For every firm to turn a profit, sound financial management is essential. QuickBooks provides a methodical approach for businesses to track their income and expenses in order to assess their profitability. The sustainability and growth of start-ups and medium-sized enterprises depend heavily on the Profit and Loss Statement feature in QuickBooks, which enables them to make well-informed decisions about their revenue and expenses.

Dancing Numbers helps small businesses, entrepreneurs, and CPAs to do smart transferring of data to and from QuickBooks Desktop. Utilize import, export, and delete services of Dancing Numbers software.

Track the financial tendencies of your business by using the information in this article to set up the program and get started. You will learn about QuickBooks and its main features in this post. You will also learn about QuickBooks’s Profit and Loss Statement. You may learn how to put up a profit and loss statement in QuickBooks by reading this article. You will be able to open QuickBooks with ease and generate a profit and loss statement by the time you finish reading this article.

Short Overview of QuickBooks

The purpose of QuickBooks is to deliver precise financial reporting to businesses. With the aid of the program, business owners can keep track of all their financial activities, compile the information into reports, and see it in an easy-to-read format to help them make well-informed decisions.

Small and medium-sized enterprises may handle their accounts without the assistance of a professional accountant thanks to this technology. This program has affordable prices in addition to providing a plethora of accessible accounting functions. QuickBooks customers may also get advice from professionals in accounting and bookkeeping.

One of the most often used financial reports accessible is the profit and loss statement seen in QuickBooks. You may quickly and simply change the Profit and Loss Statement template found on the QuickBooks website to meet your needs. Because of this, even novice users of finance may quickly and easily generate a thorough profit and loss statement in QuickBooks.

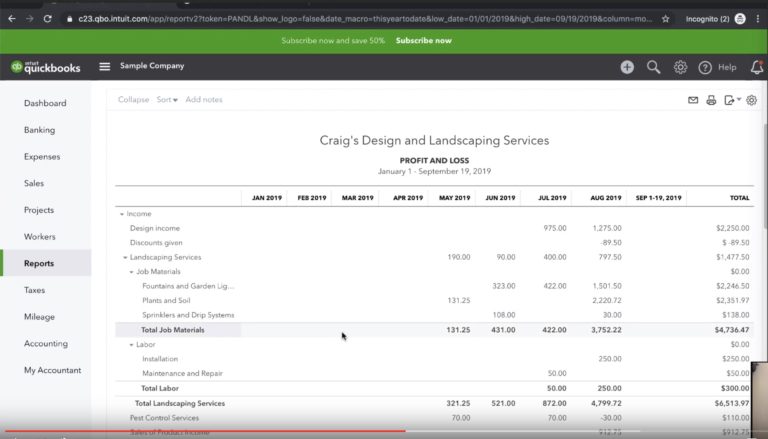

In QuickBooks, the Profit and Loss Statement is arranged quarterly, yearly, and monthly. The ‘Date Range‘ option in QuickBooks may be used to view the Profit and Loss Statement for earlier months.

Key Features of QuickBooks

The essential features of QuickBooks that you should know about are listed below:

- Customer Relationship Management (CRM): QuickBooks gives small company owners the ability to gather and keep track of supplier and customer information.

- Invoice Management: QuickBooks allows its users to create personalized invoices, send them to their clients’ email addresses, and track overdue payments by integrating their accounts with programs like Bill.

- Organization of International Transactions: To make trading with foreign clients easier, QuickBooks gives its users access to the most recent currency rates.

- Inventory management: QuickBooks helps you maintain track of your inventory, allowing you to identify high-demand items and replenish them before receiving new orders.

- Company Snapshot: You can see how much money your company is making or whether it is solely losing money by simply looking at your QuickBooks reports.

- Tax Computation: Finally, QuickBooks computes your company’s taxes.

Introduction to Profit and Loss Statement in QuickBooks

In order to ascertain if your company is turning a profit or a loss, a QuickBooks profit and loss statement analyses your income with your costs over a given time period. Typically, QuickBooks’ Profit and Loss Statement comprises the following five main components:

- Cost of Goods Sold (COGS): The total cost price of the merchandise you sold during a given time frame is what this term refers to.

- Income: Revenue in a QuickBooks Profit and Loss Statement is the money you’ve made from selling products or services.

- Expenses: This is the total amount you have paid for supplies for manufacturing, subcontractor payments, and products purchases.

- Gross Profit: Your monthly income is less your Cost of Goods Sold (COGS) to determine your gross profit.

