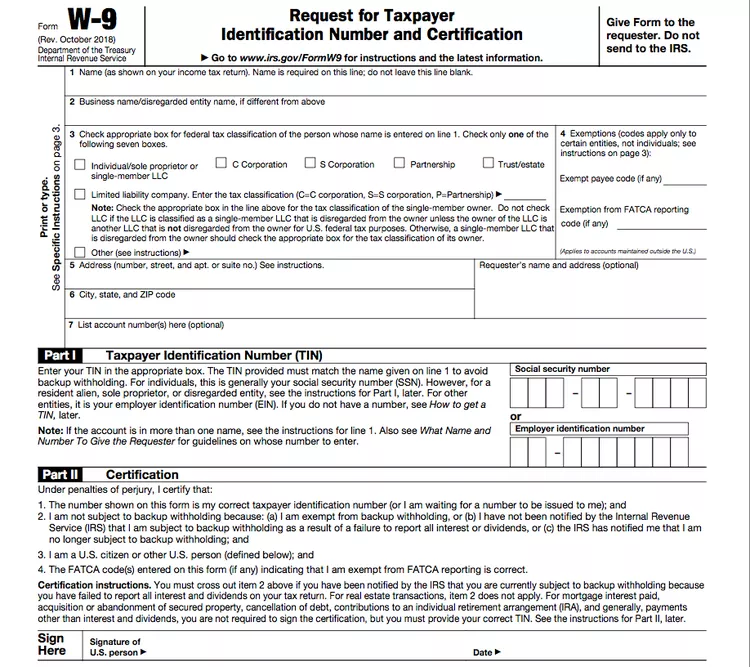

For employment or other income-generating purposes, the Internal Revenue Service (IRS) uses a W-9 form to verify a person’s name, address, and taxpayer identification number (TIN). Either a resident alien or a person who meets the criteria for citizenship in the United States may request the confirmation.

An alternative name for a W-9 form is a Request for Taxpayer Identification Number and Certification form.

Table of Content

What Is Form W-9?

A W-9 form is an Internal Revenue Service (IRS) tax form that is used to confirm a person’s name, address, and taxpayer identification number (TIN) for employment or other income-generating purposes. A W-9 form is also known as a Request for Taxpayer Identification Number and Certification form and can be requested by either a U.S. citizen or a resident alien.

Key Points of W-9 Form

Following are the important points that you should keep in mind for the W-9 Form:

• Employers and other organizations can use W-9, an official form provided by the IRS to confirm a person’s name, address, and tax identification number before paying them.

• Frequently, information from a W-9 form is used to create a 1099 tax document, which is required for filing income taxes.

• Under rigorous privacy restrictions, the data that a business collects on a W-9 form cannot be released for any other reason.

• Independent contractors who work for businesses for which they are not employees frequently need to give those businesses a W-9.

• If a W-9 is not provided as asked, your client is required to deduct taxes from your pay at a rate of 24%.

Benefits of the W-9 form

Most frequently, a version of Form 1099 is produced using the data collected on a W-9 form. Any income that the TIN holder could have gotten that wouldn’t typically be on a W-2 is disclosed on a 1099 form.

A W-2, however, is only given to workers of a corporation; it is not given to independent contractors or unaffiliated vendors. This covers a variety of financial transactions as well as money paid to a person under the terms of a contract, certain real estate deals, dividends paid on investments, and income received as part of other financial transactions.

The IRS mandates that the proper W-8 form be used in place of a W-9 form by persons who are not considered to be U.S. citizens or resident aliens.

When the minimum income threshold is reached, which for the majority of miscellaneous income is set at $600 for tax years 2021 and 2022, Form 1099 is only necessary to be produced. A 1099 form is not necessary for amounts below this cap, but the TIN holder must still declare them as income.

An employee’s privacy is protected by law even when they are contractually compelled to give their employers certain personal information. An employer could face both civil and criminal charges if they improperly expose an employee’s personal information.

