The W-4 form is the form which must be completed by each employee to specify that the amounts of taxes are to be withheld from each paycheck. It has been changed if you are transferring your employment and haven’t done it so recently. The Federal Revenue Agency that is IRS claims that by revising the form it can be easily improve both the accuracy and transparency of the payroll in a withholding system.

There is no need to fill a new W-4 form if you are not changing your job and do not have a cause to do so. The one W-4 form which you have currently on a file it may still and used by your employer.

Personal and dependent exemptions which are no longer applicable are not asked for on the current W-4 form by the employees. If you have a second job or you are qualified for an itemized deduction then the form also asks that if you want to increase or decrease the amount of the tax which you withhold.

The most recent Form W-4 which has been in use since December 2020.

Table of Content

What is Form W-4: Employee’s Withholding Certificate?

W-4 Form is also known as an IRS form. Sometimes in other words it is also known as an employee’s withholding certificate. This form is one that which is necessary for the employees to complete and give it to their employers, when they begin their new job. Businesses compute the amount of tax to deduct it from the employees’ paychecks throughout the year by using the information which is entered on their W-4 form.

Employers use to calculate some of their payroll taxes by using the information of W-4 and on the behalf of its employees, employers send the taxes to the IRS and the state if it is required. Whether the taxes are owned or refund can send significant impact that how you will complete your W-4 form.

In case if you already have a W-4 form on a file with your company then there is no need that you will fill out the new one. There is no need that you have to complete annually a new W-4 form. But, you will be required to complete a new W-4 form if you had started a new employment or wish to change the withholdings at your current position in a business.

It’s a good idea to evaluate your withholdings and W-4 as your circumstances change because significant occurrences like divorce, marriage, the addition of dependents, or side jobs, can also result in a change in your tax liability.

Key Features of W-4 Form

• The information which you have entered on Form W-4 that is commonly also known as the Employee’s Withholding Certificate decides that how much tax your employer withholds from your paycheck.

• You will be receiving less amount of money when you are filing your annual income taxes than the more properly which you fill it out.

• If you have a second job or other specific personal circumstances then you can modify your withholding by using the new W-4 form.

Working of the W-4 Form

The significant redesigning of the W-4 form is done in year 2020 and it was reduced to the five pieces from its previous seven pieces.

The amount of the tax of your employer will be deducted from your paycheck and it depends on how Form W-4, Employee’s Withholding Certificate is completed. Your name and your Social Security number both are sent to the IRS together with the money that your employer withholds from your paycheck.

Whenever you will file your tax return for the year then your withholding is used against the annual income tax obligation which you determine. This is the reason why W-4 form requests you to identify details such as your name, address and the Social Security number.

Changes in W-4 form

The W-4 Form is the best opportunity for you to claim your personal allowances and this opportunity you got recently.

In the past, a W-4 includes a Personal Allowances Worksheet which is helpful in assisting you to determine that how many allowances you have to claim. Whenever you had claimed more allowances then the employers would deduct less from your salary but if you claimed fewer allowances then more would be deducted from your salary.

The personal and the dependent exemptions that you claimed on your tax form were previously related to your allowances. The Tax Cuts and the Jobs Act (TCJA) raised the standard deduction while eliminating the personal and the dependent exemptions.

In third step of the current form you are required to list the number of the dependents who are residing in your household. It also asks you if your situation is justified for a higher or lower level of withholding. Now it gives you the option to specify whether you are receiving income from a second job or anticipate having deductions that you will categorize on your tax return.

Summary of the Five Steps of Form W-4

There are five main steps in the W-4 form from which one is optional.

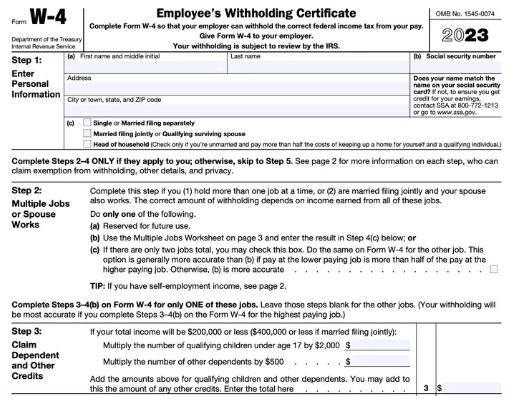

- Step one: Enter Personal Information- In this step you have to enter the standard personal information of yours that will be helpful in identifying you and specifies that whether you are intend to file your taxes as an individual, a married individual or a head of household.

