Talking about the financial aspects of the business world, comprehending and handling general journal entries in QuickBooks Desktop is important.

In today’s guide, we will talk about the process of using, viewing, and comprehending general journal entries and at the same time offer insights into the significance and possible drawbacks to avoid.

Regardless if you are a qualified QuickBooks user or you are just a beginner, in this article we will provide you with the knowledge and approaches required to smoothly manage general journal entries in the QuickBooks Desktop platform.

What are General Journal Entries in QuickBooks Desktop?

All business transactions are documented in general journal entries in QuickBooks Desktop 2024, which are crucial financial documents that form the basis of correct accounting and record-keeping.

They are essential in ensuring accurate financial records since they keep track of all financial transactions using a common format. For small firms, tax filing, regulatory compliance, and making strategic decisions all depend on accurate bookkeeping.

General journal entries give owners and stakeholders a thorough picture of a corporation’s financial operations, including everything from little expenses to significant investments, empowering them to make well-informed business decisions. They are therefore essential for efficient planning, financial reporting, and comprehending the financial health of the company. They are essentially the foundation of responsible financial management.

How to use General Journal Entries in QuickBooks Desktop?

There are multiple ways for customers to access general journal entries in QuickBooks Desktop, giving them choice and convenience while managing their financial data and transaction history.

One of the best ways to use general journal entries in QuickBooks Desktop is via the Home Screen as given in the steps below:

- When you go to the Home screen, users can find the Company menu and choose Make General Journal Entries to begin the procedure.

- Users can use the journal entries via the Menu bar by pressing the Company tab and then clicking the Make Journal Entries. Such methods provide QuickBooks Desktop users the capacity to easily monitor and evaluate their accounting transactions for increased financial management.

From the Home Screen

QuickBooks Desktop Home Screen allows users to access general journal entries, which offer an easy-to-use interface for managing and reviewing transaction history and financial information.

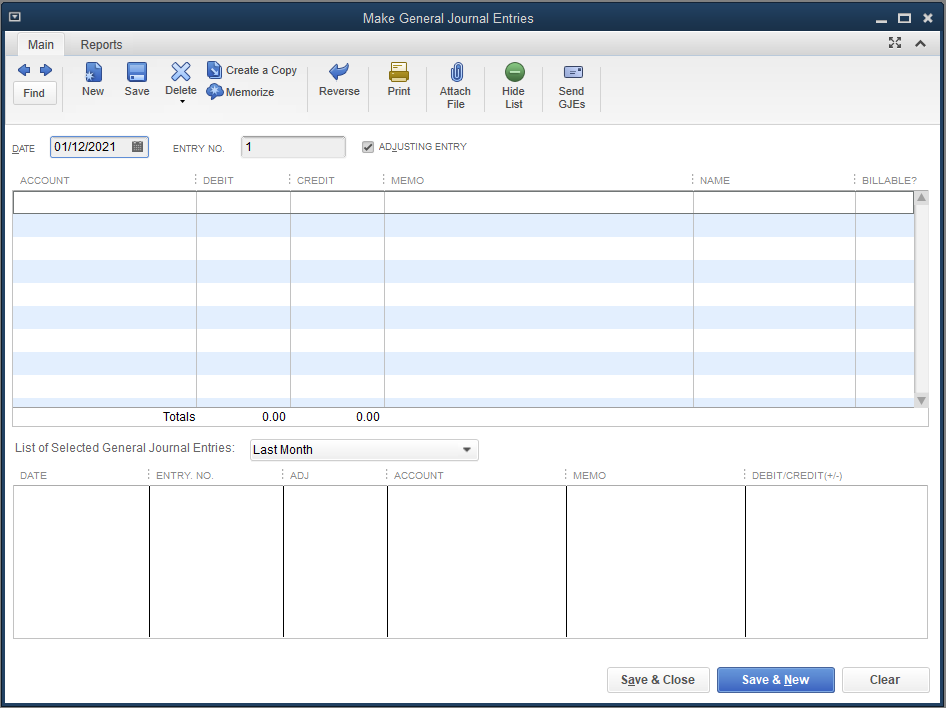

Getting to the general journal entries is a simple process. Users can access the Company menu by navigating to the Home Screen after launching QuickBooks Desktop. To open the diary entry window, users can choose Make General Diary Entries from there. Users can quickly input and update transactions using this window. Users may easily move through the entries because of the clear prompts and sensible layout.