Who Can File Form W-9?

A W-9 form is a formal written request for information (TIN) which is used to verify a person’s taxpayer identification number. To report any gains or losses that could have an impact on your federal tax return or your taxable income, an employer or other organization has to have your proper TIN in order to file an informational document with the IRS, such as Form 1099. The Social Security Number will often be the TIN for most people (SSN).

The W-4 Form, which is more frequently given by employees to direct employers, varies from the W-9 in that the W-9 does not automatically make arrangements for the withholding of any taxes owed. Unless the taxpayer is subject to backup withholding, any required taxes based on gains associated with the submitted W-9 are the responsibility of the TIN holder identified on the form. If backup withholding is necessary, it must be specified on the W-9 so that the entity receiving the information is adequately informed of the need to make the appropriate with holdings.

How to Fill Out Form W-9

One of the easiest IRS forms to do is Form W-9, but if filling out tax forms gives you the willies, don’t be concerned. The correct technique to finish it will be demonstrated to you.

Follow the following steps in order to fill out the w-9 form correctly:-

- First, You have to enter your name as shown in your tax return.

- Specify your company name or the name of a “Disregarded Entity,” if it differs from the name you provided in step 1. As an illustration, a sole proprietorship might opt to “Conduct Business as” a different name in order to avoid using its own name for marketing purposes. You would type that name in this field.

If it differs from the name you gave for step 1, Enter your company name or the name of the “Disregarded Entity.” For instance, a sole proprietorship might opt to “Conduct Business as” another name in order to avoid using its own name for marketing purposes. That name would be entered in this field. - Select which type of business entity are you for federal tax classification: sole proprietorship, partnership, C Corporation, S corporation, trust/estate, limited liability Company, or “other“. Only one classification should be chosen, thus check the relevant box.

- Exemptions. There’s a good chance you’ll leave these boxes empty. Two outliers are listed below:

- A code may need to be included in the “Exempt Payee Code” section for payees who are exempt from backup withholding, such as corporations (in most circumstances). The exempt payees and their codes, as well as the kinds of payments for which these codes should be used, are listed in the Form W-9 instructions. For instance, businesses would input code while completing a W-9 to receive interest or dividend payments.

- Some payees may be required to submit a code in the “Exemption from FATCA Reporting Code” box if they are exempt from reporting under the Foreign Account Tax Compliance Act (FATCA). For the usual independent contractor or freelancer, neither of these boxes will apply.

- Your street address, city, state, and zip code should be provided. You should use the address that will appear on your tax return. If you’re a sole proprietor who rents office space but files your tax return using your home address, for instance, provide your home address on form W-9 so the IRS won’t have any issues tying your 1099s to your Form 1040.

- Additionally, the W-9 might be a business’s main method of getting your personal data. This address might be utilized to send you your 1099 or other crucial tax documents because it might end up in their accounting system when you’re added to their supplier list.

- The requester’s name and address may be provided in this optional stage. For the purpose of documenting to who you gave your tax identification number, you might want to check this option.

- At the conclusion of this first part of the Form W-9, you also have the choice to provide pertinent account numbers. Using a number stored in the client’s system, this account number portion may be used to identify a person specifically. You might be asked to complete a Form W-9, for instance. They might ask you to write down your supplier number in this section because they have listed supplier #45 in their database.

- The next part is referred to as Part I by the IRS. You must provide your business’s tax identification number here, which is either your personal Social Security number (if you’re a sole proprietor) or your employer identification number (EIN) if you’re another kind of business. Although some sole proprietorships now have EINs, the IRS recommends that sole owners utilize their SSNs on Form W-9. Again, doing this will make it simpler to match any 1099s you receive with your tax return, which you will file using your SSN.

