Table of Content

- 1 What is Form 1040: U.S. Individual Tax Return?

- 2 Understanding Form 1040

- 3 Different Types of Form 1040, US Individual Tax Return

- 4 Standard Deductions on Form 1040

- 5 Who Should Dile Form 1040

- 6 Schedules of Form 1040, US Individual Tax Return

- 7 IRS Form 1040 Helpful Hints

- 8 Filing Electronically vs By Mail – What’s the better option?

- 9 Conclusion

- 10 Frequently Asked Questions

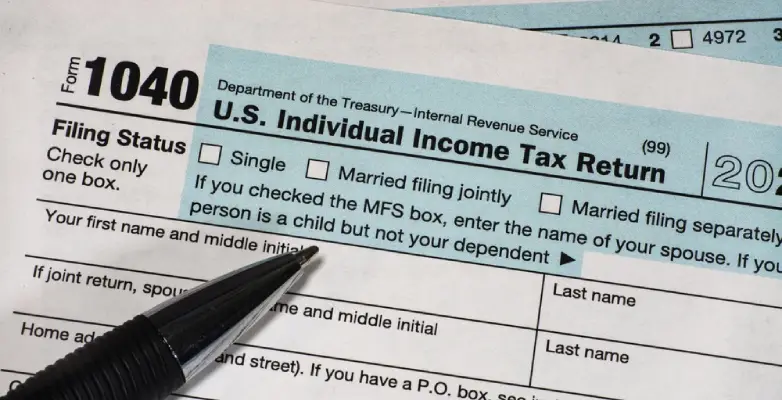

What is Form 1040: U.S. Individual Tax Return?

Those who all are Individual taxpayers they use to file their annual income tax returns by using Form 1040, which is known as the basic Internal Revenue Service (IRS) form. For the purpose of determining that whether further taxes are due or whether a tax refund will be issued, the form is comprised the sections that ask taxpayers to reveal their taxable income for the tax year.

Key Features of Form 1040, US Individual Tax Return

• The Individual tax filers will submit their tax returns to the IRS by filling the Form 1040.

• The form establishes on the basis that whether further taxes are owed or whether the filer will get a tax refund.

• Name, address, Social Security number and the number of dependents are just a few examples of the personal data that taxpayers must have to submit on Form 1040.

• Together with these sources of income, a filer must also disclose the wages, salaries, taxable interest, capital gains, pensions, Social Security payments and the other sources of income.

• Depending on all of their circumstances, taxpayers might need to submit additional 1040 tax forms.

Understanding Form 1040

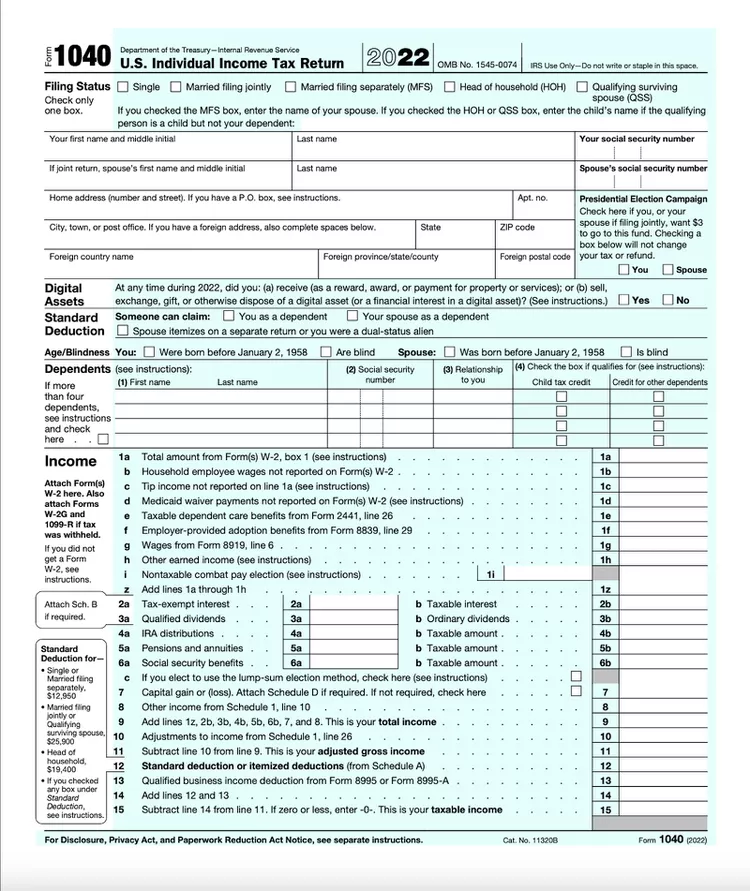

The IRS typically requires the Form 1040 in order to submit it by the date that is April 15 of the each year. Every person whose income is above a particular amount they are required to file an income tax return with the IRS. But there are several forms which are used by the firms to record their profits.

