Adjusted Gross Income (AGI) is a crucial number that the IRS uses to figure out how much income tax you owe each year. To get your AGI you need to start with your gross income. This is the total of all the money you earned throughout the year including things like wages, dividends, interest, etc. before any deductions. Then you make some adjustments to this gross income to arrive at your AGI. This is the amount upon which your tax is calculated.

AGI impacts the size of your tax deductions and can also affect your eligibility for specific retirement plans like a Roth IRA.

In certain situations, there’s another term you might hear which is Modified Adjusted Gross Income (MAGI). This is your AGI with some allowable deductions added back in. But for most people, AGI and MAGI are the same.

When calculating your AGI you have to subtract certain items from your gross income like alimony payments and educator expenses. It’s important to note that many U.S. states use your federal AGI as a starting point to calculate their state income taxes with potential further adjustments based on state-specific deductions and credits.

Table of Content

- 1 Features of Adjusted Gross Income (AGI)

- 2 Different Types of Income

- 3 Calculating Your AGI (Adjusted Gross Income)

- 4 How to Lower Your Adjusted Gross Income (AGI)?

- 5 Example of AGI Impacting Deductions

- 6 Adjusted Gross Income (AGI) vs. Gross Income vs. Taxable Income

- 7 What is Adjusted Gross Income (AGI) on your W-2?

- 8 Conclusion

- 9 Frequently Asked Questions

Features of Adjusted Gross Income (AGI)

- The IRS relies on your adjusted gross income (AGI) to determine the amount of income tax you are responsible for paying in a given tax year.

- AGI is calculated by taking your total income for the year (referred to as your gross income) and then making a few specific adjustments to this income figure.

- Your AGI can influence the extent of your tax deductions and might impact your eligibility for certain retirement plan contributions such as a Roth individual retirement account (Roth IRA).

- Modified adjusted gross income (MAGI) is essentially your AGI but with the inclusion of some deductions that would otherwise be allowed. For many people, AGI and MAGI will be similar.

- When calculating your AGI, certain items are subtracted from your gross income which can include things like alimony payments and educator expenses.

Different Types of Income

Navigating tax terminologies can be confusing sometimes, especially when discussing income. Here’s a breakdown of various income-related terms:

- Taxable Income: This is your AGI minus the larger of your standard or itemized deductions. It’s the figure used to determine your tax bracket. Remember, AGI and taxable income are different.

- Gross Income: Gross income encompasses all your earnings from various sources, which can include money, property, and the value of services you receive. Wages, tips, interest, dividends, rents, and pension income contribute to your gross income, excluding tax-exempt income.

- Modified Adjusted Gross Income (MAGI): MAGI is essentially your AGI with some adjustments added back in. It’s crucial for determining the eligibility for some specific deductions, credits, and retirement plans. It’s important to note that there’s no fixed definition for MAGI because these adjustments vary based on the tax benefit in question.

These distinctions are key when navigating the tax landscape and understanding how different forms of income impact your tax situation.

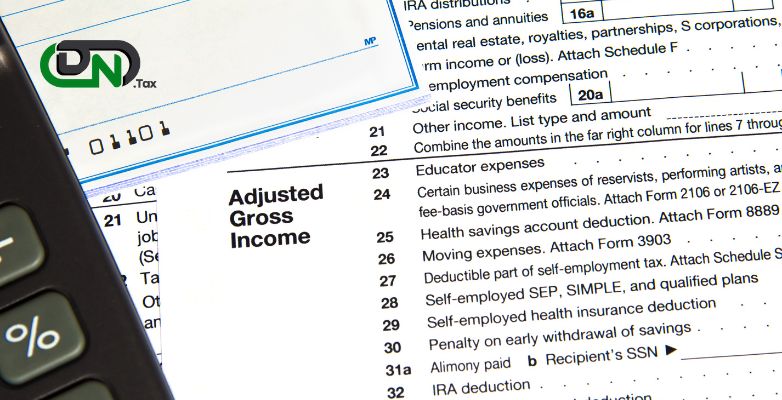

Calculating Your AGI (Adjusted Gross Income)

The process of calculating your AGI is very straightforward. It’s the sum of all the income that is subject to income tax. For example what you earn from your job, self-employment, or interest from a bank account. Then, you subtract specific deductions or “adjustments” that you qualify for. You should also keep a note of whether your AGI is determined before you consider standard or itemized deductions, which come later in your tax return.

