Table of Content

What is Form 1099-C: Cancellation of Debt?

The Internal Revenue Service (IRS) is mandates for Form 1099-C. The Cancellation of Debt for reporting a variety of payments and transactions which is made by creditors and lenders to the taxpayers. If a debt was cancelled or forgiven for $600 or more then these entities are required to file Form 1099-C. The amount on the form must be reported as other income by the taxpayers who will receive it. Even if the issuer doesn’t submit a Form 1099-C because the cancelled debt is under $600 and it must be shown as the taxable income on annual tax returns.

Key Features of Form 1099-C, Cancellation of Debt

• If a lender cancels or forgives a debt for $600 or more then they are required to provide Form 1099-C to both the IRS and the borrower.

• The amount on a 1099-C may need to be reported as a taxable income on your income tax return if you receive one.

• The cancelled debt may be reducing by whatever tax refund that you are entitled to because it is deemed income which has tax ramifications.

Who Can File Form IRS 1099-C: Cancellation of Debt?

There are three different versions comes in Form 1099-C. The lender must maintain Copy C which provides you Copy B and submit Copy A with the IRS. You should receive Form 1099-C from the lender if you took out a loan from a business lender and at least $600 of that debt which was discharged or forgiven.

Assume, for illustration, if you borrow $10,000 and repay $4,000 before defaulting on the loan. The remaining $6,000 is reported on the Form 1099-C if the lender can no longer attempt to collect the debt from you. This sum is qualifies as taxable income.

Following are the common reasons in which lenders send Form 1099-C:

- Foreclosure

- Repossession

- Delivering Property to a Lender

- Property Abandonment

- Modification of a Mortgage on a Primary Residence

- Paying off a Credit Card Debt

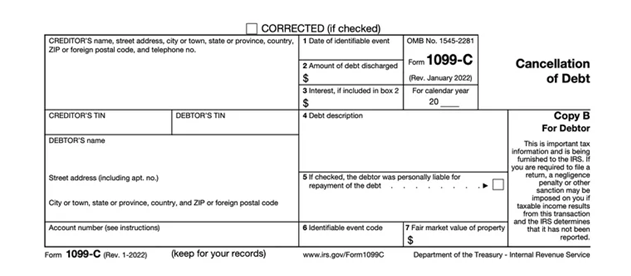

What Information is on Form 1099-C?

The debtor and the creditor’s information all are includes names, residences, tax identification numbers and the corresponding account number which all are listed on the left side of the form. Seven boxes are located on the form’s right side:

- 1st Box: Date of Identifiable Event: It includes the date of First Identifiable Event which will be displays the date of the first observable incident or the day of the debt which was discharged.

- 2nd Box: Amount of debt discharged: This box shows the amount of Debt Discharged which displays the total amount of Debt Discharged which can be either Actual or Assumed. If you disagree with this sum then you can speak to the creditor.

- 3rd Box: Interest, if included in box 2: It is the Interest box it contains the debt which all are listed in second box and it also includes interest.

- 4th Box: Debt Description: This is the Debt description Box; it is used to provide the description of debt. This box additionally displays a property description in case you filled seventh box.

- 5th Box: Check Here if the Debtor was Personally Liable for Repayment of the Debt: In this box you can see if the debtor is responsible individually for the repayment of the debt. If it is appropriate then fifth Box will indicates whether you were personally liable for the debt’s repayment at the time it was established or if later, when it was updated in last.

- 6th Box: Identifiable Event Code: The sixth box is used for the justification of filing the form which is displayed in it.

- 7th Box: Fair Market Value of Property: The purpose of seventh box is to show the fair market value of Property. This displays the fair market value if a property was foreclosed upon or abandoned in the same year and if it is in conjunction with the cancelled debt. But in case if it is not then a separate 1099-A form will be sent to you.

How to File Form 1099-C: Cancellation of Debt

Forgiveness or cancellation by a lender or creditor which includes the Withdrawal of secured property or foreclosure of amounts of $600 or more, this all is reported on Form 1099-C. The Principal, interest, fines, late fees, penalties and administrative costs all may be included in the sums of recorded on the form. The IRS website also offers you to download links for all the three forms.

You are required to include the sum from the first box of your Form 1040 or 1040-SR’s and the other Income line when you file your income tax return after receiving the form. If the cancelled debt is less than $600 and you don’t receive Form 1099-C then you still need to include it in your income. When you file your tax return then Form 1099-C is not required but you should keep it to you for your records.