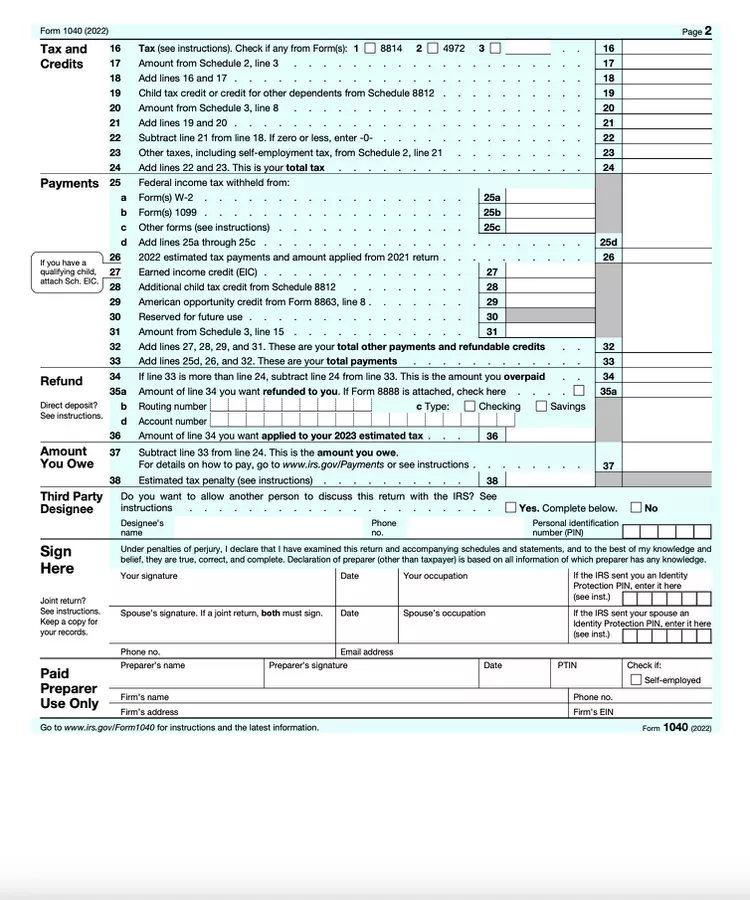

Two pages of the Form 1040 which are available on the website of IRS must be filled out by the individuals. You have two options for filing the Form 1040, one you can do it by electronically or second by the mail. They are required to enter their status along with their personal details like name, address, Social Security number and the number of dependents. Tax filers must also disclose if they are currently filing their taxes or not. The form also inquires the individual about that if the taxpayer has full-year health insurance or whether they want to make a $3 donation to the presidential campaign.

The Form 1040 is the income part of the tax form which requests for the information on the filer’s wages, salaries, taxable interest, capital gains, pensions, Social Security payments and the other sources of income. Several deductions, such as for the relocating of expenditures for employment and unreimbursed employee expenses and they were repealed under the new tax legislation except for military on the active duty.

The form of employs is used for a building block that is used to approach as the IRS describes about it and it enables filers to include all the schedules which they actually need in their tax returns. Certain taxpayers could also need to file one or more of the six brands of new supplemental schedules together with their form 1040 in addition to the traditional schedules for all the things like business income and loss. If they are used to owning additional taxes or are claiming tax credits then it will be determined by this form. But many individual taxpayers merely need to submit a Form 1040 without any schedules.

Different Types of Form 1040, US Individual Tax Return

A separate version of the 1040 form may be needed to be submitted by the taxpayers in some of the circumstances rather than the usual one. Following are some of them:

1040 Form-NR

The following non-resident aliens or their representatives all are used to file this form:

- Individuals those who are conducting commerce or business within the United States.

- Representatives of a decedent who would have been required to file a Form 1040-NR.

- Whoever is in charge of an estate or trust all of them are required to submit a 1040-NR.

The 1040-PR and SS are also used to produced by the IRS. In order to avoid having the file Form 1040 with the IRS, citizens of American Samoa, the CNMI, Guam, Puerto Rico, or the U.S. Virgin Islands who all have net self-employment income they must instead file Form 1040-SS. The counterpart of the Form 1040-SS in Spanish is the Form 1040-PR.

