The Trial Balance Statement is mostly created at the end of a particular accounting period. Not to mention, it is a common activity of current accounting systems to automatically edit, create, and report the trial balance. When the QuickBooks trial balance report is run, it is possible to spot potential errors along with irregular account balances too. Likewise, there are several other benefits of using trial balance reports. In today’s article, we will talk in detail about the trial balance report.

Dancing Numbers helps small businesses, entrepreneurs, and CPAs to do smart transferring of data to and from QuickBooks Online. Utilize import, export, and delete services of Dancing Numbers software.

In addition to it, we will also talk about how to do a trial balance in both QuickBooks Desktop and QuickBooks Online.

Let us first learn about QuickBooks Trial Balance.

What is QuickBooks Trial Balance?

Trial Balance assists you to monitor and see the precision of credit and debit amount registered in separate ledger accounts. It is actually a statement that shows the total debits and credits of the ledger accounts. Such type of statements are created to authenticate the arithmetical accuracy of posting multiple journal entries in the particular ledger accounts.

Thus, Trial Balance is a crucial accounting statement since it displays the last status of every ledger account when the financial year ends. These final results of balances also assist you to make final accounts like the Profit and Loss Statements and Balance Sheet.

Benefit of Trial Balance in QuickBooks

- It helps in detecting error if there is in summation of Debits and Credits.

- It helps in detecting Abnormal Account Balances.

- It detects the Negative Balance in Expense Account Which you need to Rectify.

Making of Trial Balance Sheet in QuickBooks

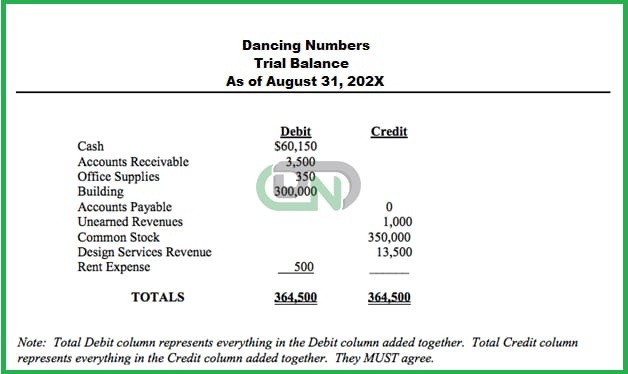

For preparing trial balance sheet you need 3 columns that are:

- Left Column: Its label can be Cash, Account Receivable, Land, Account Payable, Utilities Expenses.

- Debit Column: In contains the Amount Which is Debited (gave some one) from our Account.

- Credit column: In contains the Amount Which is Credited (receive from someone) in our Account.

In order to start working on trial balance sheet you need

- Firstly, Prepare your List of Accounts.

- Then Add Columns in it.

- It should also Contain Column of Adjust Journal Entries.

In the trial balance the account must be appear in the following manner:

- Assets

- Liabilities

- Equity

- Dividend

- Revenues

- Expenses

In the assets category the asset which is closer to becoming cash will appear in first and the least appear in last.

In the liability category those liabilities which come with the shortest maturities appears first and with the largest maturities appears in last.

In last total the debits and credits which are come from T-accounts or ledger card. If the left side balance is greater in T-Account then balance is debit and if the right side amount is greater than the balance is credit. The balance is to be calculated after each transaction while you are using Ledger card. The balance must be equal to the balance of normal account.

For Example:

Advantages of Trial Balance in QuickBooks

The trial balance help in verifying the accuracy of your ledger accounts. It also helps in preparing the financial statements. A Trial Balance helps in the following areas:

1. Find out the Accuracy of the Ledger Account

- The first step is to determine if all your debit or credit entries are recorded properly or not.

- It provides you the summary of general ledger account.

- If the debit column is equal to the credit column then the financial transaction is recorded properly.

- Keep in mind that if the credit and debit amount is equals it doesn’t means that your account is accurate. It just means that you have recoded transaction correctly.

2. Finding Errors

Accounting errors occur in any stage of the accounting process. Following are the accounting process stages:

- Sum up the subsidiary books.

