Table of Content

About W-2G, Certain Gambling Winnings

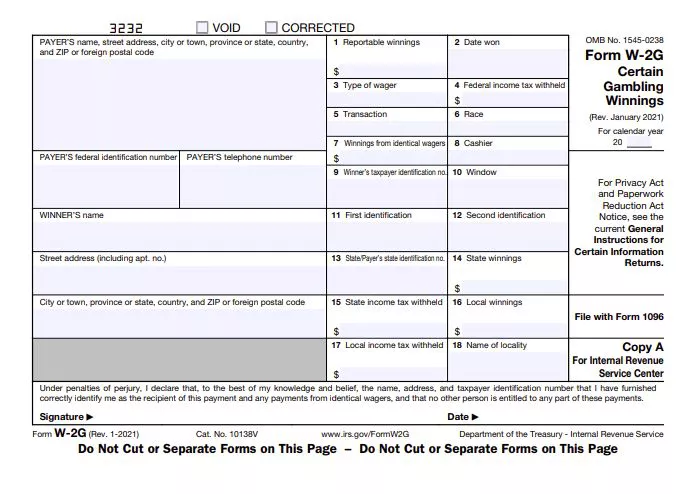

When a customer already wins in the previous year then they must be reported as an income to the Internal Revenue Service then the casino or other gambling facility will send them a Form W-2G. The Form W-2G is officially known for Certain Gambling Winnings.

The form includes the data that the taxpayer needs to submit for their taxes of the year. Included are the total wins that are the date on which they were received, the type of wager and the amount of federal and the state income tax that has already been withheld.

Although all the earnings from the gambling are taxed only some of the winnings are reported on a Form W-2G.

Key Features of W-2G, Certain Gambling Winnings

• Whether or not they obtain a W2-G, American citizens which must be report by any gambling gains to the IRS as income.

• Any winnings from games of chance, lotteries and competitions must be included under other income on Form 1040.

• Taxes are due on both type of payments that is cash payments and prize values.

• Winnings may be subject to both the taxes that is municipal and state taxes.

• Only if you itemize your taxes then you are able to use your losses to reduce your tax obligation.

Who Can File Form W-2G: Certain Gambling Winnings?

It is the requirement of Internal Revenue Service that is IRS for the regulations to report the wins from all forms of gambling which includes lotteries, horse racing, bingo, sports, slot machines and card games, regardless of how much you won. This includes any money which is obtained through foreign gambling.

A Form W-2G must be used by gambling establishments in the certain situations in order to record your winnings:

- Bingo or slot machine winnings of at least $1,200.

- A keno win of $1,500 or more

- Poker tournament winnings is of $5,000 or more

- $600 in earnings from further forms of gambling which provides the reward that is at least 300 times of the stake.

The W-2G form is not required for the certain games that are most notably skill-based games but the winnings are still subject to tax. By deducting bets or buy-ins from the total payout and the winnings are determined.

How to Use Form W-2G

If you don’t declare your winnings after receiving a W-2G form then you will eventually get an IRS Notice CP 2000 Underreported Income in your mail. In this notice you will get information regarding the apparent disparity and the instructions that how you can easily deal with it.

Your gambling profits must be reported as income even if you don’t get a W-2G. This form is profitable when your gambling is at it’s crucial to retain records like bet statements and receipts. Also, all the records will aid in confirming the veracity of the data on any W-2G forms you might receive.

Several gaming establishments may send you W-2G forms. If so, you must separately report the amounts from each form.

Filing Form W-2G: Special Considerations

The casino may have deducted some of your earnings to satisfy federal income taxes, depending on how much you won and the game you played.

On Box 4 of Form W-2G, it is stated how much has already been withheld for federal taxes. Boxes 15 and 17 are used to track state and local tax withholdings, respectively.

There are two different withholding methods for gambling winnings: normal and backup.

Regular Withholding

When the difference between the wins and the wager is $5,000 or more, the gambling establishment is required to withhold 24% of your cash profits. Regular withholding is what this is.

The following winnings are subject to regular holding:

- Sweepstakes

- Lotteries

- Betting ring

- Other bets (if the winnings amount to at least 3,000 times the amount of the wager)

If the winner pays the withholding tax to the lottery or gaming sponsor, the rate is 24% for non-cash payments as well. In the event that the payer pays the withholding tax, the rate increases to 31.58%.

