We are all familiar with credit cards and how they operate. It is a card that is given by your bank. It enables you to take out a loan from the bank at a predetermined interest rate. Your bank account and credit cards may be connected in QuickBooks, and all transactions will be immediately logged. Additionally, you may use QuickBooks to make payments via debit cards, bank transfers, credit cards, etc. When you receive payment or make a purchase using a credit card, you will be charged a fee known as the QuickBooks credit card fee.

This thorough tutorial will examine credit card processing rates, detail all related expenses for processing credit card payments on QuickBooks, and assist you in estimating your costs. We’ll also offer advice on how to use the best payment processing services to cut costs.

What is QuickBooks Credit Card Fee?

The cost of all the services used in a transaction is what you pay for with your credit card processing rate. This comprises the charges made by your processor, issuing bank, card association, and merchant service provider. Although the interchange charge is set and cannot be altered, there could be ways to lower your communications and processing costs. For instance, QuickBooks offers a 40% transaction discount to businesses who process more than $7,500 per month.

If you’re processing a lot of payments, this could be useful. It’s crucial to compare prices because doing so can end up saving you money in the long run. Additionally, be sure to conduct thorough research to identify the ideal processor for your company. Make sure the processor has all the services you want, such as online payment processing and fraud detection. By understanding the different types of payment processing fees, you can ensure that you get the best rate for your credit card processing rate.

How are QuickBooks Credit Card Processing Fees decided?

The credit card network, the payments processor, and the credit card issuer are the three separate parties that are engaged when a merchant processes a credit card payment. The credit card issuer assesses a fixed commission or fee to the merchant for the capacity to process a card. A fixed charge and a percentage of the transaction are typically used to compute this cost. Chase, Citi, and Capital One are the most popular credit card issuers, and they operate with networks like Visa and Mastercard that are well-known across the world. The job of payment processors is to allow the safe exchange of information and payments. They furthermore charge a percentage of the transaction in addition to a fixed fee per transaction.

Merchants may have greater control over their money and be more selective about the payment methods they accept by being aware of how credit cards are handled. Furthermore, because they now know how much each transaction will cost them, retailers can now budget for processing fees. Merchants could utilize this helpful information to better manage their costs while raising consumer happiness, whether it be through physical cards or digital payment systems.

How Much Is QuickBooks Credit Card Processing Fee?

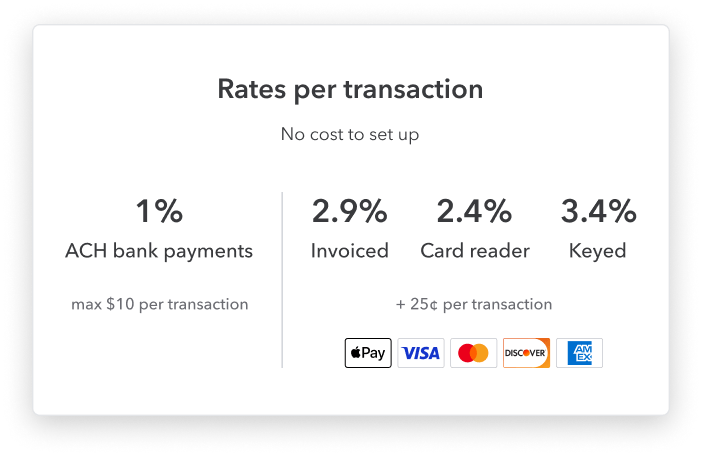

You should be aware that there are three distinct methods to pay with a credit card through QuickBooks before learning more about the credit card processing cost. For various payment methods, the QuickBooks credit card processing charge calculator estimates various processing fees.

- Credit Card Swiped: 2.4% of the total transaction + $1.92 will be charged by QuickBooks online. The processing cost for QuickBooks desktop’s pay-as-you-go option is 2.4% + $2.3. Additionally, the monthly plan will cost $2.3 plus 1.6%.

- Online Credit Card Invoice: The processing cost for online credit card payments through QuickBooks is 2.9% plus $1.92. The pay-as-you-go model levies a fee of $2.3 in addition to 3.5% of the total transaction. Last but not least, the monthly QuickBooks desktop plan adds a $2.3 credit card processing cost on top of the 3.3% charge.

- Credit Card Keyed: If you pay with a credit card through QuickBooks Online, you will be charged 3.4% of the total transaction plus $1.92. The cost of processing credit cards through QuickBooks is 3.5% + $2.3 for pay as you go plans and 3.5% + $2.3 for monthly plans.

Note: Keep in mind that you will only be charged 1% of the AHC payment, up to a maximum of $10 per transaction. Since credit card swiped transactions are thought to be the most secure, you’ll be charged the least amount. A merchant can personally confirm the cardholder’s details when they swipe the card.

How to Save Money on QuickBooks Credit Card Processing Fees

We’ll look at ways to reduce these costs now that you know what they are and how much they cost for QuickBooks credit card processing.

- Searching around for the finest payment processing provider for your company is the first step. Make sure to compare services to discover the one with the lowest prices for your company by keeping in mind that different payment processing providers have varying rates.

