Whenever the QuickBooks users download the latest release updates then the error occurs is known as Payroll update error 15243. Payroll update error produces the discrepancy in the workflow of business. Discrepancy leads to unwanted payroll update error 152342. This error might affect the working of QuickBooks software.

Whenever intuit announced about new updates but your system is unable to download it at that time the message flashes on your screen is “QuickBooks error code 15243: the payroll can’t be updated. The QuickBooks FCS (File Copy service) is not accessible, it might be damaged.”

Dancing Numbers helps small businesses, entrepreneurs, and CPAs to do smart transferring of data to and from QuickBooks Desktop. Utilize import, export, and delete services of Dancing Numbers software.

The fixes and resolutions of previous bugs are defined by intuit which are released in their new updates. The updates also consist of new features which are very efficient and helpful for you in doing work in QuickBooks and improve your business.

Causes of QuickBooks Payroll Error 15243

There are several causes due to which QuickBooks Error 15243 Occurs.

- The QuickBooks Payroll which is running on your system is not having latest updates.

- QuickBooks File Copy Service (FCS) is not responding properly due to some reasons.

- QuickBooks File copy service had a damage in it and it is not running properly.

- You do not have active payroll subscription.

- The updates are complete improperly.

- The latest file is blocked by the Anti-Virus.

- QuickBooks is not downloaded or installed properly on this system

- The window registry is corrupted.

- The system is affected by the viruses or malware.

- The QuickBooks files are deleted mistakenly by the other program.

Symptoms for QuickBooks Payroll Error 15243

The following are the some symptoms of QuickBooks Error 15243:

- The active window crashes frequently.

- The error message appears on the screen in front of you.

- Window is performing sluggishly.

- Mouse and keyboards start running/working slowly.

- Computers hangs frequently means it start freezing after a few intervals of the time.

- Whenever the errors occur it crashes the active program window.

Procedure before Starting Troubleshooting Error 15243

There are two main steps which you have to perform before fixing the QuickBooks Error 15243.

Creating Backup of QuickBooks Company File

- Access the QuickBooks Software.

- Open the file menu.

- Click on the backup company.

- Now select to create local backup.

QuickBooks Desktop is updated

- Try to close the QuickBooks Application.

- Till the QuickBooks window appears you have to press the ctrl button for some time on the keyboard.

- Now move to the help button once the QuickBooks Window appears.

- Now select Updates QuickBooks desktop.

- Now click on the update QuickBooks desktop button.

- Choose the option in order to get updates.

- When the QuickBooks has updated then click the close button in order to close the window and update successfully.

Methods to Troubleshoot the QuickBooks Payroll Error 15243

Following are the methods of troubleshooting of QuickBooks Error 15243.

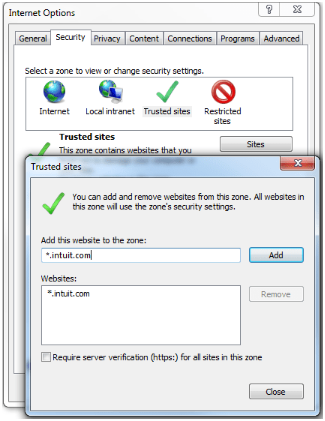

Method 1: Internet Explorer options are to be Edited

- Once you switch on your computer open the internet explorer on your system.

- Select the Gear icon visible on the screen.

- Now click on the internet options.

- Click on the security tab from the internet options.

- Now select the trusted webpage which are available.

- On the webpage in the address bar type the url of the website.

- In the address bar type “.intuit.com & .quicbooks.com” or you can also type “.quickbooks.ca&.intuit.ca”.

- Now close the option.

- Hit the button apply in order to apply changes.

- In last click on the OK button.

Method 2: QuickBooks Desktop is to be Repair

- In order to close all the QuickBooks programs which are running on the system you have to open task manager for it.

- Select all the applications from the menu which are starting with the “.qb, QuickBooks or intuit name“.