- What happens if your company is brand-new and lacks an EIN? Form W-9 can still be completed. According to the IRS, you should fill out an application for your number and put “Applied For” in the TIN field. You should obtain this number as soon as you can since backup withholding will apply to you until you do. Applications for EINs are available. For more information about backup withholding, see the instructions for Step 8, Part II, below.

- Before you may sign Form W-9, you must be sure in Part II that all of your data is accurate. The IRS doesn’t play around; if you knowingly lie on a tax form, you are a risk to pay a fine or perhaps go to jail. Under penalty of perjury, you must certify the following statements are true on the form W-9 before signing it:

- This form’s number is my legitimate taxpayer identification number (or I am waiting for a number to be issued to me).

- Taxpayers are required to use valid tax IDs. Using a “Borrowed,” “Stolen,” or “Fabricated” tax identification number would be equivalent to lying under oath and carry severe repercussions.

- I am not required to withhold backup funds because:

- (A) I am exempt from backup withholding;

- (B) the Internal Revenue Service (IRS) has not notified me that I am required to withhold backup funds because I failed to report all interest or dividends; or

- (C) I’ve received notification from the IRS that backup withholding is no longer applicable to me.

- The vast majority of taxpayers are exempt from backup withholding. You are probably exempt if you have no idea what the IRS is referring to. The IRS will inform you if you aren’t exempt, and the organization paying you needs to know since it is required to deduct income tax at a fixed rate of 24% (as of 2020) from your pay and transmit it to the IRS. or (c) the IRS has informed me that I am no longer required to withhold backup funds.

- I am an American citizen or another American.

- You’re safe if you’re an alien resident. A domestic estate, a domestic trust, a partnership, corporation, firm, or association established or organized in the United States or under American law are also regarded by the IRS as U.S. individuals. If your business is a partnership with a foreign partner, special rules apply; learn more about them in the Form W-9 instructions. If you are not a citizen of the United States, you might need to complete Form W-8 or Form 8233.

- If applicable, the FATCA code(s) on this form indicates that I am exempt from FATCA reporting are accurate.

- The Foreign Account Tax Compliance Act is the subject of this one, so you probably don’t need to worry.

Frequently Asked Questions

Who Needs to Fill W-9 Form?

In general, a W-9 must be completed by anyone who will receive payment as a non-employee. Form W-9 may be required in a variety of circumstances. For instance, a taxpayer who is expected to earn interest, real estate transaction proceeds, home mortgage interest, student loan interest, or debt cancellation proceeds must also get certain forms of Form 1099. The opposing party may use Form W-9 to obtain your tax information in order to appropriately furnish the tax form.

What will Happen in case You don’t Provide a Form W-9?

A withholding tax of 24% will be deducted from any future payments you receive from your customer if you decide not to provide a Form W-9 or if the information given is untrue. The deliberate withholding of accurate information or the unauthorized use of TINs is also subject to fines and penalties.

What are the Penalties for Non-Compliance with W-9?

Consequences for non-compliance include the following:

1. Unless you can show that there were errors that weren’t made intentionally, there will be a $50 fine for each request for a TIN that wasn’t provided accurately.

2. If a false statement is made without a good reason and there is no backup withholding, there is a $500 fine.

3. For will fully forging certifications or affirmations, additional penalties and/or jail time may apply.

4. The misuse or disclosure of another party’s W-9 information may result in civil or criminal consequences under federal law.

Is W-9 can be used for Self- Employed Individuals?

Yes, self-employed people are the ones who use a W-9 the most frequently. Form W-9 must be given to anyone from whom a worker has received over $600 without being officially engaged as an employee, regardless of whether they are an independent contractor, freelancer, or self-employed.

For What Purpose W-9 is Used?

Tax information is provided from one party to another via Form W-9. A standard means of conveying information is used, and the furnisher must attest that the data they are supplying is accurate before it can be formally collected as personal information. Then, using Form W-9, detailed tax statements are sent to non-employees who received specified payments throughout the year.