How to Calculate Your AGI?

If you’re using tax software or an online tax preparation service, they’ll handle the AGI calculation for you. But if you prefer to do it manually, here’s a step-by-step guide:

1. Add Your Total Income and Wages

Start by totaling all your income that’s subject to income tax for the year. For most people, this includes income from your job which is what you find on your W-2 or 1099 forms.

You might also have other income sources, such as capital gains, dividends, interest, money from a partnership or S corporation, pensions, rental income, self-employment earnings, Social Security payments, taxable alimony, and even unemployment compensation.

2. Subtract “Above-the-Line” Deductions

After calculating your total income, it’s time to subtract any deductions that apply to the income you listed earlier. Some common adjustments include deductible alimony payments, educator expenses, contributions to a Health Savings Account, military moving expenses, contributions to a traditional IRA, self-employed health insurance deductions, self-employed retirement plan contributions, and payments of student loan interest.

The result of this subtraction is your Adjusted Gross Income (AGI). The formula is: Gross Income – Deductions = Adjusted Gross Income.

Calculating your AGI is an important step in the tax filing process, and it helps in determining your tax liability and eligibility for various deductions and credits.

How to Lower Your Adjusted Gross Income (AGI)?

We’ve already understood ways to decrease your AGI, but let’s delve a bit deeper into some common “above-the-line” deductions that can be beneficial:

Contribute to a Health Savings Account (HSA)

If you’re enrolled in an eligible Health Savings Account you might have the option to contribute up to 850 for individuals and 750 for family coverage in 2023. Those aged 55 and above can add an extra 000. You can make contributions until the tax deadline for the following year, giving you flexibility. Even if you don’t itemize HSA contributions are deductible. Also, HSA funds don’t expire so you can use them for future medical expenses tax-free.

Save for Retirement

Contributions to a traditional Individual Retirement Account (IRA) can directly reduce your AGI. However, your income and participation in a workplace retirement plan can affect the extent to which your AGI is lowered. The maximum deduction is 000 (or 500 for those over 50).

Student Loan Interest Deduction

This deduction covers interest payments on qualified student loans. While the maximum deduction is 500, it’s income-dependent. If you’re Single, Head of Household, or a Qualified Widower with a modified AGI over 500 in 2023, you’re not eligible. Married Filing Jointly couples making over 5,000 also don’t qualify for this AGI-lowering deduction.

Educator Expenses

Educators often dip into their own pockets for classroom expenses. The tax code acknowledges this by providing a tax deduction of up to 0 (for 2022) for qualified K-12 purchases like books, supplies, classroom technology, and related items. If you’re married and file jointly then the deduction can go up to 0 (for 2022) with a combined maximum of 0 per person.

These deductions reduce the AGI which can impact your overall tax situation and potentially lower your tax liability.

Example of AGI Impacting Deductions

Let’s illustrate how your AGI can influence your deductions. Suppose you had dental expenses for the year that weren’t covered by insurance and you’ve chosen to itemize your deductions. You’re allowed to deduct the portion of those expenses that exceed 7.5% of your AGI.

For example, if you’ve incurred,000 in unreimbursed dental costs and your AGI stands at 000, you can deduct the amount exceeding,000. In this case, that would be 000. However, if your AGI is 000, the 7.5% threshold is lower which amounts to 000. In the end, you will get a deduction for a larger portion of the 000 totaling 000.

Adjusted Gross Income (AGI) vs. Gross Income vs. Taxable Income

Your gross income is essentially all the money you earn in a year, and it’s subject to taxation. This includes your salary, wages, interest, dividends, capital gains, and various other sources of income.