Form 1040-ES

You can calculate your expected quarterly taxes by using the form 1040-ES and you can also pay them. Earnings from self-employment, interest, dividends and the rents are among the income types that aren’t subject to withholding tax. In addition, the taxable share of Social Security benefits as well as income from the pensions and unemployment benefits may be included in this form. (Learn more about the form 1040-ES)

Form 1040-V

For any of the balance on the amount which you owe in the line of the 1040 or 1040-NR, the taxpayer must include this statement with the detail of their payment.

Form 1040-X

Form 1040-X is used to make modifications in the previously filed 1040s if a filer makes an error or forgets to include information on any 1040 form. (Learn more about the form 1040-X.)

Form 1040-SR

In the year 2019, the IRS released the new Form which is named as 1040-SR and it is used for the seniors. The standard deduction chart from now has a larger font, no shading and the shaded areas can be difficult to see and an additional standard deduction for seniors is also available. The difference won’t be noticeable to the seniors who file their taxes online but those who do so on the paper should get benefit of this.

Standard Deductions on Form 1040

Taxpayers are questioned about the status of their filing in the section of the 1040 income. The taxpayer’s standard deduction is calculated on the basis of this filing. Deductions for the 2022 and 2023 in every tax years are highlighted in the table which is shown below. You must file your 2022 taxes in 2023 and your 2023 taxes in the year 2024.

| Filing Status | 2022 | 2023 |

| Single or Married Filing Separately | $12,950 | $13,850 |

| Married Filing Jointly or Qualifying Widow(er) | $25,900 | $27,700 |

| Head of Household | $19,400 | $20,000 |

Those all who are blind or over 65 they may also take an additional discount with the help of this form. These numbers are also yearly inflation-adjusted, exactly same as the standard deduction.

- $1,750 is for the year 2022 and $1850 is for the single and for those who are never-married people in year 2023.

- If you and your spouse both are 65 or older or blind then you each can claim $1,400 in year 2022 and $1,500 in 2023 when you both file jointly.

Who Should Dile Form 1040

Form 1040 is used to file income tax returns. This tax form is for individuals living in the United States. On the basis of this form, the IRS decides to give you tax credits or ask for more in taxes. This tax form can be filed jointly if you’re married.

Form 1040 or one of the above mentioned variants of Form 1040 must be filed if a citizen of the United States wants to or if required to submit a federal income tax return. While determining whether someone needs to file, there are three general circumstances which are to keep in mind and followed.

- The IRS mandates that the taxpayers with a specific threshold of gross income must submit taxes. The age and the filing status of the individual affect this criterion. The income thresholds for the people under sixty five are shown in the below table. In addition, if neither, either or the both partners in a marriage who are 65 years of age or more, the barrier varies. Older taxpayers are typically having higher thresholds.

| Filing Status | Age at End of Previous Year | Gross Income Threshold |

| Single | under 65 | $12,550 |

| Married Filing Jointly | under 65 (both spouses) | $25,100 |

| Married Filing Jointly | 65 or older (one spouse) | $26, 450 |

| Married Filing Jointly | 65 or older (both spouses) | $27,800 |

| Married Filing Separately | Any age | $5 |

| Head of Household | under 65 | $18,800 |

| Head of Household | 65 or older | $20,500 |

| Qualifying window(er) under 65 | $25,100 | |

| Qualifying widow(er) | 65 or older | $26,450 |

- There is no need to file if the children and dependents both are qualified as the dependent. The dependent must submit their own Form 1040 if their gross income will exceed from a particular amount in case if their unearned income exceeds $1,100 and their earned income exceeds $12,550 or combination of any of these.

- In case of single dependents are as opposed to the dependents those who are married then these regulations alter slightly.

The entire individual must submit Form 1040 in a particular specified circumstance in order to sum up. Following are the few of those circumstances, regardless of their income or dependent status:

- You are liable for all the additional special taxes such as the alternative minimum tax.

- HSA or other health account payouts all are made for you.

- You have to make at least $400 in net income from the self-employment.

- You must be above the threshold for receiving the salaries of church.

