Identifying the worker’s status is the responsibility as a recruiter who provides contract staffing services that is employee or independent contractor. Sometimes, recruiters mistakenly designate someone who is employed on a contract basis as an independent contractor and fail to deduct taxes from their pay. In this case the recruiter’s employee is required to submit Form 8919.

You supply workers for your clients through contract staffing. Your customers will pay you for both your services and the employee’s pay. Then, if the contract workers are considered W-2 Employees then you can pay them and deduct taxes.

Table of Content

What is an IRS Form 8919

Form 8919 is the form for those who are employee but their employer treated them as an independent contractor, then they must calculate and report their portion of the unpaid social security and Medicare taxes owed on their compensation. Your social security earnings will be recorded on your record once you submit by this form.

Your employment status will have a big impact on the employment tax which you pay and the employer will pay on your behalf. There are inconsistencies with Social Security and Medicare taxes when an employee is incorrectly labeled as an independent contractor. Form 8919 typically is used in this type of situation.

- Those who did not have Social Security and Medicare taxes deducted from their paychecks must file IRS Form 8919, Uncollected Social Security and Medicare Tax on Wages.

- The employee fills out Form 8919 to report the amount of unpaid Social Security and Medicare taxes.

- The IRS is still owed money from misclassified workers. The employer’s share of FICA is another debt you have to the IRS.

SS-8 Form

Use Form SS-8 which is for the determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding, to determine a worker’s status if you are unsure of how to classify them. A worker’s status as an independent or employee worker is determined using the SS-8 form. Employees can also submit Form SS-8 if they feel their classification has been incorrect.

The IRS will inform the Form SS-8 filer of the worker’s accurate classification. Your employee is required to submit Form 8919 if the person was incorrectly labeled as an independent contractor.

What Makes a Worker an “Employee”

The Internal Revenue Service may classify a person as a paid employee, despite the fact that a company may have hired them as an independent contractor as it totally depends on the nature of their role. When an employer reserves the right to dictate how and when an independent contractor completes their work, they’re probably not an independent contractor but rather an employee. A worker who uses tools and equipment owned by the employer may be seen as an employee but as a contractor he owns their own equipment.

Classification of Worker

An employee and an independent contractor differ in a few significant ways. Companies that misclassify their employees are subject to fines, back pay, and taxes.

If you incorrectly classify contract workers, your clients may also face legal repercussions. Make sure you comprehend the differences between an employee and an independent contractor:

About Employee

Taxes must be deducted from an employee’s pay when they are hired to work for you as a contract staffing agency. These levies consist of Social Security and Medicare taxes, state and local income taxes, and federal income tax which ever applicable (FICA).

You and your employer each pay a matching percentage of the FICA tax to the IRS. 7.65% of the employee’s money is withheld from them, and you also put 7.65% of it towards their compensation.

On Form W-2, All of the employee’s earnings and tax deductions are detailed. You distribute copies of Form W-2 to your staff members annually so they can submit their taxes.

About Independent Contractor

Independent contractors are not full-time staff members of a corporation. They are independent contractors as they contracted to carry out a certain duty. The employee must meet the six economic realities listed by the Department of Labor in order to be categorized as an independent contractor.

Independent contractors may be something you deal with as a recruiter. They don’t play the same functions as regular employees when you place them with a company.

An independent contractor is not paid by a business. They do not have any federal, state, municipal, or FICA taxes deducted from their paychecks. In order to pay for Social Security and Medicare taxes, independent contractors must pay self-employment tax. You are not required to pay taxes towards their salary. The 15.3% self-employment tax rate is paid by the independent contractor on their compensation.

When to Use Form 8919

Tax repercussions may result if your employer incorrectly classifies you as an independent contractor. As, there is a method to make things right and possibly lower the taxes which you would owe. In the first place, before submitting your tax return, you must submit IRS Form SS-8, Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding. The IRS can use the data from this four-page questionnaire to identify your true worker status. Although the IRS’s review and decision-making process can take months, the chances are normally in your favor.

You should file Form 8919 after submitting Form SS-8. You could avoid paying the 7.65% in employment taxes that your employer should have paid by doing this. The correct credit will be sent to your Social Security record for any Social Security earnings. It is crucial to understand that you are not required to submit Form 8919 until the Form SS-8 has received a final ruling.

When completing your tax return, don’t forget to attach Form 8919.

You could be required to submit Form 8919 if you are one of the following:

- Perform services for a business as an independent contractor, yet the IRS views for you as an employee and it does not deduct Social Security and Medicare taxes from your income.

- Form SS-8 is completed and submitted, Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding.

- In case you got a letter from the IRS confirming your employment status or if you haven’t heard back by tax season.

- Received a W-2 and a 1099-MISC from the same business during the same tax year as the amount on the 1099-MISC should be listed as wages on the W-2.

