Sometimes it may be necessary for users or companies to remove a bank account from their QuickBooks accounts. They might delete them if they are no longer needed or for a variety of other reasons. The software gives consumers the option to totally delete their bank account from QuickBooks in addition to disconnecting it. Users also have the option of deactivating their accounts. Users of QuickBooks or QuickBooks Online have two options for moving forward: either use the Chart of Account option or remove the account from the Transactions page.

Dancing Numbers helps small businesses, entrepreneurs, and CPAs to do smart transferring of data to and from QuickBooks Desktop. Utilize import, export, and delete services of Dancing Numbers software.

The blog describes various reasons for bank account deletion by users. You will also learn about the many choices for deleting a bank account in QuickBooks. You will also know how to delete it from QuickBooks Online. The steps to delete the bank account have been highlighted, even for QuickBooks Self-Employed.

What is Deleting a Bank Account in QuickBooks?

While you are surfing through your record maintenance, you might be facing a need to eliminate few entries of vendors, transactions, and most importantly a dormant or ‘not so needed right now’ bank account.

When you start with the choice of deleting bank accounts in QuickBooks, you will be having two options; the first one is obviously to delete a bank account permanently and the second being deactivated the account that comes with a later recovery option.

Continue reading further to understand how to delete a bank account in QuickBooks along with associative features.

Why Delete a Bank Account in QuickBooks?

If a user no longer requires a bank account, they can delete it from QuickBooks. They might try to remove the bank account from QuickBooks at times when they don’t want to sync their data with the current bank account.

There are other reasons also why users may delete a bank account in this software mentioned below:

- A new Bank account is created by the company or user.

- By mistake users may have attached their personal bank.

- The current bank account may not be properly working.

How to Delete a Bank Account in QuickBooks?

A bank account can easily disconnect from QuickBooks and can be permanently deleted. If you want to disconnect the account then you can find the Disconnect this Account on Save option helpful. In case you want to delete a bank account in QuickBooks then you may also want to make it inactive. By selecting the Make Inactive button within the software, you can also deactivate it. By selecting the Make Inactive button within the software, you can also deactivate it.

Option 1: To Disconnect and Delete the Bank Account

Launch QuickBooks and select Banking from the left for disconnecting as well as deleting a bank account on a permanent basis. Then you have to go to the sub-tab for the Banking option. Select the account you want to delete, then hit the Edit button on it. Select Edit Account Info from the menu. Select Disconnect this Account from the Save menu under the Account menu. At this point, click Save and Close.

From QuickBooks, if you want to delete a bank permanently, follow the steps that are mentioned below:

- Launch QuickBooks for disconnecting a bank account.

- At the left of the page select Banking.

- Now, you have to move towards the Banking option sub-tab.

- Then choose the account that is to be deleted. After choosing hit on Edit button.

- Then click on Edit Account Info. From the Account menu tap on Disconnect this Account on Save.

- Lastly, you have to press Save and Close.

From QuickBooks, this will disconnect your Bank account. In case you want to permanently delete the account, then follow the steps that are mentioned below:

- In QuickBooks, look for the Gear symbol and then open Chart of Accounts.

- Then choose the account that you want to delete permanently.

- By the side of View Register, you will find a drop-down. Tap on it.

- After that, click on Delete and then confirm to delete the selected bank account.

Option 2: To Make the Account Inactive

A bank account can be deleted in QuickBooks by being marked as inactive. You must choose the Gear button on your QuickBooks account to do that. The next step is to find the account you want to delete. Go ahead and approach the Action drop-down menu. Finally, click Make Inactive.

To make an account inactive in QuickBooks go through the steps:

- Select the Gear button after running your QuickBooks account.

- Choose the bank account which you want to delete.

- After that, you have to move to the Action drop-down bar.

- Then click on Make Inactive.

How to Delete a Bank Account From QuickBooks Online?

You can delete a bank account from QuickBooks Online by selecting the Chart of Accounts option. After that, you have the option to deactivate your account by selecting the Make Inactive button. You can also eliminate it by deleting the account from the QuickBooks Online Transactions page.

The below methods will showcase the process explaining how to delete a bank account from QuickBooks Online.

Method 1: Using Chart of Accounts

A Chart of Accounts option is available in QuickBooks Online to successfully remove a bank account. You can run QuickBooks Online and look for the Accounting option. You must now select the bank account that is to be deleted by clicking on the Chart of Accounts. Tap on the drop-down icon that is next to the Action bar. You can then select the Make Inactive option. Press Yes right away to confirm the deletion of the bank account in QuickBooks Online.

- First, you have to go to QuickBooks Online.

- You will get the Accounting option on the left.

- Click on the option of Chart of Accounts.

- Then click on the bank account that you want to remove.

- Below the Action Bar select the drop-down option.

- After that, click on Make Inactive and then click on yes for confirmation.