- Net Profit: Subtract your expenses from your gross profit to determine your net profit. The precise profit that your company has made is known as its net profit. You have experienced a loss if your expenses exceed your gross profit.

Advantages of QuickBooks Profit and Loss Statement

The benefits of utilizing QuickBooks’ Profit and Loss Statement are as follows:

- QuickBooks’ Profit and Loss Statement is user-friendly, enabling business owners to generate reports using the software’s templates rather than starting from scratch.

- It costs less. QuickBooks has several useful features that you may use for as little as $12.50 a month.

- It provides small business owners with the opportunity to grow their company. For their company to expand, many entrepreneurs require financing. The bank or credit agency may require your Financial Reports in order for you to be approved for a company loan. You may see the necessary files, including the Profit and Loss Statement, with its help.

- It cuts down on how much time a business owner needs to devote to bookkeeping. QuickBooks’ Profit and Loss Statement automates most of your accounting tasks so you can focus more of your time on other aspects of your company.

- It provides consumers with access to several accounting features on one platform. You may manage your financial responsibilities in one location by integrating your account with payment tools for tasks like inventory management and payroll administration with a QuickBooks profit and loss statement.

- Expensify (for payroll administration in medium-sized firms) and PayPal (for online payments and invoice creation) are two examples of third-party applications on the QuickBooks Profit and Loss Statement.

Methods to Set Up Profit and Loss Statement in QuickBooks

To create a profit and loss statement in QuickBooks, go to the instructions below:

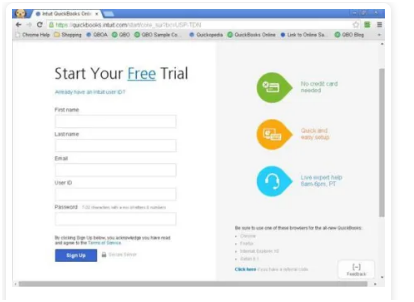

Step 1: Create an Account in QuickBooks

Before creating a profit and loss statement in QuickBooks, if you don’t already have one, you must register for one. To begin, click the “Sign Up” button on the site, as seen in the illustration below.

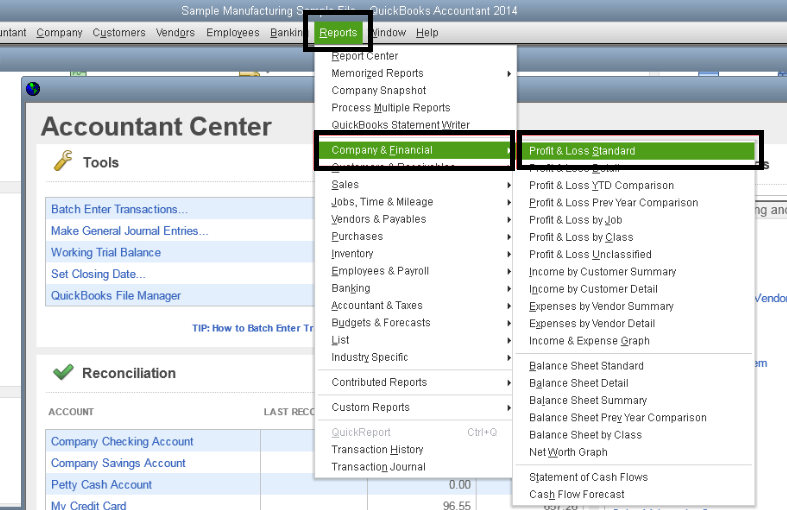

Step 2: In the QuickBooks Report Center, Locate the Profit and Loss Statement

Select “Reports” by clicking on the Menu Bar located on the left side of your computer screen. An arrow-style menu will show up. From the dropdown menu, choose “Report Center,” as the illustration below illustrates.

Next, select “Company and Financial.” You’ll see a number of options under “Company and Financial” in QuickBooks. Click “Profit and Loss Report Standard” after scrolling to find it.

