Direct Deposit Form: It is a form which gives authority to a third party, usually an employer for payroll, to send money to a bank account by simply using accounting details. An employer might need Cancelled check to verify the accounting details. Once the form is completed by the account holder it will need to be signed and returned to the employer.

Dancing Numbers helps small businesses, entrepreneurs, and CPAs to do smart transferring of data to and from QuickBooks Desktop. Utilize import, export, and delete services of Dancing Numbers software.

What Are the Benefits of Intuit Direct Deposit Form?

Payroll management can be a difficult task, but it can be made easier by using Intuit Direct Deposit Form. This method has several advantages for both employers and employees.

- Physical checks are not needed because of the Intuit direct deposit form.

- Before payday, employers start the process of transferring employee salary to their bank.

- On payday, money is transferred to the employee’s account.

- To clear there is no need to wait for the physical check.

- Employees have quick access to funds after receiving them.

- Provides a quick and effective means of being paid.

- Also, timely access to funds is added benefit.

How to Set Up QuickBooks Direct Deposit Forms for Employees?

It is easy to set up direct deposit from QuickBooks for employees, which eliminates the need for paper checks and offers a practical method of paying staff. To begin the process start by following the methods that are mentioned below:

- Employers need employee bank information such as bank name, routing number, and account number to start direct deposit payments.

- After collecting the required information, you can enter employee banking information into the Intuit QuickBooks Payroll form.

- Employers can schedule direct deposit payments for electronic transfer of compensation on payday using the bank account information they have collected from employees.

The setup procedure for QuickBooks Direct Deposit Forms is easy to complete, and they provide a safe and effective method of paying employees.

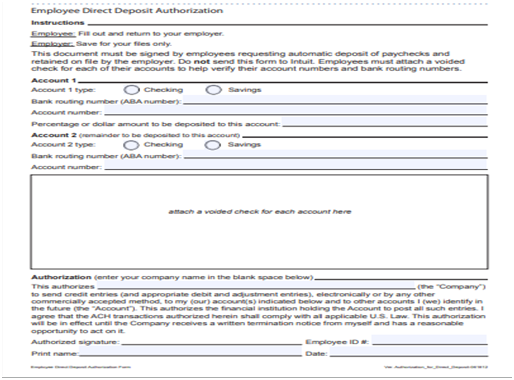

Here You can see the Sample of Direct Deposit Authorization Form QuickBooks:

In this module we are going to learn to transfer “QuickBooks payroll direct deposit form” and the way to put in writing and setup QuickBooks direct deposit. QuickBooks payroll direct deposit permits employers to pay their workers electronically via bank transfers. The cash is directly transferred from the employer’s checking account of employee’s. Machine-controlled financial organization is employed by the banks to coordinate the payments among totally different monetary establishments. In QuickBooks payroll, you wish to setup direct deposit for workers so as to pay them through your checking account and record the transactions mechanically within the code.

How to Transfer Intuit QuickBooks Payroll Direct Deposit Form: You’ll be able to directly transfer the shape from QuickBooks payroll. The info you have saved in payroll code cannot be filled within the kind directly. This can be terribly straightforward, particularly if this direct deposit desires you would like to change for over one worker.

Understanding Direct Deposit Authorization Form QuickBooks: As a written document, QuickBooks payroll direct deposit kind permits associate degree worker to transfer cash from his or her own checking account to it of associate degree employee’s. Through this sort, you may choose that account the money area unit aiming to be transferred from additionally as that account the money area unit aiming to be transferred to. The worker can got to submit a blank voided check, which can be connected on to the form.

For a lot of data, the employee needs to discuss the work and procedure with the payroll of the company.

How to Write Direct Deposit Authorization Form QuickBooks?

Here the attached form for your kind reference as a sample.

Before filling at intervals the shape, endure the directions. 1st of all, you are not going to send the shape to get the picture. Instead the worker should send the shape and connected a voided check for every checking account. The voided check are going to be used for corroboratory every of the account numbers and bank rounding error numbers.

To fill the shape here area unit few steps you’ll be able to refer:

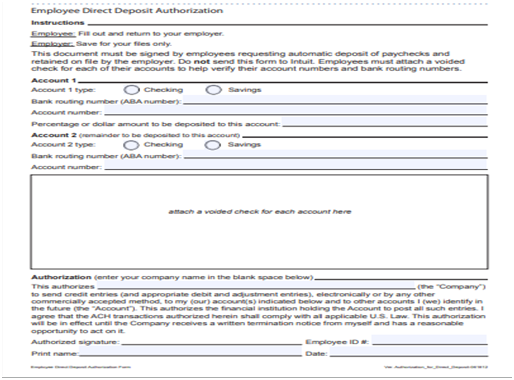

Step 1: Begin with the Labeled Space Account 1

- Select checking or saving in account kind.