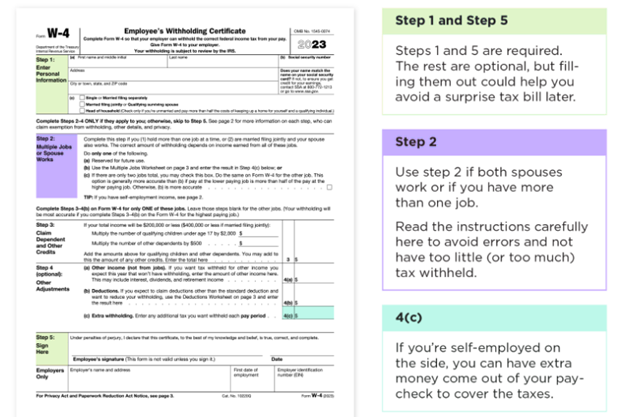

- Step 2: Multiple Jobs or Spouse Works- The second step must be completed by those who should withhold more or less than the recommended amount which is based on their circumstances. It is possible for you to list items like income from a second job, a spouse or a freelance work.

- Step 3: Claim Dependent and Other Credits- The number of your children or the other dependents should be listed in the third step.

- Step 4 (Optional): Other Adjustments- You can easily list all the additional justifications for increasing or decreasing the amount that is withheld from your paycheck in this section. This is the optional sectional which is filled only if it is required otherwise leave it. For instance, investment-related passive income could rise both of your annual income and the amount of taxes which you have owed. You can pay less in taxes if you itemize your deductions. These can warrant modifying by your withholding on the W-4 form.

- Step 5: Sign Here- You must sign in this fifth step. This is the last and the final step which is very important as it is very helpful in confirming that the information is entered by you is correct and complete.

How to Fill Out Form W-4

Most of the businesses use to utilize the form W-4 for the calculation of some payroll taxes and remit the taxes on the behalf of employees to the IRS and the state also if it is applicable. The way of a W-4 form is completed and can be significantly shows the impact that whether taxes are owing or a refund is issued.

Following is a brief explanation on how you can complete a Form W-4 in the year 2023.

First Step: Entering of Your Personal Data

You have to provide your name, address, Social Security number and status as a tax filer. There are the restrictions on which tax benefits and deductions are done and you can take advantage of it on bases of your tax filing status which is significant.

Second Step: Accounts Which have Multiple Job

You have to follow the guidelines in order to receive that which one is more accurate withholding if you have multiple jobs or if you file jointly with your spouse and you both are employed.

- You have to complete steps from second through 4(b) of the form W-4 for the position with the greatest compensation. For the other jobs W-4s will leave those stages blank.

- You may choose to check box 2(c) for the indication that you, you and your spouse work a total of two jobs and make about the same at each. You must complete this step for both W-4s.

- There are a few solutions which are available to you if you don’t want to disclose your employer that you have a second job or that you receive income from other non-work sources:

- You can tell your employer that how much more tax should be deducted from your paycheck on line 4(c).

- Alternative: Don’t include the additional revenue in your W-4. Make anticipated tax payments to the IRS on your own which is opposed that having the tax deducted from your paycheck automatically.

Third Step: Dependents Claim Which also include Children

You can enter how many children and dependents do you have and multiply that number by the credit amount if your total income is under $200,000 or $400,000 if you are filing jointly. You have to refer to the regulations regarding the child tax credit and the conditions for claiming a tax dependent. If extra taxes need to be withheld from your salary in order to lower your tax burden then you can also decide not to claim dependents even if you do have them.

Fourth Step: Refining of Your withholdings

You can make a note of it if you want to have more tax withheld or if you are anticipating of taking deductions other than the standard deduction when you file your taxes.

Fifth Step: Fill Date and Your Signature on Your W-4 Form

Provide the signed document to your employer’s payroll or human resources department once it has been finished. The payroll system of your workplace can also allow you to complete it online.

Estimating of Your Income Tax

To determine how much you should be withheld from your salary, the IRS advises you for utilizing its online Tax Withholding Calculator. To calculate how much federal income tax should be deducted from employees paychecks or employers use IRS Publication 15-T.

You can direct your employer to deduct more money from your paycheck by using Form W-4 if you have other sources of income, such as dividends, interest, self-employment compensation or retirement income.

If you are legally exempt from withholding because you did not owe any taxes the previous year and do not anticipate owing any this year, you can use Form W-4 to prevent your employer from deducting any money from your paycheck. Nevertheless, you must meet this requirement.

Revising of Your W-4 Form

If yours situation change like for example, if you get married or get divorced, have a kid or joining a second job then you might need to submit an updated W-4. If you realize that you incorrectly withheld too much or too little tax from the prior year, you can also submit a new W-4 form.

Detail of W-4 Form

Filling out a W-4 is simple if you are single or married to a non-working spouse or you don’t have any dependents, you only have one job and you aren’t claiming any tax credits or deductions aside from the standard deduction. Your name, address, Social Security number and filing status must all be entered before signing and dating the form.

