QuickBooks Payroll Error 2000 is a common banking-related issue that often emerges when the software encounters a network disruption or fails to establish a secure connection with a financial institution. Typically, it is triggered by incorrect login details, a sluggish response from the bank server, or limitations on data transmission by remote servers. This error is not internal to QuickBooks itself but rather stems from external sources like internet connectivity or unrecognized server credentials, making it easier to resolve once properly identified.

Before diving into troubleshooting, it’s crucial to recognize the early signs and meet a few basic requirements. Common signs of facing this error include failed sign-in attempts to your bank, data upload failures, or notifications from the payroll service. Here are 9 effective solutions to fix Error Code 2000 in QuickBooks Payroll.

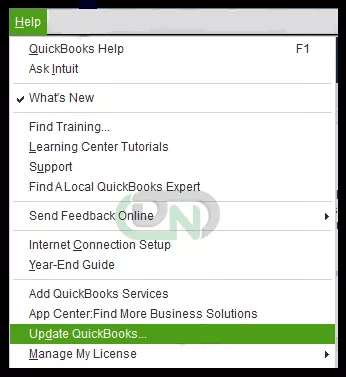

Solution 1: Update QuickBooks to the Latest Release

Updating QuickBooks fixes bugs and improves compatibility with bank servers. Here are the steps to fix Error 2000:

- Launch QuickBooks Desktop.

- Click the Help tab > Update QuickBooks.

- In the Update Now section, click Get Updates.

- Restart QuickBooks to complete the update.

- Check if the error is gone.

Solution 2: Verify Your Bank Login Credentials

Incorrect bank credentials can block server access and trigger Error 2000 in QuickBooks Payroll. Check out these steps to verify and update your details to resolve the login issue.

- Visit your bank’s official website.

- Try logging in with your usual credentials.

- In case login fails, save your username and password in a text file and retype them carefully.

- Ensure CAPSLOCK is off (passwords are case-sensitive).

- In case you’ve forgotten your password, use the Forgot Password option to reset it.

- After resetting, try signing in again through QuickBooks.

Solution 3: Rename QBWUSER.ini and EntitlementDataStore.ecml Files

Corrupted user files can cause Payroll Error 2000. Here are the steps to fix the solution by renaming key configuration files.

- Restart your computer and log in as Administrator.

- Go to the location:

C:\Users\[Your Username]\AppData\Local\Intuit\QuickBooks\[Year] - Find the QBWUSER.ini file, right-click, and rename it to QBWUSER.old.ini.

- Also find EntitlementDataStore.ecml and rename it similarly.

- Reopen QuickBooks and select Open a Sample File to check if the error is fixed.

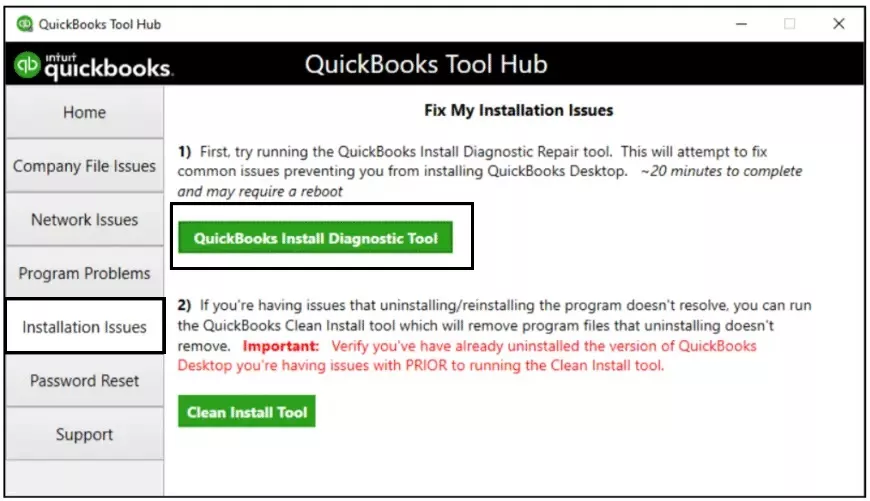

Solution 4: Run QuickBooks Install Diagnostic Tool

Installation issues may interrupt system processes. Check out these steps to run the diagnostic tool and repair software-related problems instantly.

- Download and install QuickBooks Tool Hub from Intuit’s website.

- Once installed, open it and go to Installation Issues.

- Select QuickBooks Install Diagnostic Tool.

- Run the tool and wait for it to diagnose and repair problems.

- Restart your computer and launch QuickBooks again.

