Accounting software assists small business owners in managing the financial intricacies of operating a company structured as an LLC or other entity, as well as in keeping track of accounts receivable and payable, evaluating their profitability, and being ready for tax season. Accounting software that is preconfigured and doesn’t require a lot of modification is frequently suitable for small enterprises. A customized enterprise resource planning (ERP) system is frequently required, though, as a company’s accounting requirements may grow more sophisticated as it expands.

QuickBooks Desktop Pro Plus Payroll 2024 is designed for small enterprises that helps them manage their revenue and expenses while monitoring their financial performance. It can be used for billing customers, paying invoices, creating reports, processing payroll, and getting ready for tax season.

Features of QuickBooks Desktop Pro Plus Payroll 2024 (Subscription)

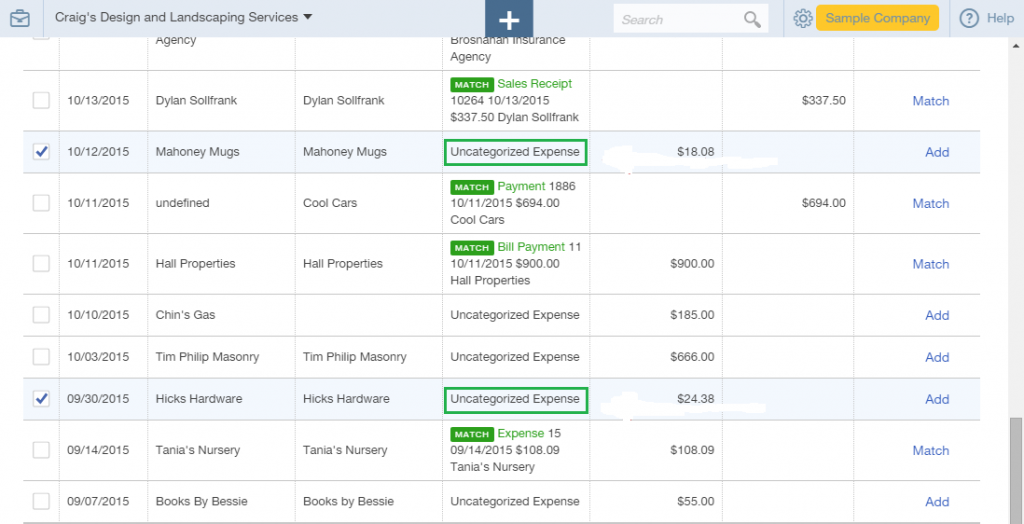

Improved Bank Feeds

Every month, entrepreneurs invest many hours in entering their bank transactions. With the help of improved matching, bulk editing, and rules, they may now save time.

- QuickBooks Desktop Pro plus Payroll asks you to examine and automatically classifies most of your transactions into accounts.

- Make rules that will automatically classify and annotate the remaining transactions.

- Easily pick several transactions, update them jointly, and add them to your books.

Send Statements Automatically

Monthly statement automation has made it easier for business owners to follow up with clients about past-due bills.

- You can examine and forward statement emails to your clients that QuickBooks Desktop Pro Plus Payroll generates automatically.

- Schedule the delivery of statements to certain customer groups according to their preferred delivery time.

- Individualized layout customization for the email and statement for various clients, according to your requirements.

For Efficient Outreach, Establish Customer Groups

To make managing and utilizing them across various features easier, create rule-based customer groups based on attributes like customer type, status, location, and balance.

- Make advantage of and create client groups based on pre-established standards that don’t require constant human updating.

- Utilize an existing mailing list for payment reminders to market your products to your clientele.

- Using attributes like customer type and status, create rule-based customer groups.

- To make it easier to manage and use them across many features, set the placement and balance.

QuickBooks Desktop Manager

Businesses can now use QuickBooks Desktop Manager’s streamlined installation process if they lack confidence or find it difficult to set up QuickBooks Desktop Pro Plus Payroll.

- Examine all of your compatible QuickBooks versions and make an appropriate action.

- You only need to click once to install or update your QuickBooks software.

- You don’t have to search for the appropriate product license or be concerned about any installation setup.

