QuickBooks is an amazing accounting software that enables users to manage their bank accounts. But what will you do if you cannot get connected with your bank? There is no way you can manage your account. You will see an error message appear on your computer screen suggesting a bank connection error. This is the QuickBooks error OL-301 that prevents you from proceeding with the software.

Dancing Numbers helps small businesses, entrepreneurs, and CPAs to do smart transferring of data to and from QuickBooks Desktop. Utilize import, export, and delete services of Dancing Numbers software.

The article here demonstrates the causes, signs, and methods to resolve this issue efficiently. First, let us know what this error stands for.

What is QuickBooks Error OL-301 (Account Not Syncing with Bank)?

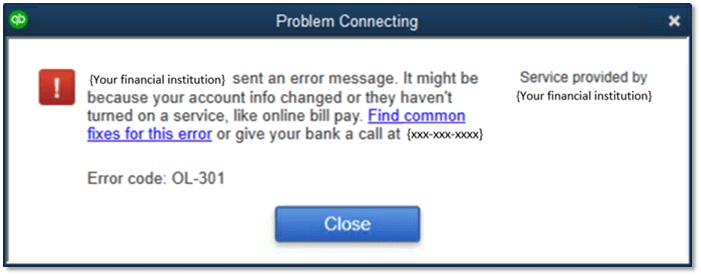

As QuickBooks helps users perform tasks related to accounting it is directly linked to their bank accounts. At times the bank accounts disconnect with QuickBooks, which leads to Error OL-301. It can occur due to various reasons, especially if there is a problem in the company file, or if it could not connect with the bank server. It appears stating that your bank has sent an error and is thus unable to execute the process.

The main causes of the error OL-301 occurring in QuickBooks can be seen in the below section.

What are the Reasons for QuickBooks Error OL 301 Occurrence?

When you are using QuickBooks frequently, you might come face-to-face with OL-301 error. Even though inaccurate bank connection is the main issue related to this error, some other problems can be its reason for occurrence as well.

- Incorrect bank details can lead to this error. Therefore, making sure to fetch bank information correctly is essential.

- If the login details at the time of running the application do not match the actual login information.

- The finance account has been blocked by the branch of the bank.

- The registered financial institution’s server is down.

- QuickBooks company file is damaged or corrupted.

- If the user has an incomplete know your customer process.

You can determine the occurrence of QuickBooks error OL-301 easily. Know the facts below.

What are the Signs of QuickBooks Error OL 301?

The symptoms related to error OL-301 can be as shown below:

- An error message will pop up on the computer screen.

- The other programs working on the computer stop working.

- QuickBooks Desktop will lag down and stop proper functioning.

- The computer’s system will freeze after the error message shows up.

Now, that you are aware of the causes and signs of QuickBooks error OL-301, let us learn the troubleshooting methods to fix it.

Note: Make sure that your QuickBooks Desktop is of the latest version. Also, refresh the branding and profile settings after the updates.

Steps to Fix QuickBooks Error Code OL 301

Solution 1: Deleting the Temporary Internet Files

It is essential to update the application to its newest version, after which you can carry on with “Delete Temporary Internet files“. Follow these steps to ensure the update.

- Select the Tools option and choose the Online Center icon

- Click on Financial Institution from the drop-down menu and select the registered bank.

- Hold Ctrl + Shift and click on the Contact Info icon.

- A drop-down list will appear where users must opt for the affiliated bank account.

- In the list, select the Financial Institution Branding & Profile option and then press the Refresh button.

- Press OK and go online after selecting the Update/Send tab.

- Reopen the Online sessions to completely eradicate the error.

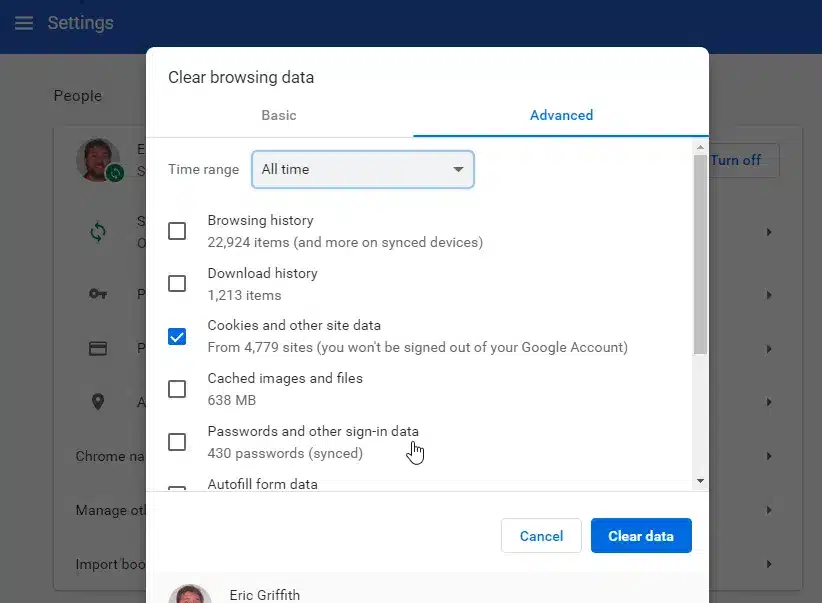

The steps to delete temporary files differ based on the operating system

A. For Windows 7 and 8

- Visit the Control Panel from the Start button on your computer.

