Table of Content

- 1 What is IRS Form 1040-ES?

- 2 Estimated Taxes are Paid by Whom?

- 3 Paying of Estimated Tax

- 4 Calculation of Estimated Tax

- 5 Who Should File the IRS form 1040-ES?

- 6 Expected Requirement of Filing Form 1040-ES

- 7 How to Calculate Estimated Taxes?

- 8 How to File a 1040ES

- 9 Due Dates for 1040-Estimated Taxes

- 10 Payments

- 11 Where to Get the Latest 1040 ES Form?

- 12 Frequently Asked Questions

What is IRS Form 1040-ES?

Form 1040-ES is provided by the IRS. With the help of Form 1040-ES you can easily compute and pay your estimated taxes for the current year. While the expected tax of your form is helpful in calculating taxes for the current year. The form 1040 is related to the prior year. While filing Form 1040-ES, you can easily utilize it to pay your income tax, self-employment tax and any other taxes which you may be obligated to pay.

Estimated Taxes are Paid by Whom?

Taxes are not always withheld at the source from all the taxable income. For instance you can say that tax is often not withheld from the compensation of independent contractors and the freelancers. Other instances of income where tax which is frequently not withheld at the source which include earnings from interest, dividends and the rent, as well as taxable unemployment benefits, retirement benefits and the taxable portion of your Social Security benefits. If you will receive any of these forms of income then you may be required to pay an estimated tax throughout the year.

Paying of Estimated Tax

Your income for the current year is used in order to calculate the projected tax payment. So, if it is possible for you to underestimate the tax rules then it would result in an underpayment and a penalty. So to avoid it you can follow all the tax rules from the prior year to avoid this penalty. In many of the instances, you won’t be charged the penalty as long as you will be paying the full tax which is due for the preceding year. If you end up by paying more than the amount which you should have to pay then you can either get a tax refund at the end of the year or carry the extra money over to assist you for the payment of the estimated taxes for the next year.

Timeliness and amount with the considerations for both play a role in the necessity to submit the estimated taxes. While making your payments, you must have to pay an enough sum. Even if you are overpaid then the overall amount of tax payable for the year are entitled to a refund, you should still pay the quarterly tax on the time to avoid incurring penalties for a particular quarter because the tax was received late.

Calculation of Estimated Tax

An estimated current income is used on the basis for the calculation. You might begin it by using the federal tax return from the prior year as a starting point for the estimation. Look at your last year’s numbers for taxable income, tax paid credits and deductions and then compare them to this year which is in figures. Worksheets are included in the Form 1040-ES package to assist you in accounting for income variances between the prior and the current years and figuring out for your tax liability.

Who Should File the IRS form 1040-ES?

If you want to know about that if you need to file a 1040-ES for the current year then you can use the following calculation:

Take the total of your taxes from the prior year. Determine your estimated tax liability for the current year or you can do 90 percent of it. Choose the lower number after comparing the two. Take the case where you paid $500 in taxes the year before. You anticipate paying $1,000 this year, of which $900 or 90% is due. $500 is the lesser of the two sums. Add any tax withholdings and tax credits which you may have and then subtract it from the total. When you prepare your taxes then this is ought to give you an idea of how much you will owe.

You should use Form 1040-ES to make estimated tax payments if you anticipate having to pay at least $1,000 in taxes overall, after all the deductions and credits, AND if you anticipate having withholding and credits that are less than the calculated amount then in this case, $500.

Expected Requirement of Filing Form 1040-ES

You are not required to submit Form 1040-ES if you did not owe any taxes for the previous year, were a citizen or resident of the United States for the entire year and your prior tax year was a full calendar year.

How to Calculate Estimated Taxes?

When making an estimation of your tax payment, it is possible to underestimate the amount due. To avoid any penalties, it is recommended to use your previous year’s taxes as a guide.

If you pay 100% of last year’s taxes, you will not be subject to a penalty. In the event that you overestimate your payment, you will be eligible for a refund at the end of the year. To calculate your estimated tax payment accurately, follow the instructions provided for the 1040-ES form. This will allow you to determine your estimated quarterly taxes for each quarter.

Once calculated, this information should be added to your IRS quarterly tax payment form.

How to File a 1040ES

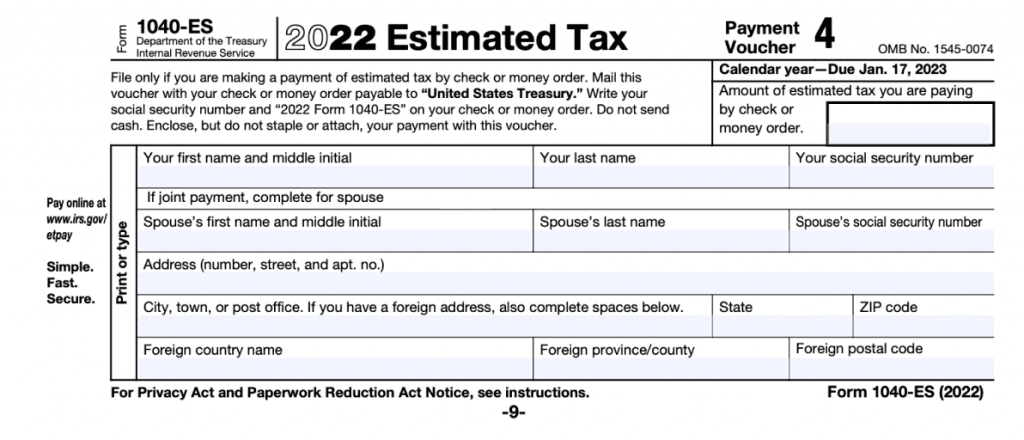

To file the 1040-ES form, you have the option to either download the printable version from the IRS website and fill it out manually or complete the form digitally on the IRS website. It is important to also use the Estimated Tax Worksheet to assist in calculating and entering your estimated income and expenses.