- Enter the bank routing range. Its 9 digit code looking forward to the case of your bank throughout that you opened your account.

- Enter your account range.

- Enter the “Percentage or dollar quantity to be deposited to the current account”.

- If the payment quantity is to be deposited in 2 separate accounts, then enter a share however 100%.

- If you are not giving the details for a second account, then a check kind area unit aiming to be issued for a similar.

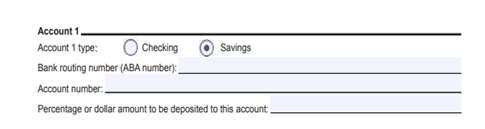

Step 2: Repeat Same Steps, if you would like to Feature Second Account

You need to repeat an equivalent steps, if you would like to feature second account. The share of the quantity that didn’t attend the primary account can attend the second account.

- Choose the kind of account: checking or savings.

- Enter the bank routing range (ABA number).

- Enter the second account range.

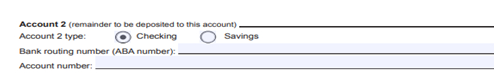

Step 3: Attach a off Check for Every Account

- Attach a voided check for every account.

- This may be used for corroboratory each of the account range and bank routing range (aba number).

You must attach the voided check when taking the output of entire kind.

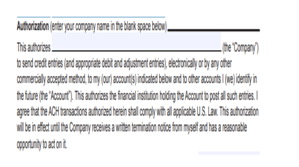

Step 4: Enter the Corporate Name within the Space

- Enter your name at intervals the house provided.

- This is often associate degree authorization that company can electronically deposit cash into your account and deduct any quantity which can area unit deposited through a blunder.

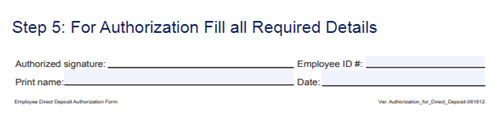

Step 5: For Authorization Fill all Needed Fields

To authorize the account; enter the remainder of the data like:

- Approved signature

- Worker id range

- Print name

- Date

Once you have got crammed out the shape and brought the print out of an equivalent, attach the voided check for every account. Then, submit the whole kind to your unit of time department. Thereafter, your leader can apply the method and came upon the direct deposit of wages to your account.

How to Recognize Direct Deposit for Employees?

In order to deposit wages directly into the checking account of your workers, you wish to line up direct deposit in QuickBooks payroll. Once you have organized direct deposit, you’ll be quickly able to change the payment method for every worker through this accounting code.

To set up direct deposit for staff in QuickBooks payroll, you’d prefer to attempt to the following:

- Gather accounting data of workers through Intuit QuickBooks direct deposit authorization kind.

- Enter the checking account data of workers within the on-line payroll account.

Below are the steps that area unit useful for you to induce the desired banking data of employees:

- Fill and print the direct deposit kind.

- Print the shape through QuickBooks on-line payroll increased through the subsequent steps like open taxes -> click on the payroll tax -> click on worker setup -> choose bank verification -> choose read -> click on the print.

Once you have collated the bank data from your workers, you wish to enter their bank details in QuickBooks payroll. To do that, you are required to follow the below mentioned steps:

- Within the workers/payroll menu, choose workers tab.

- Choose the name of the workers.

- Click on the edit worker.

- Choose the payment methodology for the specified payment transfer. You have got few choices like direct deposit, direct deposit with balance as a check, direct deposit to 2 accounts.

- Enter the accounting data of workers.

- Click as done.

What Steps to Take if QuickBooks Direct Deposit Form is Late?

You should take the following actions if an employee’s direct deposit from QuickBooks is not deposited to their account on the scheduled day.

- Verify the transfer’s status by getting in touch with the payer and bank.

- Direct deposit processing delays may be the result of system errors or updates.

- The issuing entity should make you aware of the circumstances and the anticipated turnaround time for the deposit.

- In case you have not received any communication then you can get in touch with them right away.

How to Set a Preferred Template for QuickBooks Direct Deposit Form?

