Table of Content

What is IRS Form 1099-G, Certain Government Payments?

Certain Government like Federal, State and Municipal Governments must submit a document which is known as Form 1099-G for the Certain Government Payments. Form 1099-G is used to show all the details of the payments which they made to the taxpayers. In order to report payments like unemployment benefits and payments which are made on a Commodity Credit Corporation (CCC) loan, the form is issued to the Internal Revenue Service (IRS) and to the taxpayers. Taxpayers will receive the necessary forms before the end of January of the year or after the payments.

Key Features of Form 1099-G, Certain Government Payment

• Governments of the different levels like at the local, state and federal level, all of them used to submit Form 1099-G for the payments which are made to taxpayers.

• With the help of Form 1099-G, Payments which are made on loans from the Commodity Credit Corporation may also be reported.

• The form is also used to submit the order to receive government benefits such as state or municipal income tax refunds, unemployment compensation payments or other types of payments.

• Some of the data may need to be reported by the taxpayers who will receive the form on their yearly income tax filings.

• The form 1099-G must be delivered by the last of January 31 of the year after the payments.

Who Can File Form 1099-G, Certain Government Payment?

Many levels of the government which all include those at the federal, state, and municipal levels will have to submit Form 1099-G, Certain Government Payments. This form must be submitted each time whenever they make payments for:

- Unemployment

- State and Local Level Refunds, Credits or offsets of the Income Taxes

- Trade Adjustment help for Reemployment (RTAA)

- Deductible Grants

- Payments for the Agriculture

If a federal, state or local government receives any payments on a Commodity Credit Corporation (CCC) loan then it is required by them to file Form 1099-G, so that it can help you to disclose this payment.

The 1099-G must be completed in different five separate copies.

- Copy A goes to the IRS and the first copy goes to the state tax office.

- Copy B goes to the taxpayer and second copy is sent to the taxpayer whom is to be filed, if it is necessary with their state income tax return.

- Copy C is sent to the payer or the filing agency.

How to File Form 1099-G, Certain Government Payment?

If the federal, state or local government paid you then you will receive the Form 1099-G. Reporting unemployment benefits and the state and local income tax refunds which are the two most typical payments which are use for the Form 1099-G. While filing your income tax return, you might need to submit the part of the information from a Form 1099-G. This detail information is included in your income section on Form 1040.

On the 31st of January of the year after the tax year you should receive your Form 1099-G. If you are receiving unemployment benefits then you can also get the form online by visiting the website for unemployment benefits in your state.

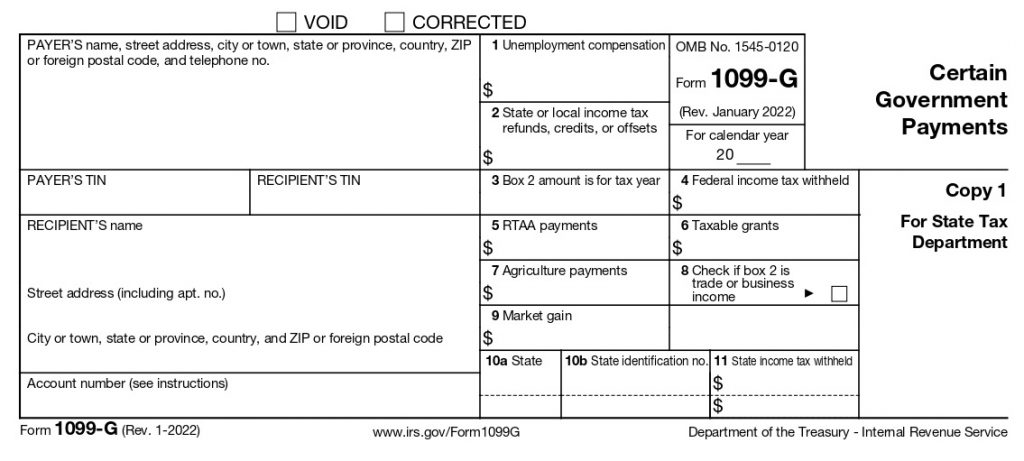

The payer from whom the government making the payment and the recipient like you and the taxpayer who must include the names, addresses, tax identification numbers (TINs) and any related account numbers both are listed on the left side of the form. There are 11 boxes on the right side of the form, they are:

- First Box: Compensation Unemployment: The total amount of the benefits of unemployment which all includes Railroad Retirement Board payments, which were received this year, they will be listed in this box. When the reporting of your income on the line for unemployment compensation on your tax return then add the Box one amounts from each Form 1099-G which you get.

