A Schedule C-EZ will ease your tax burden if your business is really small. That is the Schedule C in condensed form. Tax return can be more difficult if you receive money from self-employment than you receive solely revenue from an employer. The filing procedure can be significantly streamlined with Schedule C-EZ.

While reporting self-employment income, preparing your tax return can be a little trickier than when you are reporting income from a job. This is due to the Schedule C form that you need to fill out if your net profit is $400 or higher. Yet, you can end up saving some time by filing the shorter Schedule C-EZ if you are qualified.

For tax year 2019 and later, you will no longer use Schedule C-EZ, but instead use the Schedule C.

The only expenses and income related to your self-employment operations are reported on Schedules C and Schedule C-EZ. The net profit or loss must be included in your 1040 form income section. However, you must confirm that you are truly self-employed before determining if you qualify to use the shorter Schedule C-EZ.

If you run a firm as a solo proprietor, or as the only member of a limited liability corporation, you are considered as self-employed. If you get paid as an independent contractor, you are also self-employed. You must record your business expenses on a Schedule C in the correct categories, which are mentioned on the form. A few examples of these categories are advertising, insurance, and rent.

The Schedule C-EZ is less complicated to complete because it enables you to report business expenses on a single line as opposed to having to account for them by category. However, you must first fulfill a number of conditions in order to use the Schedule C-EZ.

Table of Content

What was Form Schedule C-EZ?

Prior to the start of the 2019 tax year, sole proprietors and small business owners had access to Schedule C-EZ, a streamlined, simplified version of Schedule C.

The profit that is specific to your small business is reported on a Schedule C-EZ. When you work for yourself, filing your tax return may be more challenging than if you were an employee who only received a salary. You can streamline the tax return procedure for yourself by using a Schedule C-EZ. If you are eligible, filing your taxes with the Schedule C-EZ can be simpler and quicker.

The earnings area of your 1040 Form, you should also list your earnings or losses. If you are considered self-employed it is necessary before assessing whether you are eligible for the Schedule C-EZ or not.

Running your own company, whether it is a single proprietorship or an LLC in which you are the only owner, qualifies you as self-employed. You might be able to claim self-employment if you work as an independent contractor.

While creating a Schedule C, you must include your net business income in the relevant categories that are specified on the form, such as advertising, insurance, and recruiting expenses, among others. As opposed to recording each item separately per class, the Schedule C-EZ allows you to report several expenses on a single line, making it simpler to keep track of them all. Remember that you must perform this analysis each and every tax year since just because you can utilize Schedule C-EZ in one tax year which does not mean you can in all other years as well.

Key Points for Schedule C-EZ

• A simplified version of Schedule C is known as Schedule C-EZ which is submitted by some small business owners in order to calculate their taxable income.

• One must be eligible to file this form rather than Schedule C, a number of requirements must be met.

• Qualifying business deductions are subtracted from income on Schedule C to determine taxable income. An easier way to perform this calculation was made available by Schedule C-EZ.

• After the 2018 tax year, Schedule C-EZ was discontinued.

Criteria for Schedule C-EZ

If your company fits the following requirements, you can utilize it:

- Accounting using Cash

- No Net Loss for that Tax Year, Up to $5,000 in Business Expenditures

- Zero Employees

- No Stock and Only one Business

- There is no Deduction for Keeping a Home Office for Work.

How Schedule C-EZ Worked?

Whether you are a sole proprietor or business owner, you must include Schedule C with your Form 1040 Tax Return. Your taxable income from self-employment is calculated by listing all of your sources of income and deducting your allowed business expenses. Afterwards, your Form 1040 receives your taxable income.

Through the tax year 2018, some small firms and sole owners might use Schedule C-EZ instead of dealing with the far more challenging then Schedule C. But to be eligible, company owners have to fulfill a number of conditions:

- Using the Cash method of Accounting, had no Inventory at any Point in the Tax Year and had Business Expenses of $5,000 or Less for the Entire Year.

- Incurred no Net Loss for their Firm.

- Possessed just One Business Whether it is as a Solo Proprietor, a Qualifying Joint Venture, or as a Statutory Employee.

- For the Year It had No Employees.