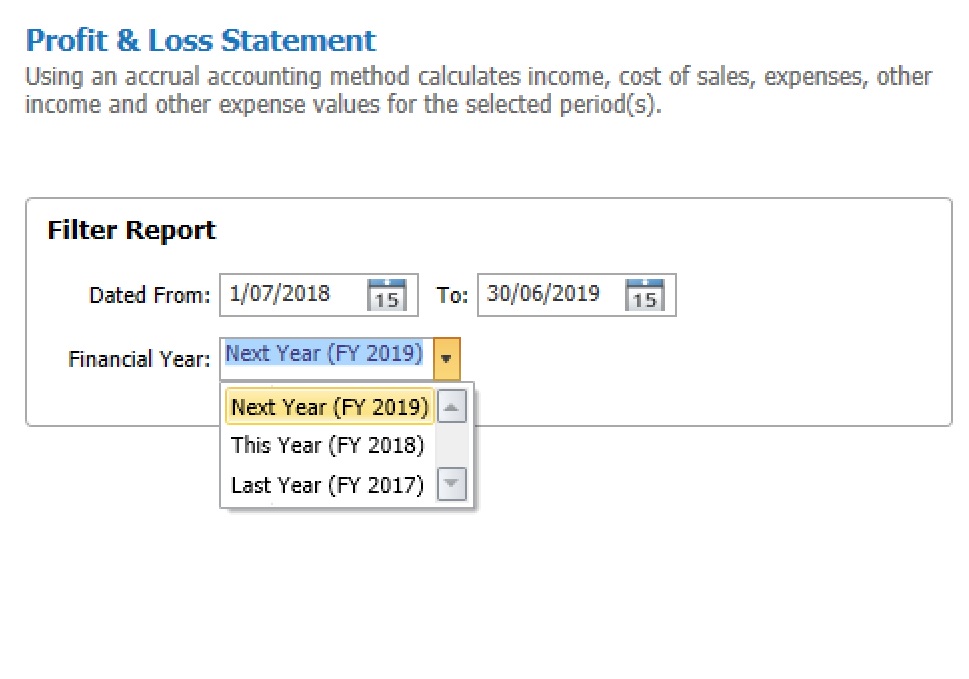

Step 3: Select the Range

The Profit and Loss Reports page has a number of options at the top. Choose a Date Range by clicking on “Dates,” as seen in the illustration below. The period of time you wish the report to cover is indicated by the Date Range.

Step 4: In QuickBooks, Personalize your Profit and Loss Statement

Tailoring various variables to your company needs is the key of creating this report. You have other customization options, such as Accounting Methods, Columns, and Reporting Period. As seen in the figure below, adjust your choices and save your modifications.

Step 5: Launch the QuickBooks Profit and Loss Statement

To complete setting up the Profit and Loss Statement in QuickBooks for your company, click the “Run” option now.

Step 6: You may Download, Print, or Email Your Report.

In QuickBooks, you’ve just created a profit and loss statement. Harvesting the report is the next step, which may be done in one of three ways: print it, email it to a mailing address, or download it as an Excel spreadsheet or PDF.

Conclusion

As soon as you post your profit and loss statement, QuickBooks will start to handle it. You may see your Profit and Loss Statement in QuickBooks at the conclusion of each day, week, month, or fiscal year. This article is the best resource for a detailed explanation of how to set up a profit and loss statement in QuickBooks. If you have any questions, though, please don’t hesitate to contact our Dancing Numbers specialists.

Looking for a professional expert to get the right assistance for your problems? Here, we have a team of professional and experienced team members to fix your technical, functional, data transfer, installation, update, upgrade, or data migrations errors. We are here at Dancing Numbers available to assist you with all your queries. To fix these queries you can get in touch with us via a toll-free number

+1-800-596-0806 or chat with experts.

Frequently Asked Questions

What Distinguishes an Income Statement from a P&L?

The profit and loss statement is abbreviated as P&L. Your company’s earnings and losses over a given period of time are displayed on a profit and loss statement. Profit and loss and the income statement are the same thing. A P&L is a common term used to describe an income statement.

What is a Balance Sheet for P&L?

A business’s profit and loss statement (P&L) displays its revenue, expenses, and profitability over time. Its assets and liabilities as of a specific date are shown as a snapshot on the balance sheet, however. Usually, as of the last day of the business’s fiscal year, the balance sheet is displayed.

What Format is a P&L Account?

Any format can be used to generate the profit and loss account. It should, however, show gross and net profit separately. These organizations often use a “T-shaped form” to organize their profit and loss statements. Debit and credit are the two sides of a T-shaped profit and loss account.

Does Financial Statement Preparation happen Automatically in QuickBooks?

QuickBooks Online will complete all required financial reports for your company instantly. You’ll have all the information you need to make those crucial business choices with just a cursory glance at your dashboard. You may now easily gather all of your financial statements in one location thanks to our assistance.

How to Draft a Statement of Profit and Loss?

- Monitor your operating revenue.

- Set a record for sales costs.

- Determine your gross profit.

- Calculate the Overhead.

- Compute Your Operating Income.

- Think About Additional Revenue and Expenses.

- Reach Your Net Profit at Last.

+1-800-596-0806

+1-800-596-0806