Retention of Backup

Backup withholding, which is also 24%, may apply to payments made for bingo, slot machines, keno, and poker tournaments.

Any of the following circumstances triggers backup withholding:

- A proper taxpayer identification number (TIN) was not given by the winner to the gambling establishment.

- It wasn’t withheld for gambling as usual.

- At least $1,200 from bingo or slot machines, $1,500 from keno, or $5,000 from a poker event constitute at least $600 in earnings and at least 300 times the amount wagered.

You Could Still Be Owed Taxes

The withholding amount might not be enough to pay your federal income tax obligation depending on your federal income tax rate. Above the standard deduction of 24% from gaming earnings, there are three more tax brackets.

If yours overall income is below the 24% rate, your debt might be reduced or you might even receive money back.

The W-2G contains information regarding any state and local taxes that were withheld in addition to federal income tax withholding.

That will be useful if you have to file taxes in a state where gains from gambling are taxed.

Can You Recover Losses From Gambling?

You are unable to record your net profits, which are calculated as winnings minus losses, on your tax form.

On Schedule A, you can, however, report your gambling losses as an itemized deduction in order to lower your tax obligation.

But, you are not allowed to disclose losses that exceed your winnings. Other costs, such lodging and travel costs that you might have incurred while gaming are not deductible.

Any receipts or other documentation attesting to your gaming losses should be kept if you believe there’s a chance you might itemize your taxes.

Conclusion

This page gives you all the detailed information which you need to comprehend the Form W-2G, Certain Gambling Winnings. We advise that you read it thoroughly from the beginning to the end for a better understanding. We discuss the Form W-2G, Certain Gambling Winnings, in length in this piece.

We really hope that you will find the information on the Form W-2G, Certain Gambling Winnings, provided above would be helpful. Any questions you may have about Form W-2G, Certain Gambling Winnings, should be directed to one of our experts. Our committed staff of knowledgeable specialists can address any concerns which you may have regarding your Form W-2G, Certain Gambling Winnings. The only thing we advise you to do in any situation where you need assistance is to call our toll-free hotline right away.

Frequently Asked Questions

Are You Receiving a Form 1099 for Gambling Winnings?

For gambling earnings, the W-2G form is comparable to a 1099. In other words, it details the winnings, the taxpayer, and the amount of federal, state, and local taxes that have already been paid on them.

Is there any Requirement to Report Gambling Winning to the IRS?

Gambling wins are fully taxable, and you must disclose the income on your tax return, according to the IRS. That includes winnings from casinos, horse races, raffles, and lotteries. You must declare any winnings in cash as well as the prize’s cash value. On Form 1040, it is shown under “Other Income” if you gamble “casually” as opposed to professionally.

Up to the value of your winnings, you can deduct losses, but doing so requires itemizing your taxes (and keeping paper records to prove your losses).

Is there any Requirement of Sending W2 and W-2G Forms to the IRS?

Although the W2 and W-2G are not required to be sent to the IRS, they must be filed in case of an audit or a query from the IRS.

The W-2G form’s sending organization will submit the data to the IRS.

What was the Reporting of the Gambling Winning?

Every gaming winning is completely taxable.

The W-2G forms are only necessary if a specific sum is earned on some but not all games. Gambling establishments may give you one or more W-2G forms for taxable winnings.

The forms are mainly needed by the winners of chance games like slot machines but not for the winners of skill games like blackjack.

You must pay taxes on each, though.

Notice that the casino is unaware of your losses from playing at its tables. You must keep meticulous records and itemize your taxes if you want to claim your losses as a deduction.

Up to the amount of your wins, losses may be claimed. Hence, even if you gamble and win $1,000 while losing $1,000, you might not owe taxes on your winnings.

What do You Understand by Tax Rate?

The percentage at which a person or a business is taxed which is known as the tax rate. The federal government and several states in the US implement a progressive tax rate system, meaning that as a person’s or an entity’s taxable income rises, so does the percentage of tax due. With a progressive tax rate, more money is taken in from taxpayers who earn more.