Your adjusted gross income takes your gross income and subtracts certain allowable expenses and adjustments to arrive at a lower figure. When it’s time to file your taxes, you have the choice of either taking the standard deduction for your filing status or itemizing your deductible expenses from the year. You can’t do both. The outcome of this decision is your taxable income.

What is Adjusted Gross Income (AGI) on your W-2?

One common question that often comes up is about the location of Adjusted Gross Income (AGI) on a W-2 form. The straightforward answer is that it’s not found on your W-2 because AGI is a figure you need to calculate using information from various sources. However, your W-2 is an essential starting point for this calculation. Let’s dive into how to calculate your AGI in the section below.

How to Determine Annual Income?

Sometimes, when people refer to their annual income, they might be thinking about their earnings before or after-tax deductions from their paychecks. To find your annual income, you can refer to your Form W-2, which is provided by your employer. If you’re specifically searching for your prior-year AGI, please see the next section.

Locating Your Prior-Year AGI on Form 1040?

Your prior-year AGI is often needed for electronic tax return validation with the IRS. To locate it, you’ll need a copy of your tax return from the previous year. For the tax year 2023, you can pinpoint the AGI on the following lines, depending on the type of form you filed. If you used Form 1040, Form 1040-SR, or 1040-NR, your AGI can be found on Line 11.

Where to Find Your Adjusted Gross Income (AGI)?

You’ll find your AGI on line 11 of the IRS Form 1040 which is the document used to file your annual income taxes. It’s important to keep this number handy because you might need it when e-filing your taxes in the following year. The IRS often uses it for identity verification purposes. Additionally, starting from January 2022, many individuals are eligible to use the IRS Free File program to electronically file their federal (and sometimes state) taxes without any charge. This clarifies the distinctions between these income categories and explains where to find your AGI for future reference.

Conclusion

In summary, understanding Adjusted Gross Income (AGI) is essential for anyone who is working with the U.S. tax system. AGI serves as an important tool for calculating your taxable income. It influences the deductions and credits you’re eligible for. It’s a comprehensive reflection of your annual earnings encompassing various sources of income. Moreover, keeping track of your AGI can prove beneficial not just for tax purposes but also for identity verification in the digital age. In essence, AGI is a critical element in managing your financial obligations and opportunities. If you are still facing any further issues with AGI, feel free to reach out to our Experts who are available 24×7 to help you out.

Frequently Asked Questions

What is Adjusted Gross Income (AGI)?

AGI or Adjusted Gross Income is a crucial figure used in the U.S. tax system to calculate your income tax liability. It’s determined by taking your total income for the year and then subtracting certain allowed adjustments or deductions. AGI serves as a starting point for calculating your taxable income.

What’s the Difference Between AGI and Gross Income?

Gross income includes all your earnings before any deductions. It includes your wages, interest, dividends, capital gains, rental income, and other sources of income. AGI on the other hand deducts specific allowable expenses and adjustments to arrive at a lower income figure used for tax calculations.

How Does AGI Impact Tax Deductions?

Your AGI plays a significant role in determining the tax deductions you’re eligible for. Many deductions and credits are tied to your AGI. For example, certain medical expenses are deductible only if they exceed a certain percentage of your AGI. So, a lower AGI may make you eligible for more deductions.

Can You Lower Your AGI?

Yes, you can lower your AGI by taking advantage of “above-the-line” deductions. Contributions to retirement accounts, Health Savings Accounts (HSAs), student loan interest payments, and certain other expenses can reduce your AGI. These deductions can ultimately lower your taxable income and, in turn, your tax liability.

Where Can I Find My AGI on My Tax Forms?

You’ll locate your AGI on line 11 of IRS Form 1040, the standard tax form used for federal income tax filing. It’s essential to keep a record of this number as it may be required for identity verification when e-filing your taxes in the future.

What If My AGI Changes Throughout the Year?

Your AGI can change due to various factors such as changes in your income, deductions, or life circumstances. If you expect significant changes, it’s good to review your tax strategy periodically and consult a tax professional to ensure you’re optimizing your tax situation. Major life events like marriage, divorce, or the birth of a child can also impact your AGI.