The special type of expense transaction is known as refund. It is known as expense transaction because it reduces the expenses of your business as the original purchase was the lesser amount. The refund is also not recorded as revenue.

Dancing Numbers helps small businesses, entrepreneurs, and CPAs to do smart transferring of data to and from QuickBooks Desktop. Utilize import, export, and delete services of Dancing Numbers software.

Whenever you purchase QuickBooks Desktop products or an annual subscription for QuickBooks online and it is within a 60 day’s date of purchase then you are eligible for refund. Following are the options to request a refund for the QuickBooks Products:

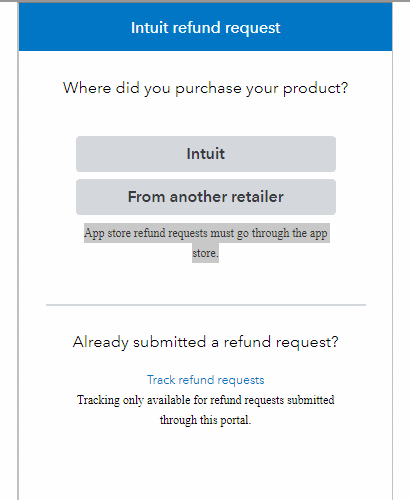

Option 1: Filling out a Request Form

The following form is the request form for the refund of QuickBooks products. You can use this form in any case:

- The QuickBooks Desktop

- The Self-Employed QuickBooks

- The QuickBooks Online

- Any of the Intuit or the QuickBooks payroll products.

Following option can be used if the product is purchased from the retailer also.

Option 2: Refund Request For other Products and Situations

Following are the detailed steps for your products or situations:

Returning of the QuickBooks Products Which are Purchased Directly from the Intuit:

If you purchase from intuit and its time limit is within 60 days of shipment, download, in such case you are eligible for refund without any query.

In case of Software

Following are the steps which are to be followed if you request for a refund through intuit account:

- First you have to log in to your intuit account with the help of log in ID and Password.

- Now navigate to the product and services and select the product for which you want a refund from drop down menu.

- Once you select the product then select return product link by right clicking on the product.

- Choose the cancel reason as why do you want to return the product.

- Hit the return product option from the menu.

- Once your request is successfully submitted, the confirmation message will pop up on your screen.

- The confirmation email is also sent to you.

In case of Hardware

In 60 days of purchasing if you want to return your physical products then you can easily do it.

In such case, you must use traceable methods; these are very helpful in refunding. If you ship via USPS then you must have registered or certified mail or a return receipt. Intuit will not refund in the following cases:

- The Staples rewards which are used for the initial purchase.

- The shipping fees for initial order.

You must fill the QuickBooks return form and then send the product to the following detail address:

USPS – Return

ATTN: Returns Department

PO Box # 580926

Pleasant Prairie, WI 53158, US

Non-USPS – Return

ATTN: Returns Department, Door 20

11500 80th Avenue

Pleasant Prairie, WI 53158, US

Returning of the QuickBooks Products Which are Purchased from the Amazon:

Within the 60 days of purchase, you can easily return Amazon QuickBooks Products which you purchased.

In order to return items, we advise you to use a traceable method. Traceable method is considered by using registered or certified mail, as well as a return receipt, when shipping via USPS.

Products damaged in transit or lost mail are not the responsibility of the Amazon (In such case the return is difficult).

The shipping costs for the initial order and the returned item will not be refunded.

All physical product returns should be sent to below address: with the original order number.

You must fill the QuickBooks return form and then send the product to the following detail address:

USPS – Return

ATTN: Returns Department

PO Box # 580926

Pleasant Prairie, WI 53158, US

Non-USPS – Return

ATTN: Returns Department, Door 20

11500 80th Avenue

Pleasant Prairie, WI 53158, US

Returning of the QuickBooks Products Which are Purchased from the Ebay:

In case of eBay, first you have to visit the QuickBooks product page available on eBay.com, so that you can submit a refund request for purchases you made there.

At the bottom of the page, you have to click on the link which says “Ask a Question”.

Please include the following details in your message:

- Yours First and the last name.

- Registered email for eBay.

- From the list of items select the item you bought from eBay’s.

- The License key for the product which you have purchased and you get its license key on your email.

Returning of the QuickBooks to the Retailer:

If you purchased the item from a shop then you have 60 days to send it back to from the date of purchase. You must provide us the following things:

- All physical parts which includes all required manuals and CDs.

- The duplicate receipt of the retail sales.

- Provide the name of the payee on which the refund check was provided.

- Provide the address where the reimbursement of the item should be sent.

- Contact number of the person on which they can call easily in order to refund the amount.

- Provide your email address so that both can exchange their queries if there is any.

As we studied that Intuit always advises us to use a traceable shipping method for returning goods. It considers the use of registered or certified mail, as well as a return receipt, when shipping via USPS is done.

If the Products are damaged in transit or if you lost mail then it is not the responsibility of Intuit. The shipping costs for the initial order and the returned item will not be refunded.

You must fill the QuickBooks return form and then send the product to the following detail address:

USPS – Return (It is for Software)

Intuit Inc.

PO Box # 580926

Pleasant Prairie, WI 53158, US

Non-USPS – Return (It is for Hardware)

ATTN: Returns Department, Door 20

11500 80th Avenue

Pleasant Prairie, WI 53158, US

Payments Refunds or Points of the Sale Hardware:

While returning hardware to Intuit, you are only eligible for a refund if intuit satisfaction guarantee, which you made your purchase from the company within 60 days of the ship date.

