Schedule C form is used for the report of income from a sole proprietorship to the IRS by any self-employed. It is a component of your personal tax return. When it comes to filing taxes, you simply attach the Schedule C form to your 1040.

With the help of the Schedule C form, you can easily keep track of your business earnings, outlays, and overall profit or loss for the tax year. It applies to companies that are unincorporated sole proprietorships or single-member limited liability companies (LCC).

When tax season rolls around, you might need to complete IRS Form C if you freelance, have a side gig, own a small business, or work for yourself in another way. If you work for yourself, you probably need to complete an IRS Form C to disclose how much money you gained or lost from your firm. When filing their taxes, freelancers, contractors, side hustlers, and small business owners generally attach this profit or loss schedule to their Form 1040 tax return.

Table of Content

- 1 About Schedule C IRS Form

- 2 IRS Schedule C Form for Profit and Loss from Business (Form 1040)

- 3 Why Do You Need to File Schedule C Form?

- 4 Information on IRS Form Schedule C

- 5 Downloading of Schedule C: Profit and Loss Form for Business

- 6 How to File Schedule C?

- 7 Schedule C Tips and Tricks

- 8 Summing Up

- 9 Frequently Asked Questions (FAQs)

About Schedule C IRS Form

A taxpayer’s main tax return is Form 1040, and IRS Schedule C, Profit or Loss from Business, are both tax forms used to report revenue and costs for businesses.

Schedule C must be used to report any activity which is carried out for revenue or profit by those who are self-employed, firm owners who are the only employees, or Limited Liability Companies (LLC) with one member. The computations of the ensuing profit or loss are typically regarded as self-employment income.

A tax form known as IRS Schedule C is used to report a business profit or loss. During tax season, you complete Schedule C and either attach it to or electronically file it with Form 1040. Owners of sole proprietorships and single-member LLCs often use Schedule C.

While it’s possible to need an IRS Form 1099 in order to complete a Schedule C, a Schedule C is not the same as a 1099 form.

Key Points of Schedule C

- While submitting their annual tax return, everyone who runs a business as a sole proprietor must complete Schedule C.

- For inclusion as a tax deduction on Schedule C, a business expense must be reasonable and necessary.

- The taxpayer determines the net profit or loss of the company for income tax purposes using Form C.

- For businesses that you own as a sole proprietor or a single-member LLC, Schedule C is utilized to report revenue and outlays.

- Schedule C should be used to report your income and outgoings for your trade or business if you are self-employed or receive 1099-NEC Forms.

- Expenses must be both usual and required for your business in order to be deducted on Schedule C.

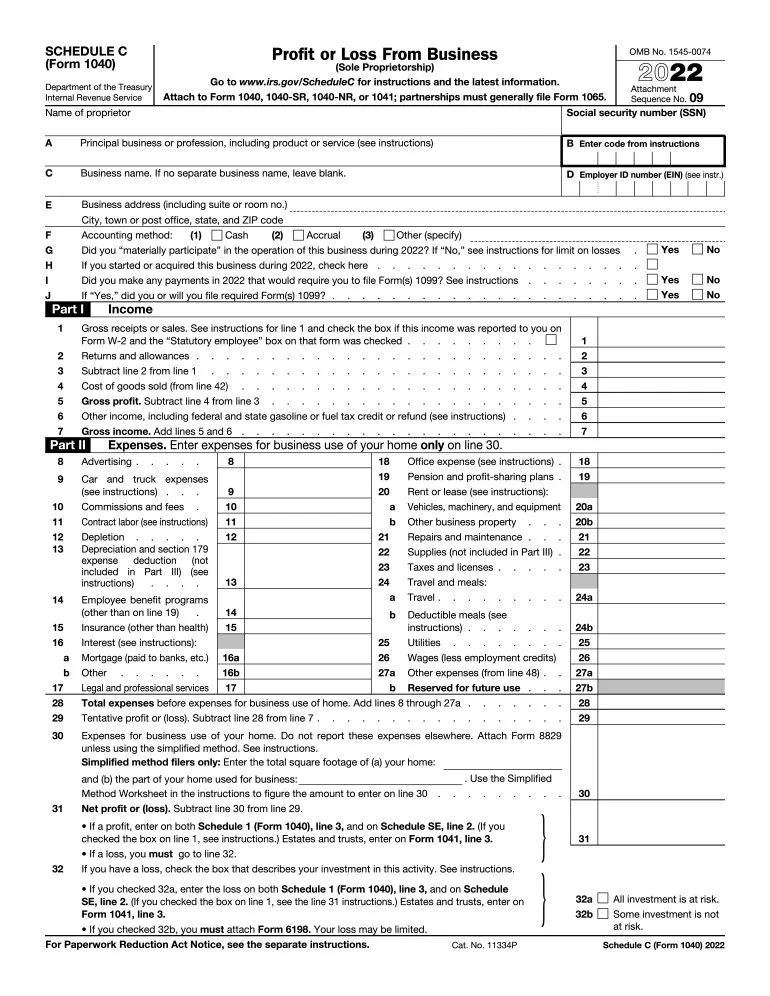

IRS Schedule C Form for Profit and Loss from Business (Form 1040)