In contrast, your tax position is more complicated and you’ll need to supply more information and if you have dependents, spouses with income or you intend to claim any tax credits or deductions.

Below is a detailed explanation on how to fill out the form.

Submit Your Information

You have to submit your name, address, filing status and Social Security number in this section. Your company requires your Social Security number so that the money it deducted from your paycheck and sent to the IRS is applied correctly towards your yearly tax obligation.

Single filers with the aforementioned straightforward tax position simply need to sign and date the form after completing this step, and they are done.

Everyone else has to go a little further.

Include Additional Jobs or a Spouse Who is Employed.

If you have more than one job and you are married filing jointly and your spouse has a job then you have to go to second step. If this applies to you, you can select from one of the following three options:

Instance A

Utilize the IRS’s online Tax Withholding Calculator and, if necessary, incorporate the estimate in forth step.

Instance B

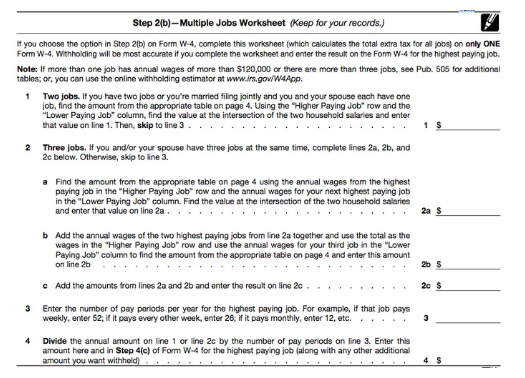

As stated below, complete the Many Jobs Worksheet found on page three of the Form W-4 and enters the outcome in step 4(c).

For the worksheet to result in the most accurate withholding, the IRS suggests that just one married couple, the one with the higher-paying job, should complete it.

The first distinction you must make while completing the Many Jobs Worksheet is whether you have two jobs (including both you and your spouse), three jobs, or more. Line 1 on the form should be filled out if you and your spouse each work one job. If your spouse is unemployed and you work two jobs, you must also complete line 1.

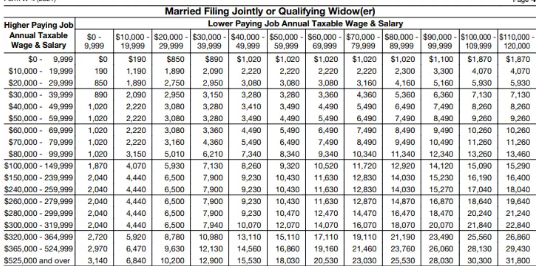

The graphs on page 4 of Form W-4 must be used in order to correctly complete line 1. Because these graphs are organized according to filing status, you must choose the appropriate graph based on your tax filing method. The higher-earning spouse’s money amounts are listed in the left-hand column, while the lower-earning spouse’s dollar amounts are listed in the top row.

Consider a married couple filing jointly as an example. In first line in case of many Jobs worksheet are required by spouse A to enter $8,340 that is the intersection of the $80,000-$99,999 row from the left-hand column and the $50,000-$59,999 column from the top row while assuming that Spouse A earns $80,000 per year and Spouse B earns $50,000 per month.

The second section of the Many Jobs Worksheet must be completed if both you and your spouse have three or more jobs collectively. Choose your highest-paying job first, followed by your second-highest-paying employment. The amount to increase to line 2a on page 3 can be calculated using the graphs on page 4. The second-highest paying job is used as the “lower paying job,” which is the same as in the previous case.

Secondly, you must combine the salaries from your two highest-paying jobs. Take the salaries from the third job as the “lower paying job” in the graph on page 4 and that amount for the “better paying job.” Line 2b on page 3 should be filled in with the data from the graph, and line 2c should be the sum of lines 2a and 2b.

Assume, for instance, that Spouse A has two jobs at $50,000 and $15,000 each, whereas Spouse B works a job at $40,000. Line 2a, which represents the union of the $50,000–$59,999 row from the left-hand column and the $40,000–$49,999 column from the top row, would be filled out by Spouse A as $3,490. On line 2c (the junction of the $80,000-$99,999 row from the left-hand column and the $10,000-$19,999 column from the top row), Spouse A would enter $3,150 after adding $50,000 and $40,000 to a total of $90,000. The total for line 2c after adding these two figures is $6,640.

On line 3 of the Many Employment Worksheet, you must enter the number of pay periods in a year at the highest-paying job; for instance, 12 for monthly pay, 26 for biweekly pay, or 52 for weekly pay. Divide your annual amount on first line for two jobs or second C line for three jobs or more by the number of the pay periods. Line 4 of the Multiple Jobs Worksheet and line 4c of the Form W-4 both require you to enter this amount.

