Do you want to grow your business by injecting your own funds into it but want to avoid the hassle of mixing personal expenses with business expenses? Know how to record owner investment in QuickBooks.

Well, who would not? Every business owner, when they start their business, put in their own funds to give a head start to the up and running of the business. It helps in improving the new business’s cash flow situation and helps in funding equipment, machinery, research cost, staff hiring, etc. Now the question arises if there is actually a need to record the owner’s investment as a separate item in the books of accounts. And the answer is, it certainly is.

Dancing Numbers helps small businesses, entrepreneurs, and CPAs to do smart transferring of data to and from QuickBooks Desktop. Utilize import, export, and delete services of Dancing Numbers software.

Recording the owner’s investment as a separate item in the books of accounts is a very important activity as it helps in keeping the books of accounts accurate and up to date. Owner investment can be in the form of simple cash injected into the business or the owner’s fund used for buying assets or inventory. QuickBooks can help you in tracking the owner’s investment and record the transaction with the help of a series of simple steps. In the next section, we will see the detailed process for recording the owner’s investment.

Advantages of Record Owner Investment in QuickBooks

There are a few advantages that you get after recording owner investment in QuickBooks. These advantages are as follows:

- It helps to keep track of the investment using the Equity account.

- You can check the investment amount anytime whenever required as it is recorded into the QuickBooks account.

- You can also add other equity accounts as the sub-accounts under the main equity account.

- Get to know when the owner or partner added the equity to the business.

How to Record owner Investment in QuickBooks?

Follow the step-wise step process ways to record the owner’s investment in QuickBooks.

Step 1: Set up an owner’s Equity Account in QuickBooks

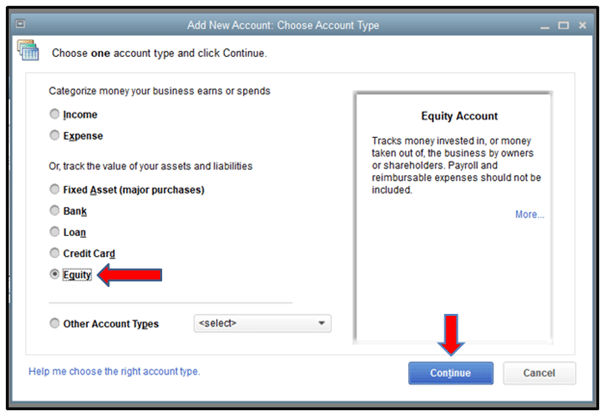

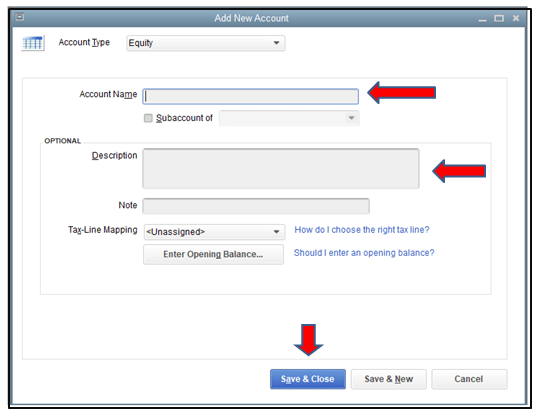

The process starts with setting up an owner’s equity account by following a series of simple steps:

- First of all, go ahead and click on Settings (gear icon) and then click on Chart of accounts on the QuickBooks page.

- After that, you need to click on New and then go to the Account type drop-down menu and select Owner’s equity.

- Now go to the Detail type drop-down menu and choose owner’s equity or partner’s equity as per your requirement and then click on save and close button.

By following the above steps your owner’s equity account will be set up, now let us move toward the next action.

Step 2: Steps for Recording Owner’s Contribution in the QuickBooks

You can follow the below steps for recording the owner’s investment in the business in your books of accounts in QuickBooks:

Step 1. In the initial step, you go to the QuickBooks page and click on accounting.

Step 2. Once you have clicked on ‘Accounting, click on Chart of Accounts and then click on New.

Step 3. Now in this step, you need to click on New and under the account type select Equity and choose Owner’s equity (as set up earlier) from the detail type drop-down menu.

Step 4. In this step, you will have to type the owner’s contribution or equity in the name or description.

Step 5. Once you are done with the above steps, go ahead and type the owner’s investment fund / amount in the balance field and hit on save and close button to finish the process.

There is another way as well, that is if your bank account is connected to QuickBooks, you do not need to actually record the owner’s investment, you can simply categorize the transactions associated with your deposits following the below simple steps:

- Start by clicking on the ‘New‘ button and then click on Bank deposit.

- Now from the Account type drop-down menu select the relevant bank account, the one which is connected and you are depositing the money in it.

- Now you need to enter the date of the deposited money and enter the name of the investor in the Received from the box under the ‘Add funds to this deposit’ section.

- In this step, you need to choose the appropriate equity account in the account field and specify the payment method.

- Now you need to enter the owner’s investment amount in the Amount field/box and click on save and close button.

Step 3: Return the Funds From the Investment

Here is how to record an investment once you have received it and are able to repay it. You might need to record paying yourself, your partners, or co-owners back after you record an investment at a later time. An example of this is capital disbursement.

Paying with an actual check

Follow the below-mentioned steps in case you are going to send someone a paper check.

- First, you have to select +New and then you have to select Check.

