As a QuickBooks user, you must be knowing that even though you are using QuickBooks for all kinds of accounting services alongside payroll, you still must keep tracking the respective paychecks associated with the data in QuickBooks. This article will guide further on how to manually add or enter payroll in QuickBooks. Scroll further to learn more about the Manually Enter Payroll in QuickBooks in QuickBooks.

Save Time, Reduce Errors, and Improve Accuracy

Dancing Numbers helps small businesses, entrepreneurs, and CPAs to do smart transferring of data to and from QuickBooks Desktop. Utilize import, export, and delete services of Dancing Numbers software.

Such paychecks are called third-party paychecks, which are done outside of QuickBooks with services like ADP or Paychecks.

What is Manual Add or Enter Payroll in QuickBooks?

When you are using payroll services, one thing you must keep in mind is that not all payroll services would allow importing the data on the paycheck into the QuickBooks software.

In this case, where you wouldn’t be having the option of importing the data on the paycheck into the QuickBooks software, you need to manually track all the respective payments which are currently fed into the system as journal entries.

The chief difference that you can spot between automated payroll data entry and a manual one is that, while you are trying to enter payroll manually into QuickBooks, you have to calculate the taxes associated manually as well.

You can manually calculate the taxes associated with the payroll entries with the help of formulas or tax tables and payroll tax forms. Remember, that you cannot print payroll tax forms.

To understand the action of manually adding or entering payroll into QuickBooks, let’s hop onto the next section.

Why do You need to Manually Add or Enter Payroll into QuickBooks?

The manual entry of payroll into QuickBooks is required because of specific reasons.

You would notice that several business owners have initiated using the payroll services available online in order to mechanize their respective payroll. Nevertheless, there are still many who wish to enter payroll manually into QuickBooks.

You can now manually add or enter payroll into QuickBooks and can easily access the same. This would help in storing all the account and payroll data in one place and start tracking the payment in total.

How to Manually Add or Enter Payroll in QuickBooks?

Manually adding or entering payroll into QuickBooks is not rocket science.

To enter payroll into QuickBooks, there are few descriptive steps that you need to take care of. The following section would help you to read through all the steps involved in entering payroll into QuickBooks manually.

Here are the steps:

Step 1: Tap on Help which you would find under the QuickBooks bar and choose the particular QuickBooks Help.

Step 2: Add the particular calculate payroll manually option.

Step 3: Visit Company Preferences, and find a sequence of payroll topics.

Step 4: Choose the particular Calculating payroll taxes manually.

At this stage, if you are intimidated with a pop-up saying, “if you utilize the manual payroll processing, Intuit will not take any liability for any unsuitable calculation“, do not panic since manual payroll entry does not change the liability.

Step 5: Click on manual payroll calculations.

Step 6: A window with the statement, “Set my particular company file in order to do calculations manually“, will ask for your confirmation on setting the company file compatible for using manual calculations.

Choose OK

Step 7: This will activate your manual payroll in QuickBooks.

Step 8: Choose Edit and tap on Preferences.

Step 9: Locate Payroll & Employees and choose Company Preferences. You would see payroll items are appearing below the List Menu.

Step 10: In this step, start adding tax rates which include Social Security, Medicare, and Federal withholding, which are the payroll liabilities.

Step 11: Assign the payroll timetable for the respective employees and then QuickBooks will start calculating the actual due dates against each pay period.

Note: Please make sure that you follow each and every step in the given order.

How to Manually Enter Payroll Paychecks in QuickBooks Online

You must still track those paychecks in QuickBooks even if you use it for accounting and other services such as running payroll. The third-party paychecks are created by services like ADP or Paycheck outside of QuickBooks. QuickBooks Online allows you to manually enter payroll salaries and track payment totals. However, this does not create the information needed to produce W-2s for your employees. To get your year-end forms, you must work directly with your payroll service. Always keep in mind that diary entries require an understanding of debits and credits.

Step 1: Create Manual Tracking Accounts

To create new accounts in your Chart of Accounts to track your payroll liabilities and expenses, you have to follow the below steps:

- First, you have to open QuickBooks Online, then you have to select Settings, and then select Chart of Accounts.

- To create a new account, you have to click New.

- Afterward, select a type of account from the Account Type dropdown menu.

- Under the Detail Type dropdown, select the detail type that most closely matches the types of transactions you need to track.

- A new account should be assigned a name. To add a name and a description, use the details under Description Type.

- Selecting the sub-account before logging into the original account is how you add a sub-account.

- Choose where you want to start with your money tracking from the dropdown menu. If the account you are tracking is now as new as today, select Today. In the Account Balance field, enter the current account balance.

If you want to create the expense accounts then choose Expense as the account type:

- Payroll Expenses: Taxes

- Payroll Expenses: Wages

If you want to create a liability account then choose Liabilities as the account type:

- Payroll Liabilities: [State] SUI/ETT

- Payroll Liabilities: [State] PIT/SDI

- Payroll Liabilities: Federal Taxes (941/944)

- Payroll Liabilities: Federal Unemployment (940)

Note: Several common payroll tax situations are included in these accounts. For specific taxes, for your state or territory, you might need to create additional accounts.

