As an accounting software suite, QuickBooks was created by Intuit. Small and medium-sized enterprises are the main target market for QuickBooks products. These packages also provide cloud-based and on-Premise Accounting software, which may be used to manage and pay invoices, receive payments from clients, and ensure that payroll processes run smoothly. Payroll Reports are the documentation that employers use to inform the government of their payroll and employment tax obligations.

Dancing Numbers helps small businesses, entrepreneurs, and CPAs to do smart transferring of data to and from QuickBooks Online. Utilize import, export, and delete services of Dancing Numbers software.

The QuickBooks Payroll Report is covered in-depth in this blog. Before getting into how to set up a QuickBooks Payroll Report, it begins with an overview of QuickBooks and Payroll Reports.

Introduction to QuickBooks

As you track sales, create, generate, and transfer invoices using QuickBooks Accounting software, your accounting data can be organized in the Cloud. Additionally, it provides constant feedback on the state of your company. You don’t need to be an expert in accounting or finance to get the hang of using QuickBooks because it’s so simple to use.

You can enter vendor bills into the accounting software QuickBooks and only make payments that are ultimately due. It’s possible to set recurring payments to save time. Additional features in the QuickBooks Accounting Software include free, unrestricted assistance that may help you with questions and also give you advice on how to operate your company.

You may examine your cash flow in real time with QuickBooks. You can link your bank account to import and automatically classify transactions. To quickly take images of your receipts, you may also simply integrate and sync with well-known applications. These receipts can be kept in QuickBooks Mobile.

You have access to effective invoicing features like Payment Reminders and Invoice Tracking with QuickBooks Accounting Software. To assist you in managing your costs, you can view dozens of reports. The mobile app can be used to run your company while you’re on the go.

Introduction to Payroll Reports

Depending on the type of tax, Payroll Reports assist you in reporting your company’s liabilities. Employer contributions to taxes and employee payroll taxes deducted from wages can both be reported using QuickBooks Payroll Reports. Lenders and government organizations can use your payroll reports to analyze the payroll costs for your company. When requesting a company loan, this can be useful.

Filling out payroll reports can be made comparatively simple by using payroll software. With a lot of payroll service providers, you may obtain particular documents directly in your program, fill them out, and send the completed forms to the appropriate organizations. Depending on your payroll service provider, you may also choose a full-service payroll software package that submits your payroll reports.

Requirement of the QuickBooks Payroll Report

To manage and analyze your payroll data, QuickBooks Payroll provides a number of reports. Depending on the version and edition of QuickBooks you are using, the particular requirements for Payroll reports may change. Following are some payroll reports which are used:

Report on Payroll Expenses

For a given time period, this report gives you a summary of your payroll costs. It often contains details like total compensation, taxes deducted, employer contributions, and each employee’s net pay.

Payroll Detail Report

This report offers a thorough analysis of payroll transactions for a specific time frame. Individual employee pay, deductions, taxes, and employer contributions are all included.