While signed in, you can use QuickBooks’ Feedback feature to recommend changes to the Intuit direct deposit form templates.

- You can open the left navigation bar and select the Invoices tab.

- To leave feedback on an invoice, you have to click the Pencil () icon next to it.

- Then you have to use the Feedback option

- A “What did you think?” field will be visible.

- Enter any feedback feature requests there.

- You can add an image file if necessary and then you have to click Next.

- Now you have to enter your email address

- Finally, click Done to submit your feedback.

How to Set Up QuickBooks Direct Deposit Forms for Vendors?

You have to set up a direct deposit form in QuickBooks for vendors to facilitate easier and quicker payments. To save time and streamline your payment procedures, follow the detailed instructions.

- You have to begin by logging in to QuickBooks Online and then you have to go to the Expenses tab.

- From the left side of the sub-menu, you have to select Vendors.

- Then you have to open the profile of the vendor you want to set up a direct deposit.

- From the top-right corner of the page, you have to click Edit.

- Choose Direct Deposit from the drop-down option that is under Payment and Billing.

- Now you have to enter the vendor’s bank account details and then you have to choose whether you want to make this their default payment method or not.

- Then you have to review the information and then you have to click Save.

- When creating or paying a bill, you have to use the direct deposit payment option.

We have tried to be as informative and as inclusive of fact as we can, but if in case you are stuck in between the process, or having an additional query connect with Dancing Numbers team via LIVE CHAT.

Looking for a professional expert to get the right assistance for your problems? Here, we have a team of professional and experienced team members to fix your technical, functional, data transfer, installation, update, upgrade, or data migrations errors. We are here at Dancing Numbers available to assist you with all your queries. To fix these queries you can get in touch with us via a toll-free number

+1-800-596-0806 or chat with experts.

Frequently Asked Questions

How can I Get a PDF of the Intuit Direct Deposit Form?

- To get the Intuit Direct Deposit form in PDF format, you have to sign in to your Intuit Payroll account.

- Then you have to Go to the Payroll tab, and pick Direct Deposit Authorization Form, and then click the Download Form link in the drop-down menu.

What is an Intuit Direct Deposit Form PDF?

Businesses can set up direct transfers for employees using the Intuit Direct Deposit form in PDF. This is the process of transferring payroll funds to their bank accounts.

Do Direct Deposit Forms for QuickBooks have a Limit?

Yes, there are restrictions on direct deposits in QuickBooks to prevent fraud.

Can I use the Intuit Direct Deposit Form to make any Additional Payments?

No, You can only pay employees or contractors using Intuit’s direct deposit services.

What is Direct Deposit in QuickBooks?

Paying your employees directly into their bank accounts with QuickBooks Direct Deposit is a feature.

What do I Need to Use QuickBooks Direct Deposit?

Requirements include a U.S. bank account, a subscription to QuickBooks Payroll, and valid employee bank account information.

How do I Fill out the Payroll for Intuit Direct Deposit?

By following the instructions in the QuickBooks Payroll setup, you can set up QuickBooks Direct Deposit.

How long does it take for Employees to Receive their Direct Deposits From QuickBooks?

Employees receive their Direct Deposit after processing within 1-2 working days.

Is Intuit Direct Deposit safe?

The answer is that QuickBooks Direct Deposit is secure.

What is the Cost of QuickBooks Direct Deposit?

Each month, Each Employee must pay $2 for QuickBooks Direct Deposit.

What if a Employees Direct Deposit is Unsuccessful?

You will be notified if a direct deposit for an employee fails, and you can either rectify it or find another way to pay the employee.

Can Contractors use Intuit Direct Deposit?

Yes, Employees are the only ones who can use QuickBooks Direct Deposit.

Can I Cancel QuickBooks Direct Deposit at any time?

Yes, You can cancel Direct Deposit whenever you choose by getting in touch with QuickBooks Payroll support.

How to Print a Direct Deposit Form in QuickBooks online?

- In the QuickBooks Online Payroll section, you have to go to Paycheck List.

- Then you have to choose the desired Paycheck, and then you have to select Direct Deposit.

- Now you have to click Print.

How to Change the Direct Deposit Form in QuickBooks?

- If you want to change a Direct Deposit in QuickBooks then you have to select the Paycheck from the Paycheck List in Payroll

- Then you have to click Edit.

- Now you have to change the direct details and now you have to submit the changes.

+1-800-596-0806

+1-800-596-0806