|

|

You could make errors like putting the wrong amount on a check or issuing a check to the incorrect individual while paying bills, clients, and associates using QuickBooks. You can void a check using QuickBooks in several circumstances before completing the transaction. The voided check is still present in the application’s register, but its value is now 0. The registry also keeps a record of the voided transaction for the check’s number, payee, and date.

Dancing Numbers helps small businesses, entrepreneurs, and CPAs to do smart transferring of data to and from QuickBooks Online. Utilize import, export, and delete services of Dancing Numbers software.

If you go for voiding a check, the transaction amount will become zero, but the record of the transaction will always be there in your books of account. Most of the people go for voiding the check option due to this specific reason.

But if in case you decide to delete the check entirely, the transaction will be permanently deleted from the books. The status of the paid bill will return to unpaid, and you won’t be able to find the entry related to deleted check in your books of account.

We will see how to void as well as void a check in QuickBooks Online in the next section.

How to Void a Check in QuickBooks Desktop?

To void checks in QuickBooks Desktop for payroll checks and bill payment checks that have previously been issued but haven’t been cashed or deposited. You will also know how to void a check in this blog.

How to Void a Check for Bill Payment in QuickBooks Desktop

Step 1: Go to the Check Register

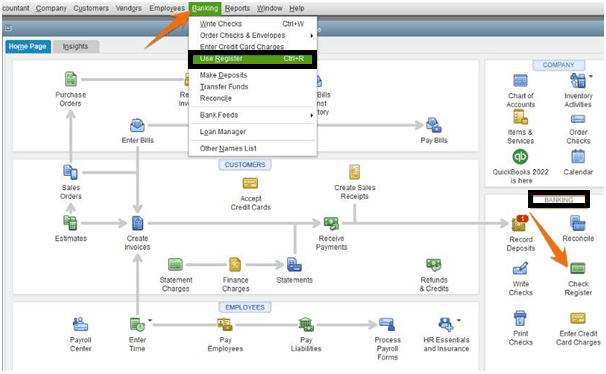

- Begin by going to your QuickBooks Desktop home page and then click on the Banking menu.

- Then you have to choose Check Register.

- On the top of the screen, you can click on the Banking menu.

- After that, as shown below from the drop-down list menu you have to choose Use Register.

Step 2: To Void Select the Check

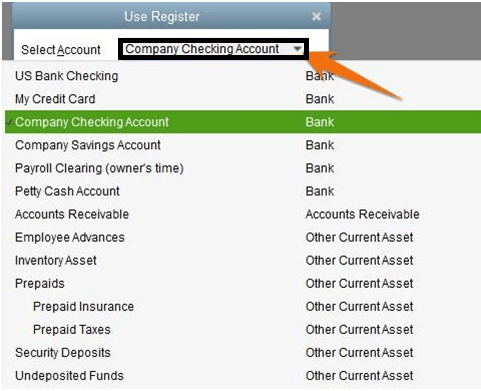

- Choose the bank account from which the void check was drawn. Here, you will see a company checking account as an example.

- The creation of all checks will be shown in a new window. By clicking twice on any part of the line, you can choose which check you want to void. In the example given below, a $340 bill payment check (check #5314) made out to the Printing Shop needs to be voided.

Step 3: Void the Check

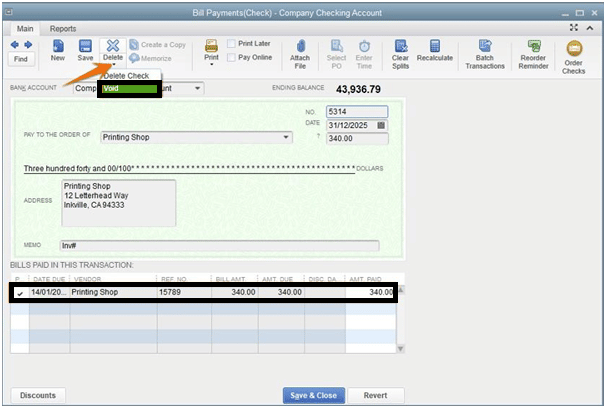

- Your check will show up after you choose it from the list, as depicted below. You will see that the list also includes any unpaid invoices owed to the business to which you are writing the check. Select Void from the small drop-down menu that appears after clicking the Delete button at the top of the check screen.

- When you select Void, you will see that the amount changes to zero, signifying that the bill was opened again. The memo field will also have “VOID” in it. To cancel the check, use the Save & Close button.