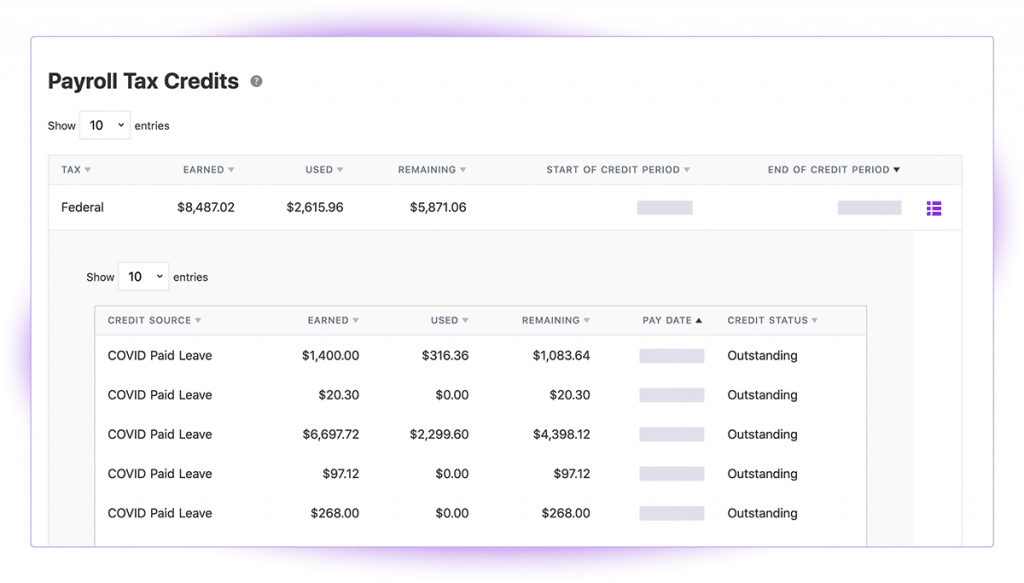

Report on Payroll Tax Liabilities

This report details your obligations for federal, state, and municipal payroll taxes. It gives details about the owed sums, tax rates, and any outstanding balances.

Payroll Item Detail Report

This report gives you the overview of each payroll item that was utilized in your payroll transactions. Information like the item type wage, deduction, contribution, quantity, rate, and amount are included.

Employee Earnings Summary Report

This document provides an overview of employee earnings for a certain time frame. Regular salaries, overtime, bonuses, and other categories of earnings are often included.

Employee State Taxes List Report

State taxes withheld for each employee are listed in this report, which is called the Employee State Taxes List Report. It contains details about the imposed taxes, their amounts, their rates, and any applicable exemptions or deductions.

Employee Details Report

This report gives you a thorough breakdown of all the payroll data for each employee, including their salaries, benefits, taxes, and employer payments. It may also contain information on the individual, their employment, and their benefits.

Benefits of QuickBooks Payroll Report

There are a number of benefits that QuickBooks Payroll Report provides that can improve and streamline your payroll administration process. Several of the main advantages are as follows:

Accuracy

The QuickBooks Payroll Report makes sure that employee salaries, deductions, and taxes are calculated and tracked accurately. Compared to human computations, it automates complicated calculations and lowers the possibility of errors.

Time-saving

The software automates a number of payroll chores, including figuring employee hours, creating pay stubs, and creating tax forms. For business owners or payroll administrators, this automation saves a lot of time.

Compliance

QuickBooks Payroll Report aides in making sure that tax and payroll requirements are followed. It tracks accruals, calculates and deducts taxes automatically, and produces the relevant tax documents, like W-2s and 1099s.

Customization

The reports can be modified to meet your unique business requirements. Employee earnings, deductions, tax liabilities, and year-to-date totals are just a few examples of the data you can select to include in the reports.

Analysis

The QuickBooks Payroll Report offers insightful analysis of your payroll data. On the basis of the information, you can assess trends, spot patterns, and make wise decisions. This aids in staff planning, forecasting, and optimization.

Employee Self-Service

QuickBooks Payroll provides access to employee self-service portals where workers may view their pay stubs, W-2 forms, and update personal data. By providing employees with self-service options, this lessens the administrative strain.

Integrating

It is seamlessly with other QuickBooks modules like accounting and time tracking is QuickBooks Payroll. By removing the need for human data entry and lowering the possibility of mistakes, this integration guarantees continuous data flow between various operations.

Accessibility

QuickBooks Payroll is available online and may be used from any location. You may simply work with your team thanks to this and manage payroll remotely while also reviewing reports on the fly.

Savings

By automating payroll procedures, QuickBooks Payroll demand for time-consuming manual work like data entry and computations.

Working of the QuickBooks Payroll Report

The QuickBooks Payroll Report functions as follows:

Payroll Data Entry

It’s important to make sure that all pertinent payroll information is an input into QuickBooks accurately in order to provide accurate payroll reports. It is included in this are the names of the employees, their compensation, hours worked, tax deductions, and any other information pertaining to payroll.