- Recording of journal ledger in journal entries of the transaction.

- Calculating the balances of the various accounts.

- Carrying the balance of the accounts to the trial balance sheet.

- Balancing the trial balance columns.

3. Preparing of Financial Statements

- The correct balance statements help in preparing basic financial statements including the income statement and balance sheet.

- With the help of correct and balance out trial balance sheet you can easily prepare the Financial Statements. There is no need to go through each and every ledger account.

- All the revenue and expenses of trial balance must be shown in trading and profit and loss account.

- The company balance sheet shows the detail about all your liabilities, assets, capital account which are appearing in the trial balance sheet.

4. Helps in taking Managerial Decisions

- The company manager can find out the financial or the growth of the company easily by the trial balance sheet.

- Company can easily track about some of the important accounts like purchase, debtor, sales etc.

- Business management can do comparative analysis and peer analysis.

- Analysis helps business to understand the business trends and able to take the step according to their needs.

- The decision taken by the company is like manufacturing cost, business expenses and incomes etc.

- The management comes up with the financial budget for the coming accounting period.

5. Summary of Financial Transaction

- It provides the detail summary of financial transaction of your business.

- Company can prepare summaries by transferring the balances of various income, assets, liability, expenses and capital account.

- These summaries help you to locate journal entries in the original book of accounts.

- It helps in carry out the audit of your financial statement.

- You can provide the comments in order to prepare the audit report.

How to Use Trial Balance Sheet in QuickBooks

Trial balance sheet is a is a internal report which you prepare to make ensure that journal entries are correctly balance in ledger. Lets understand the various uses of trial balance sheet. Following are the uses:

- It is the initial step in order to prepare the basic financial statement. These statements are the Balance Sheet of the company and trading and Profit and Loss Account.

- It helps in finding the error in the account. You can easily find the error if there is by tallying the sum of your both the column i.e is debit and credit. If the amount of both the column is equal that means there is no error in the account but if there is error then you should find for it.

- It helps in assuring the arithmetical accuracy of the general ledger account.

- It helps in giving the snapshot of the transaction to the accountants and the auditors.

- If there is any error you can easily find it and adjust it.

Trial Balance Includes

Trial balance sheet include the following in it:

- The list of general ledger accounts ending with the debit and credit balances.

- It includes the account number of each General Ledger Account.

- Description of accounts is also included in the trial balance sheet.

- It shows name of the entity and the date of financial period.

- It also shows the adjustment entries.

- It shows adjusted and unadjusted balances of the ledger accounts.

- It shows financial transaction separately by the accounts.

How to Generate a Trial Balance Report in QuickBooks Online

Step 1: Go to the Report at left menu bar, and after that start typing the “Trial Balance” in the search field at Go to Report.

Step 2: Then Select the Trial Balance from the list and change the date in on the screen to reflect the dates you want.

How to Run Trial Balance by Class in QuickBooks Desktop?

In order to run the QuickBooks Trial Balance report in the particular desktop version, it is compulsory to go via the Reports menu. From here, you need to open the Trial Balance report and then implement the relevant filters.

Here are the steps to run a trial balance by class in QuickBooks Desktop:

- Press on the Report menu.

- Now go down and select the section Accountant and Taxes.

- Now, Select the Trial Balance option.

- Press the Customize Report option.

- Press on the tab for Filters.

- Now you can locate the Accounts field.

- Now choose the option for Multiple Accounts with the help of the Account drop-down.

- Once completed, You can choose the accounts that you want to add in the report.

- Now, Press the OK option.

Note: Once the steps are completed, the customization can be saved as well. It will assist you to use the same report with the identical customization preferences. Not to mention, you do not require to customize the report once more.

How to Run Trial Balance in QuickBooks Online?

A trial balance report usually summarizes the debit and credit balances of every account present on the Chart of Accounts during the particular tenure. It is also possible to customize a reporting period while running the QuickBooks Trial Balance report. It will provide you with a monthly report of the particular trial balance.