The year after the debt was cancelled or forgiven; you should get Form 1099-C till the date January 31. Ensure that the data on your 1099-C is accurate. If not then you should speak with the lender and ask for a modified form. If you were supposed to receive a cancellation notice but didn’t get it then be in the touch with the creditor since you are responsible for including the cancelled debt on your tax return.

You are not aware that a 1099-C form is the form which you need to file for your taxes prior to receiving it since a creditor is free to decide how long it wants to carry a debt. In that case, you ought to file an amended tax return even though your tax liability remains the same. You risk raising a red flag and inviting an IRS audit if you don’t do this. The amount of cancelled debt which you can deduct from your gross income which is calculated by using IRS Tax Form 982 and you should always keep a record of it.

Which Non-Taxable Cancelled Debt

The IRS states that there are some circumstances in which income from a cancelled debt may not be taxable. If any of the following situations will apply to you then in that case you won’t receive a form.

- One who is Bankrupt that is also known as Bankruptcy

- Insolvency of the one.

- A few Farm Loans.

- Non-recourse Financing.

- Forgiving of Loans to the Public Dector.

- Forgiveness of Student Loan Debt or Financial aid.

- A Student Loan Borrower’s Passing away or Developing for a Lifelong Handicap.

Taxes may not apply to some types of the mortgage debt. The Mortgage Forgiveness Debt is the Relief Act of 2007 (MFDRA), which was extended through 2020 and permitted people to exclude up to $2 million of the specific mortgage debt of cancelled by a lender if it involves in a foreclosure, short sale or the restructuring of a mortgage with a lower principal amount on a primary residence. This was extended through 2025 but the amount of debt which may be excluded and was decreased to $750,000 by the Consolidated Appropriations Act, which was signed into law on December 27, 2020.

Conclusion

Forgiven or cancelled debt is reported to the IRS by using the Form 1099-C. For every amount of debt which is $600 or more, a creditor is required to submit one form to the IRS and one form to the debtor and one form is used to keep it for its records. Once a taxpayer receives the form, they are required to include the sum on their tax return. In fact, even if the debt was cancelled for less than $600 and if no document was provided then they still had to declare it on their tax return.

The debt cancellation is typically regarded as a taxable income. It is crucial to comprehend what such exclusions entail because the IRS does exempt some forms of it from taxation. Remember, you don’t want to pay taxes which you don’t have to.

Contact our specialists if you have any questions concerning the Cancellation of Debt Form 1099-C. Our experts who are professionals in their respective fields, who have high qualifications, they will help you with any problems which you might be having while paying your taxes. Simply call our toll-free helpdesk right away in this situation.

Frequently Asked Questions

What is the use of Form 1099-C?

The IRS demands that you have to file Form 1099-C as a federal tax document. Whenever cancelling or forgiving of a debt of $600 or more rises then the lenders and other creditors are required to provide a copy to the agency and taxpayers. The one should deliver the form to the taxpayers till January 31st.

What kind of Debts can be Reported on Form 1099-C?

There are different kind of debt cancellation and forgiveness which lender will report on Form 1099-C, some of them are connected to the foreclosure, repossession, the return of property to a lender, the abandonment of secured property, loan modifications for primary residences, the settlement of credit card debts and the student loan forgiveness for borrowers on income-driven repayment plans.

What information you can Report on Form 1099-C?

Only for the amount of $600 or more the issuers will provide you Form 1099-C. It is your duty to record any sum that qualifies as a cancelled or forgiven debt on your yearly tax return. Forms 1040 or 1040-SR’s are the other income line which requires the entry of the sum which is shown in First Box of Form 1099-C.

What do you Understand by Bankruptcy?

When a corporation or a person is unable to pay back their debts or obligations then bankruptcy is a legal process which takes place. Those who are no longer able to pay their expenses, the bankruptcy will give them a new beginning.

A petition is filed either on the behalf of a creditors which is less frequent or by the debtor, it is how the bankruptcy process gets started. All of the debtor’s assets have been counted and assessed. They might be utilized to pay off some of the outstanding debt.

What do you Understand by Insolvency?

A person or business is said to be insolvent when they are unable to pay their creditors as soon as their payments are due. Unofficial agreements with creditors, such as the creation of alternative payment arrangements, are likely to be made before an insolvent company or individual becomes involved in bankruptcy procedures. Poor cash management, a decline in cash inflow, or an increase in expenses can all lead to insolvency.