Yes off course, let’s know about QuickBooks. QuickBooks is an accounting software package. QuickBooks accounting software basically used by the small and medium-sized businesses and offer the accounting applications and also cloud-based versions which allows the business payments, manage and pay bills and payroll features. Here you can learn how to track reimbursed expenses in QuickBooks.

Dancing Numbers helps small businesses, entrepreneurs, and CPAs to do smart transferring of data to and from QuickBooks Desktop. Utilize import, export, and delete services of Dancing Numbers software.

How Can We Define Reimbursement?

Before moving further. Let’s know about reimbursement. Reimbursement is an amount paid by the company or business for other expenses incurred or overpayment made by an employee, client, or another party. Reimbursement of business expenses includes the cost of insurance, taxes which are paid in excess. But like other compensation, reimbursement is not liable to taxation.

In short reimbursement can be defined as:

- Reimbursement is the payment made to the Employee or Customer, or Another Party, as repayment for a Business Expense, Insurance, Taxes, or other costs.

- Reimbursements for business expense consists out-of-pocket Expenses, like travel and meals.

- Payment made to employees in the form of Per Diem rates for business travel.

- Another form of reimbursement from the government is tax refunds.

How to Record the Expenses in QuickBooks Accounting Software?

You can cut costs and track expenses and reimbursements efficiently with an inclusive accounting program like QuickBooks, one of the most popular tools for businesses. It’s a great program for tracking expenses and reimbursements and constantly balancing expense budgets before they get too complicated to control.

Who Needs to Record Client Reimbursed Expenses?

- If you are a Sole Proprietor LLC and your Business is an IT Consulting Practice.

- If some part of Your Travel Reimbursed by Your Clients.

- If there is other Amount Which is Reimbursed by Your Clients.

- When you Bill Your Clients You need to Record these Items as “Reimbursable” Expenses and Understand this is “Income“.

How to Change the Company Settings in QuickBooks Online?

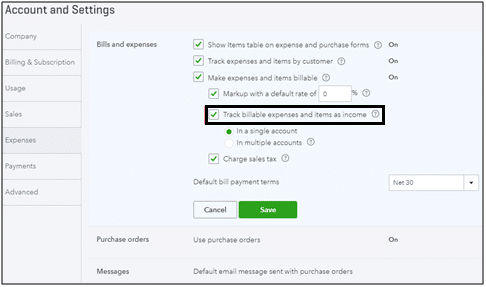

To begin, here are the steps given-below which will be helpful for you to change the company settings if you are using QuickBooks accounting online software:

- Firstly, Navigate to the Gear icon.

- Secondly, Select the Accounts and Settings under the Company.

- After that, You are required to select Expenses and Hit on the Expenses and Bills.

- Once it’s done now, Check the option to Track Billable Expenses and Items as Income.

- Now it’s time to click Save, and it is Done.

How to Change the Company Settings in QuickBooks Desktop?

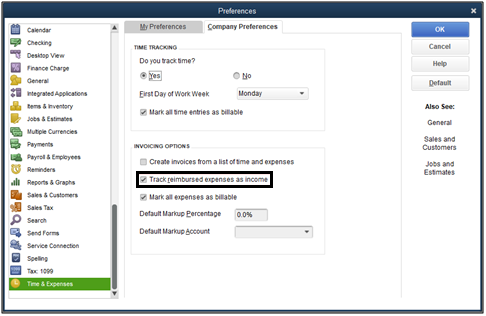

Here are the steps given-below which will be helpful for you to change the company settings if you are using QuickBooks Accounting Desktop Software:

- Firstly, Navigate to the Edit Menu Bar.

- Secondly, Select the Preferences and Select Time and Expenses.

- Now, Hit on the Company Preferences.

- In this step, Now you are required to Verify the Option for Tracking Reimbursed Expenses as Income.

- Once all the Steps are Done click OK.

Once the above given procedure is done now, You are able to track reimbursed or billable expenses as an income. Furthermore, We have also given below screenshots for your kind reference:

You can always reach out to our experts in case of any query. All the details we will provide in end of this module. So keep reading till end.

What is the Procedure to Record the Reimbursement in QuickBooks Accounting Software?

Here are few steps given which will assist you to understand the procedure of recording the reimbursement in QuickBooks accounting software:

- In the first step, You are required to navigate to the QuickBooks dashboard.

- After that, Hit on the + button Which is called “New” on the upper right-hand toolbar to go to the dropdown menu.

- In the third step, You are required to Choose the Journal Entry. Now, A Spreadsheet will be visible to you Which you Need to Fill with a Variety of Line Items Just Ensure to Fill one Row Per Transaction.

- Post that, Hit on the Account Column to open a Dropdown Menu of Accounts Which are connected to QuickBooks and Which you Conduct the Majority of the Business through. Select the Bank Account Which you use to make the Payment to the Employees for Expenses.

