The most often chosen option for small and medium-sized enterprises has always been QuickBooks. Because they can simply generate invoices, keep track of transactions, and make payments.

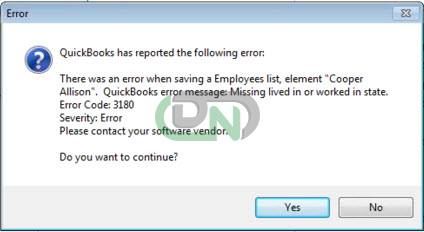

However, it is not uncommon for you to get an issue when attempting to make a payment. This is the result of damaged payment items, which can cause QuickBooks status error 3180 and flash the message “There was an error when saving a sales receipt” on your screen.

But as we all know, there is always a solution to a problem. Therefore, don’t give up on QuickBooks because of a few mistakes. In this article, we will provide you with the best methods to assist you get rid of the QuickBooks 3180 error. Now let’s get going.

What is QuickBooks Error Code 3180?

QuickBooks POS Sales Tax error is related to sales receipts. It shows the following code, warning messages, and descriptions:

- Status code: 3180 Status message: An error emerged when saving an employee list, element “ Employee, Name”

- Status Code 3180: QuickBooks error message: A/P or A/R detail line must have a vendor

- Status Code 3180: Status message: Sales tax detail line should have a vendor

- Status Code 3180: An error is occurring when trying to save a sales receipt

- Status Code 3180: A problem arose while saving the General Journal Transaction

- Status Code 3180: QuickBooks error message: The posting account is not valid

Now that you have learned about the various error messages related to 3180, let us talk about the causes that trigger this POS error.

Also Read: QuickBooks Error 15102

What are the causes of the QuickBooks POS error code 3180?

There can be several reasons that trigger the error code 3180 in QuickBooks. Here is a list of some of the most common ones for your reference. Based on the cause of the error, the solutions can be implemented to fix this issue.

- Wrong account mapping of Sales Tax payable account

- The sales tax payable account is being used as the target account for one or more items on receipts.

- An incorrect type of QuickBooks Desktop account was accessed in mapping accounts in the particular QuickBooks POS, leading to the QuickBooks Desktop tax line mapping list.

- In QuickBooks Desktop, the Sales Tax item is not connected to any of the vendors.

- With the help of the Sales Tax payable account, a Paid Out was created.

- The payment item type is incorrect or damaged.

- Often the antivirus present in the system leads to this error.

Now that you have learned about the causes that trigger this QuickBooks Sales Tax error, let us learn about the signs and symptoms of this technical issue.

What are the Signs and Indications of the QuickBooks error code 3180?

Here is the list of the signs and symptoms that indicate the presence of the QuickBooks error code 3180:

- The system does not respond to the commands of the mouse and keyboard or starts to respond slowly

- Error message 3180 keeps appearing on the screen

- The user fails to save any sales receipts

- QuickBooks automatically closes repeatedly

Now that you know about the causes and symptoms of the QuickBooks error code 3180, let us learn about the troubleshooting steps to fix this issue.

How to fix the QuickBooks Error Code 3180?

We hope that you now understand the meaning of QuickBooks problem 3180 and the reasons for its occurrence. It’s time to eliminate this error so you may carry on working without any problems.

Solution 1: Confirm that you have Allocated the Vendor to Sales Tax Item

When you make any taxable sale, the sales tax item is utilized to add and compute tax charges.

- Open QuickBooks Desktop, then select List.

- Select Include Inactive after clicking on the item.

- Sort the list now, then select Type.

- Lastly, make sure that every sales tax item has a tax agency.

Solution 2: Choose Your Tax Preferences to Fix QB Error 3180

You can customize QuickBooks to suit your needs or the needs of your business by adjusting its options.

- Press QuickBooks POS, then select File.

- Next, Select Preferences and then Company.

- Next, Select Accounts from the Financial menu.

- Note the Basic and Advanced settings.

- Finally, Confirm that QuickBooks Sales Tax Payable is the only row that has sales tax under it. Change the scenario and run the financial exchange if this is not the case.

Solution 3: Make Sure that the Problem Receipt is not Paid with Sales Tax Payable

The use of sales tax payable on receipts is one of the causes of this inaccuracy. All you need to do is this:

- Open QuickBooks point of sales.

- Choose the sales history from the options.

