Understand the steps to unvoid a check in QuickBooks Desktop or QuickBooks Online by reading the following article and understanding the step-by-step procedure for a hassle-free experience. You may learn more about it here and the implementation of the steps below can teach you an important QuickBooks process.

Dancing Numbers helps small businesses, entrepreneurs, and CPAs to do smart transferring of data to and from QuickBooks Desktop. Utilize import, export, and delete services of Dancing Numbers software.

It might sound simple but some people might find the procedure to do it complex. For paychecks, QuickBooks does not have an automated unvoid function so you will have to manually unvoid certain checks that you wish to.

To Re-enter and Recover Information, Follow these steps:

- Launch QuickBooks Desktop.

- Search and open the desired transactions.

- Click on the ‘More‘ tab located on the bottom bar.

- Select ‘Audit History‘ from the options.

- Click on the ‘Show All‘ button located in the top right corner of the screen to view all edits and original details for the transaction.

- Once you have the transaction information, you can use the back button in your browser to go back to the screen where you can re-enter all the information.

How do you Unvoid a Check in QuickBooks Online and Desktop?

To unvoid a check, you must reverse the check you have voided, and your job is done.

Follow the below-mentioned instruction steps to unvoid a check in QuickBooks Online

- The first step is to start your PC with QuickBooks.

- You then have to look for and open the transactions in QuickBooks.

- Click on the tab below next to the bottom of the bar.

- Click on the History Audit option thereafter for the display bar to appear.

- Go up to the top of the screen and click all the buttons on the display.

- Here are all the changes and the original transaction information is stored.

- You can utilize the back button from the browser as soon as you receive the transaction information and be taken to the screen in which all information can be reentered.

Note: If the voided check has been reconciled, you will need to undo the reconciliation before you can un-void the check.

Follow the below-mentioned instruction steps to unvoid a check in QuickBooks Desktop

This feature allows you to enter your details again correctly, which is useful if you want to unvoid a check. However, there is one thing that you can do Audit the log. Once an invoice has been canceled, there is no way to restore it so be very sure about canceling it. The information can also be seen and re-entered in the Audit Log if you wish to do it. Carry out the actions outlined below:

- Go to the Gear symbol at the start.

- Then, go to the Tools menu and select Audit Log.

- Select the Events filters and the User Date from the list of Filter options.

- Click the Apply button.

- Find and locate the canceled invoice.

- Click View in the History column.

- Using the Audit History data after a fresh invoice with the same information has been produced.

- Transaction logs that have been invalidated or deleted, as well as freshly saved restoration transactions, have all been voided or deleted. Records should be updated after proper transactions have been added accordingly.

How to Unvoid A Paycheck in QuickBooks?

Follow the procedures below to unvoid paychecks:

- After you have launched QuickBooks, you should look for the main menu and click on ‘Reports’.

- Now, from the context menu, you should select ‘Accountants and Taxes’ followed by ‘Voided/Deleted Transactions Detail’.

- After this, under the list of voided transactions, you should go to the voided transaction that you want to retrieve. You should copy or write down the transaction amount.

- Next, you should click ‘Lists’ in the main navigation menu and then select ‘Chart of Accounts’ from the drop-down list.

- Now, double-click the account that contains the voided transaction. This would open the account register.

- It is important to know that when you void a transaction in QuickBooks, the program changes the transaction amount to zero but in the account register it still continues to show the transaction.

- The next step for you is to scroll through the transactions in the account register, then click and highlight the voided transaction.

- To end this task, you should now type or paste the original transaction amount into the amount field on the transaction.

- Finally, click the ‘Save’ or ‘Record’ button to restore the transaction with the retrieved information in the account register.

How to Find Voided Transactions in QuickBooks?

- If you wish to observe empty transactions, open QuickBooks first

- Turn to the gear icon next to and hit the same button

- Go to Tools now and choose the Audit Log option Tools

- Use the filters later so you can obtain the needed comprehensive information

- Tick the button Apply and then you’ll see the list of vital facts.