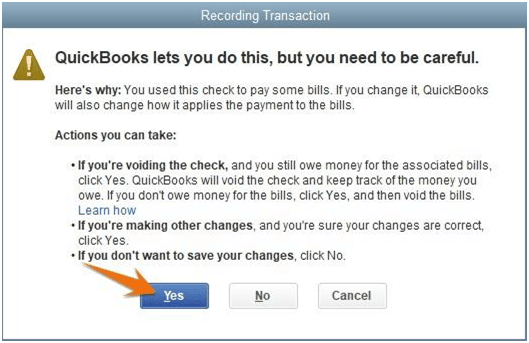

- When you will click Save and Close, you will get a message asking whether you want QuickBooks to record the changes. Then you have to click on Yes to proceed.

- Follow the steps for paying bills as described in our guide on printing checks on QuickBooks Desktop if you need to reissue and reprint the check.

How You can Void a Payroll Check in QuickBooks Desktop?

When all payroll tax returns have been submitted, voiding a payroll check is a little trickier than voiding a general check. This could have a big impact on your payroll and bookkeeping. The best way to reissue a payroll check is to reprint it with a new check number rather than void it. Then, to leave a paper trail, you can make a new check, give it the old check’s number, and void it.

Step 1: Navigate to Check Register

As shown above for voiding a general check you have to navigate to the check register.

Step 2: Find the Payroll Check

- Select the payroll check you want to void from the check register. Let’s cancel Jeannette Deen’s check (check #3006) to demonstrate what happens next.

- To view your paycheck, double-click anywhere on the input line. Make a note of the check’s current check number that you want to void. The check number in our illustration is 3006.

Step 3: Reprint with a New Check Number

- Click the Print menu at the top of the payroll check window, then select Check from the drop-down list, as shown below, to change the check number.

- A new check number will then be automatically generated by QuickBooks Desktop. Print the new check after making sure that this number matches the check in your printer, or change it if necessary.

- The check will immediately be entered into the check register once it has been printed with the new number. The previous check with number 3006 is now shown as check number 3091, as can be seen below. The old check won’t be there, but you can find the new one in the register.

Step 4: Put the Previous Check’s Number on a new one and void it.

- It’s a good idea to show the old check number as voided in your check register even though it’s not strictly necessary to do so. Click on the register’s bottom line, enter the old check number, and then adjust the details to do this.

- Then, you should find the old check in the register and proceed as directed to void a check.

When to Void a Check in QuickBooks Desktop?

When necessary, you must void a check in QuickBooks Desktop.

- The wrong person received a cheque.

- A check is misplaced or taken.

- Inaccurate information was entered, such as the wrong amount or date.

- Paycheck entry for incorrect work locations (tax jurisdiction)

- Duplication checks are conducted

In most cases, you should duplicate checks and then provide a correct replacement, with exception of duplicate checks. As was already mentioned, doing this for regular checks can be simple, but reissuing paychecks might be challenging.

How To Void a Check in QuickBooks Online

For accurate record-keeping, you should know how to void a check in QuickBooks Online. If a check was not cashed, issued to the incorrect person, made out for the incorrect amount, contained other errors, wasn’t included in a previous reconciliation, was sent to the incorrect address, was eaten by the printer, or was simply issued to give your bank account information to a third party, you may need to void the check.

Step 1: Navigate to the Check Screen

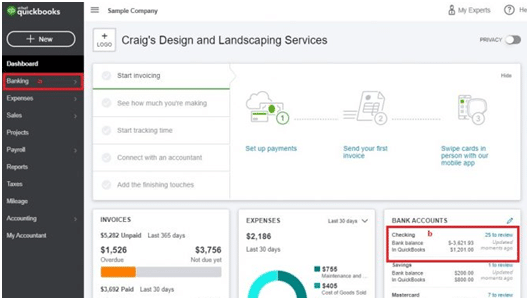

Select Accounting from the left-hand sidebar on the QuickBooks Online main page, then clicks on Chart of Accounts. Then choose the appropriate checking account, and then click View Register to access the bank register, which lists all of your issued checks.

Step 2: Find the Check on the Check Register

Once you have located the check you wish to void, scroll down through the check register. To find the relevant check, you can filter the transactions by date range, transaction amount, payee name, and check number.