Here are the steps to run trial balance by class in QuickBooks Online:

- Navigate via the Reports menu

- Now begin looking for the Trial Balance report

- Shift to the field for Report Period and select the particular month you want to display

- Click the Run Report button

Note: With the help of the steps mentioned above, it is possible to run the trial balance report. If needed, it is possible to save the customization for this particular report. It will assist you to get the data with the identical customization settings for any other time when you try to run the report.

How to Find the Detail Trial Balance in QuickBooks?

If you wish to find the traditional trial balance reports in QuickBooks, you can keep performing the steps provided below:

- Navigate via the Reports menu.

- Now select the Accountant and Taxes option.

- Choose the Trial Balance option.

- Post this, You can edit the date range of your particular report.

Note: If you access the Accrual Reporting process, then it will assemble the balances automatically even prior to the period that you have fixed on your particular report. Post this, you can edit it to the Cash. When you do so, the report will show expenses if payment has been done and income, in case you just received it.

What are the Benefits of QuickBooks Trial Balance?

As mentioned before, trial balance assists in authenticating the ledger account precision. Hence, it is a crucial statement in the particular accounting process. Apart from this, there are many advantages of accessing this trial balance.

Here is the list of the benefits:

- Trial balance assists in identifying the errors. In case the debit balance of your trial balance is not same as the credit column, then you can easily locate the accounting errors.

- It is possible to take managerial decisions with the help of trial balance. It means your company manager will be able to distinguish between the trial balance of other years very easily and then determine the changes in balances.

- It assists you in determining the precision of your particular ledger accounts in QuickBooks. In simple words, you can authenticate all the debits and credit entries and check if they are getting registered properly in the ledger accounts.

- Thanks to trial balance, users can create income statements and balance sheets seamlessly. Hence, you do not need go through the particular ledger accounts while creating the financial statement.

- Trial balance also assists to summarize the financial transactions. Such type of summaries will allow you to know how to view the journal entries in an actual accounting book. Such type of summary can be created by shifting the balances of other income, expense, capital, liability, and asset accounts.

- Not to mention, Trial balance will also provide you with a snapshot of your accounting transactions of your business to the accountants and auditors.

- Trial balance will make sure that you conduct the adjustments to the account, in case any error occurs.

How to Fix Possible Data Errors?

There can be cases when you encounter some issues concerning the data. In such scenarios, it is possible to run the rebuild and verify tool. Once you have verified the data, you can discover the issue with the help of the rebuild data utility you can solve the possible issues.

Here are the steps to fix possible data errors:

- Navigate to File menu.

- Now select the Utilities option.

- Press on the option for Verify Data.

- In case there are no errors, press the button for OK and keep using the particular company file. However, if you witness any error then press on the button for Rebuild Now.

- Now you will need to wait as the rebuild data utility begins running.

- When it is finished, press the OK button. It will solve your data issues. After that you can use the company files along with reports in QuickBooks Online and QuickBooks Desktop.

Error Correction

Follow the steps in order to correct the error:

- Firstly try to re-totaling of the two columns.

- Then divide the difference of total by 2 and then by 9.

- If the difference of the total is divisible by 2 then it means that you must have transfer debit balance to credit or credit balance to debit.

- In this case you must look for the amount in Trial Balance which is equal to one half of the difference.

- If the difference of the total is divisible by 9 then it means that made transposition error in transferring balance to the trial balance or a slide error.

- Transposition error means error occurs due to reverse of two digits.

- Slide error means error occurs due to incorrect placement of decimal.

- In this case you must compare the trial balance amount with the general ledger account balance.

- Search for the error in Post part of Journal Entry.

- Posting of debit amount as credit or credit amount as debit.

- You must be determining the balance incorrectly.

- You are recording the balance of account incorrectly in trial balance.

- You must omit any of the account from the trial balance.

- Transposition or slide error.

How to Make Adjustments to Trial Balance in QuickBooks?

Accountants and bookkeepers make adjustments to trial balances in QuickBooks to fix small errors or record uncategorized transactions. If your trial balance is out of balance and you don’t know why, always use the above procedure to identify the issue and resolve it!