- Exempt from Filing Business Depreciation or Amortization

- Did not Deduct Costs for using their House for a Business.

- Had no Unallowable Passive Activity Losses from the Business in the Prior Year.

Since the 2018 tax year, Schedule C-EZ is no longer accessible. For tax years 2019 and after this the sole proprietors must use Schedule C to complete their small business tax filings.

Who Used Schedule C-EZ?

You are eligible to use Schedule C-EZ if you could only have one business. That company might be:

- An LLC with one Member Which is an Example of a Solo Proprietorship.

- A Qualified Joint Venture, Which is a Partnership between a Husband and Woman that Files Two Schedule C Forms.

- You worked under the Law Who is a Sales Representative, Commissioned Driver or a Life Insurance Salesperson.

Even if your profits from self-employment are modest, you must still declare them to the Federal Revenue Service. According to the IRS you are a sole proprietor if you operate a small, unincorporated business alone. Profit or Loss from Business appears on Schedule C. You must Submit a Schedule C for each of your sole proprietorships if you operate two or more of them. The IRS won’t fine you if you claim all the professional business expenses for which you are qualify.

How To Fill Out and Read Schedule C-EZ?

There were few steps which are involved in completing Schedule C-EZ. On your personal tax return, C-EZ was included. On the first page of the 2018 Form 1040 tax return and on Line 12 the net income from Schedule C-EZ was entered.

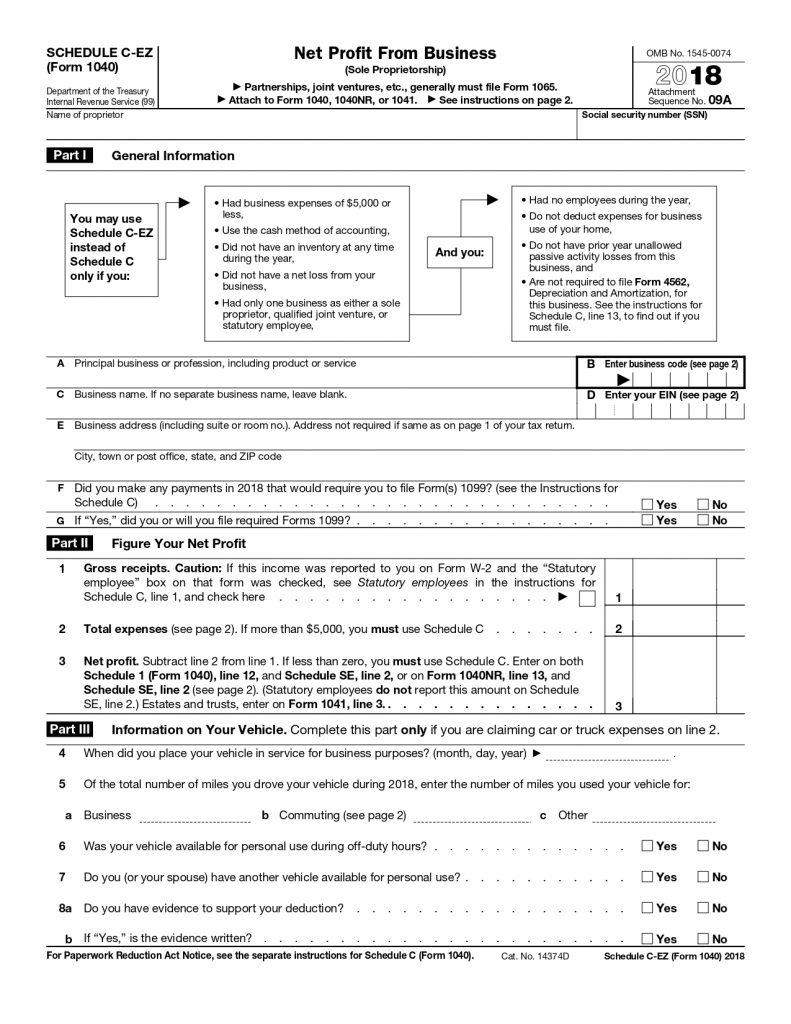

Part I: General Information About Your Business

First Part contained the following details:

- Primary Industry or Occupation.

- Business Lingo (NAICS code).

- Commercial Name.

