|

|

Before starting on the process part, let us first look into the relevance of the undeposited funds in QuickBooks. An undeposited funds account in QuickBooks holds invoice payments and sales receipts you wish to combine. Know How to Clear or Delete the Undeposited Funds from the Bank Deposit.

Dancing Numbers helps small businesses, entrepreneurs, and CPAs to do smart transferring of data to and from QuickBooks Desktop. Utilize import, export, and delete services of Dancing Numbers software.

It is a temporary virtual space for holding the payment till the time you do not have the deposit slip. Once you have your deposit slip then you can make a bank deposit in QuickBooks to match the undeposited funds.

What are the Undeposited Funds in QuickBooks Accounting Software?

In QuickBooks, there is an account for undeposited funds. In this account, there is information about the payment, received from clients. When a payment is made via a check or any kind of sale receipt, the amount information is added to the account. Then that is perceived as Undeposited Funds in QuickBooks.

What Leads to a Buildup in Undeposited Funds?

A buildup in undeposited funds is caused by wrongly following the industry benchmark methods for the money-in transaction. A buildup in a particular undeposited fund arises when you do not deposit the money and register the payment as the right income. Rather, You just add it to any income account from the particular banking sector of your QuickBooks account.

As a result, It leads to an uncategorized income of your earnings and the payment itself stays as an undeposited fund.

The Undeposited Fund’s Account is an internal other current asset account that is created by QuickBooks itself. The feature helps in the invoicing process by connecting receive payment and bank deposit features in QuickBooks.

Now if there are a lot of old entries in your QuickBooks undeposited fund account, then you would like to clean up these entries, it is recommended that you apply the utmost care while doing this.

You should be clearing or deleting only those entries from the undeposited funds account in QuickBooks where the money has been deposited in the correct bank accounts and everything is reconciled.

In other, you should be deleting only those entries which are not required anymore. Now that we have a good understanding of the purpose of the Undeposited Fund Account in QuickBooks, Let us move ahead and look into the process steps of clearing or deleting the fund from the bank deposit in QuickBooks in the next section.

How to Clear the Undeposited Funds from Bank Deposit in QuickBooks

So, Once you have decided to clear the undeposited funds account, you can follow the below steps to do so. But do ensure that you reconcile the data first because only those entries should be deleted that have been already assigned to the bank register. In other words, The entry that is already posted everywhere and is no longer required to be reflected in the undeposited funds account should be cleared out.

Steps to Reconciling the Data

- First of all, Open QuickBooks Online > Click on settings and then click on Reconcile. You need to take out your Bank Statement for Performing Reconciliation so keep it handy.

- In this Step, Choose the Bank Account, Enter the Start and End Date from the Statement, and click Start Reconciling. Now Start Matching or Reconciling every Entry from your Bank Statement to the Corresponding Item on the Screen.

- Verify the Balances by Matching from the Top once you are Done with one-to-one Transaction Matching and Click on Finish.

If you are able to Reconcile the Bank Data Successfully without any issue, then the Transactions or Entries left in the Undeposited Fund Account are Duplicate ones and need to be deleted. Let us see below the steps for doing so:

Steps to Clear out Undeposited Funds

- First of all, Click open QuickBooks Online and Click on the Plus icon, and After that click on Bank Deposit.

- Now Go to the Payment that is Duplicate and needs to be Deleted and Click on the Customer’s Name to open the Transaction.

- Now go to the Bottom of the Payment Screen Click on More and then Select Delete to Clear the Entry.

How to Clear Undeposited Funds in QuickBooks Online?

To clean up undeposited funds in QuickBooks, generally, two kinds of methods are used. The first one is the Remove and Record method. In this method, the incorrect entry in the Uncategorized Find is deleted. After that, the particular entry is made in your bank account.

The second method is the Dummy Bank Account method. In this method, the undeposited funds are cleared and then they are sent to a dummy account.

Read on to understand how these two methods function.

Solution 1: Remove and Record Process

In this particular Remove and Record process, any transaction that is uncategorized with cash inflow is overturned in QuickBooks. It assists in clearing the particular undeposited funds in the QuickBooks software.

It also deletes the error from the particular Banking entries, and after that, the real amount is added with the right details. A systematic bank account is required to be chosen while re-entering the particular amount that is to be deposited.

Here are the steps to clean up undeposited funds in QuickBooks Online with the help of the Remove and Record Process:

- Open Your Particular QuickBooks Account.

- Go to the Banking Tab.

- Press on the Option, Bank Account from the given Drop-down.

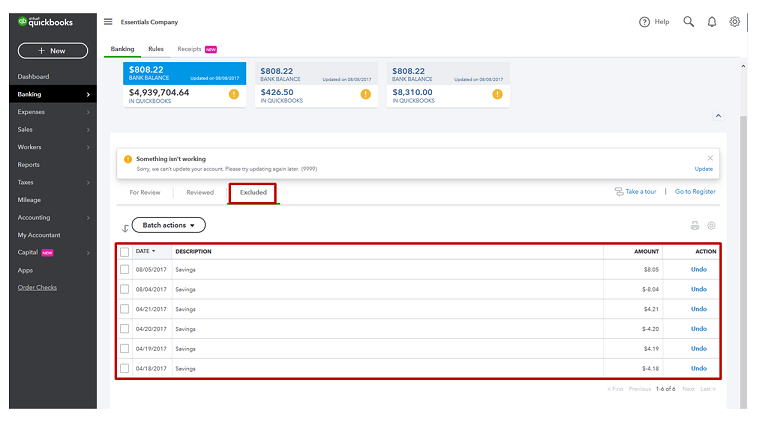

- Press Undo in the Uncategorized Money-in Transactions option.

