Small firms which are used to handle card payments and online transactions, such types of firms required to issue IRS Form 1099-K to the merchants. The merchants used to utilize their platform at the conclusion of each calendar year. The merchant includes the data from the form on their income tax return.

With a combined experience of more than 10 years, our tax professionals can help you with tax preparation, tax filing, disclosure & compliance, transactional tax issues, and audit representation.

The form lists the total amount of revenue of your firm which is generated from third-party network transactions by using credit and debit cards. All independent contractors, retailers, and freelancers are required by the IRS. They all need to provide the information on the 1099-K form in their annual income tax returns and at the time if they exceed the $600 mandatory reporting threshold.

The companies which all conduct more than $600 in digital sales in their business must send a Form 1099-K, and if the company uses the payment processors like Venmo and Paypal or sales platforms like eBay or Etsy.

Use of Form – 1099K

The IRS employs Form 1099-K is used in following ways:

- It is used in monitoring the digital withdrawals and payments which are made by using credit cards and other third-party payment processors.

- It helps the government in collecting taxes properly.

- It is helpful in assisting the IRS in confirming that all firms are reporting the correct sales or not.

Cheatsheet of Form 1099-K Taxes

A firm that receives a Form 1099-K must complete it before January 31 in order to comply it with the law’s requirement which will help them to declare the revenue on their tax returns.

- Minimum Amount Which is Required to Receive: If your revenues are greater than $600, a third-party digital payment network like Venmo or Paypal will issue you a Form 1099-K. If the revenue is less than $600 then there is no need to issue the form 1099-K.

- Tax to be Pay on Form 1099-K: If you are a self-employed person then you are accountable for the entire payment of 15.3%. All 1099 revenue, including 1099-K, will subject you to this obligation.

Anyone who makes money is subject to FICA taxes, which are federal tax rates that they must pay to the government. Typically, this rate is divided if there is an employee and an employer, needing 7.65% from each.

Steps for the Reporting of Form 1099-K on Tax Return

As a business owner, Form 1099-K functions quite similarly to other tax forms which you may encounter at the time of your tax return. In order to finish your entire tax return, you’ll need to provide specific information from this form.

Following are the actions which are to be taken at the time of reporting of the form:

- Recognize the forms which you will receive and used to look for them.

- Verify the information is accurate and complete in your 1099-K.

- Always look into the Tax Deductions.

- Put all the data together in your Schedule C.

Step 1: Recognizing of the Forms Which you will receive and used to look for them.

If you’re running the small company, you probably accept a variety of payment methods as you want; it includes all modes of payments that are credit cards, Apple Pay, and others.

It is your job to maintain the track of your transactions throughout the year so you will always aware of which businesses you want to utilized for the processing of payment and how much money you made from them.

In case if you want to utilize accounting software then it must be connected to your bank account and this task won’t be as taxing as done by searching with the hand.

When you prepare a 1099-K form by using QuickBooks and the procedure is significantly simpler. Finding your digital transaction gross receipts is as simple as:

- Activate the preparation for the tax program.

- By using the merchant category code which is associated with the log in of your account.

- You can found the Activity & Reports menu there.

- Choose 1099-K and start the downloading.

- Select the download button.

In order to determine that who will be issuing you a 1099-K, this will enable you to sift through the process of payment. You can have a word to your CPA or another tax expert in case if you need to make additional changes as a result of items like refunds.

A 1099-K will not be issued to you if you haven’t made at least $600 from the third-party payment processors that aren’t credit card firms.

If you try to use a financial management tool like QuickBooks then your 1099-k form is automatically prepared. QuickBooks compiles and distributes a 1099-K form on or before January 31 when ever you processed at least $600 in gross credit card transactions over the course of the previous calendar year.

Following are the steps of download locations for the downloading of form 1099-K:

- First you have to visit the Merchant Service Center and log in it.

- Choose the Download Form 1099-K button from the Activity & Reports option.

- Hit the download button in order to start downloading.

Step 2: Verify the Accuracy of the Data on each 1099-K

Make sure that the figures and details on your 1099-K are accurate and complete by reviewing it carefully. By doing so, you must confirm the following:

- Your name

- Your organization’s name

- Address

- Number of your account

- The federal tax identification number

- Identifying information for the taxpayer

- Total payments which is received in cash

- The amounts for each monthly payment

You risk for paying the wrong taxes is that you don’t take the time to go through it. You can owe more in the taxes on the income which you never received, for instance, if you overestimate your gross payment amount and include this inaccurate Information to Your Schedule C.