- Second Box: Refunds like Income Tax, Credits or Offsets of State or Local Government. Box 2 lists that if any state or local income tax refunds, credits or offsets which you have received. If you deducted the state or local income tax which you have paid on Schedule A then this sum might be taxable.

- Third Box: Second Box Amount is for the Tax Year. The tax year for which you will get the credits, offsets or refunds that are shown in second Box, they all were are needed to be indicated in this Box 3. If the credit, offset or refund is for the current tax year then you have to leave the field empty.

- Forth Box: Federal withheld Income Tax. The backup withholding or withholding which you requested is shown in the fourth Box for payments which are made the connection with crop disasters, Commodity Credit Corporation (CCC) loans and benefits of the unemployment.

- Fifth Box: Payments of RTAA. Your reemployment trade adjustment assistance (RTAA) payments all are displayed in the Box 5 of this document. The other income of the line of Schedule 1 must include this sum.

- Sixth Box: Grants Which are Taxable. Your taxable grants which are taken from public bodies that all will be displayed in the sixth box.

- Seventh Box: Payments on Agriculture. The U.S. Department of Agriculture made taxable payments to all of you, which is as shown in the seventh Box that is USDA. Where to disclose this income, about this all information is explained in IRS Pub and the 225 and the Form F guidelines.

- Eight Box: Check if Second Box Income is for Trade or Business. Box 8 is used to indicate whether the sum in the second Box is related to the income tax that only applies to income which is derived from the trade or business. If taxable, fill out Schedule C or Schedule F with the amount from Box 2.

- Ninth Box: Market Profit. Box ninth is mainly used to display any of the profit in the market which is related to the repayment of the loan from the Commodity Credit Corporation that is CCC then it will be available only to the farmers.

- Tenth Box (a): State. The short name of state’s can be seen in the 10 A Box.

- Tenth Box (b): Identification Number of State. State identifier: The state identifier is displayed in Box 10b.

- Eleventh Box: Withheld Income Tax of State. The tax which is applied on state income will be deducted here. The state income tax withheld is displayed in eleventh box in dollar amounts.

Payments made to the taxpayers by government entities are reported on Form 1099-G, Certain Government Payments. Among other things these payments could be for unemployment benefits, tax refunds and for the taxable grants. These payments must be reported on Form 1099-G, Certain Government Payments to the IRS. If you have any concerns or need assistance completing the form, speak with our tax expert.

If you have any query about Form 1099-G, Certain Government Payments, get in touch with our tax experts. Our highly qualified experts will assist you with any issues which you may be experiencing while paying your taxes because they are professionals in their respective fields.

Frequently Asked Questions

How can You see Your Form 1099-G Online?

You can easily see your form by logging in and entering your account details on the issuer’s website. Once you successfully login to your account then you can view a copy of your Form 1099-G online. Now you can view records for Form 1099-G as it is kept for up to five years by some organizations, such as the California employment division.

For What Purpose Form 1099-G is Used for?

The benefits of Unemployment for the state and local income tax refunds, reemployment trade adjustment aid, taxable grants and agricultural payments which are just a few of the payments which is made by government organizations to the taxpayers that are reported on Form 1099-G. Payments for loans from the Commodity Credit Corporation are also reported by using this form.

How can You Get a Form 1099-G?

Taxpayers can receive Form 1099-G by January 31 of the year after the year in which payments are made or received in the case of a Commodity Credit Corporation loan from local, state and federal governments as well as other government organizations. A copy of your form can also be obtained online by visiting the agency’s website.

What is the Meaning of G in Form 1099?

Your WRS benefit all were transferred to another eligible plan, as shown by the distribution code G on your Form 1099-R, unless you transferred your distribution to a Roth IRA, your 1099-R will typically display $0.00 as the taxable amount in Box 2a.

Does California Issue Form 1099-G for Tax Refund?

When a refund is actually given out in the year by following the filing year, a Form 1099-G will be generated for that year. This requires that the taxpayers must disclose the refund in the year as it was actually received, not in that year but the tax return was filed which results in the overpayment.