In case you want to make an adjustment to your QuickBooks trial balance, the process is mentioned below:

- You have to choose the company that you are entering an adjustment for

- Then you have to click New and then choose Journal Entry

- You will be asked if this is an adjusting entry then you have to click yes

- Then you have to follow the prompts to complete the adjustment

- At last. Save and close

How to Print a Working Trial Balance in QuickBooks?

In order to share trial balance reports with people who don’t have access to your software, or for management meetings, etc., you often need to print them out in QuickBooks.

- Select Reports from the Accounts menu to get started.

- Choose Trial Balance from the list of options, then click Customize to specify the accounts and date range you wish to print for.

Select the print option after saving. If you are printing this report for the first time, you might need to perform a print setup.

We hope that all your questions concerning QuickBooks Trial Balance by class have been answered in this article. Still, if you some questions left or need to resolve any query regarding the concerned topic, we highly recommend that you get in touch with our team of experts.

In order if you have any query regarding the trial balance sheet then you can call us, our expertise make sure that you will understand and able to do work easily in the trial books. With this you can easily complete your job without any error is less time.

Looking for a professional expert to get the right assistance for your problems? Here, we have a team of professional and experienced team members to fix your technical, functional, data transfer, installation, update, upgrade, or data migrations errors. We are here at Dancing Numbers available to assist you with all your queries. To fix these queries you can get in touch with us via a toll-free number

+1-800-596-0806 or chat with experts.

Frequently Asked Questions

How can I get Trial Balance Report in QuickBooks Desktop?

BY performing the following steps you can get the trial balance report in QuickBooks Desktop:

Click on the report menu in QuickBooks online account.

Click on the report menu in QuickBooks online account. In the search menu enter journals and click the report in order to open it.

In the search menu enter journals and click the report in order to open it. Now set the report period date.

Now set the report period date. Click on the customize button.

Click on the customize button. Scroll down and click on the changes of column.

Scroll down and click on the changes of column.

Is Trial Balance and Balance Sheet are same?

Trial balance is the first step towards preparing the balance sheet of the company.

What do You Mean by Trial Balance Report?

Trial balance report is a book keeping worksheet in which balance of all the ledgers are calculated in credit and debit account and the amount of the both credit and debit must be equal.

How can I Extract Trial Balance from the QuickBooks?

Steps to be performed are:

Click on the report tab.

Click on the report tab. Select accounts and taxes.

Select accounts and taxes. The trial balance sheet page is open.

The trial balance sheet page is open. Now set the date in the trial balance sheet and then click on the excel drop down menu.

Now set the date in the trial balance sheet and then click on the excel drop down menu. Choose create for creating the new worksheet.

Choose create for creating the new worksheet. In order to export follow all the on screen instructions.

In order to export follow all the on screen instructions.

What is the Another Name of the Trial Balance?

In accounting language or in accounts it is known as books.

In accounting language or in accounts it is known as books. In balance sheet it is known as financial statement.

In balance sheet it is known as financial statement.

How many Types of Trial Balances are There?

There are three types of balances are:

Unadjusted Trial Balance

Unadjusted Trial Balance Adjusted trial balance.

Adjusted trial balance. Post closing trial balance.

Post closing trial balance.

What type of Reports is Generated in Trial Balance?

Two types of report are there:

Summary Report

Summary Report Detail report

Detail report

Why Trial Balance Sheet is Generated?

It is used to see whether the total of debit balances is equal to the credit balance.

What is the Formula of Trial Balance?

The Formula is:

Liabilities + Revenue + Owners equity

What are the Keys used for Reporting Types in QuickBooks Online?

QuickBooks Report types are:

Transaction Reports

Transaction Reports List Report

List Report Summary Reports

Summary Reports Detail Reports.

Detail Reports.

What are the Untraceable Errors in Trial Balance?

It is crucial for every business owner to tally the trail balance sheet that comprises both debit and credit journal entries for all financial transactions that is registered systematically. However, there can be cases when the trial balance is not precise.

+1-800-596-0806

+1-800-596-0806