In order to return items, we advise you to use a traceable method. It is consider using registered or certified mail, as well as a return receipt, when the shipping is done via USPS.

Products which are damaged in transit or in case you lost mail are not the responsibility of Intuit. In such case, the company won’t pay back:

Following are the some cases in which the reimburse cannot be done

- The purchase was done by using Staples rewards.

- Initial order shipping costs.

Ensure that the package contains an insert with your initial Order Number and the date of purchase on it.

You can return your equipment to:

ATTN: Returns Department, Door 20

11500 80th Avenue

Pleasant Prairie, WI 53158, US

Refunding of the Point of Sale Software:

If the return of the product was purchased within 60 days from the shipping date or the unlock date then only the refund for the product can be done otherwise not.

Always keep in mind that as part of the refund procedure, Intuit will cancel the product license also. Due to which in future, you won’t be able to utilize it once more.

Refunding for the Returning of an Education Pack, Instructor Guides, or a Bulk Software:

The resources like guides and education/lab packs do not come with a 60-day money-back guarantee.

But in case, if you haven’t been opened the purchased resources then you are allowed to return these.

For a refund or exchange, you can send unopened merchandise to the returns department.

In case if the wrong item was ordered or bought, they could be swapped.

USPS Returns (In case of Software)

ATTN: Returns Department

PO Box # 580926

Pleasant Prairie, WI 53158, US

Non USPS – Returns: (In case of Hardware)

Intuit Inc.

ATTN: Returns Department, Door 20

11500 80th Avenue

Pleasant Prairie, WI 53158, US

Refunding of the Electronically Delivered Products:

In case you want to apply refund requests for the product downloads, product unlocks, and any other electronically delivered then Intuit media must be made within 60 days of the original purchase date.

There is no requirement to send anything back to the returns department because there is no actual merchandise was shipped.

You just send an email to EReturns@intuit.com with a copy of your purchase receipt and the license number of the product then you can seek a refund for electronically delivered QuickBooks.

Tracking of Your Refund Request

Below are the steps which are to be performed in order to track your refund request:

- First you have to select track refund request.

- Now you have to find the products for which you want a refund.

- Enter your case number.

- Now you have to enter your email address.

- Select to track the request.

Requesting of Refunding in QuickBooks

The actions that must be taken are listed below in order to request of refunding in QuickBooks:

- First you have to select the product which you are requesting a refund for.

- Enter the product bill or the order number.

- Enter your email address where you will get the confirmation.

- Now, you have to find the details of your orders.

- Once you find your order then review its detail information and the charges.

- From the list item, you have to select the item for which you want a refund.

- In the reason field, you have to enter the reason as why you want a refund for the product.

Reasons for the Return Refund Request

There are five common examples which will help you in avoiding them:

- Whenever they receive the request of refund, they think the consumer either realized they had made a mistake or changed their mind.

- The wrong item was shipped by the retailer.

- Purchasing was done either made too late.

- The consumer receives the item when he does not require it.

- The term “wardrobe”.

- The item was flawed or damaged.

- Conclusion.

Entering of the Refund Charge on a Credit Card

Below is a list of the actions that need to be taken in order to enter refund charge on credit card for the return item:

- The very first step is to click on the plus icon which is available on the top.

- Under the vendor column click on the credit card option.

- In the payee section you have to enter the name of the vendor.

- In the drop down menu of Bank/Credit account you have to select credit card.

- Now you have to enter the detail of item which are involve and the amount of those items in the item detail section.

- Hit the save button in order to save the changes which you made in the above steps.

- Select close button in order to exit from the screen.

We hope that the above article will help you in requesting refund but if you face any issue then you can contact us. We have a huge team of experts. They will be there in resolving the issue in the effective and the efficient manner. Our expertise will help you to avoid any loss.

Looking for a professional expert to get the right assistance for your problems? Here, we have a team of professional and experienced team members to fix your technical, functional, data transfer, installation, update, upgrade, or data migrations errors. We are here at Dancing Numbers available to assist you with all your queries. To fix these queries you can get in touch with us via a toll-free number

+1-800-596-0806 or chat with experts.

Frequently Asked Questions (Faqs)

How can I Enter a Refund from Vendor in QuickBooks Desktop?

Following are the steps to enter a refund from vendor in QuickBooks Desktop:

• The deposit being recorded.

• Recording of the bill Credit for the Returned Items.

• Link the Bill Credit and Deposit.

• Recording of the deposit.

• Recording of a Bill Credit.

• Specifics Regarding Bill Credit’s Impact on Wash Account.

What are the Types of Refunds?

Below are the types of refunds:

• The unintentional or mistaken overpayment of tax.

• Surplus in the electronic cash ledger.

• Export under a bond.

• LUT

• IGST payment.

• Supplies provided to SEZ units.

• Developers in exchange for IGST payments, bonds, or LUTs.

• Reversed hierarchy of duties.

• Considered Exports

• UIN-holding individuals.

How do You Handle Customer’s Returns?

There are three steps which are to be followed to handle customer’s returns:

• Reduce your losses as much as you can. Reduce your losses by including returning the items.

• Record of All Retail Returns, Exchanges, and Refunds.

• Ensure that you are consistently offering excellent customer service.

How do You Write Claim Email?

Follow the following steps in order to write claim email:

• Name and label the recipient.

• Entre the email address of the one who needs to receive your email before you start to compose it.

• Specify the problem in the subject column, regarding which the mail is.

• Attach the supporting documents if you have any.

• Describe the effect in detail.

• Choose a goal for your resolution.

• Finalize the formatting and hit yes button.

+1-800-596-0806

+1-800-596-0806