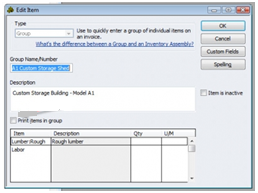

It is a specific type of item in QuickBooks used to quickly enter a group of individual items that are usually purchased or sold together when tracking the details of individual items is necessary.

Dancing Numbers helps small businesses, entrepreneurs, and CPAs to do smart transferring of data to and from QuickBooks Desktop. Utilize import, export, and delete services of Dancing Numbers software.

Short Overview about Group Item

When it is required to keep the details of individual things then a group item in QuickBooks is a special sort of item that is used to swiftly input a collection of separate items that are frequently purchased or sold together.

It is comparable to inventory assembly items, another method of maintaining a collection of separate objects, but distinct from them. An inventory assembly item is a new item that is made from a collection of separate things, hence lowering the number of the individual goods that were originally used to make the assembly. A group item behaves similarly to an on the fly kit, in contrast to an inventory assembly item, which acts like a pre-assembled kit.

A group item allows a business to keep track of the specifics of each item in the group and, if desired, offers a mechanism to make the information provided to clients and suppliers simpler. A single group item immediately fills in the data for all of the items in the group, making data entry quicker.

QuickBooks will only print the group item itself if the Print items in group checkbox are left unchecked. A client or vendor won’t be able to see the specifics of each item in the group. However, business reports will monitor every item in the group in detail.

Here is an example of a bill for the group item A1 Custom Storage Shed that was mentioned before. When entering the single group item, the two individual items that make up the group were immediately entered.

The price of a group item is equal to the total cost of the items in the group; the price of the group itself cannot be modified directly, but it is possible to adjust the price of each individual item.

Sales tax is computed for group products depending on the taxable status of each component part of the group. The group in the aforementioned example contains both taxable and non-taxable items.

In contrast to other groups, a group item can contain any other item; it cannot be a part of an inventory assembly item. For group goods, there are no reports. As an alternative, each item in the group is described in depth.

5 Reasons to Use QuickBooks Group Items

A useful and time-saving function that QuickBooks offers you is the QuickBooks Group Item, which is frequently underused and misunderstood.

Following are the five reasons for which QuickBooks Group items is used:-

- For swiftly inputting a collection of separate things that you have previously set up as single items in your Item List, you may create and use group items.

- Group things are flexible because you may decide whether to print or not to print the things inside the group, allowing you to keep track of more information than your consumer will ever need to see.

- Group Items help you avoid leaving something out, which might result in financial loss.

- Imagine being able to add 19 things with a single mouse click to help create estimates and invoices more quickly.

- The different units of measurement used to acquire and sell goods or commodities can be reconciled using group items.

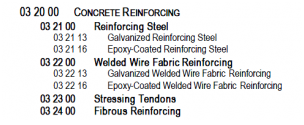

The CSI MasterFormat Cost Code section 03.20.00 for Concrete Reinforcing is discussed in the example that follows.

Create Group Items in QuickBooks Desktop Pro

Within the Item List in QuickBooks Desktop Pro, you may create Group items. For products you might buy separately but wish to show as a single line item on a sales form, you can create Group items in QuickBooks Desktop Pro. If you sold gravel by the ton and added a service charge for delivery, for example, you could create the gravel (a non-inventory part) and the service charge (another charge), and then create a Group item (like Gravel Delivery) that combines the gravel and the delivery charge.

This enables you to display just one line item on the invoice as opposed to two different line items. Nevertheless, if you’d like, you may also display the individual parts. The Item List must contain all the items that will be added to the group before you can create group items in QuickBooks Desktop Pro.

You may create the group item by clicking the Item button in the lower-left corner of the Item List window after generating the items to add to the group. Select the New command next. From the Type drop-down option in the New Item box, choose Group. Then, in the Group Name/Number box, provide a name for the group. In the Description area, type the line item description for the group that will appear on sales forms.