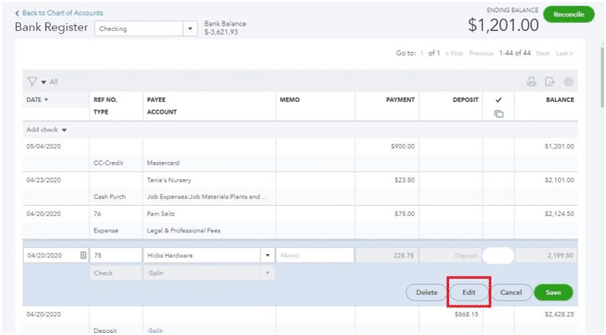

Step 3: Click on Edit

Several options will show up under the check details after you click on the line for the relevant check. Go to the editing screen by clicking Edit.

Step 4: Void the Check

Click on More at the bottom of the screen. To void the check, select Void from the list of options that appears.

Step 5: Dismiss the Warning

A warning verifying your desire to cancel the check will show up if the check you want to cancel is a bill payment check. This is a reminder for you to create a fresh bill payment check to replace the void one. A confirmation box will show up when you click Yes to indicate that you want to cancel the check and it wasn’t a mistake.

Step 6: Reissue the Check

To make sure the vendor is paid and your QuickBooks accounting software records are accurate after the check has been voided, you must now issue the check once more from the proper account and with the proper information.

In Special Cases Void a Check in QuickBooks Online

For checks that were entered into your check register on a bill or cost, follow the instructions for how to void a check in QuickBooks Online. If the original check wasn’t recorded or you’re dealing with a duplicate entry, the methods are a little bit different.

The Original Check Was not Recorded

If a check has been deposited into your QuickBooks account, only then can you void it. To avoid issuing another check with the same check number and clearing out the rest of your check register, you must add voided checks for checks that were never recorded.

If you want to create a new voided check then:

- Begin by clicking on the Gear icon.

- Click on Banking which is under the Other option.

- To issue the check you have to select the bank account that you used.

- Enter the check’s information, including a Voided check note and a $0.00 amount.

Your check register will now show that voided transaction as a reminder not to use that check number again. There is nothing else to do since you entered $0.00 as the amount.

Duplicate Entry

When you enter the same check twice with the same check number, payee name, and amount, it is known as a duplicate entry. Simply choose the duplicate check and click on Delete rather than voiding duplicate checks. The duplicate will be permanently removed when you do this, and it won’t show up in your records anymore.

Please be aware that a voided check with a distinct check number should never be deleted. This could result in errors down the road, like failing to reissue the check or leaving the canceled check open to fraud. Every paper check must be documented, whether it was canceled to give a vendor or customer account information or for another reason.

Preventing Fraud

Failure to properly void a check (rather than simply deleting it) and securely dispose of or store the paper check after voiding the transaction in QuickBooks can expose businesses to check fraud. Make sure to at least mark the check with VOID. After that, either shred the check or store it safely.

How to Void a Check that QuickBooks Online has Already Recorded?

Properly voiding your checks in QuickBooks Online can keep your bookkeeping records accurate. This will protect your business from fraud and then helps you in ensuring your financial statements. Although voiding a check has the same effect as voiding it on your financial statements, doing so undermines your recordkeeping and leaves room for errors. Additionally, deleting checks makes it more difficult for you to spot account fraud. A check should only be voided if a mistaken duplicate entry was entered.

Void a Check from the Check Page

From the Check page, where you may review the specifics of the original transaction, you can void a check.

- Choose Expenses from Bookkeeping, Transactions, or Expenses.

- Then you have to choose Filter.

- Now you have to choose to Check in the Type field.

- Choose Apply after selecting the check’s receipt date range.

- To open the check on the Check screen, select it from the Expense Transactions list.

- From the pop-up menu, you have to click More and then click on Void.

- When asked if you wish to void the check, choose Yes.

Without Opening the Transaction Void a Check

Without opening the transaction, you can void a check from the list of expense transactions.

- Begin by choosing Expenses from Bookkeeping, Transactions, or Expenses.

- Locate the check you want to cancel in the list of expense transactions.

- Choose Void from the View/Edit dropdown menu in the Action column.

- When asked if you wish to void the check then you have to choose Yes.

Voiding a Check that was Previously Recorded

Step 1. You need to first locate the check that you wish to void. For this, you need to click on the check register from the dashboard. You can reach there either by clicking on banking from the left-hand toolbar or clicking on the bank account on the right side of the screen.

Step 2. In the second step, you need to search for the check that you wish to void and click on it. After that, you need to click on the edit button at the bottom of the screen.