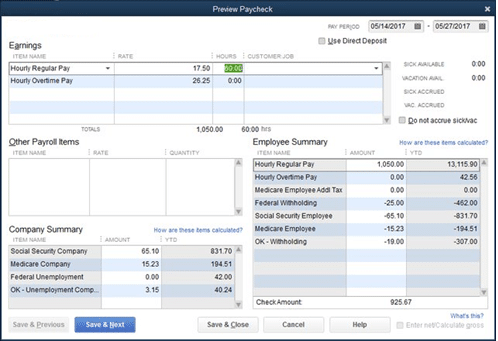

Processing of Payroll

Using the data entered, QuickBooks processes payroll and determines a required deductions and withholdings. This covers taxes paid to the federal, state, and local governments as well as Social Security, Medicare, retirement contributions, and any additional deductions unique to your company.

Report Generation

After processing the paycheck, QuickBooks enables you to produce a number of payroll reports. These reports give you thorough details on your payroll costs and aid in your analysis of the financial effects to your payroll-related activities.

Type of the Payroll report

QuickBooks provides a variety of pre-built payroll report types, including:

- Payroll Tax Payments

- Employ Deduction

- Employ Earning

- Payroll Detail

- Tax Liability

Customization

QuickBooks enables you to modify the payroll reports in accordance with your particular needs. To hone in on specific information in the report, you can change columns, add or remove data fields, and use filters.

Analysis and Decision-Making

The payroll reports created by QuickBooks enable you to analyze your payroll costs, spot trends, monitor changes over time, and arrive at well-informed choices regarding staffing, budgeting, and tax planning.

Exporting and Sharing

You may export the payroll reports from QuickBooks to different file types, including PDF or Excel, and then distribute them as necessary for your accountant, the management group, or other stakeholders.

Overall, QuickBooks Payroll Report makes managing payroll easier by offering thorough reports that let firms efficiently track and examine their payroll-related operations.

Understanding QuickBooks Payroll Report Setup

You can access vital data about your employees and business using a variety of QuickBooks Payroll Reports. The following are the many payroll report types:

- Employee Directory: This report can be used, among other things, to confirm an employee’s job, salary, and tax information.

- Employee Details: These reports include information about the employees, such as payment details, employment information, payroll details, and more.

- Paycheck List: This report shows a list of the paychecks you have received. You can edit or modify print pay stubs, cheque numbers and other information in the Paycheck List Report.

- Multiple Worksites: For the selected quarter, the Multiple Worksites Report shows the total wages each quarter. The amount of employees by month is also displayed.

- Retirement Plans: The business and employee contributions to your retirement plans are taken into account here.

- Time Activities by Employee Detail: This report discusses the services (time activities) and goods that each employee provides, along with their duration and hourly rates.

- Total Payroll Cost: This term refers to all expenses incurred while paying your employees, includes taxes, deductions, and net pay.

- Total Pay: The sums of the wages of employ are broken down per pay category.

- Holidays & Sick Days: The Vacation and Sick Leave Report is a thorough summary of an employ accrued vacation and sick time, including the hours used and the remaining balance.

- Worker Compensation: The salaries received for each Worker Comp class are discussed in the study on Worker’s Compensation.

Following are the elements of a QuickBooks Payroll Report:

- Net Pay: This is the sum that an employee really earns after all withholdings and taxes are applied. This is the number that appears on checks or is included in direct deposits.

- Gross Pay: Gross pay is the sum an employee receives before any withholdings or taxes.

- Adjusted Gross Pay: A worker’s adjusted gross pay is the amount received less any pretax deductions, such as a 401(k) plan contribution made by the employee.

- Employer Taxes and Contributions: This section of the report shows the total accrued throughout a reporting period. No matter if your business paid them or not, this still applies.