Single Dependents

The table below shows the condition and requirement to qualify as a single dependent. Individuals can get tax credits for dependents. Find out more by reading the table given below.

| Age and Condition | Filing Requirement |

| No (under 65 and not blind) | unearned income over $1,100; earned income over $12,550; gross income was the larger of $1,100 or earned income (up to $12,200) plus $350 |

| Yes (65 or older) | unearned income over $2,800; earned income over $14,250; gross income was the larger of $2,800 or earned income (up to $12,200) plus $2,050 |

| Yes (65 or older and blind) | unearned income over $4,500; earned income over $15,950; gross income was the larger of $4,500 or earned income (up to $12,200) plus $3 |

Married Dependents

The table summarizes the requirements for filing taxes based on an individual’s age and whether they are blind. The different criteria are based on the individual’s unearned income, earned income, and gross income. The table also includes a separate condition for cases where the spouse files a separate return and itemizes deductions and the gross income is at least $5.

| Criteria | Unearned Income | Earned Income | Gross Income |

| Neither 65 or older nor blind | over $1,100 | over $12,550 | Larger of $1,100 or earned income (up to $12,200) plus $350 |

| 65 or older | over $2,450 | over $13,900 | Larger of $2,450 or earned income (up to $12,200) plus $1,700 |

| 65 or older and blind | over $3,800 | over $15,250 | Larger of $3,800 or earned income (up to $12,200) plus $3,050 |

| Spouse files a separate return and itemizes deductions and gross income is at least $5 | applicable to all criteria above | applicable to all criteria above | Applicable to all criteria above |

Schedules of Form 1040, US Individual Tax Return

For the assistance of taxpayers in reporting their tax liabilities, Form 1040 includes a number of supplementary schedules. Following are the schedules which are used to gather financial data outside of Form 1040 so that Form 1040 can be served as the main source of reporting.

Schedule 1

First schedule is used for the purpose of reporting of additional income or the modifications to this income which is utilize. This could include alimony, money which is received from the sale of a company, teacher expenditures, money which is deposited into a health savings account (HSA) or unemployment benefits.

It is significant to remember that:

- Additional first Schedule Income will be disclosed on Line 8 of the Form 1040.

- Modifications to the first Schedule Income will be disclosed on Line 10 of Form 1040.

Schedule 2

All types of additional taxes are reported by using second schedule. The payback of excess premium tax credits for the purpose of insurance is purchased through health insurance. Market places are reported in one section of second schedule which is alternative minimum tax section.

Self-employment taxes, Medicare taxes, IRA taxes, household employment taxes and many other taxes all are reported in a separate section of second Schedule. In lines 17 and 23 of the Form 1040 are the two components from Schedule 2 which are reported.

Schedule 3

Additional tax payments and credits both are reported in Third Schedule. These credits consist of home energy credits, excess social security taxes which are paid in the past and excess federal income taxes which also paid in the past. Dependent care expenses are also included.

Line 20 of Form 1040 is used to report nonrefundable credits in third schedules, whereas Line 31 is used to submit refundable Schedule 3 credits.

Schedule A (Itemized Deductions)

The taxpayer’s itemized deduction is calculated by using Schedule A. By selecting the bigger of their basic deduction or itemized deduction, taxpayers are most frequently able to reduce their federal income tax obligation.

The calculation of itemized deductions includes costs for the theft losses, certain taxes, dental and medical costs, interest assessments, and other costs. Line 12a of the Form 1040 should contain any information from Schedule A.

Schedule B (Interest and Ordinary Dividends)

Taxpayers all who are receiving more than $1,500 in taxable interest or regular dividends which will be utilize in Form B. Moreover, interest from seller-financed mortgages, bond accrued interest, interest or regular dividends received as a nominee and other comparable types of interest all are reported by using this form. On Line 2b and Line 3b of Form 1040, you have to inserts input from Schedule B.

Schedule C (Net Profit From Business)

Business profit or loss is reported on Schedule C. A taxpayer engages in an activity which is primarily for the purpose of generating income or profit, if that activity meets the definition of a business. If the taxpayer engages in the activity regularly and continuously then it is likewise regarded as a business. Schedule 1, Line 3 is used to record Schedule C’s profit. Schedule SE employs it as well.

Schedule D (Capital Gains and Losses)

For the record of taxable income from the sale or exchange of a capital asset you have to utilize Schedule D. This profit might have resulted from an exchange or from an unauthorized conversion. Distributions of capital gains that are not otherwise reported on Form 1040 and non-business bad debts, both are reported on Schedule D. Form 1040, Line 7 contains data from Schedule D.

Schedule E (Supplemental Income and Loss)

Several forms of supplemental income or losses are reported on Form E. This extra income comes from a variety of sources which all are including real estate rental income, royalties, partnerships, estates, trusts and residual interests in conduits for real estate mortgage investments. On Line 5 of Form 1040, additional income information from Schedule E is reported.