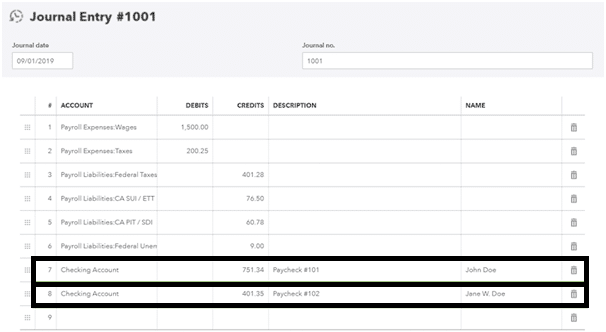

Step 2: Enter the Payroll Paychecks into QuickBooks Online

After paying your employees outside of QuickBooks, You have to Create a Journal Entry.

- Request from your payroll service pay stubs or payroll reports for each of your employees.

- Then you have to select + New.

- Choose to enter a journal entry later.

- Under the Journal date, you have to insert the paycheck date.

- You must provide your paycheck number in the Journal no. field if you need to track it.

- Create a journal entry based on the data from your payroll report. If you have paid multiple employees for the pay period, you can make a journal entry that includes the addition of all of their paychecks. Additionally, you can make separate journal entries for each employee if you wish to break down the details.

Add Gross Wages

- As a debit insert the entire amount.

- For wages for the account, you have to click on Payroll Expenses.

Add Employer Payroll Taxes

- As a debit insert the amount.

- You have to click on Payroll Expenses for Taxes for an account.

Note: As a separate debit such as FUTA employer, Social Security employer, state job training taxes, medical staff, and state unemployment insurance you can add the following taxes debit or you can add every tax item.

Add Taxes Paid Towards 941 or 944 Taxes

- As a credit insert the amount

- For Federal Taxes (941/944) for an account, you have to click on Payroll Liabilities.

Note: As a separate debit such as Social Security Employee, Federal Income Tax, Social Security for Employer, Employer Treatment, and Medicare for Employee can be added by the following taxes to debit or add every tax item.

Add State Unemployment Insurance Taxes

- Select the Payroll Liabilities link. SUI/ETT [State] Liability for an account.

- Put the sum in the credit field.

The following taxes can be added to debit or added individually, such as state unemployment insurance and the state employment training tax.

Add State Income Taxes

- To open an account, select Payroll Liabilities: [State] PIT/SDI.

- You have to insert the amount as a credit.

The following taxes can be added to debit or added individually, such as state personal income tax and state disability insurance.

Add Federal Unemployment Taxes (FUTA)

- As a credit insert the amount

- Federal Unemployment (940) for an account you have to click on Payroll Liabilities.

Add Net Wages

- Select the checking account from which you pay your employees by clicking on it.

- Instead of adding them, insert each paycheck on a separate line. Add the sums up as credits.

Manually Enter Payroll Paychecks in QuickBooks Online

Manually Enter Payroll Paychecks in QuickBooks Online

- Click the Save button once you have finished entering the debits and credits.

Do you lack technical knowledge or do not have any technical know-how? Relax! Do not worry. Just hire a QuickBooks professional to help you manually enter payroll in QuickBooks. Just make sure you hire only the best in the industry.

Looks like, manually adding or entering payroll in QuickBooks seems to be easier now? We hope so to be! Now that you have understood how to manually add or enter payroll in QuickBooks, follow the procedure accordingly.

When you follow the steps as stated above, you will be able to manually enter payroll in QuickBooks easily. But often it has been noticed that users face some problems.

Accounting Professionals, CPA, Enterprises, Owners

Looking for a professional expert to get the right assistance for your problems? Here, we have a team of professional and experienced team members to fix your technical, functional, data transfer, installation, update, upgrade, or data migrations errors. We are here at Dancing Numbers available to assist you with all your queries. To fix these queries you can get in touch with us via a toll-free number

+1-800-596-0806 or chat with experts.

Frequently Asked Questions (Faqs)

Do I Need to Set up the Payroll Timetable Every Time Before Each Pay Period?

No. Much to your content, the payroll timetable needs just a one-time setup and the software eases out entering or adding payroll journal entries. However, advisably make sure to schedule tax payments for the particular payroll taxes. In case, there is an unprepared payment that needs to be made, you would have the flexibility to allocate that.

Is there any Risk Involved in case of Wrong Calculations while Entering Payroll Manually in QuickBooks?

Yes. Make sure you cross-verify the calculations carefully before going ahead with manually entering payroll since wrong calculations can be time-taking and undauntedly expensive.

Can I Record Outsourced Payroll In QuickBooks?

Yes. You can record outsourced payroll in QuickBooks. However, make sure that while you are recording the particular outsourced payroll in QuickBooks, the data gets uploaded to the system must be correct.

Which Software is Recommended to be Best if I Wish to Record Outsourced Payroll in QuickBooks?

If you wish to wish to record outsourced payroll in QuickBooks, the best software to work with is Intuit Payroll Service. You might feel it a little difficult initially to start with, but the software is way more advanced along with immediate assistance readily available.