In QuickBooks, you can easily report your sales tax without any problems. The sales tax is the whole amount of tax that is collected in the sales from the customers. This tax is collected by you on the behalf of the government. You must follow all the norms related to the sales tax. Being the owner of the business or organization you have to track all your sales that are taxable or non-taxable specifically.

Therefore, here you get to know how you can adjust sales tax payable in QuickBooks. With this, you also get the knowledge about add or delete the sales tax adjustments easily.

Dancing Numbers helps small businesses, entrepreneurs, and CPAs to do smart transferring of data to and from QuickBooks Desktop. Utilize import, export, and delete services of Dancing Numbers software.

Sales Tax Adjustment in QuickBooks

By using the automated sales tax, it is easy for you to adjust the sales tax into your QuickBooks account. The adjustment can be done when you receive a discount, fine, or tax credit.

Here, you get to know how you can add, delete, or adjust the sales tax into QuickBooks. You just required to follow the procedure to do the actions properly without any problem.

How to Add Sales Tax Adjustment in QuickBooks

To add the sales tax you must have the account for it so create or set up the account and then adjust it. If you already have an account then you can go with the steps to add the adjustment in QuickBooks.

1. Set up the Account for Sales Tax Adjustment

- Go to the Gear icon in the QuickBooks account.

- From the settings menu, choose option Chart of Accounts.

- Click on the New button that is at the top right side of the window.

- You see the field Account Type so click on its drop-down arrow.

- Then select the Income account to set up the income account as you have to add the sales tax.

- The income account helps you to decrease your tax.

- Click on the Detail Type of accounts.

- In this, choose Sales of Product Income for your income account.

- After that, name the adjustment account that you just created.

- Click on the Save and Close button.

2. To Add the Adjustment

- Go to the Taxes.

- Then click on the Tax tab.

- Search for the period of tax that you have to adjust.

- Click on the option View Return.

- You can see an option Add an adjustment, select it.

- After that, click on the Reason for the adjustment option.

- Choose the Account for adjusting tax in QuickBooks.

- In this, choose an income account as you are adjusting the sales tax and it comes under the income account.

- Mention the amount that is required to adjust.

- In the end, click on the Add button.

How to Delete Sales Tax Adjustment in QuickBooks

- In QuickBooks, click on the Gear icon.

- Then select the option Chart of Accounts.

- Find out the income sales account that you used to add an adjustment.

- When you get the account then click on the Run Report.

- Click on the adjustment that you want to delete from your QuickBooks account.

- Hit on the Delete button.

- It asks you for the confirmation for deletion so, you have to click on the Delete button again.

How to Adjust Sales Tax Payable in QuickBooks

The payable is the due amount that you owe. This means that you owe the sales tax amount that you have to adjust now into your QuickBooks account. While making the sales tax adjustment, you are required to move the money from the sales tax liability account. There are few reasons to adjust the sales tax liability that are as follows:-

- You are charged a fine from your tax agency for the non-payment or late payment in your previous tax year.

- Your agency declared the sales tax holiday.

- Done corrections to your sales for the previous period.

- The sales tax agency has given you the credit for early payment or over payment discount as a credit.

- There are rounding differences between your sales tax forms and QuickBooks.

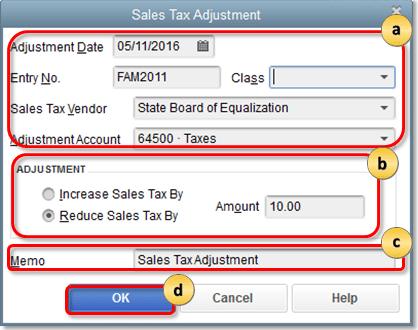

To Adjust the Sales Tax Payable or Dues

- Click on the Sales Tax menu.

- Further, select the option Manage Sales Tax.

- After that, click on the Adjust Tax Owing.

- You have to select an Adjustment Date.

- Mention the Entry No. in the field.

- Hit on the drop-down arrow of Tax Agency.