- Hover on the Network and Internet tab and click it.

- Select the Internet option.

- Now move to the General tab and select Delete under the Browsing history.

- Click on the Delete All option and select Yes to remove all the files.

- Press OK to ensure the process is complete.

You can either follow the same steps for Windows 10, or you can try the alternate process.

B. For Windows 10 (Alternate Process)

- Open the File Explorer.

- Go to C:/ drive and click on the Properties tab.

- Select the Disk Cleanup option after it.

- Uncheck every other file except the temporary internet files.

- Press OK to confirm their selection.

- Click Delete Files to end the process of deleting temporary internet files from your system.

Solution 2: Resolving the QuickBooks Error OL 301 Manually

- Generate a Test Company File.

- Reset the connection with your financial institution.

- Reset the Online Banking Connections.

- Investigate your company data and contact your financial institution.

Solution 3: Rebooting the Account Connection in QuickBooks

- Go to the Charts of Accounts from the drop-down menu.

- Go to the accurate version by right-clicking on it and select Edit Account.

- Now, move to Bank Feed Settings and choose deactivation of all online services.

- Save settings after clicking OK

- Prepare for reactivating by going to the Direct Connection option.

- Choose Bank Feeds and select Set Up a Bank Feed Account.

- Select the account of your registered bank and input valid information about your bank account.

- Follow all the instructions as displayed on the computer screen to complete the procedure.

The QuickBooks error OL-301 can be solved by web connection as well. To resolve the error via web connections, consider the below instructions.

- Log in to your online bank account and download the .QBO transaction file.

- Store the downloaded files in an easy-to-access folder on your computer.

- Visit the File tab in QuickBooks and choose the Utilities option from the drop-down menu.

- You will see many options. Select import and then web connection files.

- Click open the .QBO file you have just downloaded.

- You will be prompted with a query box, where you must select either New Account or an Existing QuickBooks Account.

- The next time the error appears, click OK for the software to read the web connect data.

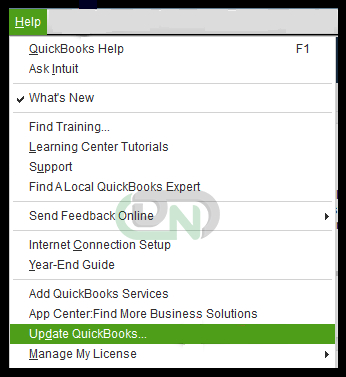

Solution 4: Updating QuickBooks Desktop

Updating QuickBooks regularly can help in resolving errors because many errors occur due to outdated versions of the software.

- Visit the Help tab in QuickBooks.

- Hover on Update QuickBooks Desktop and click on it.

- Check whether your QuickBooks version requires any updates.

- If yes, then update the software and check if the error persists.

Solution 5: Searching for Inactive Accounts in QuickBooks

- Go to Charts of Account from the drop-down menu.

- Now go to the Accounts option and select the inactive accounts

- After that press edit account.

- Put a tick on the checkbox and mark all the deactivate all services in the Bank Feed settings.

- Choose the confirmation window and press OK.

- Reopen QuickBooks Desktop to verify the error OL-301.

- Make sure to deactivate other inactive accounts.

Final Words

Error OL-301 makes things difficult for users to continue with their work. Therefore, understanding the resolution processes for the error is essential. The article here clarifies all the methods that can be used to resolve error OL-301 in QuickBooks. However, if you still need professional help, feel free to contact our Dancing Numbers experts.

Looking for a professional expert to get the right assistance for your problems? Here, we have a team of professional and experienced team members to fix your technical, functional, data transfer, installation, update, upgrade, or data migrations errors. We are here at Dancing Numbers available to assist you with all your queries. To fix these queries you can get in touch with us via a toll-free number

+1-800-596-0806 or chat with experts.

Frequently Asked Questions

What is a Banking Error Appearing in QuickBooks?

A banking error occurs in QuickBooks when there is a connection issue in the financial institutions’ server. Common reasons are maintenance pauses or other server issues. These problems restrict bank connection to QuickBooks.

When does the error OL-301 occur in QuickBooks?

The QuickBooks error OL-301 occurs when QuickBooks cannot connect to financial institutions while using direct connect. It can also be caused due to problems in web connection.

How can I fix the QuickBooks bank feed?

You can follow the below steps to resolve Bank Feed issues in QuickBooks.

Step 1. Download the bank feed transaction (. QBO extension) file within a test company.

Step 2. Note if the files are compatible with QuickBooks because only .QBO files are compatible with the software.

Step 3. Now refresh the bank connection.

Step 4. Create accounts and merge them.

Step 5. Make sure to activate online banking and turn it off.

+1-800-596-0806

+1-800-596-0806