You submit IRS Schedule C, Profit or Loss from Business, along with your Form 1040 to record the revenue and outgoings for your company. The resulting profit or loss is regarded as self-employment income.

If you complete Schedule C, you also need to complete Schedule SE or the Self-Employment Tax. Your Social Security and Medicare tax based on your self-employment income will be calculated using this form, and then you will report it on Form 1040, Schedule 2 Part II, and other Taxes.

Why Do You Need to File Schedule C Form?

If you work for yourself as a sole proprietor or as a limited liability company with only one member, you must submit a Schedule C (LLC). If you were a C Corporation or S Corporation, you wouldn’t record your business’s revenue and costs on a Schedule C.

You should receive 1099 forms like the 1099-NEC from your business clients if you are self-employed. The money that a company paid to you throughout the tax year is reported on these forms. Any contractors or vendors who have been paid by your firm may likewise require 1099s from you. Along with other permissible company expenses, these payments are listed as expenses on your Form C. You are subject to a Schedule C if there is the following:

- You run a tiny business.

- In your normal, paid employment, you operate a side business.

- You work for yourself.

- You work for yourself as a freelancer.

- You also make money from other self-employment ventures.

Two types of business arrangements necessitate the filing of a Schedule C that is sole proprietorships and single-member limited liability companies (LLCs). For each business you own, you must fill out a separate Schedule C form. Schedule C does not apply to you whether your business is a C corporation or an S corporation.

Sole Proprietors

A sole proprietor is a person who owns and manages an unincorporated business. Moreover, it implies on:

- The entire profit is yours which you keep.

- Any losses or obligations will belong to you.

The majority of small business owners have to file Schedule C and they typically work as independent contractors, freelancers, and one-person firms. It guarantees that the profits are only subject to one tax and designates your company as a pass-through organization for taxation purposes.

Single–Member Limited Liability Companies (LCC)

This company is entirely owned by one person. You can decide to have it by handling it as a corporation and submitting a corporation tax return if you do so with the IRS. For tax purposes, it is typically not regarded as a distinct legal business entity from the owner. Using Schedule C, you must report all self-employment revenue from the business as well as any profits.

Side Hustler and Gig Worker

If you work as an employee but also run your own side business, you will need to submit a Schedule C. If you consistently and continuously engage in any activity with the intention of making a profit, according to the IRS, you are in business.

But, if it involves farming, you will need a Schedule F, and if your company generates revenue from royalties or rentals, you will need a Schedule E.

Also, if you make a little additional money through a pastime, you are exempt from filing a Schedule C.

Information on IRS Form Schedule C

There are various elements relevant to your trade or business that are requested in Schedule C. These are a few of them:

- Name and address of the company.

- Principal items, services, or occupations provided by your firm.

- Your company’s accounting procedure like cash, accrual, or other.

- If you founded or purchased the business during the current tax year, regardless of whether you materially participated in it or not.

- Your income is fully disclosed.

- Items like advertising, insurance, legal, and professional services, rent or lease payments, repairs and maintenance costs, utilities, wages, and more should be itemized in your business spending reports.

- Data about the cost of goods sold that is relevant to your business in case it is applicable.

- Information on the vehicles which you utilize for your business if it is applicable.

- Unclassifiable by the forms which specified fields are other expenses.

Minimum Income to File Schedule C

The IRS Form C can be filed regardless of one’s income level. No matter how much or how little money you produce, you must report all business income and expenses on Schedule C.

Self-employment tax must be paid at least in the amount of $400. Hence, you are not required to file Schedule SE or pay self-employment tax if your income for that tax year is less than $400. Even if your self-employment tax liability is zero, you must still submit your Schedule C with your Form 1040.

Downloading of Schedule C: Profit and Loss Form for Business

On the website of the Internal Revenue Service, Schedule C is available in every version.

How to File Schedule C?

According to your small business, Schedule C requests the information which is listed below:

- Name of the Business

- Address of the Business

- Method of accounting you use for the purpose of tax.

- Services or the Products

- EIN that is Employer Identification Number

- Business Profit and Expenses from the statement of your income.