Solution 5: Adjust Firewall Settings

Firewall blocks can prevent QuickBooks from connecting to servers. Here are the steps to fix the solution by updating firewall permissions.

- Open Windows Firewall and go to Advanced Settings.

- Add Inbound and Outbound Rules for QuickBooks.

- Allow QuickBooks through the required ports.

- Restart your computer.

- In case a third-party security app is interfering, disable or uninstall it temporarily and check QuickBooks again.

Solution 6: Use QuickBooks Install Diagnostic Tool via Tool Hub

Repair network and install errors easily using the Install Diagnostic Tool. Check out these steps to launch it through the Tool Hub.

- Download QuickBooksToolHub.exe from Intuit’s official website.

- Run the installer and accept terms.

- Open the tool and click on Installation Issues.

- Select QuickBooks Install Diagnostic Tool to begin the scan.

- Once done, restart your computer to apply changes.

Solution 7: Use QuickBooks Connection Diagnostic Tool

Connection Diagnostic Tool helps identify and fix server and network errors. Here are the steps to fix the issue by using this utility.

- Download the QuickBooks Connection Diagnostic Tool from Intuit’s website.

- Install the tool by running the .exe file.

- Agree to the terms and follow the on-screen instructions.

- After installation, launch the tool to scan and fix any network-related issues.

Solution 8: Perform a Clean Installation of QuickBooks

A clean install removes corrupted files and ensures fresh software setup. Check out these steps to reinstall QuickBooks without carrying over errors.

Step 1: Uninstall QuickBooks

- Go to Control Panel > Programs and Features.

- Select QuickBooks and choose Uninstall/Change > then Uninstall.

Step 2: Use the Clean Install Tool

- Download the Clean Install Tool from a trusted source.

- Follow instructions to install and run the tool.

Step 3: Reinstall QuickBooks

- Re-download QuickBooks from the official site.

- Run the installer and follow the setup steps.

- Open QuickBooks and check if the error still occurs.

Solution 9: Check the Active Status of Your Online Banking

Inactive online banking may block server communication. Here are the steps to fix the error by verifying and reactivating your banking access.

- Log in to your bank’s website using a browser.

- Go to the Notifications section.

- In case prompted to update or re-activate your online banking, follow the instructions.

- Return to QuickBooks and open your company file to see if the error is resolved.

What are the Prerequisites to Fix QuickBooks Desktop Payroll Error 2000?

Before fixing QuickBooks Error 2000, make sure that the following requirements are met:

- Ensure a stable and uninterrupted internet connection.

- Check that QuickBooks is updated to the latest release.

- Make sure your bank login credentials are correct and working.

- Access QuickBooks as an administrator for full permissions.

- Backup your company file.

- Ensure that your system’s date and time settings are correct.

How to Identify QuickBooks Desktop Payroll Error 2000?

Here are a few signs that you will face when Payroll Error 2000 occurs in QuickBooks:

- You receive a “Sign-on was rejected” message when logging in to your bank.

- QuickBooks displays a server communication error or data upload issue.

- There’s a delay or failure in submitting payroll data.

- Error appears while attempting to send data from a dormant or inactive bank account.

- QuickBooks displays alerts asking to verify bank details or credentials.

- The system crashes or freezes unexpectedly while processing payroll.

- Payroll services show incomplete or rejected transaction messages.

How to Prevent QuickBooks Error 2000?

Follow these tips to avoid facing QuickBooks Payroll Error 2000 in the future:

- Keep your payroll subscription and bank account information up to date.

- Configure the firewall and antivirus to allow QuickBooks connections.

- Run diagnostic tools like QuickBooks Tool Hub periodically to catch early issues.

- Monitor alerts from your bank or payroll service for any required action.

When Should You Seek Professional Help for QuickBooks Desktop Payroll Error 2000

In case QuickBooks Error 2000 keeps popping up despite your best efforts, or you’re unsure about updating files or editing system settings, it’s best to call in the pros. You should also seek help if you notice repeated sign-in failures, server issues, or delayed payroll processing.

Hire QuickBooks Error 2000 Resolution Services

It is completely okay to get professional help if fixing QuickBooks Error 2000 feels overwhelming, maybe due to a lack of time, technical know-how, or fear of data loss. That’s where Dancing Numbers (DN) comes in. DN offers expert QuickBooks support with a focus on fast, secure, and reliable error resolution. Trusted by thousands of businesses, their team ensures your data stays safe and your payroll runs smoothly.

+1-800-596-0806 or chat with experts.