During the year, you may receive a 1099-DIV if you own stocks that pay dividends or if you invest in mutual funds that distribute capital gains.

Table of Content

What is Form 1099-DIV, Dividends and Distributions?

Financial institution and other banks send a Form 1099-DIV that is Dividends and Distributions, to an investor who has received dividends or distributions from any kind of investment during a calendar year. The Internal Revenue Service (IRS) is referred to as the sender. Several 1099-DIVs may be sent to the investors. An investor’s tax return must include a report of each 1099-DIV form. If cumulative dividends are less than $10 then the investors normally won’t get a 1099-DIV form.

Key Features of Form 1099-DIV, Dividends and a Distributions

• Investors who use to receive distributions from any kind of the investment during a calendar year and sent a Form 1099-DIV, Dividends and Distributions.

• The form must be made available to the taxpayers by the January 31 of each year from the banks, investment firms and other financial institutions.

• Taxpayers will provide the data from each 1099-DIV form, either on a Schedule B form or a directly on Form 1040.

• Only if the taxpayer will receives more than $10 in dividends or other distributions and they will be sent to the form.

• Financial institutions are required to send it to the form to both the taxpayer and the IRS.

Who Can File Form 1099-DIV, Dividends and Distributions?

Businesses provide a copy of the document to the investor and to the IRS. Taxpayers who must received a Form 1099-DIV by the date January 31 in each year from banks, investment firms and other financial institutions.

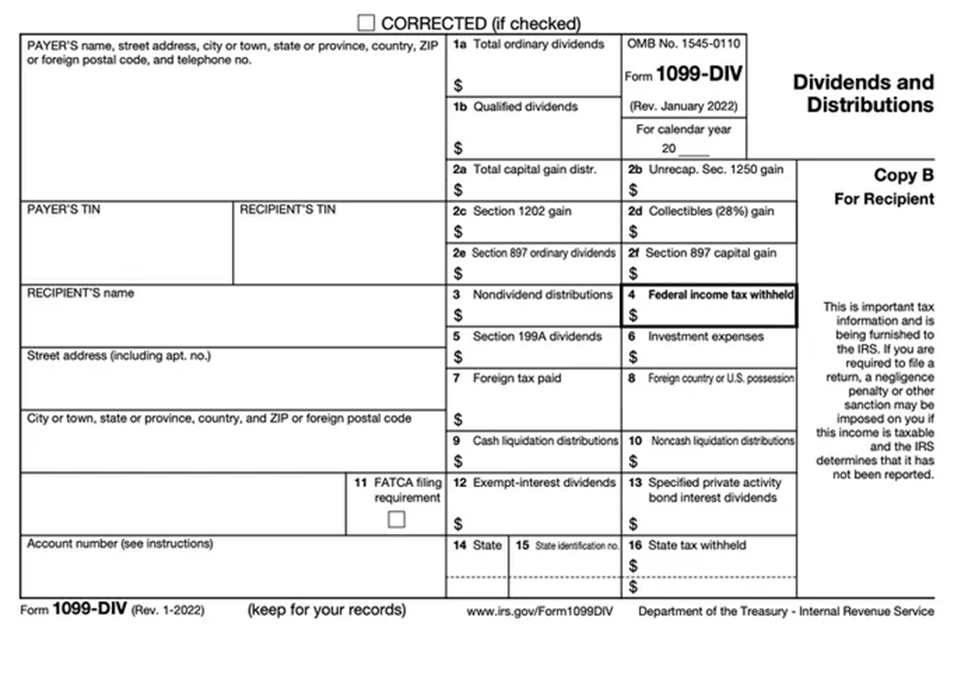

The form includes the recipient’s name, address and the Social Security Number that is SSN. It also has the payer’s name, address, identification number and a plan number. The recipient will need some of the key numbers which are listed on the right side of the form, such as the total distribution of capital gains, qualified dividends and ordinary dividends.

Ordinary dividends, qualifying dividends, or total capital gains will typically be reported on a Form 1099-DIV to investors. Other categories for the investors include:

- Gains which are not yet captured under the section 1250

- The gains of Section 1202

- The Collectibles Gains

- Non-dividend Distributions

- The withheld of Federal Income Tax

- Expenses for the Investment

- Payment to the Foreign tax

- Possessions for Foreign country or U.S.