Step 3: Deduction of Tax is to be Checked

A tax deduction is available to the businesses for almost every type of processing of credit card fee or credit card company charge. Aim to reduce your taxable income is to by taking advantage of IRS-approved deductions.

There are a variety of possible deductions, such as:

- Processing of Credit Card

- Hosting of the web

- Advertising

- Internet Surfing

- Uniform required

- Service for the cell phone

It is your choice in order to keep track of your costs, fees, and levies throughout the year so you can deduct them.

Step 4: Preparing of Schedule C

A Schedule C is an IRS form that lists the Profits or Losses to your company which is made over the course of the tax year. A 1099-K is used to report about your digital payments, and it will be included in your tax return’s Schedule C.

The form is in fill-in-the-blank format which will be used for the following section once you have verified that your 1099-K displays in the correct amounts and information:

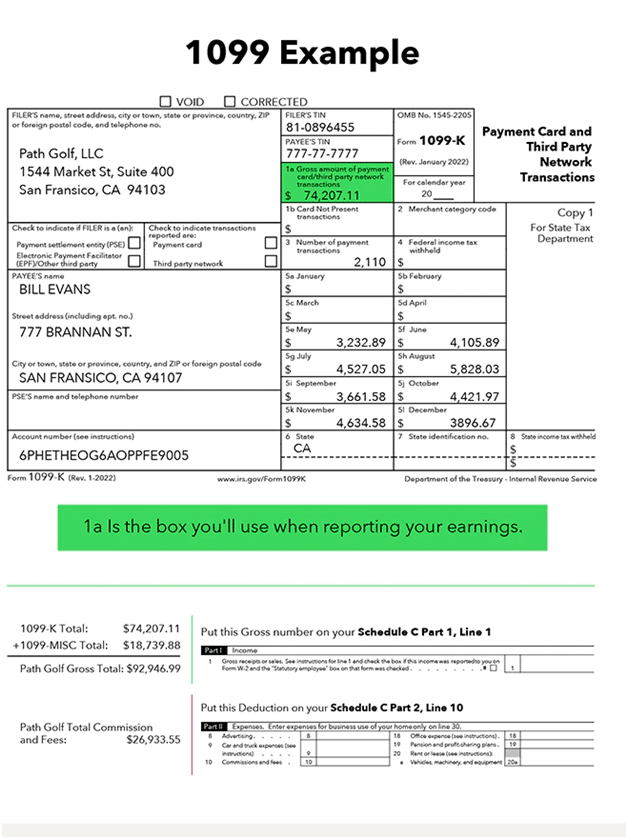

- Line 1 of Schedule C part 1 is where you can easily add the gross amount of your payments from box 1a on your 1099-K.

- Now you can add up all of your fees and credit card company charges, in order to enter them on line 10 of Schedule C part 2.

The IRS goes into more detail in its publication of PDF 535 on additional deductions that you can add to Schedule C from this point.

Example of Form 1099-K

A visual representation of a 1099-K and the location of the information on Schedule C is shown below go through it. The form that you would send to a payee would look like same as the following.

How to E-File of QuickBooks 1099-K Form

You can e-file QuickBooks 1099-K forms for Merchant Card and Third-Party Network Payments by using W2 Mate. This is a time and money-saving which is alternative to paper tax filing which also helps tax payers throughout the season of tax. With the help of this functionality, there is no longer requirement for preprinted IRS forms. Count on W2 Mate will help you with the 1099-K tax reporting process. Follow are the steps which are listed below:

Steps for Importing 1099-K Data from QuickBooks

Before you start, First you have to make sure that the company which you open in W 2 mate is correct.

- From the top menu first you have to select Import Data tab.

- From QuickBooks W-2 and/or 1099 Data should be selected.

- The QuickBooks Import wizard will open in front of you.

- Now, you have to read the message and realize that you must open QuickBooks and run it.

- Select the next button.

- Select QuickBooks by clicking on the given link.

- Once you are done with the above step QuickBooks window will appear in front of you and ask if you wish to grant W 2 Mate access to your company’s data.

- Now, press yes button for the confirmation.

- Select the option yes or no to grant the application access to your personal information.

- Press the Continue button.

- Once done with all the above steps successfully hit the done button.

- Now move to next window by selecting the next button.

- Again press next.

- Now you have to choose 1099 Data in this step.