From the Menu Bar

Using the QuickBooks Desktop Menu Bar to access general journal entries provides users with a quick and easy method to browse their finances and transaction history.

- Once you open QuickBooks Desktop, just go to the Menu Bar

- Choose the Company tab and then click Make General Journal Entries. From here, you will get easy access to all the general journal entries, enabling you to view, edit, or add new transactions without any hassle.

How to View General Journal Entries in QuickBooks Desktop?

This simplified procedure offers a user-friendly interface for handling your accounting responsibilities while saving you significant time. For individuals who need to effectively collect and evaluate financial data, this capability is crucial.

With this tool, customers can keep track of every transaction in one location, giving them a thorough picture of all their financial activity. QuickBooks Desktop enables organizations to see trends, patterns, and anomalies in their financial data, facilitating well-informed decision-making. Users may view and analyze both the debit and credit entries.

Users can extract significant insights for strategic financial planning and management by customizing reports and filtering entries based on specific criteria, which improves the depth of analysis.

From the Chart of Accounts

Users can see a detailed overview of their financial records and transaction history, arranged by accounts and categories, by viewing general journal entries from the Chart of Accounts in QuickBooks Desktop.

Users can obtain a thorough analysis of all financial transactions through this procedure, which offers insights into income, costs, assets, liabilities, and equity. Through the use of the Chart of Accounts, users may quickly identify particular entries and look up the supporting information for each transaction.

By streamlining the process of examining and evaluating financial data, this well-organized framework enables users to make deft decisions based on a comprehensive calculation of the financial health of their business.

From the Reports Menu

QuickBooks Desktop users can access general journal entries through the Reports Menu, which offers customizable reporting options for viewing and analyzing financial data and transaction history.

With the help of this tool, users may create comprehensive reports such as cash flow analyses, balance sheets, and income statements that are customized to meet their unique business requirements. These reports can be very helpful in making decisions and developing strategic plans. Users can also follow the financial performance of their company over time, spot trends, and dig down into individual transactions by utilizing analytical tools.

Customization and exportation of these reports in several forms improve accessibility even further and make it easier to work together smoothly with financial advisors and stakeholders.

What Information is Added in General Journal Entries?

QuickBooks Desktop general journal entries provide a thorough record of all financial transactions by including relevant details such as the date, account names, debit and credit amounts, and memos.

Keeping an accurate and transparent financial history depends on thorough recordkeeping. The date ensures that transactions are recorded in the appropriate accounting period by acting as a chronological marker. Account names identify the impacted accounts, which facilitates monitoring the money movement.

The financial impact on the accounts is shown by the debit and credit amounts, whereas notes offer further information or justifications for the entry. These elements work together to provide a strong basis on which companies can monitor and evaluate their financial operations.

Date

For proper record-keeping and analysis, the date in general journal entries acts as a chronological reference point, capturing the precise moment of every financial transaction.

It gives organizations a clear timetable so they can monitor and evaluate the order of events and financial activity. For auditors and other stakeholders to have a clear and cohesive view of the organization’s transaction history, this chronological procedure is essential.

In financial analysis, dates are essential because they allow for the identification of trends, patterns, and correlations based on the timing of transactions. This provides important insights into the financial performance and stability of the organization, supporting forecasting and decision-making processes.

Account Name

Account names guarantee correct representation and structure inside the accounting system by offering clarity and classification for every financial transaction in general journal entries.

This classification is necessary to monitor the money coming into and going out of the company, enabling suitable spending and financial activity analysis. Making educated business decisions, generating financial reports, and evaluating the company’s financial health are all assisted by accounts with the correct names.

A structured set of account names makes tax preparation easier and guarantees that all applicable requirements are followed when tax season arrives. Improved transparency and trust are also achieved by facilitating communication with stakeholders like creditors, investors, and regulatory bodies.

Debit and Credit Amounts

The financial impact of each transaction is represented by the debit and credit amounts in general journal entries, which offer a balanced record of inflows and outflows within the accounting system.

Increases in assets and expenses as well as decreases in liabilities and revenues are recorded using debits, whereas decreases in assets and costs as well as increases in liabilities and revenues are recorded using credits.