- Distributions of Cash Liquidation

- Distributions for Non-cash Liquidation

- Dividends for Exempt-interest

- The Dividends on the Specified Private Activity Bond Interest

- Withheld for State Tax

For the foreign accounts, the Foreign Account Tax Compliance Act (FATCA) needs a filing requirement which may also apply to the investors. This is a statute that requires the U.S. citizens with both in the country and overseas, to file the reports on foreign account holdings. It is required to report these account by holdings in the US dollars.

How to File Form 1099-DIV, Dividends and Distributions

There are three copies of Form 1099-DIV. The Copy A is in red and it is for the informational purposes which only and should not be printed. Copy B is that which can be downloaded and printed and it is divided into two parts. The recipient receives one and the state tax authority which receives the other along with the tax return. You can easily use this section, which is in black in order to fulfill the recipient’s requirements.

Taxpayers are expected to file the information for an each of the Form 1099-DIV that they receive on their annual tax form. Either a Schedule B form or Form 1040 can be used for this.

A Schedule B must be completed along with a 1040 form if a taxpayer receives more than $1,500 in the taxable interest and/or ordinary dividends over the course of the year.

Except in certain circumstances the dividends are taxed at the investor’s marginal tax rate. The main exception is qualified by the dividends. Qualified dividends can be taxed at lower capital gains with the tax rate because they have satisfied some of the requirements.

Also, the tax rate on the capital gains may differ from the rate for a regular income. Long-term capital gains have lower taxes than short-term capital gains. Long-term capital gains are taxed at the ordinary income tax rate.

Ordinary Dividend

Regular dividends are a portion of a company’s profits that are distributed time to time to the shareholders. The benefits of having stock in a company are well known, while the benefits of owning stock in a company are not well known.

It is a fact that the majority of the world’s population is senior people. While qualified dividends are taxed at the lower capital gains rate, ordinary dividends are subject to ordinary income taxation.

Capital Gains

Capital gain can be described as the increase in a capital asset value upon a sale. A capital gain happens in order to put it simply, when you sell an asset for more money than you purchased for it.

Your capital assets can be in any form. This can be a purchase made for personal use or as a kind of investment such as a stock, bond, or piece of real estate, like furniture or a boat.

When an asset is sold the capital gains are earned by deducting the purchase price from the sale price. In some of the cases, the Internal Revenue Service (IRS) charge a capital gains tax on people.

Conclusion

All of the complete information which you want to understands the Form 1099-DIV, Dividends and Distributions are provided in this article. For the better understanding, we suggest you to read it completely. In this post, we go into detail regarding to the Form 1099-DIV, Dividends and a Distributions.

We truly hope that you will find the above-mentioned material on the Form 1099-DIV, Dividends and Distributions is useful. Contact one of our experts, if you have any queries concerning Form 1099-DIV, Dividends and Distributions. Any issues you might be having with your Form 1099-DIV, Dividends and Distributions can be handled by our devoted team of trained specialists with complete knowledge. The only one thing we suggest you in any of the circumstance in which you need help then dial on our toll-free helpline number without any delay.

Frequently Asked Questions

Download Form 1099-DIV, Dividends and Distributions

The form 1099-DIV, Dividend and Distribution is available on the website of IRS.

Why, Despite being Paid Dividends, I did not get a Form 1099-DIV?

If your dividends totals are more than $10 then you will only receive Form 1099-DIV.

In the event in which your dividend payments are exceeded to this amount and you haven’t gotten a form then get in touch with the issuer and request for the one.

What do You mean by Form 1099-DIV?

The IRS mandates are a form which is known as a Form 1099-DIV, Dividends and Distributions. It is used to report any of the dividends or distributions that banks and other financial organizations make to taxpayers. This comprises among all other things that are the total of capital gains which are ordinary and qualifying dividends, federal income tax withheld and international tax paid.

How can I Report for the Form 1099-DIV?

The data on the Form 1099-DIV can be directly reported on Schedule B or on Form 1040.

What do You Understand by Section 1202?

The Internal Revenue Code (IRC) sections 1202 is often known as the Small Business Stock Gains Exception which enables the capital gains from a number of small business stocks and are to be exempt from federal tax. Only QSBS bought after September 27, 2010, and held for a period of more than five years. These are subject to Section 1202 of the Internal Revenue Code.