Tools of QuickBooks Desktop Pro Plus Payroll 2024 Subscription

Track Sales and Create Invoices

- To keep track of who owns your money, what they purchased, and when they paid you, you may easily produce invoices and sales receipts.

Gain Insight in Your Business

- Use one-click financial, tax, and sales reports to keep tabs on the performance of your company.

Reconcile Online Banking

- Save time entering data by downloading your bank transactions from the internet straight into QuickBooks.

Batch Delete Transaction

- By eliminating duplicate transactions or entering errors from the form sections in one go, you can save time.

Tracking of Invoice

- Track the status of your invoices quickly to improve your cash flow.

Stay on Top of Your Expenses

- View purchase orders and bills clearly in one location. Keep tabs on what has been paid and what is still outstanding, and pay any outstanding debts right away.

Checking of Bill Pay

- Easily manage payments by viewing outstanding invoices from a vendor.

Transfer Credits

- Move client credits between jobs with ease and speed.

Convert E file GST or HST to the CRA

- Send your GST/HST forms to the CRA electronically with only a few clicks to save time, paper, and stamps.

Employees are Paid Quickly

- Give QuickBooks Payroll your hours, and it will take care of the rest.

Remit Payroll Taxes Easily

- The T4/RL-1 forms, including EFILE2, are easy to submit because QuickBooks Payroll automatically completes them and tracks both federal and provincial taxes.

Stay Up To Date Automatically

- Your tax tables are always current since we automatically provide you payroll updates as soon as they are available.

Requirements of the System for QuickBooks Desktop Pro Plus Payroll Subscription

- Operating Systems: Windows 11, 10, 8.1 Update 1, or 10 (incompatible with Mac)

- Windows Server 2012, 2012 R2, 2016, 2019 R2 SP1, 2012

- Processor running at 2.4 GHz

- RAM of at least 4 GB and ideally 8 GB

- Disc space must be at least 2.5 GB accessible (extra space needed for data files).

- Up to two extended monitors can be supported; optimized for screen resolutions of 1280X1024 or higher.

- Default DPI settings are optimized

- Internet access (1 Mbps recommended speed) is necessary for online features and payroll.

- Registration of products is necessary.

See more: How to Cancel QuickBooks Desktop Subscription

Conclusion

We hope the given procedures will enable you to take the necessary action on your own. For small and medium-sized businesses that are satisfied with reliable accounting software and don’t want the newest and most advanced features, QuickBooks Pro is a decent choice.

All of QuickBooks Desktop 2024 with Payroll’s features and benefits are yours if you choose to purchase the subscription. Get in touch with our staff if you are having any issues. To help you with your problems, we are available 24/7. We guarantee that you will always receive our best services. In order to assist you with the payroll update, we also have payroll experts.

Looking for a professional expert to get the right assistance for your problems? Here, we have a team of professional and experienced team members to fix your technical, functional, data transfer, installation, update, upgrade, or data migrations errors. We are here at Dancing Numbers available to assist you with all your queries. To fix these queries you can get in touch with us via a toll-free number

+1-800-596-0806 or chat with experts.

Frequently Asked Questions

What Modifications has QuickBooks 2024 made?

QuickBooks Desktop 2024 is a useful tool for companies of all sizes because of its improved user interface, sophisticated reporting features, enhanced integration options, and more automation. Sensitive financial data is also protected thanks to the upgraded security measures.

In What Way can I Update to QuickBooks 2024?

You must download the installation files in order to upgrade to QuickBooks 2024. You can buy the software from an approved reseller or download it from the official Intuit website. Make sure the version you are downloading or buying is the right one for your current QuickBooks 2023 edition and license.

Will QuickBooks Desktop Become a Subscription-based Programme?

Starting with the 2022 releases, Intuit will solely provide QB Desktop products through subscription. They won’t be accessible as a one-time payment option as they previously were (except from QB Accountant). Premier, Enterprise, and QB Pro are among the QB Desktop products.

What is the Annual Cost of QuickBooks?

Begins at $799 for a single user each year. Local installation of fundamental bookkeeping software, such as time tracking, inventory management, reports tailored to a particular business, invoices, and more. An annual subscription model underpins the cost of QuickBooks Desktop.

+1-800-596-0806

+1-800-596-0806