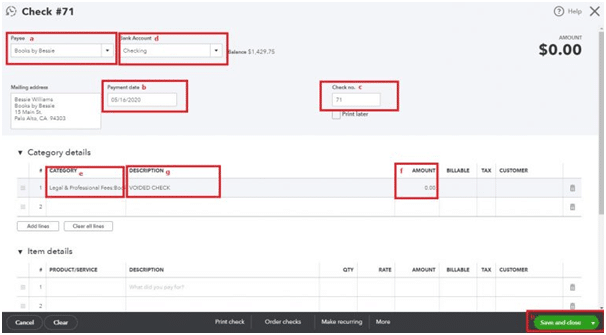

Step 3. Now you need to click on More at the bottom of the next screen then click on Void.

Step 4. If the prompt appears, you need to click on Yes. The prompt tells you about the fact that the check was used to pay the bill.

Step 5. Once you have clicked on Yes, the payment or check is void now, the bill is updated now to show as open and payable on your AP records.

Voiding a Check that was Not Previously Recorded

Step 1. First of all, click on the New button on the dashboard and then you need to choose check under vendors.

Step 2. In this step, you need to create the check by filling in information like, payee name, date of the check, check number, category, correct bank account etc. After that, you need to enter the amount as zero and mention voided check in the description box. Once you are through with all this, click on save and close.

You can review your check register now where you will see that the check is voided and the amount is zero.

As you have read the above article, all the steps are properly mentioned. You will get all the information related to voiding a check in QuickBooks Desktop and in QuickBooks Online. You now understand how to cancel a bill payment check in QuickBooks Desktop as well as cancel and reissue a payroll check. In case you still face any issues related to this then you can connect with Dancing Numbers team. You can call them any time as the experts are available round the clock for their users.

Looking for a professional expert to get the right assistance for your problems? Here, we have a team of professional and experienced team members to fix your technical, functional, data transfer, installation, update, upgrade, or data migrations errors. We are here at Dancing Numbers available to assist you with all your queries. To fix these queries you can get in touch with us via a toll-free number

+1-800-596-0806 or chat with experts.

Frequently Asked Questions (Faqs)

How to Void a Check Payment in QuickBooks?

● First, You have to go to Bookkeeping and then you have to choose Transactions and then you have to choose Expenses.

● Then you have to choose Pay Bills Online.

● Now you have to select the Payments tab. Search for the payment that you want and then you have to click on track Status and then you have to click on Void.

● Choose the void request type and enter the reason for the void request.

● At last, You have to select Submit Request.

How to Void a Refund Check in QuickBooks Desktop?

● Select Customer Center by going to the Customers menu.

● Then you have to search and open the profile of the customers.

● Now you have to find and then you have to open the Credit Card Refund or Credit Memo that you want to refund.

● Select View Refund receipt in the Credit Card Refund or Credit memo window.

● At last, you have to choose Void Refund and then click on OK.

Should You Write Void on the Back of the Check?

In the payment amount box, across the payee line, and on the signature line, you would need to type VOID. Either method works well. Write the word VOID over the majority of the check, but leave the check numbers at the bottom unwritten.

What are the Process Steps to Record a Voided Check in QuickBooks Online?

First of all, click on the plus icon for New. Then you need to go to the vendors and select check under it. Now you should complete all the required fields like Bank account, check number, payment date, etc. After that, you need to select more and click on the void. Now a dialogue box will appear on the screen saying “Are you sure you want to void this?” , you need to click on Yes to confirm.

Can You Let me Know How Can I Record a Voided Check in Accounting in QuickBooks?

You need to start the process by opening QuickBooks and clicking on the Accounting and then add transaction. After that, you need to select the transaction type. You need to ensure that the ‘Is reversal’ check box is ticked at the top. Now you need to enter the expense transaction with some of the details as a voided transaction or check. After you have entered all the relevant information click on save the transaction.

List down the Steps to Enter Opening Balances of the Accounts in QuickBooks Desktop

First of all, You need to click on the chart of accounts from the company menu. After that, you need to right-click anywhere on the screen and select New and choose the correct account type. Now in the Add new account screen, fill in all the required details and click to enter the opening balance button. You need to now enter the amount of opening balance and date, if you want you can use the date before QuickBooks start date and then click on Ok. After that, you can click on the save and close button to complete the process.

Know the Steps to Force Reconcile an Account in QuickBooks Desktop

For this, You need to first click on the Gear icon located at the upper-right corner of the screen. Now you need to click on reconcile under tools. After that, you need to select the account from the Account drop-down menu list and enter the ending balance and ending date and then click on start reconciling. But you need to be aware that once you force reconcile an account in QuickBooks desktop, QuickBooks will create a transaction/ entry to adjust for the difference.

+1-800-596-0806

+1-800-596-0806