Method 2: Eliminate from Transaction Page

When you no longer need your bank account in Intuit QuickBooks Online, you can delete it. On the left side of the QuickBooks Online window, select Transactions to get started. Choose the bank account that has to be deleted. Find and tap on the Pencil icon in the top right corner of the page. To delete the bank account, use the Edit Account Info option from QuickBooks Online. Mark a checkbox next to Disconnect this Account and your account will shortly be deleted.

- On the left of the homepage choose Transaction in QuickBooks.

- Then you have to click on the bank account that is to be deleted.

- Find a Pencil icon that is located towards the top right. Click on it.

- Now you have to press on Edit Account Info.

- At the bottom of this page, checkmark Disconnect this Account on Save.

- Lastly, head to Save and Close.

How to Remove a Bank Account from QuickBooks Self-Employed?

Users using QuickBooks Self-Employed can also remove their credit card and bank account information. But this change is irreversible. Therefore, be cautious when you decide to remove your bank account from QuickBooks. Because all the special calculations and transactions will be removed by this update.

Similar to QuickBooks Online, there are several options available if you want to delete a bank account in QuickBooks Self Employed. For example, you can choose to hide the bank account rather than delete it or remove the transactions and bank account using an iOS, Android, or web browser. By reading the below points know how to delete a bank account in QuickBooks Self-Employed:

Method 1: Remove Bank from QuickBooks by Hiding It

You can easily hide the transactions if you no longer want to view the ones from your bank account. By doing this, QuickBooks will not download any new transactions while still keeping all of your data safe. Let’s have a look at the steps

- Open a web browser and run QuickBooks Self-Employed.

- After that, select the Profile icon.

- Select Bank Accounts from the menu now.

- Then you have to choose the account that you wish to hide.

- Here, on the Show Account screen, click on the OFF option.

Your account won’t display in the account as you complete these steps. Additionally, you won’t be able to see the transactions, but the data will still be there. The same steps can be used to reactivate the account if you decide to display it. This time, all you have to do is select the ON toggle.

Method 2: Delete the Transactions and Bank Accounts by Web Browser

There are two ways to delete the bank account and transactions if you are sure you want to. For example, you can delete the data from the connected bank or credit card accounts. The transactions that you imported using the CSV file can also be deleted. Let’s know by reading the detailed steps-

Delete the Connected Credit Card and Bank Account

- First, Select Profile from the menu.

- Next, Choose Bank Accounts from the menu.

- You can perform a search for the account you want to delete here.

- Select that section by clicking the Trash symbol.

- To confirm, type DELETE and press the Delete button.

Delete the Transactions Imported from CSV File

- Choose the Profile icon first.

- After that, click on the Imports option and then choose the bank account into which you want to import a CSV file.

- Then you have to switch to the screen of Files imported and then click on the icon of Trash for the file.

You can quickly remove all bank account-related transactions by following these instructions, or you can import data from a specific CSV file. Keep in mind that you should use a web browser to complete these instructions.

Method 3: Delete the Transactions and Bank Accounts by iOS and Android

Using a mobile phone, it is possible to delete bank accounts and transactions! These steps will tell you how to delete a bank account on QuickBooks using an Android, iPhone, or iPad.

iOS Device (iPad and iPhone)

- First, you have to go to the Profile icon.

- Then you have to select the option of Settings.

- Select Bank Accounts from the menu.

- To delete a bank account, select it.

- Select Delete Bank from the menu.

- You can check this box to confirm that you really do want to stop this connection and then delete the data.

Android Tablet or Phone

- Go to the Menu by navigating.

- The Settings tab should be opened.

- Select Bank Accounts from the menu.

- Then choose the bank you want to delete by clicking the three vertical dots.

- You can select Delete Bank from this menu.

- Then, to complete the action, press the Delete button.

Is there a way to Disconnect a Bank Account in QuickBooks?