- Enter the person or company you are repaying.

- Then you have to enter a check number in the check number field.

- The Category Details section should contain the following information.

- First line: The equity account you use in QuickBooks to keep track of the investment and the amount you are repaying right now.

- Second Line: The amount of interest included in your current payment as well as the expense account you use to keep track of your interest payments.

- Other lines: Any extra charges and their appropriate accounts.

- At last, you have to select Save and then close.

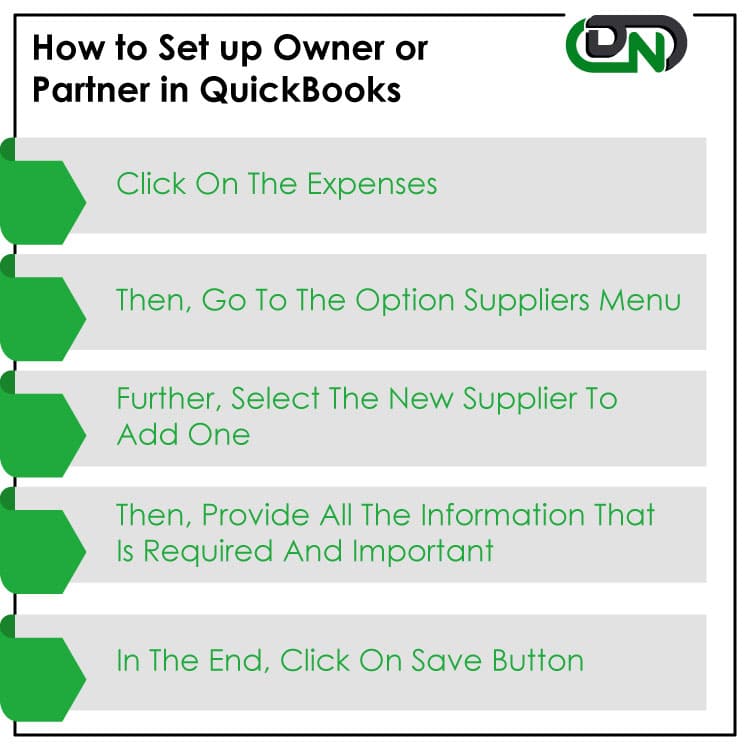

Set Up an Owner or Partner in QuickBooks

You have to record the things like yourself, the owner, or the partner as the supplier into your QuickBooks account. This helps you to track the capital that is invested by you and your partner. To set up owner or partner the steps are:

- In QuickBooks, click on Expenses.

- Click on the option Suppliers menu.

- Further, select a New supplier to add one.

- Provide all the information that is required and important.

- In the end, click on the Save button to save the information about the new supplier of the business.

Let us now move towards the frequently asked Questions section, where we have gathered the user’s queries answered by the experts.

Looking for a professional expert to get the right assistance for your problems? Here, we have a team of professional and experienced team members to fix your technical, functional, data transfer, installation, update, upgrade, or data migrations errors. We are here at Dancing Numbers available to assist you with all your queries. To fix these queries you can get in touch with us via a toll-free number

+1-800-596-0806 or chat with experts.

Do You know the steps that I can take to Account for Investment Income in QuickBooks?

First, you need to create the vendor in QuickBooks. For this, you need to open QuickBooks and go to the expenses tab and then click on the vendor, follow the onscreen process. The next step would be the creation of the owner’s equity account for tracking the owner’s investment (the process is detailed in the above sections). Lastly, you need to deposit the capital investment funds in this account.

Would You let me know the Steps to Enter the dividend Income in QuickBooks?

You need to initiate the first step, which is clicking on the Account column and then clicking on Retained earnings account from the Account type drop-down menu. Please remember you can do this when you are using retained earning account to track the dividend income. Now you will have to enter the dividend amount for the period in the debit column and write a memo if you wish to.

What are the Basic Steps to Record a Stock Transaction via Journal Entry in QuickBooks?

It is quite simple actually, you need first click on the Plus button (New) and click on the journal entry. Now go to the first line and select the expense account for the purchase and enter the amount in the debit column. Now in the second line of the journal entry choose partner’s or owner’s equity and enter the same purchase amount in the credit column and press the save and close button.

Can You Let me Know the Steps to Record Cash Income in QuickBooks?

You need to Open QuickBooks first and go to the Banking menu. Now after clicking on the Banking menu, you need to go to the Make deposits and choose a bank account in the Deposit drop-down and set the date as needed. Now choose a payee in the received from the column and then choose an account. After that, you can enter the cash income amount that you received from the customer in the amount column and follow onscreen instructions to complete the process.

What type of account is this Owner’s Investment in QuickBooks?

This is the capital account and this account is separate for each owner or partner who invests in the business. This account shows their ownership of the business. You can record and track the account easily in your QuickBooks account.

Is it Important to Connect the Bank Account to Record Owner Investment in QuickBooks?

No, it is not important. If there is no bank account connected then you have to make an account for them. If the bank account is connected then you don’t have to record the investment. In this case, you have to categorize the transactions only.

What do Sub-accounts Mean in the Owner Investment Account in QuickBooks?

The sub-accounts means that there are different owner or partners in the business who does the investment. So, you have to create an account for each of them. In other words, you can make multiple accounts for owner or partner investment into QuickBooks.

+1-800-596-0806

+1-800-596-0806