then in such case you must include the distribution in your income. The same rule applies if you are not roll over an HSA or an Archer MSA. There can be a situation in which you have to pay other fees.

Taxes will be due in case you are earning income from the contributions in which you made excessive HSA or Archer MSA contributions. Even if you are using it to cover eligible medical expenditures then you must include the earnings in your income for the year in which you got the distribution and if you withdrew the excess plus the earnings by the deadline for filing your income tax return. You are also subject to an annual excise tax of 6% on any excess individual and employer contributions that are remain in the account.

After the date April 15 of the year and by following the first year you must knew or should have known the distribution which was a mistaken and you may reimburse it as an HSA error.

Account and Taxes which are Inherited

If you got an Archer MSA or MA MSA from your deceased spouse then there are specific rules which are needed to apply. The IRS gives you the guidelines for Form 8889 if you received an HSA by the inheritance after your spouse passed away.

You must include the fair market value (FMV) of the account as of the date of death as income on your tax return if you received the account as an inheritance from someone other than your spouse. Even if you received the account’s dividend in a subsequent year then you must include the sum on your tax return for the year that the account owner was passed away. You must report the earnings on the other income line of your tax return if they were made one after the account owner passed away.

The Value of the account as of the account holder’s death is included in the account holder’s gross income if the estate is the beneficiary in any of these scenarios. The account holder’s final income tax return should include the sum.

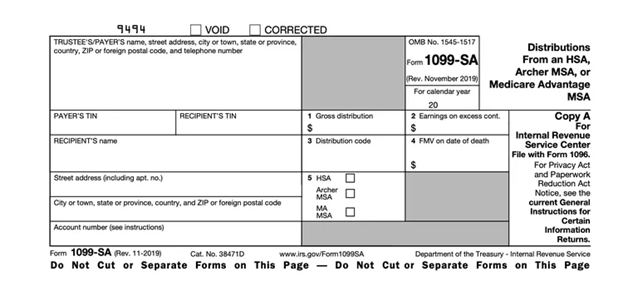

How to Read Form 1099-SA

You will see the following options on the left side of the Form 1099-SA:

- Information about the trustee or payer such as name, address and contact information.

- The whole or a portion of the payer’s tax identification number which is also known as TIN number.

- Yours entire or a portion of your tax identification number, Social Security number, individual taxpayer identity number, adoption taxpayer identification number or employer identification number (EIN).

- Your contact information such as your name, address and a account number.

The following information is located on the right side of the form:

- The sum of the money that was obtained and either distributed to you or made directly to a healthcare provider.

- The amount of any profits on overage donations.

- The distribution code specifies that the kind of distribution where there are six.

- Once the account holder passed away, its fair market value will be determined.

- Details on whether the account is an HSA, Archer MSA or MA MSA.

Whenever the reporting distributions from the special accounts take place in order to cover medical costs, the 1099-SA is used as an important document. You may or may not owe additional taxes depending on the exact facts on the form, which must be recorded accurately.

Work with a tax preparer or specialist if you have questions regarding Form 1099-SA. If you have any queries about Form 1099-SA, get in touch with our experts. Our highly qualified experts will assist you with any issues which you are experiencing while paying your taxes because they are professionals in their respective fields. Our experts are available round the clock in order to help you.

Frequently Asked Questions

Can You E-Filed the Form 1099-SA?

Absolutely yes, Financial institutions can also submit documents digitally. They must own software that produces a file in accordance with the guidelines in IRS Pub. The IRS also offers a fill-in-the-blank option in order to file the Form.

How can You Mail Form 1099-SA?

There are the three copies of the Form 1099-SA.

• Copy A is used to file with the IRS.

• Copy B will be sent to you.

• Copy C is kept by the financial institution for the handling of the account.

You will get the Form 1099-SA in the mail. You should save it for your records even if you do not have to include it while filing your tax return.

How can You Get Form 1099-SA?

A copy of Form 1099-SA will be sent to you by the financial institution in charge of the account. In case if you did not get it, so in such case contact the one in order to get it.

What do You Understand by Fair Market Value?

Fair market value (FMV) is the amount of a product that would be selling for the open market assuming in which both the buyer and the seller are acting in their own best interests. Both are not under any undue pressures that are given a reasonable amount of the time in order to complete the transaction and both are reasonably knowledgeable about the asset.

In certain circumstances, the fair market value of an item should be a reliable indicator of its estimation or evaluation.

In the fields of bankruptcy law, tax law and real estate, the fare market value is widely accepted.

What do You Understand by Medical Expenses?

All the costs which are incurred for injury or disease prevention or the treatment of the disease, these all are considered as a medical expense. Medical costs can also include but they are not limited to the health and dental insurance premiums, doctor and hospital visits, co-pays, prescription and over-the-counter of medications, glasses and the contacts, crutches and wheelchairs. For the specific amount, medical costs that are not covered by insurance are deductible.