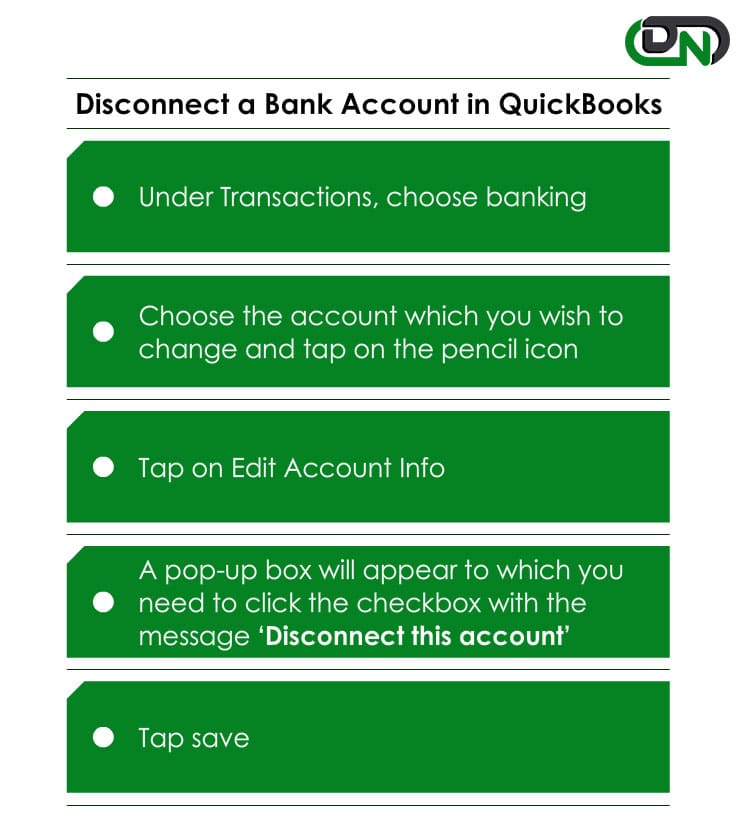

Yes, there is a particular set of steps involved for disconnecting a bank account in QuickBooks:

- Under Transactions, choose Banking.

- Choose the account which you wish to change and tap on the pencil icon.

- Tap on Edit Account Info.

- A pop-up box will appear to which you need to click the checkbox with the message ‘Disconnect this account on save‘.

- Tap Save.

This is how to use an android, iOS, or web browser to hide a bank account rather than destroy it or all of its transactions.

Disconnect Accounts Connected to Online Banking in QuickBooks Online

QuickBooks download your recent transactions automatically when you connect an account to online banking. You have the option of making the account inactive or disconnecting it if you decide you no longer require it.

Disconnecting an account from online banking and deleting it from your chart of accounts are two very different things. Here are a few tips to remember.

Understanding the Difference Between Disconnecting and Making an Account Inactive

Disconnecting an account from online banking and deleting it from your chart of accounts are two very different things.

Instead of disconnecting accounts that are connected to online banking, it is advised to disconnect them. When you will do this then QuickBooks will no longer download any new transactions. Your existing accounting information won’t change if you disconnect an account through online banking. Anytime you want to start downloading transactions then you can simply reconnect it.

Disconnect an Account Connected to Online Banking

QuickBooks deletes transactions that need to be categorized in the For review tab after you disconnect. In QuickBooks, transactions that are older than 90 days cannot be downloaded again.

Important: If you face bank connection issues, you have to wait to disconnect the account until you have resolved them. When you reconnect it after disconnecting it with issues, it might download duplicate transactions.

Below are some of the steps to disconnect an account from online banking:

- Begin by going to Bookkeeping, then you have to select Transactions, and then you have to go to Bank transaction

- Then you have to choose the tile for the bank account

- Choose Edit account info after selecting the pencil icon.

- Check the box that is next to Disconnect this account on save. You won’t see this option if QuickBooks is downloading new transactions.

- Then you can wait for a few minutes for the update to finish and then you can try again

- Lastly, You just have to save and then click on Close.

To resume downloading transactions, you have to reconnect the account.

There are several reasons why the bank account or transaction data in QuickBooks could need to be deleted. However, you can disconnect from or hide the account if you’re unsure about removing the bank from QuickBooks. This will temporarily delete the account and safeguard the data. You can also reconnect the account if necessary. If not, you may immediately delete the account. But keep in mind that this action is permanent, thus you cannot get the data back.

Looking for a professional expert to get the right assistance for your problems? Here, we have a team of professional and experienced team members to fix your technical, functional, data transfer, installation, update, upgrade, or data migrations errors. We are here at Dancing Numbers available to assist you with all your queries. To fix these queries you can get in touch with us via a toll-free number

+1-800-596-0806 or chat with experts.

Frequently Asked Questions (Faqs)

Can I undo Deleting a Bank Account in QuickBooks?

No. The change is respect to the deletion of a bank account in QuickBooks is permanent and it erases out any transactional data or calculations associated with the respective bank account. There is no way you can undo the action of deleting a bank account in QuickBooks.

How to Delete an Inactive Bank Account in QuickBooks online?

● First, you have to go to settings and then select Chart of Accounts.

● Then choose the account that you want to delete.

● Select Make inactive from the Action dropdown menu.

● Then click Yes to the pop-up.

What Happens When You make a Bank Account Inactive in QuickBooks Online?

When you deactivate an account that has a balance, QuickBooks generates a journal entry. Thus, the remaining balance is transferred to another account. Existing transactions remain on your financial records and don’t disappear.

How to Delete Your Bank Account.

First, Cancel from your bank. Many financial institutions let you accomplish this online, but it can also involve calling customer service or going to a nearby location of the bank. You might need to complete an account closure request form or send a written request to some banks and credit unions.

+1-800-596-0806

+1-800-596-0806