- From the drop-down option of 1099 Data select the year of Tax.

- Choose Form 1099-K from the drop-down selection of the year of tax.

- From the drop-down menu now you have to choose the proper 1099-K box for the relevant financial amounts.

- Select Next.

- Select OK button to confirm.

- Check the data which is imported.

- Select Next.

- At last select Finish button and now you are done exit from the screen.

Steps for E-File of QuickBooks 1099-K Form

You must first confirm that the company you open in W2 Mate is accurate.

- Navigate to the top menu and select E-Filing.

- Now you have to choose 1099-K Forms.

- The Electronic Filing Transmitter Setup will open in front of you.

- Complete each and every field in the transmitter and fill the information of the company.

- Now, You need to Add Company’s contact information.

- Click on the browse button for choosing the electronic file where you saved it.

- Select the OK button.

- The pop-up window will open in front of you so select yes in order to access the folder where the file was saved.

- To upload your 1099-K electronic submission file first you have to log into the IRS FIRE system online right away.

- In W2 Mate, Navigate to the IRS FIRE system website.

- Now again navigate to the top menu and select IRS & SSA Instructions.

- Select the option to Go to IRS FIRE System Website (1099 Electronic Filing).

Steps for Printing of 1099-K Form in QuickBooks

Verify that the relevant Company is open in W2 Mate.

- Data from 1099-K forms from QuickBooks have been imported by navigating the imported data in W2 Mate.

- In the Shortcuts menu first you have to select 1099 & 1098 Forms.

- Now you have to select Print button.

- Choose recipients from the list of 1099-K form.

- Select the sort of copy which you want to print.

- Select Print DATA only in case if you want to print the data on the preprinted IRS red form.

- Select the OK button to confirm.

- Now you have to choose the appropriate printer from the drop-down list of printers.

- Select OK button.

We hope that the above article will help you in Form 1099-K but still if you face any issue then contact us. We can evaluate your books and digital transaction history with the help of one of our skilled bookkeepers, who can also provide you tax filing guidance. With the help of QuickBooks Live, determine your tax situation for the year.

Looking for a professional expert to get the right assistance for your problems? Here, we have a team of professional and experienced team members to fix your technical, functional, data transfer, installation, update, upgrade, or data migrations errors. We are here at Dancing Numbers available to assist you with all your queries. To fix these queries you can get in touch with us via a toll-free number

+1-800-596-0806 or chat with experts.

Frequently Asked Questions (Faqs)

What should I do if a Form 1099-K has an Error?

If you discover any kind of mistake then you must get in touch with the payment settlement entity (PSE) what to be identified on your Form 1099-K. The PSE is in charge of reporting the payments that were made to you.

Some of such mistakes are includes:

• Spelled incorrectly.

• Unreliable taxpayer identification numbers.

• The document is a copy and not at all yours.

What Happens if I don’t Submit my 1099-K?

You could face IRS fines if you don’t submit the information return forms (1099s) on time. There is no maximum fine for willful form-disregard and the limit may change based on the size of the company.

Does my 1099-K Reflect my Personal Payments?

Your 1099-K does not reflect the transactions for your personal use. Only income obtained through transactions from the third-party networks should be reported.

Money that you might get from your friend or from the member of your family that is unconnected to business is known as a personal payment. These numbers shouldn’t be included in Form 1099-K submissions.

By opening a separate bank account for your business and separating the funds sent to you by friends and clients, you may prevent your accounts from becoming confusing or full of errors.

Can we File Form 1099-K Electronically?

Yes, You can use the FIRE (Filing Information Returns Electronically) system to file Forms 1099-K electronically. If a person submits 250 or more Forms of 1099-K in a given calendar year then they must go through an online process. You can also encouraged to file electronically by the IRS are filers with less than 250 information returns.

Who is Responsible for the Reporting of the Payment Card Transaction?

Reporting the gross amount of the reportable transactions is the responsibility of the merchant who is acquiring the organization which use to sends money to the participating payee.

The processing of the transactions can be delegated by a merchant acquiring entity to a processor who might also be responsible for fulfilling the merchant’s contractual payment obligations. The organization that submits the instructions to transfer the money to the merchant’s account is in charge of creating and providing a payee statement. The participated payee and submitted Form 1099-K for the payment card and the third party network transactions. The IRS with both the merchant acquiring entity and a processor are contractually required to pay the merchant.

+1-800-596-0806

+1-800-596-0806