Table of Content

What is Form 706: United States Estate (and Generation-Skipping Transfer) Tax Return?

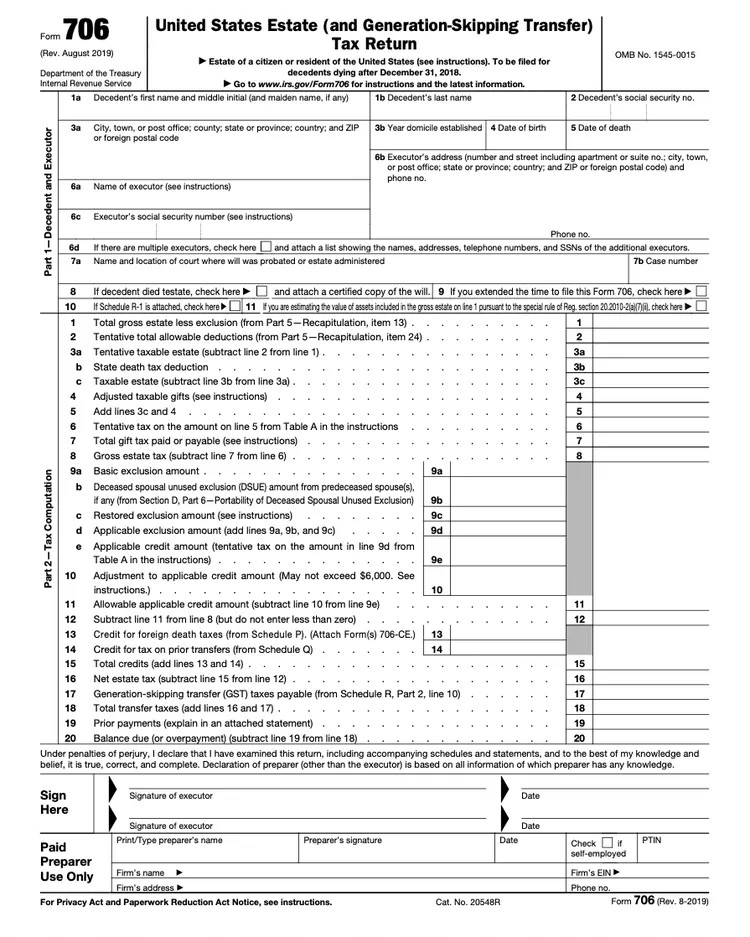

It is the duty of the executor of an inheritance to determine the estate tax that must be paid to the IRC that is Internal Revenue Code and the United States Estate and Generation-Skipping Transfer of the Tax Return is used in the form. It is just not the portion of that in a particular beneficiary which is received, but the complete taxable estate is always subject to the taxation. Executors can compute the generation skipping transfer tax (GSTT) levied by the detail information of IRC which uses the Form 706.

For the worth of estates which is more than $12.06 million and it is $12.92 million in 2023. It is important for the executor of the estate which must use the Form 706 in order to determine the amount of the tax which is due.

Before distributing any of the assets for the beneficiaries who are specified in the decedents will or the trust and the executors which can be estimated the size of an inheritance with the aid of Form 706. A stepped-up valuation is also known on the basis of step-up and it is how the IRS handles any of the bequests. In other words, the cost basis is changed into the reflection of the inherited assets for the fair market worth as of the date of the death.

Inheritor can reduce the taxes of capital gains by using the stepped-up valuation technique. It is the requirement of the estate which require the minimization of the amount of administrative work. This technique also enables a valuation process of cleaner.

Key Features of Form 706

• In accordance to the information which is provided by the IRC that is Internal Revenue Code is an executor of a decedent’s estate which must use Form 706 and it is also used to compute the generation-skipping transfer tax (GSTT) which is imposed by the IRC.

• A deceased U.S. citizen or the resident must submit Form 706 if their gross estate, adjusted taxable gifts and specific exemptions total is more than $12.06 million in 2022 and it is adjusted to $12.92 million in 2023 to allow for inflation.

• To determine the taxes which is owed on the trust payments and it is subject to the generation-skipping transfer tax and uses the Form 706-GS (D) or GSTT.

Who Can File IRS Form 706?

The executor of every American citizen or the resident’s inheritance is required to submit Form 706:

- Any of the citizens in the entire estate who has to adjust the taxable gifts and a particular exemption whose sum is more than the exclusion amount that is $12.06 million and $12.92 million in 2023 for the decedents who passed away in 2022.

- Executor who decides to give the remaining spouse that is the deceased spousal unused exclusion (DSUE) sum which is the independent of the size of the decedent’s gross estate.

Add the amounts 1, 2 and 3 which are given below in series allow you to see if the estate’s value surpasses the exclusion amount or not.

- After December 31, 1976, the adjusted taxable donation is made by the decedent.

- The complete specific exemption is permitted by the Section 2521. As it was in the force of prior to being for the repealed by the Tax Reform Act of the 1976 for the gifts which are made by the decedent after September 8, 1976.