- You may save costs on QuickBooks credit card processing fees by choosing the best payment options in addition to looking around for the finest payment processing service. As an illustration, you can save money if you wish to accept payments through PayPal by using the PayPal Express Checkout service, which has a cheaper processing price than the usual PayPal processing fee. Similarly, you may save money by using the ACH Direct function, which has a cheaper price, if you wish to take payments by ACH.

- Finally, by using the payment processing services that QuickBooks provides, you may further reduce the costs associated with processing credit cards through QuickBooks. Utilizing QuickBooks’ specialist services for these sorts of payments, for instance, can help you save money if you process invoices or recurring payments.

QuickBooks Credit Card Processing Fee: Advantages And Disadvantages

Advantages

- You may conveniently pay, and QuickBooks automatically records credit card payments for bookkeeping purposes. As a result, utilizing QuickBooks for payments is a practical choice.

- It is your one-step solution because it takes all forms of payment and allows you to easily make payments using a variety of methods.

- You and your employees are familiar with the use of QuickBooks.

Disadvantages

- You occasionally have QuickBooks issues or difficulties while processing payments. This might stop the entire transaction, causing it to be cancelled.

- You’ll experience several downtimes if QuickBooks is not updated. Therefore, be careful to Update QuickBooks.

- Due to several processes running simultaneously, QuickBooks server processing is delayed.

- The cost of using QuickBooks to process credit cards is considerable.

How To Record QuickBooks Credit Card Processing Fee?

In order to keep correct accounting, you must track every penny that is spent. Therefore, erroneous book totalling may result from failing to record the QuickBooks cost for credit card processing. It is essential to keep track of any loans or expenses. You may record the findings of the QuickBooks credit card processing charge calculator in two different ways. Let’s examine each of them separately.

Method 1. Choosing the Get Paid and Pay option

The QuickBooks built-in tool that keeps track of all the fees you pay or get is called the get paid and payment option. Here is how you record a credit card processing cost in QuickBooks using this tab:

- Start-up QuickBooks on your computer.

- Navigate towards the left panel.

- Opt for the “Get paid and Pay” tactic.

- Tap the tab for products and services next.

- Select New > service.

- Mention the service option’s credit card processing cost.

- Choose the account through which you will pay the credit card processing charge.

- Then click Save and Close.

- Your whole credit card processing fee history is now available.

Method 2. Select the Expense option

The expenditure option, as its name indicates, logs every expense. QuickBooks credit card processing fees are a type of expenditure, therefore you may enter the specifics on the expense report as well. This is how:

- Start the QuickBooks program initially.

- Then, you need to go to the left panel.

- You’ll see a plus sign. Touch it.

- Go to vendors and choose the priciest choice.

- Type the payee information now.

- Add the account where you’ll be making the payment for the charges.

- Add the method and the date of payment. (credit card)

- Add the name of the expense account that will be used for the payment on the category tab.

- Add the whole amount under the amount option.

- Then click Save and Close.

Manually Recording QuickBooks Credit Card Fee

You may manually enter the QuickBooks charge for processing credit cards in QuickBooks. When you choose the manual way of recording the QuickBooks charge for credit card processing, you have the advantage of self-verifying all the data before it is entered. Here’s how to go about it:

- Navigate to the left side in QuickBooks.

- Tap the plus sign.

- Click the invoice.

- Enter the precise amount that needs to be recorded now.

- After saving, Go back to the invoice choice.

- To accept payments, Choose the tab.

- Navigate to the deposit area after choosing the appropriate invoice.

- Tap the undeposited monies now.

- Right away, Accurately add each piece of information.

- To save and store the results of the QuickBooks credit card processing charge calculator, click Save and Close.

Using the bank deposit option is an additional way to manually add the QuickBooks credit card processing charge. This is how:

- Navigate to the QuickBooks homepage.

- Click the plus symbol and select Bank Deposit.

- Select the Payments Included in This Deposit tab by navigating there.

- Proceed to the Add Funds to this Deposit area after that.

- Now insert the QuickBooks credit card processing charge in the Received From section.

- Under the account section, enter credit card fee.

- Credit card costs must to be entered as negatives.

- Then click Save and Close.

How To Record QuickBooks Credit Card Processing Fee? (Charged From Clients)

Anyone, even consumers who use credit cards for payment, will be required to pay the credit card fees in QuickBooks, not only the owners and workers. Therefore, When you creating invoices, in order to record the costs in your books and in the invoices, you will need a QuickBooks credit card processing fee calculator. To preserve openness, you should constantly make sure that your clients are aware of the cost of the QuickBooks credit card processing charge.

- Navigate to the + icon in QuickBooks.

- Choose the option to collect money from the list of clients.

- Include the date when the processing fee for QuickBooks credit cards was or is levied.

- Add the credit card processor for your customer under the payment method.

- Fill in the blanks for the deposit amount and reference number.

- Then click Save and Close.