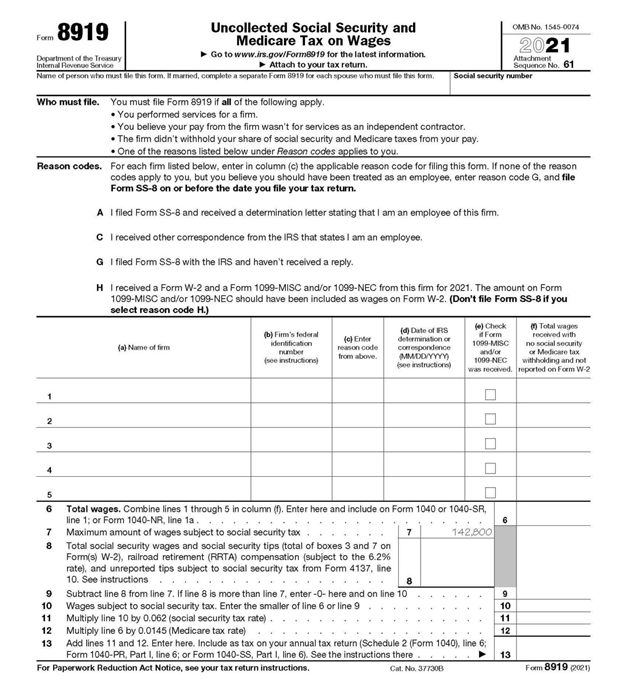

How to Complete Form 8919

Form 8919 is simple to comprehend and it doesn’t require much time to complete. Just you have to follow the directions below:

- Line 1 to 5: For each and every employer who misclassified you as an independent contractor during the tax year, complete a separate line. If there were more than five, affix an additional Form 8919 then complete lines 1 through 5 as necessary. Do not fill out lines 6 through 13 on more than one form.

- Line 6: If Lines 1 through 5 includes any supplementary forms, should have their total earnings added together in column (f), with line 6 containing the totals. On IRS Form 1040, 1040-SR (line 1), or Form 1040-NR, you must have to additionally include this number (line 1a). If Form 8959 must be filled out, line 3 of that document should also contain the total from line 6 (Form 8919).

- Line 7: It is already entered for you to pay Social Security tax on the maximum amount $142,800.

- Line 8: The sum of your Social Security earnings, tips, unreported tips, and railroad retirement benefits should be entered in this line.

- Line 9 to 13: Enter the results after completing the math problems in each line.

IRS Form 8919 Instructions

The employees who were mistakenly labeled as independent contractors must follow the procedures below. The justification on Form 8919 must be given by the employee.

- The employee reported on Form SS-8 that they are an employee and not an independent contractor.

- The worker, who was categorized as an independent contractor, received notification from the IRS that they are actually employees.

- The employee submitted Form SS-8, but no response was given.

- The employer gave the employee a Form W-2 as well as a Form 1099-MISC. The sum reported on Form 1099-MISC ought to have appeared on Form W-2.

The employee then identifies the name of your business, gives your Federal Employer Identification Number, the justification for submitting, and their entire year salary, including any unreported Social Security and Medicare taxes.

The employee calculates their wages subject to Social Security and Medicare taxes, as well as the amount they owe, on the remaining portions of the form.

Instructions for Form SS-8

The SS-8 is a four-page form that gives details about your recruiting company and the job duties of the applicant. When submitting the form, you must include any necessary supporting documents, such as Forms W-2 or 1099-MISC.

Write the name of your company, its address, FEIN (Federal Employer Identification Number), and phone number on the first page. Similar information about the worker is also requested on the form.

- Part I includes general information, includes questions about who is filling out the form, the justifications for filing, and details about the worker’s position.

- Part II includes the employee’s responsibilities which will be covered in greater detail, Behavioral Control. You should give details about the worker’s schedule, whether they have assistants or not and how they get their tasks or not.

- Part III includes the form which is devoted to Finances, Financial Control. This section asks who supplies the tools, How the Employee is Compensated, and what kinds of costs they have while working for the company.

- Part IV includes the information that how the company introduces the worker and worker termination are requested, Relationship of the Worker and Firm.

- Part V is the last section of the form and it includes the worker’s interactions with clients and leads those who are addressed in the form’s last section for Service Providers or Salespersons.

Despite the fact that IRS Form 8919 isn’t very lengthy but numerous of calculations are necessary. Please get in touch if you need help filling out the form.

Work with our tax expert who is familiar with independent contractors and freelancers while using our Full Service Self-Employed. To ensure you don’t overlook anything, our tax professionals will handle your taxes and look for 500 deductions and credits on your behalf. Additionally, you are welcome to file your own self-employment taxes with us. We’ll track down every industry-specific deduction for which you are eligible for and secure every cent due.

Frequently Asked Questions

How will You Receive SS-8 Determination?

The IRS will let you know if the worker should be classified as an employee or an independent contractor. You must accurately categories the employee and, if necessary pay back wages and taxes if the determination differs from the current classification.

In case you do not want to have an annual tax debt, the worker’s status should be ascertained as soon as possible. You can stop the issue in its tracks by submitting Form SS-8.

What Takes Place if FICA is not Deducted?

Employers may face both civil and criminal consequences for failing to accurately record and then they have to pay FICA taxes. Depending on how many days after the due date the payment is made, a late deposit might result in a penalty of 2 percent to 15 percent of the tax owed.

What is Tips-Related Uncollected Medicare Tax?

This displays the employee Medicare tax or RRTA Medicare tax on tips that were not received because the employee lacked sufficient funds to offset them.

How can I Prevent Having to Pay Taxes on Tips?

If an employee’s total tips from all the employers combined in a single calendar month and it do not exceed $20, Neither taxes nor a report of the tips must be filed nor withheld.

Who is Responsible for Paying the Medicare tax?

Each Employee, Employer, and Self-employed person is required to contribute a portion of their gross wages as the Medicare tax in order to support Medicare.