- Right-click on any of the columns.

- Choose to customize columns.

- Ensure to choose the status of the QuickBooks.

- Search for the receipts which are not completed yet.

- Now select the receipts that if any of the receipts are paid out to the sales tax payable.

- Now click on the reverse receipt.

- Recreate the paid-out by using a non-sales tax payable account.

- In last financial exchange is to be run.

Solution 4: The paid-out procedure should finally be recreated using a non-sales tax-paying account. Execute the money exchange last

- Repair Damaged Payment Item: (When an error occurs during the process of saving a receipt)

- First, navigate to Lists–>Item List–>Include Inactive on QB Desktop.

- Here, select the Type header to arrange the list.

- Rename the Point-of-Sale payment items after that. To edit the items with POS, right-click on them and select Edit. After adding OLD at the start of the item, click OK.

- Select the run financial exchange from the Point of Sale menu.

- Finally, in QB Desktop, use the right-click menu to select Edit Item when you want to combine the duplicate objects. Following that, delete the OLD file and adhere to the instructions to merge the files.

Solution 5: Access the Point of Sale

- First, Select Accounts from the Financial -> Company -> Preferences -> File menu.

- Go through every tab, basic and advanced. Verify that the accounts are correctly mapped, then select “Save” to protect all of your modifications.

- Run the financial exchange lastly.

- Redesign/Rename Every Financial Method

Solution 6: Navigate to the Payment Method List under the Customer & Vendor Profile Lists menu in QB Desktop first.

- To access the Edit payment method button, here, right-click on the Cash method option.

- Save the modifications after adding the letter X to the beginning of the payment method field.

- Click the cash method option again with a right-click to choose new.

- Run the financial exchange after renaming it as cash. Rename and rebuild every payment method if required.

Solution 7: Repair Damaged Payment Item (When Saving a Receipt Facing an Error)

Occasionally, when using QuickBooks, you may produce the same inventory again. It will therefore be simple for you to maintain track of your inventory if you add things.

- Open the QuickBooks tab.

- Now go to the list menu and from the drop-down option click on the item section.

- Choose the option that includes inactively.

- Click on the option type header to sort the list.

- Now the Point of Sale payment items are to be renamed.

- Right-click on the option which is the Payment item which starts with the point of sale.

- Select the items that are to be edited.

- To the item name add old to it.

- Once to add old to the name click on the OK button.

- From the point of sale run the financial exchange.

- Now merge all the duplicate items in QuickBooks Desktop.

- Again, choose the item for editing.

- Now from the item name remove the prefix old.

- Now Tap OK.

- Now hit the yes button and confirm it by clicking OK.

Also Read: QuickBooks Error Code 6176

You can solve QuickBooks Error 3180 using any of the methods we have listed. Any of them can be given a try. You can also contact or chat with us at any moment if you run into any problems. To make things easier for you, our support staff will walk you through each step in detail.

Frequently Asked Questions

What are the measures you need to take to prevent the occurrence of QuickBooks error code 3180?

Here is the list of the preventive measures you need to take to avoid QuickBooks error code 3180:

- Regularly backup your data to avoid losing it in the event of file corruption.

- Update QuickBooks and any associated software on a regular basis.

- Keep an eye on Network Health. Make sure the network QuickBooks is connected to is reliable and secure.

- Restrict Outside Interventions. Installing applications that could disrupt QuickBooks functionality should be done with caution.

Prevent Input Errors. Verify the data twice before uploading or syncing it.

What are the different types of 3000 error codes users are likely to experience?

When using the QuickBooks POS service, you may encounter a range of 3000 status code errors in QuickBooks, such as error codes 3140, 3120, 3170, 3180, and others.

Is there a Repair Tool in QuickBooks?

QuickBooks tool hub can assist if you encounter an error when using, installing, or updating QuickBooks. Simply launch Quick Fix my program to immediately resolve common issues. You can resume your business after we assist you in using it.

Can Corruption Occur in QuickBooks?

Problems that arise outside of the program are examples of external variables that can lead to data corruption in your QuickBooks. External factors can be software or hardware-related.

What is the best QuickBooks Repair Tool?

Using ease, corrupted QBB and QBW files can be repaired using DancingNumbers for QuickBooks, a potent program that restores all of the objects with perfect integrity. Common corruption errors are corrected by the software.

+1-800-596-0806

+1-800-596-0806