- Valued as of the date of death to the decedent’s gross inheritance

Gross Estate includes the Following

- All assets are the deceased who had a stake and are included in the gross estate. It also includes the real property outside the U.S.

- Certain moves which are made while the decedent was alive without the due care.

- Allocation.

- Joint assets with rights of survivorship are which the excludable portion.

- Tenancies that can be included in the totality.

- Profits of the certain life insurance.

- Dower or curtsey or a statutory estate of the surviving partner is the property over which the decedent had broad power of the appointment

- The decedent’s stake is in the property of community.

Related IRS Forms

Form 706-NA: The estate tax and the GSTT obligation for the nonresident alien decedents and it is determined by using the Form 706-NA, United States Estate and the Generation-Skipping Transfer Tax Return.

Form 706-GS(D): To determine the taxes owed on the trust payments of subject to the GSTT. It uses the Form 706-GS(D), Generation-Skipping Transfer Tax Return for the Distributions. Any skip person who gets a taxable distribution from a trust which must use the Form 706-GS(D) in order to determine the amount of tax owed and to report it.

A transfer of the funds or assets which can be as an inheritance or a gift to someone two generations or more below the grantor who is subject to a generation-skipping transfer tax (GST). The term skip person refers to the recipient of an inheritance or gift. A skip person can be any individual who is at least 3712 years younger than the grantor, however grandchildren are frequently considered to be a skip people.

Gifts and the inherited property are subject to the GSTT when it is received by a skip person. By doing this, taxes are paid by every generation. With a lifetime exemption of $12,06 million for 2022 and $12,92 million for 2023, the GSTT has the same exemption as the federal estate and the gift taxes.

Form 706-GS(D-1), Notice of Distribution From a Generation-Skipping Trust, is used by trustees to report taxable distributions in order to skip individuals. The trustees also give the data of the skip person as they are also needed to be calculating the tax by owing on the distribution.

Where to Mail Form 706

A paper Form 706 must be submitted to report the estate or GSTT within nine months of the decedent’s passing. In case you are unable to file your Form 706 by the due date then you may apply for an automatic six-month extension by using the Form 4768.

File Form 706 at the Following Location:

- The Internal Revenue Service, Department of the Treasury, Kansas City, MO 64999.

- Internal Revenue Submission Processing Center, 333 W. Pershing Road, Kansas City, MO 64108 is where you should mail Form 706, if you are using a private delivery service such as DHL Express, FedEx, and UPS.

Even if you are utilizing a private delivery service and send your revised Form 706 to the following address:

- 7940 Kentucky Drive, Florence, KY 41042-2915, Federal Revenue Service Center, and Attn: E&G, Stop 824G.

- Both the estate tax and the GSTT are due nine months after the decedent’s passing.

- Checks should be written out to the United States Treasury and should include the name of the Social Security number, and Form 706 of the deceased.

- A different option is to pay online via the Electronic Federal Tax Payments System (EFTPS).

To understand IRS Form 706, you may get all the necessary information in this Article. For better comprehension, we suggest that you read this article from beginning to end. In the honest hope that it would be of use to you, the information which is provided above regarding IRS Form-706 is correct and useful for you. Nonetheless, there is no need to be reluctant to ask any question from one of our pros. If you have any query, you can ask in any way or mode. Any questions you may have regarding your IRS Form 706 can be addressed by our devoted group of skilled consultants. No matter what the circumstance, we just encourage you to connect with Dancing Numbers TAX as soon as you discover that you need help.

Frequently Asked Questions

What is the Trigger of Estate Tax Return?

Form 1041, U.S. Income Tax Return for Estates and Trusts, must be filed by estates with annual gross revenue of more than $600. Quarterly estimated taxes may also be due from the estate.

Is it Necessary that Every Estate have to File a Form 706?

The Form 706 is not required for every estate. When the total of the deceased person’s gross estate, adjusted taxable gifts, and tax exemption exceeds the reporting threshold for the year of death, a form must be submitted on their behalf.

What is the Difference between IRS Form 709 and IRS Form 706?

IRS Form 709 is used by an individual to report to the government any gifts that have exceeded the annual limit, whereas IRS Form 706 is used by the executor of an estate to assess whether taxes are payable on behalf of a person who has passed away.

What do You understand by EFTPS?

• Here EFTPS stand for Electronic Federal Tax Payment System.

• The U.S. Department of the Treasury has a 24-hour service called the Electronic Federal Tax Payment System (EFTPS) that lets taxpayers pay their taxes online or over the phone.

• With their social security number and unique PIN number, taxpayers can use the system to submit their tax returns to the IRS immediately.

• In the past, bogus emails were sent to EFTPS users, warning them that their identification numbers had been rejected or urging them to click on an attached link to update their personal information.

What do you Understand by Form – 706-NA?

A tax form known as the United States Estate (and Generation-Skipping Transfer) Tax Return is used to determine the tax obligations for estates with assets located in the United States as well as generation-skipping transfers of non-resident decedents. If the estate’s worth exceeds the filing threshold of $60,000, the executor is required to file Form 706-NA, which is provided by the Internal Revenue Service (IRS), within nine months after the decedent’s passing.