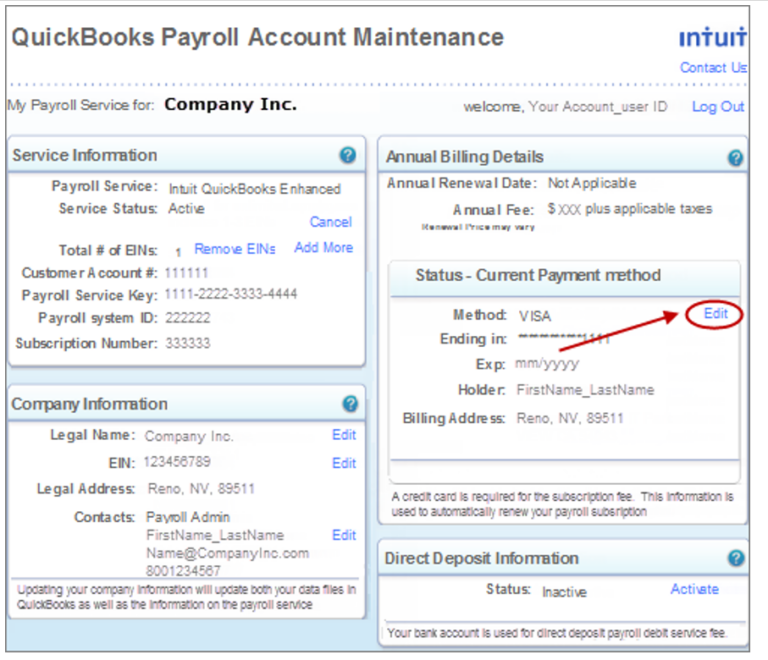

How to Add/Edit Credit Cards in QuickBooks

Sometimes you have to update or add to the QuickBooks payment options that are already there. QuickBooks is preconfigured to automatically take Visa, American Express, and Mastercard credit cards. These choices can, however, be modified. You can change the credit cards that are currently added or add new ones. This is how:

- Utilize the gear icon to access settings.

- Choose Go to all Lists.

- Select a payment method from the provided list.

- Click new.

- Include information such as the payment card’s name.

- Choose credit card under the payment method category.

- To add a new payment method, click save at the end.

Conclusion

Any firm should prioritize keeping correct accounting as its primary goal. Therefore, it is essential to consider every spending and source of revenue, no matter how tiny. Having said that, it’s critical to note the QuickBooks credit card processing cost to keep your books in order. However, the majority of customers are not aware that there are credit card fees. Whatever the case, you must inform your group, your staff, and your customer on what a QuickBooks credit card processing charge is and how much it costs.

This article is the ideal method for thoroughly describing all credit card processing costs in QuickBooks. Each and every area of QuickBooks payments and QuickBooks credit card processing costs has been thoroughly examined and addressed. However, you are always welcome to get in touch with our Dancing Numbers experts if you have any concerns.

Looking for a professional expert to get the right assistance for your problems? Here, we have a team of professional and experienced team members to fix your technical, functional, data transfer, installation, update, upgrade, or data migrations errors. We are here at Dancing Numbers available to assist you with all your queries. To fix these queries you can get in touch with us via a toll-free number

+1-800-596-0806 or chat with experts.

Frequently Asked Questions

Which Tab in QuickBooks Shows Credit Card Balances?

Each bank or credit card account that is linked to QuickBooks is shown in the Bank Accounts section of the Dashboard. QuickBooks also displays the Bank Balance and the QuickBooks Balance in addition to the account name.

Where do Credit Card Payments made to QuickBooks Go?

A merchant account receives all credit card payments and deposits them. This particular kind of business bank account enables you to receive payments from consumers using credit and debit cards.

In QuickBooks, Is a Credit Card an Asset or a Liability?

Some company owners are mystified by the handling of credit cards. Credit cards function nearly identically to checking accounts in QuickBooks, save from the fact that they are liabilities rather than assets. Keep things easy for the majority of credit card spending by using the Banking Feed and Pay down Credit Card for payments.

In QuickBooks, How can I Modify my Credit Card Number?

Updating billing information for subscriptions and payment cards: Select Subscriptions and billing under Settings. The Billing Details tab should be chosen. Update your payment details by selecting Edit billing information.

Are there any Credit Card Transactions that might be Downgraded?

No. No matter if your consumer is using a corporate card, a Visa, MasterCard, Discover, or American Express credit card, the prices shown are exactly the rates you’ll pay when you make a credit card transaction.

Which Version of QuickBooks is Best for Accepting Credit Card Payments?

Both QuickBooks Online and QuickBooks Money allow you to accept credit and debit card payments online. The QuickBooks GoPayment app may be downloaded independently or downloaded and synced to QuickBooks Online to do accounting if you need to manually enter card information or track in-person payments.

How do QuickBooks Money and QuickBooks Online Vary from One Another?

Accounting functions like automated transaction mapping, mileage tracking, bill pay, receipt capture, reporting, access to specialists, and more are available in QuickBooks Online in addition to helping you manage your payments and banking. You may view all of your options on the planning page.

+1-800-596-0806

+1-800-596-0806