- Record of Inventory

- Price of sold goods

- Record of Business Mileage and Vehicles.

- Expenses of car and truck

Your net profit or loss is calculated by subtracting your total business expenses from your gross receipts. This information is computed in Schedule C. The IRS is then informed of any net profit on your 1040 income tax form.

For every self-employed person, keeping thorough records of your business activities is essential.

The schedule C form is divided into five Main sections:-

- Income: Add up your sales and list the cost of your products that are sold to calculate your gross profit.

- Business Expenses: To make sure you account for everything, there are 12 different types of deductible business costs. This includes the cost of advertising, legal and professional services, and home office costs. Your net profit is calculated by taking the sum of these costs and deducting it from your gross profit. On Schedule 1 of your personal tax return, you should include this amount as your business’s income or loss. Your 1040 may allow you to deduct any net losses you had this year.

- Cost of Goods Sold: This section provides guidance on determining your cost of goods sold (COGS). If your company is a service-based one, it usually doesn’t apply.

- Details of Your Car: These car and truck expenses are tied to your job.

- Other Costs: This category is for other business expenses that don’t fall under one of the categories in part 2. Note that a business cost must be both ordinary and necessary in order to qualify as one for tax purposes.

Schedule C Tips and Tricks

Here are some pointers to help you easily explore Schedule C.

- Schedule C preparation software is sold by the majority of well-known tax software vendors. Although you’ll probably need to get the most expensive model to use Schedule C capabilities, the price may still be less than having someone else do your taxes.

- There may be more than one Schedule C that you must complete. Each side job is allowed one Schedule C. You must complete 2 Schedule C if you have two side jobs.

- Calculate the area of your home office. If you’re self-employed and have an office at home, you can probably write off part of the costs of maintaining it. Up to 300 square feet of home office space are eligible for a flat-rate deduction from the IRS of $5 per square foot. But, if a significant portion of your house’s square footage is devoted to your home office, your home expenses (utilities, etc.), and your ability to preserve and compare specific records are strong enough, you could be able to claim a higher deduction with the “normal” way.

- Use additional tax deductions if it is available. You can get several tax deductions for working for yourself and the qualifying business income deduction is one of the newest. Your business’s net income can be written off on your tax return up to a maximum of 20% if you qualify. Find out if you can deduct all.

- Avoid fines by paying your projected quarterly taxes. In the United States, taxes are paid on a pay-as-you-go basis; as soon as you receive a paycheck, the IRS wants its share. Taxes are deducted from employee paychecks by employers because of this. That’s probably not the case when you are paying yourself, though. You can send the IRS projected quarterly payments to avoid paying fines for late payments.

Summing Up

It’s always a little intimidating to fill out any IRS documents as a small business owner who is self-employed. Particularly if it is your first time. But don’t worry, we’ll accomplish it together. With us, you’ll get Live Full Service Self-Employed and work with a tax professional that is familiar with freelancers and independent contractors. Our tax professional will handle your taxes and look up your credits and deductions so you don’t miss anything. Additionally, you are welcome to file your own self-employment taxes with us. We will track down each and every industry-specific deduction if you are eligible for it and secure every cent if due.

Frequently Asked Questions (FAQs)

Do LLCs Submit a Schedule C?

If your LLC just has one member and you do not want to be classified as a corporation for tax purposes then you must submit a Form C. In many ways, it is equivalent to being a sole proprietor.

Form C must be filed if you have a single-member LLC and have not chosen to be taxed as a corporation for tax purposes.

Do I fill out Schedule C to report my 1099-NEC income?

You should normally report this information on Schedule C if you receive a Form 1099-NEC detailing the income you earned as a contractor, freelancer, or from another non-employee position. Also, you must include all eligible business-related expenses that support your trade or operation.

Is a Schedule C equivalent to 1099?

No, Schedule C is not the same as the 1099. Commonly, 1099 reports monetary transactions between a payer and a payee. The IRS and the recipient typically receive copies of the 1099. You could need to report this on Schedule C or one of the other Schedules of Form 1040, depending on the kind of income you earned or 1099 you received.

The revenue you receive from renting out your home will, however, typically is reported on Schedule E. The Farming income is reported on the Schedule F form.

In the event that I receive a 1099-NEC, do I need to file a Schedule C?

For each company that pays you, more than $600 per year, if you are self-employed or a contract employee then you must send a 1099-NEC. You must include this revenue on Schedule C.

With no income, do I still need to file a Schedule C?

A Schedule C for your business does not require to be filed if you have no taxable income and no deductible business expenses to declare in a particular tax year.