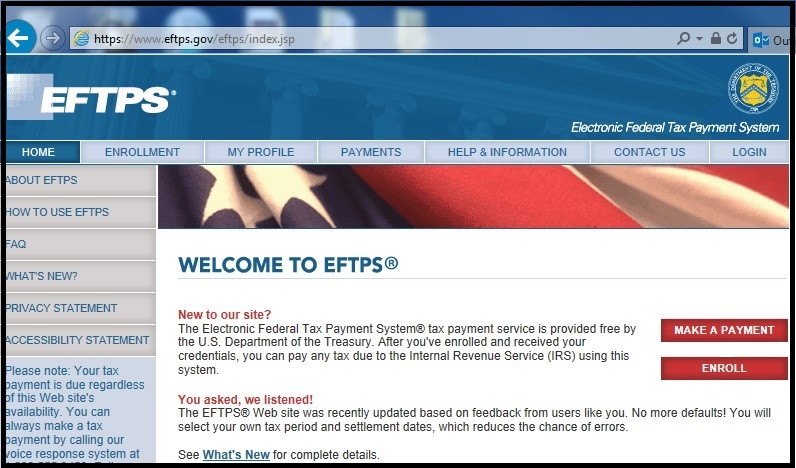

Unlike filing Form 1040, There is no need to submit the actual 1040-ES form. Instead, You can make your 1040-ES payment online using the Electronic Federal Tax Payment System (EFTPS) on the IRS website.

Alternatively, You may mail a check or money order made payable to the IRS, although this is not the preferred method of payment.

Due Dates for 1040-Estimated Taxes

Four times throughout a tax year, estimated tax payments are due. The deadlines are April 15, June 15, September 15, and January 15 or the following business day if the deadline occurs on a weekend or holiday, for taxpayers who want to file their taxes using the calendar year which is done by the majority of people.

There are four deadlines for the fifteenth of the fourth, sixth and ninth months of the current year, as well as the fifteenth of the first month of the next year, if you can use a calendar that uses a fiscal year rather than a calendar that runs from January 1 to December 31.

Estimated Tax Payment Due Dates

| Payment Period |

| Jan 1 – March 31 |

| April 1 – May 31 |

| June 1 – Aug 31 |

| Sept 31 – Dec 31 |

| Due Date |

| April 18, ’22 |

| June 15, ’22 |

| Sept 15, ’22 |

| Jan 17, ’23 |

Payments

You can make payments on a weekly, monthly or any other schedule that works for you as long as you make the complete amount owing for that time. You may also calculate your yearly tax obligation and pay it early in a single lump sum by April 15 of the current year.

Where to Get the Latest 1040 ES Form?

Using the IRS website, you can print out a copy of the 1040-ES 2022 form. Make sure you print the correct form!

This page has all the specific details you require to understand Form 1040-ES, Estimated Tax for Individuals and the filing procedure. For a clearer understanding, we urge you to read it completely. We really hope that you will find the information presented above regarding the Form 1040-ES, Estimated Tax for Individuals useful. But please contact one of our experts if you have any questions. Any questions you may have regarding your Form 1040-ES, Estimated Tax for Individuals can be addressed by our devoted staff of educated experts. Regardless of the circumstance, we merely encourage you to call our toll-free hotline as soon as you discover that you need assistance.

Collaborate with our tax professional who is familiar with independent contractors and freelancers. To ensure you don’t miss anything, your tax expert will handle your taxes and look up 500 deductions and credits. You can also file your own self-employment taxes with us. We’ll research every sector-specific deduction you’re eligible for and fight for every cent you’re due.

Frequently Asked Questions

How can I Substantiate my Projected Tax Payments?

You can first look up the details of your bank account or credit card to see how much in expected taxes you have paid. Examine the billing statements from the months you made payments. Online transcripts of your previous tax returns are also available.

Who must File a 1040?

If they earn more than a particular amount for the year, the majority of American citizens and permanent residents who work in the country must file a tax return. Even if your income is lower than that, you might still wish to file because doing so could result in financial rewards.

How should Expected Tax Payments be Reported?

You can send your anticipated tax payments together with Form 1040-ES by mail, or you can use the IRS2Go app on your mobile device to pay online, over the phone, or from your device. Also, you can pay your anticipated taxes online through your account, where you can also view your payment history and other tax documents.

How do I Prevent Being Penalized for Underpayment of Anticipated Taxes?

The majority of taxpayers will typically avoid this penalty if either their tax liability is less than $1,000 after deducting their refundable credits and withholding, or if they have paid at least 90% of the tax for the current year or 100% of the tax reported on their prior year’s return in withholding and estimated tax.

Does Everyone Receive a Form 1040?

The standard form 1040 is used by almost everyone, but you may or may not need to add one of three schedules depending on your tax position and if you wish to claim a particular deduction or credit. Any of these schedules may not be required for everyone to submit.