- Now, Navigate to the Bank Deposit Tab.

- Choose the Bank Account on Which You Need to Focus.

- Add the Payment Date and then Choose the Removed Payment.

- Press Save.

- Press Close.

Note: With the help of this method, you will be able to clear the particular payment amount from the given Undeposited Fund account. Now the said amount will be added to your real-time account.

Solution 2: Dummy Bank Account Process

In this Dummy Bank account method, you will be required to make a dummy bank account to remove the undeposited funds of QuickBooks. It will help you to transfer the amounts from the Undeposited Fund account to the particular bank account directly. Finally, you can shift the amount from the given dummy account to any given real-time account.

Here are the steps to clear up undeposited funds in QuickBooks Online via the Dummy Bank Account method:

- Open the QuickBooks software.

- Navigate to the Settings tab.

- Press the Chart of Accounts.

- Press Create New.

- Give a Name to the New Account as a Dummy Bank Account.

- After Adding all the required fields, Press Save.

- On the given Home page of QuickBooks, Navigate to the Particular Tab for Bank Deposits.

- Press on the Dummy Account.

- Choose all the Payments that you wish to Clean from the Particular Undeposited Fund Account and then Save the given Page.

Note: In this step, the amount will be shifted from the particular Undeposited Fund account to the given dummy account. So, the amount will be cleared easily.

- Now Select Expense.

- Choose the Same option- Dummy Bank Account.

- Now, you will be required to choose an Active Account that gets Income and Earnings.

- Now Press the Save Button and then Shut the Screen.

- Now Navigate to the Dummy Bank Account page and see if the Balance is Zero or Not.

How to Clear Undeposited Funds in QuickBooks Desktop?

Here are the steps to clean up undeposited funds in QuickBooks Desktop:

- Go to Your Particular QuickBooks Desktop Account.

- Navigate to the Banking Section.

- You will find many options for Drop-downs. Select Make Deposits.

- Find the Payment that you wish to Delete from the Particular Undeposited Funds account.

- Choose the Payment and then Click OK.

- Now, a Deposit Window will Appear. Press on the option for Deposit.

- Several Bank Accounts will be Shown. Select a Preferred Bank Account.

- Now, Add the Deposit Date and Other Important Details you wish to Register in the Given Transaction Detail.

- Save the Particular Deposit. Now Press on OK.

It will clear the amount that you have added to the undeposited fund account.

In today’s article, almost everything is required to share about undeposited funds in QuickBooks Online and in QuickBooks Desktop too. We have talked about the two main methods to clean up undeposited funds in QuickBooks Online.

Looking for a professional expert to get the right assistance for your problems? Here, we have a team of professional and experienced team members to fix your technical, functional, data transfer, installation, update, upgrade, or data migrations errors. We are here at Dancing Numbers available to assist you with all your queries. To fix these queries you can get in touch with us via a toll-free number

+1-800-596-0806 or chat with experts.

Frequently Asked Questions (Faqs)

We have also collated some FAQs for your quick reference purposes, let us look into those as well. They will clear the other doubts on related topics as well.

How can I Remove the Undeposited Fund Altogether in QuickBooks?

Well, You can delete payments from the Undeposited funds by clicking open QuickBooks account and going to Lists > then Chart of Accounts > Undeposited fund > Amount. After that, You need to right-click on the amount and click on delete deposit.

What are the Process Steps to Change the Undeposited Fund to Deposit in QuickBooks?

First of all, Click on the plus button icon (+ icon) and Choose Bank Deposit. Now choose the account you wish to put money into in the Account dropdown menu put the checkmark on boxes against each transaction and click on save and close.

What would be the Nature of the Undeposited Fund Account, in other words, Will it have a Debit or Credit Balance?

It can have a debit as well as credit balance, Whenever you have received the payment the balance will be debited to the undeposited fund account, and when you make the deposit entry the undeposited fund account will be credited with the amount of the deposit in the QuickBooks.

How can I fix the Negative Balance in the Undeposited Fund Account in QuickBooks?

You can easily resolve the issues relating to negative transactions in an undeposited fund account by making a zero-value deposit and entering the negative value deposit in it. You can do so by clicking on the plus icon > select Bank deposit under other section > Choose the Payment and Journal Entry you created and make sure they are offsetting i.e., totaling to Zero and Click on save.

What are the Steps for Reconciling the Deposits in QuickBooks?

First of all, Open QuickBooks find the Deposit in the Register, and Double-click on the DEP Line. Now Delete the Deposit Line by Clicking CTRL+DEL on Your Keyboard and Choose the Payment button from the top. After that put checkmarks Next to the Payment Transactions that these Deposits belong to, Click on Save, and Close.

Can You List Down the Process Steps to Delete the Duplicate Deposit in QuickBooks?

First of all, Choose Banking From the Top Menu, Select Bank Feeds, And then Bank Feeds Center. Now Click on the Transaction List Button, Look for the Duplicate Deposit, and Put a Checkmark in the Box to Select it, Now go to the Action Column and Choose Ignore. After that click on ‘Yes’ to Delete the Deposit.

Is it Necessary to Have a Balance in Undeposited Funds?

Undeposited Funds can have a Good Impact on Business. They provide Business Support During an Emergency. These Funds can also be used to provide Capital for New Ventures. However, Extra Undeposited Money can indicate that the Business is Not in Good Health.

Are Undeposited Funds Considered Accounts Receivable?

Deposits are seen as Accounts Receivable. However, Undeposited Funds are not seen as Cash.

What kind of Transaction can Lead to a Debit in Undeposited Funds?

A Debit Transaction Which is the Outcome of Withdrawn Cash, Like When a Customer Pays with Cash for their Tea.

+1-800-596-0806

+1-800-596-0806