Schedule EIC (Earned Income Credit)

Compared to all the other tax schedules, Schedule EIC is extremely unique. This schedule is not only used to compute the earned income credit. By sending the IRS your child’s name, Social Security number, birth year, relationship to you, and residency status, Schedule EIC is used to substantiate the eligibility of your qualifying children. Form 1040 does not directly get data from Schedule EIC.

Other Schedules

Some of the extra schedules of schedules to Form 1040 are:

- Farming operations profits or losses both are reported on Form F.

- If you are providing the cash wages to the employees of household and those wages were subject to different Federal taxes in such situation Schedule H should be utilized to report the household employment taxes.

- The income from the farming or fishing is reported on Schedule J by averaging the taxable income over the previous three years.

- A credit for the aged or disabled is reported by using Schedule R.

- To report the tax which is owed on self-employment net income is utilize Schedule SE.

- Potentially refundable credits for eligible children are reported by using Schedule 8812 or other dependents.

IRS Form 1040 Helpful Hints

The table below gives helpful tips for preparing and filing your 1040 income tax return form. On the basis of the situation that matches your situation, you can refer to the schedule and part to maximize your tax credits and tax deductions.

| Situation | Schedule and Part |

| Additional income, such as unemployment compensation, gambling winnings, prize or award money, as well as business or farm income or loss | Schedule 1, Part I |

| Deductions to claim, such as educator expenses, self-employment tax, or student loan interest | Schedule 1, Part II |

| Owe alternative minimum tax (AMT) or need to make an excess advance premium tax credit payment | Schedule 2, Part I |

| Owe other taxes, such as household employment taxes, self-employment taxes, or additional tax on qualified retirement plans and tax-favored accounts | Schedule 2, Part II |

| Can claim a non-refundable credit (excluding the non-refundable Child Tax Credit or Credit for Other Dependents). This may include education credits, foreign tax credits, or general business credits | Schedule 3, Part I |

| Can claim a refundable tax credit (excluding Earned Income Credit, American Opportunity Credit, the refundable Child Tax Credit or Additional Child Tax Credit, as well as the Recovery Rebate Credit), such as the health coverage tax credit or net premium tax credit | Schedule 3, Part II |

| Other payments, including “request for extension to file” payments or excess Social Security tax withheld | Schedule 3, Part II |

Filing Electronically vs By Mail – What’s the better option?

To receive your refund quickly and minimize processing delays, it is recommended to file your tax return electronically. If you don’t have a computer at home, you can usually use one for free at your nearby library.

Conclusion

For citizens of the United States, Form 1040 is the main component of tax filing. All the taxpayer financial statements eventually feed into this tax form, from which supporting tax schedules, is branched. Each taxpayer who files taxes must complete a Form 1040, regardless of their filing status or income.

Thus, please get in touch with us through any means, such as chat, a toll-free number, etc. if you ever need our help.

Frequently Asked Questions

Is Form W-2 is Similar to Form 1040?

No, a W-2 is not the same as the Form 1040. An employee who worked for a business throughout the tax year will obtain a W-2 as a wage and tax statement. The information of W-2 is used for the purpose of completing Form 1040.

What is the use of Form 1040?

American taxpayers used to file their annual income tax returns by using Form 1040. The form is filled out by the taxpayer and contains both their personal as well as tax information. The form is then submitted to the IRS for the evaluation.

From Where, You can get Form 1040?

Distribution of Form 1040 to the taxpayers does not constitute a tax statement or form. Form 1040 can be easily downloaded from the website of IRS, unlike a W-2 or 1099 statement must be mailed by your employer or a third party whom so ever you are engaged with. Digital copies are also available which are free from IRS filing websites. You might be able to pick up printed copies from the local public courthouses or federal buildings.

What is the difference between 1099 and 1040?

An individual’s tax return will consists of both Forms 1040 and 1099. There are many distinct versions of Form 1099 and it is most frequently supplied to the independent contractors in order to report tax data regarding the payments which they received throughout the tax year. As the financial data which is listed on Form 1099 and are fed into Form 1040, this information is required to complete the form.

What do You Understand by Gross Income?

An individual’s gross income is referred to as gross pay on a paycheck, is their total income before any taxes or other deductions. This covers all kinds of revenue, not just employment-related income and does not only refer to money-related income. It covers all the other types of income such as property or services.

Gross income and gross margin or gross profit all are the synonymous terms in business. The revenue from all sources less the company’s cost of products which is sold, what is shown as a company’s gross income on the income statement (COGS).