In most of the cases, You will be required to pay taxes on your withdrawal when you are removing the entirety of your funds from a tax-advantaged retirement plan, just like that you are withdrawing regular income from your account. Taking a lump amount could have serious tax repercussions if you have a sizable retirement plan balance. If you do meet a number of unique requirements, IRS Form 4972 then it does allow you to claim preferential tax treatment. Being born before January 2, 1936, is the main prerequisite.

Table of Content

Taking out a Lump-Sum Distribution

Retirement plans are designed to give you financial security when you stop working. In most of the situations, you must wait until you are 59 1/2 years old to withdraw funds from an IRA or pension plan because doing so would subject you to an additional 10% penalty on the top of regular taxes. As you reach retirement age, you have choices on how you wish to get your money.

Many investors use to withdraw a small portion of their income each year by keeping the remainder invested. Nevertheless, you do have the choice to withdraw all of your money at once. Once you withdraw the funds, they are no longer eligible to grow tax-deferred in the account. You will normally have to pay taxes as well as report the withdrawal to the IRS.

Taxes on Lump-Sum

Traditional retirement, pension, and 401(k) accounts are the frequently funded with pre-tax funds, with the exception of the Roth IRA, which is funded with after-tax funds. The money you put into these accounts is frequently free of taxation, whether your employer deducts it from your paycheck or you claim a tax deduction on your tax return. As a result, you will normally be required to pay taxes on both of your initial pre-tax contributions and any income or profits you made when you make the withdrawals.

Your tax bracket may increase as a result of lump-sum distributions.

- For instance, If you have taxable income of $9,000 per year in retirement, you’ll probably pay taxes in the 10% tax rate in 2022.

- Yet, You would undoubtedly fall into the 32% category if you took a $200,000 lump-sum withdrawal.

Even if other taxable income for the entire year was only $9,000, and if your state levies income taxes and you withdraw a lump sum before age 59 1/2, triggering the 10% early withdrawal penalty then your overall tax rate may be over 50%.

Technique for the Calculation of Lump Sum Tax

Severance pay, retirement benefits and special payroll instructions all uses the lump sum tax method to calculate taxes.

A year is worth of lump sum payments made to an employee are taken into account when you are calculating the tax rate. The Tax Bracket is not estimated based on your annual income, unlike the bonus computation.

- Add up any lump sum payments that you made or plan to make in a given year to get the composite rate. Retirement Benefits are not withheld to cover EI or CPP contributions.

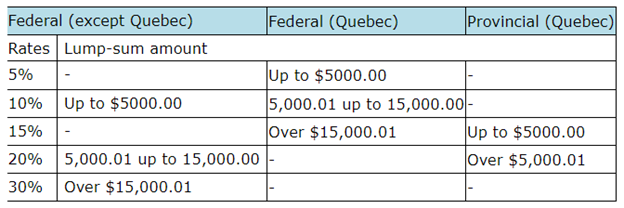

To Withhold Income Tax, Use the Following Lump Sum Withholding Rates:

- Lump Sum Yearly Amount is the Applicable Rate and it is the Formula for Calculating Lump Sum Taxes.

For calculation in custom payroll instructions, a new radio button which is known as Lump Sum Tax Calculation is now accessible.

The following equation must be used for calculating lump sum:

PV (1 + r) = FV n Future Value, or FV P = Present Value n = Years

Here, R stands for the interest rate. For instance, Let’s say that you made a lump-sum investment of Rs. 1,000,000 in a mutual fund program for 20 years. A 10% rate of return on your investment is what you can expect.

What is IRS Form 4972

You might be able to lower the taxes on a lump-sum distribution in case if you were born before January 2, 1936, and you can do this by using IRS Form 4972. You can select one of five taxing options for lump-sum payouts by assuming you are eligible, from the IRS:

- You should report a portion of your withdrawal as a capital gain and the remainder as the ordinary income.

- Choose the 10-year tax option for the remaining withdrawal and declare a portion as a capital gain.

- For the entire withdrawn balance you can choose the 10-year tax option.

- Roll over the entire or a portion of the payout and then classify any withdrawals as your regular income.

- Declare all the distributions as a ordinary income.

The best alternative for you will depend on your unique financial circumstances, but having the tax options is a benefit of Form 4972. Only option #5 will be available to those who don’t qualify for the Form 4972.

Additional Options and Considerations of the Form 4972

Even if you use Form 4972, the retirement plan administrator will normally withhold 20% of your withdrawal and send it to the IRS on your behalf if you receive a lump-sum distribution.

- You can deduct the portion of your tax obligation when you file your taxes if it is less than 20% overall.

- You will probably receive a tax refund for the majority of the money if within 60 days of receiving your distribution, you decide to change it and roll it over into another tax-advantaged account.

- The portion of the payout that does not get rolled over will be treated as the taxable income if you do not rollover the entire distribution including the 20% given to the IRS on your behalf.

Using fewer periodic distributions as opposed to a single large lump amount is one strategy to reduce the tax impact of a retirement plan withdrawal. Your tax bracket will not change much if you are taking smaller payouts and hopefully more of your money will continue to grow in your account tax-deferred.

We hope that the above article is useful for you in handling tax. If you are facing any issue then leave your investment taxes for a tax professional to handle from beginning to end. Our tax specialists will provide Live Full Service and can assist you with anything. We will give you full service guarantee and also allow you to file your own taxes. We have got you covered for your investment tax issues. We are the top tax preparation company so file with confidence.

Frequently Asked Questions

Do Lump-sum Distributions Incur Taxes?

Most taxable distributions from employer retirement plans that are paid directly to you in a lump sum are subject to the mandatory income tax withholding of 20% even if you are intend to roll the taxable amount over or within 60 days.

What is an Explanation of a Lump Sum Withdrawal?

A lump-sum distribution is a payment that is due but is made all at once rather than in the regular installments. Retirement plans, commissions, unexpected income, and some fixed-income assets all are the sources of your lump-sum payouts.

Do I Have to Submit Form 4972?

You may have additional alternatives to lower your tax burden if you were over 59-1/2, when you received a lump amount from a qualified employee retirement plan. You must fill out IRS Form 4972, Tax on Lump-Sum Distributions and attach it to your tax return in order to utilize any of these unique treatment options.

Is a Lump-sum Retirement Payment Taxable?

Three-quarters that is 75% of each lump-sum amount taken is considered taxable income under the criteria for collecting your pension as a number of lump sums. Your remaining income is increased by this. You can be forced into a higher tax bracket depending on the amount of your overall taxable income for the tax year.