It is a given fact that every business enterprise across the planet needs the Profit and Loss reports to evaluate the financial position of the capital invested by the company.

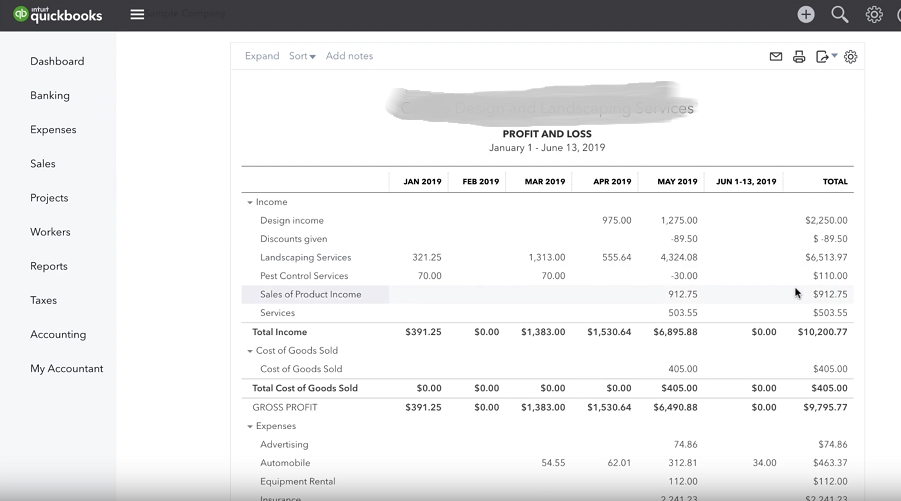

Thanks to QuickBooks, you can create numerous business reports, and a Profit and Loss report are one of them since it gives a clear picture of the profit and loss of the organization in a given period.

Dancing Numbers helps small businesses, entrepreneurs, and CPAs to do smart transferring of data to and from QuickBooks Desktop. Utilize import, export, and delete services of Dancing Numbers software.

In few instances, QuickBooks displays results that have inaccurate data, and today we will discuss in this piece of content how to fix a wrong QuickBooks Profit and Loss Report.

What is Fixing of QuickBooks Profit and Loss Wrong Report?

With the help of the right Profit and Loss report in QuickBooks, you can acquire the actual insights into the particular performance of your business and make far more informed decisions to boost your gains.

In QuickBooks accounting software, you can acquire the precise profit and loss report for a certain period of time. However, the report you receive from QuickBooks depends on the type of input you give to it, and how well you use this tool.

Often you may witness a discrepancy between the sales report and profit and loss statement. This may arise on account of several reasons.

Read on to know the reasons for a QuickBooks Profit and Loss Wrong report.

Why there is a QuickBooks Profit and Loss Wrong Report?

There could be more than one reason that triggers the error cycle in QuickBooks Profit and Loss report. Here are most common reasons listed which might lead to incorrect profit and loss report:

- The Profit and Loss report is issued on a different basis.

- There are certain transactions in the Profit and Loss report which do not utilize items.

- For both the reports, Sales report, and Profit and Loss report, a different date range is chosen.

- You have chosen the wrong sales account to pull up the particular sales item

- The company file has a damaged list or transaction data.

How to Fix QuickBooks Profit and Loss Wrong Report?

Here are the steps to fix the discrepancies in both the reports.

Step 1: Ensure that the Date Range is the same for Both the Profit and Loss Report and Sales Report

- In your QuickBooks Desktop, click Report and Choose Customize Reports.

- Select the drop-down list to select Dates and choose All.

- In the Report Basis, select Accrual and then click OK.

- Compare both the report to see if you are still receiving any wrong Profit and Loss Report.

Step 2: See if the Right Account is chosen for the Particular Items Selected

- Open the List section of your QuickBooks account, select Item List.

- Press right-click on any item from the list and select Customize Columns.

- Make sure that the Account columns and Cost Account are chosen.

- Now confirm that every sales item is showing the right amount.

- Confirm if the reports are precise now.

Step 3: Ensure that no Transactions are Present in the Absence of any Items

- Choose the right date range and open the particular Profit and Loss report by means of the accrual basis.

- Double-click the questions in the report and zoom in to the particular amount of the account.

- In the detail report section, select the Total By option to Item and refresh the particular report.

- Now from the reports, check the total amount of all the transactions in the No Item section.

- Confirm the reports again and in case there are discrepancies in the Profit and Loss report still, then follow the troubleshooting steps mentioned below.

Step 4: Compare the Report manually

Open the Profit and Loss Report

- Select Company and Financials from the specific Reports tab and then choose profit and Loss Standard.

- On an Accrual Basis, run the report and press double-click the particular account to zoom in.

- Choose the Total By to Item.

Open the Sales Report

- Select Sales from the particular Reports tab and then choose Sales by (Item Summary).

- Select Customize Report and then choose the right date range by choosing All from the particular Dates drop-down list.

- It is time to run the reports with the Accrual basis and then press double-click the account in order to zoom in the particular amount.

- Choose the Total By to Item.

- Exit from the main reports but do not close the detailed reports.

- From the particular Windows tab, select Tile Vertically.

- It is time to match the reports and look for any possible discrepancies.

Looking for a professional expert to get the right assistance for your problems? Here, we have a team of professional and experienced team members to fix your technical, functional, data transfer, installation, update, upgrade, or data migrations errors. We are here at Dancing Numbers available to assist you with all your queries. To fix these queries you can get in touch with us via a toll-free number

+1-800-596-0806 or chat with experts.

Frequently Asked Questions (Faqs)

Is it Possible to Determine Whether the Business is Operating at a Profit or Loss with the help of the QuickBooks Profit and Loss report?

Yes. With the help of the QuickBooks Profit and Loss report, it is possible to determine whether the business is operating at a profit or loss.

How to Figure out if an Expense is Added to the Wrong Account in QuickBooks Online?

Performing a regular review of all the transactions in your QuickBooks Online is probably the best way to know if an expense has been added to the wrong account.

Why You often Choose the Wrong Account Names in QuickBooks?

Account names often sound identical and hence turn very confusing. This often leads to the accidental selection of the wrong account in QuickBooks.

+1-800-596-0806

+1-800-596-0806