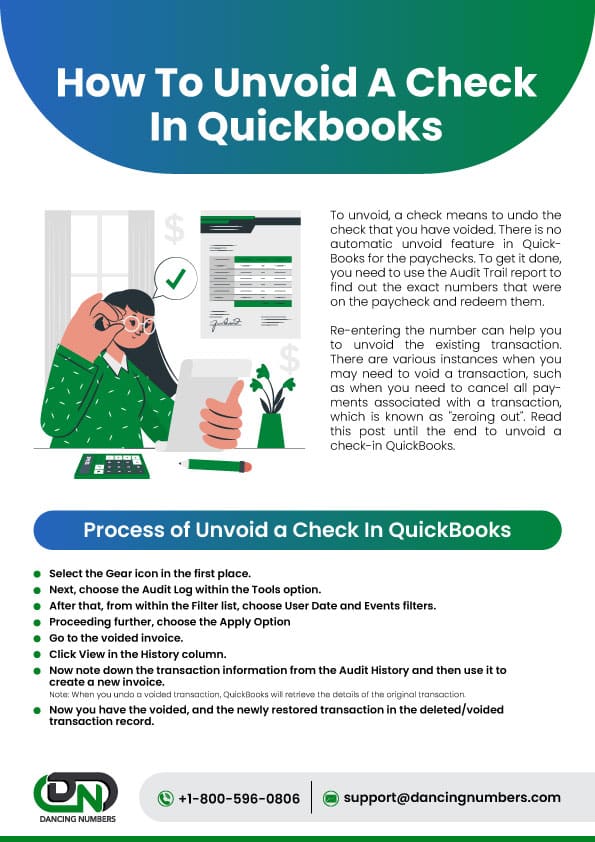

Infographics to Unvoid a Check in QuickBooks

You can void a check in QuickBooks Desktop and online easily by following the detailed step-by-step procedure. You also get to know that it can be possible to unvoid a check easily. For any further queries and issues, you can get in touch with the team of Dancing Numbers. The members of the team are highly professional with many years of experience. So you definitely get the assistance best way possible and also get your doubts and problems cleared in a short time span.

Looking for a professional expert to get the right assistance for your problems? Here, we have a team of professional and experienced team members to fix your technical, functional, data transfer, installation, update, upgrade, or data migrations errors. We are here at Dancing Numbers available to assist you with all your queries. To fix these queries you can get in touch with us via a toll-free number

+1-800-596-0806 or chat with experts.

Frequently Asked Questions (Faqs)

How to Perform the Mini Reconciliation after Unvoid a Check in QuickBooks Online?

In QuickBooks Online, click on the Accounting menu option

In QuickBooks Online, click on the Accounting menu option Further, select the Reconcile option

Further, select the Reconcile option Go to the Account drop-down arrow

Go to the Account drop-down arrow From the drop-down list, choose the account you want to reconcile

From the drop-down list, choose the account you want to reconcile You have to enter the Ending balance and the Ending Date as the beginning balance is already there

You have to enter the Ending balance and the Ending Date as the beginning balance is already there When you are done, click on the Start Reconciling button

When you are done, click on the Start Reconciling button It reconciles and you are done.

It reconciles and you are done.

What is the Difference Between Void or Delete and how it helps to Unvoid a Check in QBDT and QBO?

If you delete a check then you cannot reverse it into your books. Deletion also affects your QuickBooks transactions. But if you void a check then you can easily unvoid a check in QuickBooks software. Voiding a check won’t affect your other transactions that are related to that check.

Can I Recreate a Voided Check instead of Unvoid a Check in QBo?

You have to create a new check by using all the same information from the voided check in your QuickBooks account. You can recreate any check you want to if it is voided. After recreating it you have to correct the balances to maintain the correct amount in your books.

Is it possible to undo a voided check in QuickBooks?

Yes, voided checks can be easily undone and restored to their original state. However, if a check has been deleted, all associated information will also be deleted from the register. If no record of the check was created, the undoing process can only be performed through the audit trail.

Can you unvoid a check in QuickBooks?

Yes, it is possible to unvoid a check as long as the check has not been reconciled. However, if the voided check has already been reconciled, you will need to undo the reconciliation before you can unvoid the check.

+1-800-596-0806

+1-800-596-0806