- Select the agency to which you want to apply the adjustments.

- Go to the Sales Tax Item drop-down arrow.

- From the list, choose the sales tax item for the return line for adjustment.

- You have to now, click on the Adjustment Account field.

- From the drop-down list menu, click on the account for adjustment.

- Then enter the amount in the Amount field that you want to adjust.

- Click on the OK button and done.

In this article, you get to know about many things about how to adjust sales tax payable in QuickBooks. There is a whole process that you have to do according to your requirement. The requirements are like deleting the adjustment, adding the new adjustment, or adjusting your previous things into your account, etc.

Looking for a professional expert to get the right assistance for your problems? Here, we have a team of professional and experienced team members to fix your technical, functional, data transfer, installation, update, upgrade, or data migrations errors. We are here at Dancing Numbers available to assist you with all your queries. To fix these queries you can get in touch with us via a toll-free number

+1-800-596-0806 or chat with experts.

Frequently Asked Questions (Faqs)

Do these Sales Tax Adjustments in QuickBooks works?

Yes, it does works. If you forgot to add something or if you add an extra amount then you can do adjust the amount b mentioning it in the amount field while adjusting. When there is some adjustment in the previous year’s sales tax then you can adjust it into your current year’s sales tax.

How to do Positive Adjustments to Adjust Amounts for Sales tax items?

Click on the Customers menu option in QuickBooks

Click on the Customers menu option in QuickBooks Then select the option Enter Sales Receipts

Then select the option Enter Sales Receipts You have to not enter anything in the Customer field so leave it blank

You have to not enter anything in the Customer field so leave it blank Click on the drop-down arrow of Tax

Click on the drop-down arrow of Tax Then select the 0% sales tax item

Then select the 0% sales tax item Go to the Item column and click on the first line that is empty

Go to the Item column and click on the first line that is empty Now, choose the sales tax item to adjust

Now, choose the sales tax item to adjust Enter the amount to adjust in the Amount column

Enter the amount to adjust in the Amount column You get the pop-up message on your screen as Changing the mount of a tax line item may cause your sales tax reports to be corrected

You get the pop-up message on your screen as Changing the mount of a tax line item may cause your sales tax reports to be corrected Then click on the Yes button to provide confirmation

Then click on the Yes button to provide confirmation If you have other sales item to adjust in QuickBooks then follow the steps f to j

If you have other sales item to adjust in QuickBooks then follow the steps f to j After that, click on Save and Close button.

After that, click on Save and Close button.

How to do Negative Adjustments to Adjust Amounts for Sales Tax Items?

Click on the Customers menu

Click on the Customers menu Further, select the Create Credit Memos/Refunds

Further, select the Create Credit Memos/Refunds Choose the customer name

Choose the customer name Go to the column named Item

Go to the column named Item After that, click on the first empty line

After that, click on the first empty line Then select the sales item to adjust into the Item field

Then select the sales item to adjust into the Item field Mention the amount to adjust in the Amount field over there

Mention the amount to adjust in the Amount field over there Click on the Ok button when the confirmation message pops up on your display

Click on the Ok button when the confirmation message pops up on your display Follow the steps F to H if you have any other sales items to adjust

Follow the steps F to H if you have any other sales items to adjust Again, select an empty line to choose the Discount item

Again, select an empty line to choose the Discount item Enter the total amount in the Amount column that must be entered in the previous line and is equal to the adjustment(s) entered

Enter the total amount in the Amount column that must be entered in the previous line and is equal to the adjustment(s) entered Select the Tax in the Tax column

Select the Tax in the Tax column Then verify the total amount

Then verify the total amount In the end, click on Save and Close button.

In the end, click on Save and Close button.

What if none Exists in the Tax drop-down Options While choosing Sales Tax to Adjust Sales Tax Payable in QuickBooks?

In this case, you have to click on the Add new option then create the new one. After that, you get the option to select so select it and then proceed further.

+1-800-596-0806

+1-800-596-0806