- Tax ID (EIN or other).

- Name and Address of the Company.

Part II: Determine Net Profit

Section II included a sum of your company’s gross receipts. You would include earnings from freelance employment for which you might have received a 1099-MISC tax form. If you were an employee and received a W-2 form for the work, you wouldn’t include it. The net profit is then calculated by deducting expenses from receipts.

Part III: Business Use of Your Vehicle

If you were claiming your vehicle for business use, you would have to include information concerning the business use of your vehicle in Part Three. Together with your commute and personal travels, you would also need to list of the miles which you travelled for work during the year.

The last little information regarding your net business must be entered on the Schedule C-EZ form. You also need to figure out what your net income is. Add up all of your company’s gross revenue.

To determine your earnings, you must deduct your expenses from your receipts. You cannot utilize Schedule C-EZ if your business expenses exceed $5,000; you must use Schedule C instead. If you are claiming the car, you must include information in the Schedule C-EZ form explaining how it was used for business. If your returns are subject to an audit, you must have all the data, or proof which is related to your income, costs, and vehicle.

Submission of Your Schedule C-EZ

For Your Individual Tax Return, You must Submit the Schedule C-EZ.

Scheduling of C-EZ and Self Employment Taxes

Self-employment taxes like Social Security and Medicare tax on the income of small businesses that submit a Schedule C-EZ for their business taxes should also be paid. You must complete Schedule SE in order to compute your self-employment tax and include it with your income tax on Schedule A of your individual tax return.

Schedule C-EZ Verses Schedule C

There is a simplified version of Schedule C Which is known as Schedule C-EZ that you can use if you only had one business such as a Statutory Employee, a Sole Proprietorship or a Joint Venture and the business:

- Uses the Cash Approach

- Contains no Net Losses

- Is Exempt from Submitting Form 4562 for Depreciation and Amortization.

- Have Expenses of Less than $5,000.

- Carries no Inventory

- Does not have Losses from Prohibited Passive Activity within the Past Year.

- Does not Employ Anyone

- Does not incur Office Expenditures

All of the essential details you want to understand the Schedule C-EZ are provided in this article. To understand it better, we suggest you to read it completely. In this post, we go into great detail regarding the Schedule C-EZ for tax payment.

We truly hope that you will find the above-mentioned material on the Schedule C-EZ useful. Contact one of our experts if you have any queries concerning Schedule C-EZ. Any issues you might be having with your tax payment can be handled by our devoted team of trained specialists with legal knowledge.

Frequently Asked Questions

What was the Reason Behind the Discontinuation of Schedule C-EZ?

Following the 2018 tax year, the IRS cut at least eight tax forms. The Schedule C-EZ revisions were primarily made concurrently with the agency’s redesign of the Form 1040 for that particular tax year. In order to simplify filing, it was intended to do away with the requirement that some taxpayers provide multiple supplementary schedules.

If I Modify my 2018 Tax Return, Can I still Submit Schedule C-EZ?

The window for making changes to your 2018 tax return may have passed. As a general rule, you only have three years from the date you filed your initial return or two years from the day you paid any tax owed on that return in which to file an amended return, whichever comes first. Given that Schedule C-EZ was still in use for that tax year, you might include it with your updated return if you were eligible to do so under these regulations.

Who can Use Schedule C?

If you ran a business or worked as a sole proprietor for a profession, you must use Schedule C that is Form 1040 to declare your earnings or losses. If your main motivation for partaking in the activity is financial gain or profit, then it qualifies as a business. You can participate in the activity consistently and on a regular basis.

What Are the Expenses Which are Deductible in Schedule C?

An overview of Schedule C’s list of allowable business expenses are:

• Commissions, Fees, and Memberships.

• Employee Wages and Contract Labor.

• Depreciation, Repairs, and Utilities.

• Employee Benefits Programs.

• Company Insurance and Professional Services.

• Advertising and Promotion Costs.

• Car, Truck, Vehicle, and Equipment Costs.

• Commissions, Fees, and Memberships.

Do I use Schedule C or Schedule E?

The rental income received during a specific tax year is reported using Schedule E. To record your company revenue, you may need to use the Schedule C form instead if you offer specific services to your renters.