Section C

If you and your partner only have two jobs combined, check the box in option C and repeat the process on the W-4 for the other employment. If both earn roughly the same amount, choose this choice makes logical. In such a case, more tax may be withheld.

Adding of Dependent

Fill out step three if you have dependents to see if you qualify for the child tax credit and other dependent tax credits. The Child Tax Credit is available to single taxpayers with incomes under $200,000 and married couples filing jointly with incomes under $400,000, respectively.

The short answer is that a dependent is a qualified child or qualified relative who lives with you and is supported financially by you. Officially, the IRS definition of a dependent is very complicated.

Add $500 to the number of additional dependents and divide by the $2,000 number of children under the age of 17 who qualify. Plus the sum of the two amounts in third line.

Adding of the other Adjustments

The IRS asks if you want to have more money deducted from your paycheck in this area.

Naturally, you respond, “No.” “You have already taken enough of my money.”

But, because of the information you supplied in the earlier sections, your employer might end up withholding too little tax for the entire year. That might result in a sizable tax bill, as well as possible underpayment penalties and interest, in April.

How do you know whether or not something might occur? If you receive a sizable income that is reported on Form 1099, which is used for interest, dividends, or self-employment income that you haven’t yet paid taxes on, that is one possible reason. A pension from a prior job or Social Security retirement payments may be received even though you are still employed.

By completing one or more of the following three sections in Step 4 of a W-4, you can have additional amounts deducted from your pay:

- 4(a)

If you anticipate receiving “non-job” income that is not subject to withholding, such as dividend or retirement account income, put the amount in this field.

- 4(b)

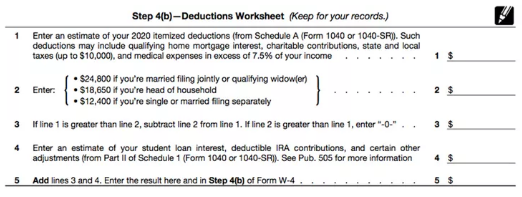

If you wish to lower your withholding and plan to itemize your deductions, fill out this box. Use the worksheet on page three of the W-4 form to estimate your deductions.

- 4(c)

If applicable, you can use this form to have any additional taxes, such as any amounts from the Many Employment Worksheet mentioned above, deducted from your pay each pay period.

Signature and Date in Form W-4

Once you are done with filling of the form now the last and final step is your signature. Sign the form and then it becomes legally binding.

The new W-4 form only needs to be completed if you start a new employment or if you wish to modify the amount of taxes deducted from your salary. Keep this in mind.

Conclusion

The IRS mandates that the income taxes will be paid progressively over the course of the year. It is crucial to complete a W-4 form accurately.

You can owe the IRS a surprisingly large sum in April if there wasn’t enough tax deducted from your paycheck, in addition to interest and penalties for underpaying your taxes throughout the year.

Your monthly budget will be more constrained than the necessary if too much tax is withheld. Also, you will be spending money that you could be saving or investing instead on an interest-free loan to the government. Your overpaid taxes won’t be reimbursed until the following year, when you file your tax return and receive a refund.

The cash may feel like a windfall at that point makes you less likely to spend it prudently than you would have if it had been received gradually with each paycheck.

Frequently Asked Questions

What is the use of W-4 Form?

You must submit Form W-4 to the IRS to inform your employer of the amount to deduct from your paycheck for federal taxes.

How can you use W-4 Form, so you can owe nothing on a Tax Return?

The accuracy of your W-4 is essential if your goal is to design your paycheck withholdings so that you file your annual return with a $0 tax liability.

• Be sure you file taxes under the appropriate status.

• Make sure your W-4 accurately depicts your present family situation.

• Estimate your additional sources of income with accuracy.

• Estimate your deductions accurately.

• Take advantage of the line to withhold more money.

What is the Special Consideration you should keep in mind While Filing W-4 Form?

Here’s a tax rule that can help you save money if you start working in the middle of the year after not having done so earlier: Request in writing that your employer compute your withholding using the part-year approach if you won’t be working for more than 245 days in a calendar year.

The conventional withholding calculation takes into account full-year employment, so if you don’t use the part-year technique, you’ll have too much withheld and have to wait until tax season to get the money back.

Who has to Fill out W-4 Form?

On their first day of work, every employee is required to complete a W-4. If you don’t, you can end up paying taxes that are either too much or too little.

What is the Difference between Form W-2 and W-4 Form?

The W-4 outlines the amount that should be withheld from the employee by the employer. The W-2 details the employee’s earnings from the prior year for the IRS. Form W-2 submission required by both the small business owners and big corporations. A W-4 must be submitted by every employee.