- Now, It’s time to Enter the Reimbursement Amount under the Credit’s Column along with the Brief, but Clear Description of the Expense in the Description Column. Though it’s not mandatory fill the description but it will help you to stay organized.

- After that, From the drop-down⬇️ menu Choose the Employee in the Name Column. This menu should include the Employees Which are Regularly get Reimbursed.

- Now Hit on the Save Option on the lower right-hand Corner and Turn off the Journal.

Is there Any other Way to Record the Reimbursement in QuickBooks Accounting Software?

Yes, the other way to record a reimbursement in QuickBooks is ensuring the reimbursement comes out of the correct bank account:

- In the first step, You are required to go to the Dashboard and click on the Add (+) Sign.

- After that, Hit on the Expenses in the Dropdown⬇️ menu.

- Now, Select the Bank Account Which will Fund the Reimbursement in the Account Column.

- Once it’s done, Fill the Description column with the same Information Which you have Mentioned in the Journal Entry.

- Now, Input the Reimbursement Amount in the Amount Column.

- You can also include other Information Which is Required like the Name of the Employee, Dates, etc.

- Now just Save the Expense Transaction and you are Done.

How to Invoice the Reimbursement?

As you have entered the reimbursement amount now you might wish to invoice the same to your customer as well. Like you have checked marked the option already in last step of having the invoice mailed to the client.

However now you are required to learn how will you activate and use it. Here are few steps given which will be helpful for you to understand the process:

- In the first step, You are required to Hit on the Invoice Tabs within the QuickBooks Accounting Software.

- The tab is Available in the Customer’s option Situated on the Top Navigation Bar.

- After that, From the Window that will Visible, Hit on the New Customer Drop Down Button and Locate Jobs Tab.

- After that, Click on the Add Cost Option.

- Once it’s Done Now Select the Reimbursable Expense Amount.

- Post this if you do not need to Charge the Customer you Need to Hit on the Hide Option.

- After that, You are required to Select the Markup from the Expenses Tab and Mention the required information and Click ok.

- Whatever information you will Fill it will be Visible on the Invoice.

- Now, Hit on the Mail the Invoice option and You will be Asked for the Information.

- After that, Mention all the Required Information and Confirm and Hit on the Send option and the Invoice Detail will be sent to the Client.

We have mentioned all the required information which you might need to understand the process of how to track the reimbursed expenses in QuickBooks accounting software. However, if you still need some more information you can always reach out to the Dancing Numbers team of our experts via LIVE CHAT.

Looking for a professional expert to get the right assistance for your problems? Here, we have a team of professional and experienced team members to fix your technical, functional, data transfer, installation, update, upgrade, or data migrations errors. We are here at Dancing Numbers available to assist you with all your queries. To fix these queries you can get in touch with us via a toll-free number

+1-800-596-0806 or chat with experts.

Frequently Asked Questions

How to Record the Reimbursement as a Check?

Here are few steps given below which you need to follow to record the reimbursement as a check:

In the first step, You are Required to Navigate to the Plus Button and Choose check.

In the first step, You are Required to Navigate to the Plus Button and Choose check. After that, You are required to Choose the Bank Account Which was used to Reimburse the Personal Funds.

After that, You are required to Choose the Bank Account Which was used to Reimburse the Personal Funds. Now, Select the Partner’s Equity or Owner’s Equity in the Category Column.

Now, Select the Partner’s Equity or Owner’s Equity in the Category Column. Now, In the last step, You are required to Enter the Amount and then Choose Save and Close option.

Now, In the last step, You are required to Enter the Amount and then Choose Save and Close option.

How to Record the Reimbursement as an Expense?

Here are few steps given below which you need to follow to record the reimbursement as an expense:

In the First Step, You are required to Navigate to the Plus Button and Select Journal Entry.

In the First Step, You are required to Navigate to the Plus Button and Select Journal Entry. After that, Choose the Expense Account for the Purchase on the First Line.

After that, Choose the Expense Account for the Purchase on the First Line. Now, You are required to Enter the Purchase Amount in the Debits Column.

Now, You are required to Enter the Purchase Amount in the Debits Column. In the Next Step, You need to Choose the Partner’s Equity or Owner’s Equity on the Second Line.

In the Next Step, You need to Choose the Partner’s Equity or Owner’s Equity on the Second Line. You need to Mention the Same Purchase Amount in the Credits Column and Click Save and Close.

You need to Mention the Same Purchase Amount in the Credits Column and Click Save and Close. Once all the Steps are Done, Now you are required to Reimburse the Amount.

Once all the Steps are Done, Now you are required to Reimburse the Amount.

+1-800-596-0806

+1-800-596-0806