Click the first row under the Item column that is open to add the items to the group. The first item can then be chosen using the drop-down menu that displays. Click in the adjacent Qty column to enter a quantity for that item. After that, type the required quantity. When using the Group item inside sales forms, you can, if desired, define the amount by leaving the Qty field empty. Up until you have added all essential items to the group, keep adding things and setting amounts.

The Print items in group checkbox must be selected in order to enable the display of the group’s items on sales forms when this item is utilized. When filling out sales forms, the goods in a Group item are always visible. You can adjust the quantity as necessary thanks to this. After creating the Group item, press OK to preserve it in the Item List.

Instruction for Creating Group item in Quickbooks Desktop Pro

- In QuickBooks Desktop Pro, choose Lists and then Item list from the Menu Bar to launch the Item List window. From there, you may create Group items.

- In the list window’s lower-left corner, click the Item button, then click the New command.

- From the Type drop-down menu in the New Item box, choose Group.

- Then, In the Group Name/Number box, provide a name for the group.

- Next, Create a line item description for the group to appear on sales forms into the Description section.

- Click the first row under the Item column that is open to add items to the group.

- Now pick the first item to include in the group.

- The required quantity of the chosen item may be entered by clicking into the Qty column.

- Alternatively, If preferred, Leave this blank and indicate the amount when using it in a sales form.

- When you have added all the required items to the group, repeat steps 6 through 9 as necessary.

- When this item is used in sales forms, use the Print items in the group checkbox to print the group’s goods.

- The data entry view of the sales forms always displays items included inside a Group item. You can adjust the quantity as necessary thanks to this.

- After creating the Group item, Press OK to preserve it in the Item List.

Conclusion

This article demonstrates how to easily create group items in QuickBooks. It provides you a thorough knowledge of the principles guiding each phase so you may understand them well and put them into practice. Everyone has to be informed on how to create group items in QuickBooks. The principles of each stage are explained in detail so you may understand them and put them into practice.

Making group items is a smart move for any business looking to boost productivity and streamline operations. Your workflows may be swiftly automated with this, and you can connect it to your favorite apps. The extensive features set it apart from competing alternatives. You can focus on growing your company while we take care of the rest. If you are not able to do this then you can connect with Dancing Numbers team via LIVE CHAT.

Looking for a professional expert to get the right assistance for your problems? Here, we have a team of professional and experienced team members to fix your technical, functional, data transfer, installation, update, upgrade, or data migrations errors. We are here at Dancing Numbers available to assist you with all your queries. To fix these queries you can get in touch with us via a toll-free number

+1-800-596-0806 or chat with experts.

Frequently Asked Questions

What is the Purpose of Group Item Type in QuickBooks?

An easy approach to input a collection of separate things that you frequently buy or sell together is to use group items. There is a list of component pieces in group items. Despite not having that name, it is extremely comparable to a bill of materials.

In QuickBooks Desktop, What are Group Items?

In order to make data entry for many Items that are commonly sold together easier, businesses frequently create Group Items in QuickBooks Desktop (QBDT). Through the use of this feature, the person generating the form is able to input the name of the Group Item and request that QuickBooks fill in the information for every item in that Group.

What are QuickBooks Four different Item Types?

The kind of an item dictates whether and how it is tracked in QuickBooks. Inventory, non-inventory, services, and bundles are the four fundamental item kinds.

In QuickBooks, What do Tags and Groups Mean?

You may monitor transactions anyway you desire using tags, which are labels that are configurable. Expenses, bills, and invoices can all be tagged. To check how particular parts of your business are doing, group tags together and run reports. Your books are unaffected by them.

In Accounting, How Transactions are Categorized?

A general ledger is used in accounting to document ongoing business activities. Transactional information is categorized inside a general ledger into assets, liabilities, income, costs, and owner’s equity. The accountant creates the trial balance after closing out each sub-ledger.

+1-800-596-0806

+1-800-596-0806