Steps for creating the Payroll Summary report in QuickBooks:

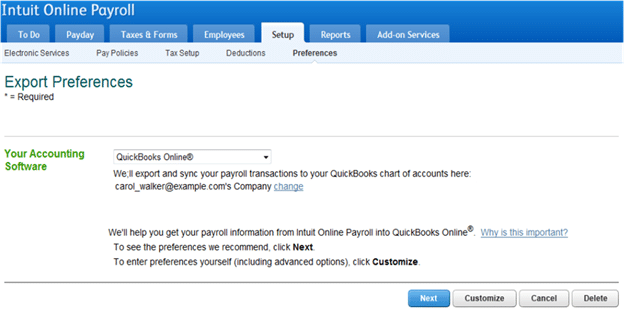

Intuit Online Payroll Report

- First you have to select Payroll Summary from the Reports Tab.

- Now, Navigate and choose a date range from the drop-down menu.

- To run the Intuit Online Payroll Report, Choose a single employee or a group of employees and click Run Report.

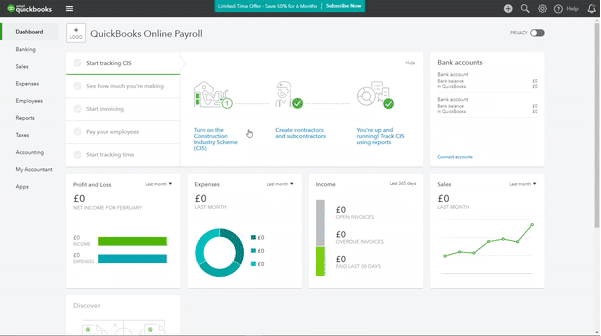

QuickBooks Online Payroll Report

- Navigate to the Reports menu and then select Payroll from the list of sections and select Payroll Summary.

- A date range should then be selected from the drop-down menu.

- Choose one employee or alternatively and choose a number of workers.

- To execute the QuickBooks Online Payroll Report, select execute Report.

QuickBooks Desktop Payroll

- First select reports and then Employees and Payroll.

- After that, Choose Payroll Summary and modify the date range as necessary.

This article discusses all the various features of QuickBooks Payroll Reports in depth, including how to utilize them and the simple setup instructions.

It comes to the rescue in this situation because it can be difficult to extract complex data from a variety of data sources. We provide you a quicker way to transfer data from databases or SaaS programs like QuickBooks into your data warehouse so it can be viewed in a BI tool.

Looking for a professional expert to get the right assistance for your problems? Here, we have a team of professional and experienced team members to fix your technical, functional, data transfer, installation, update, upgrade, or data migrations errors. We are here at Dancing Numbers available to assist you with all your queries. To fix these queries you can get in touch with us via a toll-free number

+1-800-596-0806 or chat with experts.

Frequently Asked Questions

What are the Payroll Reports?

Employers use a payroll report as a document to confirm their tax responsibilities or to double-check financial information. It might contain data on pay rates, number of hours worked, overtime earned, taxes deducted from paychecks, employer tax payments, remaining vacation balances, and more.

Is QuickBooks Used for Payroll?

Yes. Payroll services are available with all QuickBooks Online Payroll options. You will thus get full-service features in addition to automatic payroll. Automated tax and form processing: Payroll taxes, both federal and state, are computed, filed, and paid automatically, as are your year-end filings.

What are the Types of Payroll?

- Systems for managing payroll internally.

- Payroll systems that are expertly managed.

- Payroll System Agencies Manage Payroll Services.

- Payroll systems managed by software.

Who Prepares the Payroll Report?

Finance Department is the one who prepares the payroll report.

What are the Payroll Basics?

Payroll refers to the business’s accounting for all payments made by the employer to the employees, including wages, bonuses, salaries, incentives, etc. Every employee of the company, from the time they are hired until they retire or resign, must have their payroll prepared by the company.

+1-800-596-0806

+1-800-596-0806