Every transaction is guaranteed to remain balanced by this dual-entry approach, which follows the basic accounting formula of Assets = Liabilities + Equity. In addition, it makes financial activity tracking and analysis simple, which forms the basis for precise financial reporting and decision-making.

Memo

Memos attached to general journal entries give each financial transaction more context and information, making it easier to document and refer to it later for analysis and auditing needs.

They play a crucial role in upholding responsible and transparent records, guaranteeing that all financial transactions are thoroughly recorded and identifiable.

Memos establish a thorough trail of evidence that helps auditors confirm the authenticity of transactions and evaluate their accuracy by incorporating pertinent details like date, purpose, and authorization. For internal analysis, which supports financial reporting and decision-making, these specifics are essential.

Inadequate notes may risk the general journal entries’ dependability and integrity, which could result in mistakes and irregularities in financial records.

Is it Possible to Edit or Delete General Journal Entries?

General journal entries in QuickBooks Desktop can be changed or removed, giving users the freedom to make changes to their financial records as needed.

This feature makes handling financial transactions simple and guarantees that the books appropriately depict the state of the finances of the company. Users have total control over the records by modifying general journal entries, and changing information like accounts, dates, and amounts.

Users can maintain the correctness and dependability of the financial data by correcting any errors or removing duplicate entries with the option to delete entries.

Users can easily update and remove general journal entries with QuickBooks Desktop, giving them more control over the management of their financial records.

How to Look for Particular General Journal Entries?

With QuickBooks Desktop, users may easily identify and recover particular transactions by using the search option to look for specific general journal entries.

This function offers a practical method of filtering transactions according to different parameters, including amount, date, account, and reference number. Users can easily narrow down their findings and obtain the precise journal entries they require by entering specific search terms.

With the sophisticated search features available in QuickBooks Desktop, users may tailor their search parameters for more accurate results. This spontaneous search feature makes it easier to recover and handle financial documents, which improves transaction management accuracy and efficiency.

How to Filter and Classify General Journal Entries?

QuickBooks Desktop users can efficiently analyze and report on their transaction history by organizing and classifying it according to particular criteria by filtering and sorting general journal entries.

Users can filter the journal entries by dates, types of transactions, amounts, or individual accounts by using the filter settings. This makes it possible to see the financial data in a more focused manner, which facilitates tracking and transaction analysis.

The ability to sort entries allows you to arrange them either numerically or chronologically, giving you a well-organized picture of the transaction history. In the end, these techniques improve the accuracy of financial reporting and decision-making by simplifying the process of obtaining and analyzing financial data.

What are the Advantages of using General Journal Entries in QuickBooks Desktop?

Using general journal entries in QuickBooks Desktop provides many advantages comprising:

- Comprehensive Transaction History

- Precise record-keeping

- Seamless Financial Management for Small Companies

These journal entries are essential to keeping accurate and well-organized financial records, which let businesses efficiently monitor every transaction. General journal entries aid in improved financial analysis and decision-making by offering a thorough summary of all financial activity.

To maintain compliance with accounting rules, they also assist with the creation of comprehensive financial statements. Making use of this QuickBooks Desktop function encourages efficiency in handling routine financial tasks and improves financial reporting transparency.

What are Some Common Errors to Avoid When Entering General Journal Entries?

Avoid frequent errors including misclassifications, duplicate entries, and wrong data entries while entering general journal entries in QuickBooks Desktop as these might affect the accuracy of financial records.

Maintaining the integrity of financial reports requires making sure that each entry is appropriately categorized following the relevant chart of accounts. Errors that could result in inconsistencies in the books should be avoided by double-checking for duplicate entries and making sure the right amounts and accounts are being entered.

To provide a clear and trustworthy perspective of a company’s financial status, enable informed decision-making, and guarantee compliance with accounting standards, accurate data input and proper classification are essential.

Wrap up!!

We hope that after reading this article, all your doubts concerning how to view the general entries in QuickBooks Desktop all clear now.

We have stated all the crucial information related to the topic. Still, if you think you need any professional suggestions, you can get in touch with our team of QuickBooks experts. They have expertise in handling such scenarios.

+1-800-596-0806

+1-800-596-0806