- Once you click all the task hit the end task button in order to close all the selected QuickBooks programs.

- In order to repair them press “E+Windows” button together on the keyboard.

- After pressing the keys computer windows open.

- Hit the computer tab if you are using window’s 8 on your system.

- Now from the options choose uninstall or change the program.

- Open the QB installation window in order to open it.

- Now hit the next button.

- Click on the repair radio button.

- Hit on the finish button in order to finish the program.

- Now restart your system.

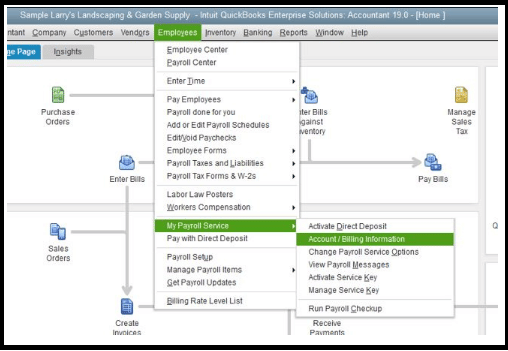

Method 3: Revalidate the Payroll Subscription

Follow the following steps:

- Open the QuickBooks Application on your system.

- Select for the employees tab.

- Click on my payroll service option.

- From the drop-down menu choose accounting/billing information.

- QuickBooks Payroll accounting maintenance page is open in front of your screen.

- Now close the QuickBooks Payroll accounting maintenance manually.

- The re-validation of the QuickBooks software needs the payroll subscription.

- Once the validation is completed successfully then you need to update software again.

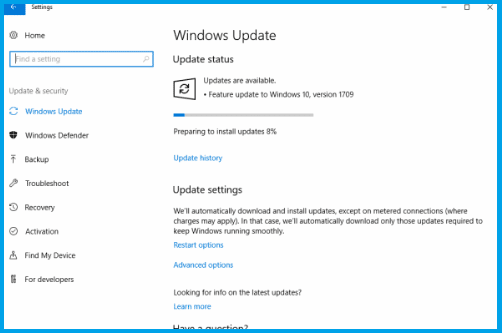

Method 4: Install the Available Window Update

Following are the steps to install window update

- Click on the start button of the window.

- In the search box type update and hit the enter button.

- On the display window updates dialog box will appear.

- Install the updates if the update is available.

Method 5: Repair QuickBooks FCS

Followings are the steps to be followed in order to repair QuickBooks File copy service.

- Open the run command by pressing the window.

- Press the R key stimulates Ly on the keyboard.

- In the open box type “service. MSc” and then hit the OK button.

- The list of services will be displayed on the screen in front of you.

- Find for the file name intuit QuickBooks FCS.

- From the Intuit QuickBooks FCS properties choose the manual option for the startup.

- Now hit the ok button.

- QuickBooks Payroll window will open.

Method 6: QuickBooks Tool Hub

QuickBooks provide the best feature that it provides tool hub with it. Tool hub is very helpful in solving various errors. Follow the following steps in order to run the QuickBooks tool hub.

- Open the QuickBooksToolHub.exe file which you downloaded previously.

- In order to install the tool follow the online instructions.

- Agree the term and conditions which are provide in it and asked by you while you are installing it.

- Double click on the tool hub icon in order to open it.

- After the QuickBooks Tool Hub is open then go to the program problems option.

- Now select Quick Fix my Program.

Method 7: Revalidate QuickBooks Payroll Service Key

Follow the following steps for revalidating service key of QuickBooks Payroll:

- Open the payroll service option from the drop-down menu of employees.

- Click on the activate service key button.

- In service key window highlight the current payroll and select to edit it.

- Now follow the instruction and click on OK button.

Method 8: Update Payroll Tax Table

Download the latest QuickBooks Payroll tax table so you can easily perform your task without any hurdles. Follow the following steps in order to download it.

- Open the QuickBooks Desktop.

- New select the employee’s option. Click on the get payroll updates from the drop-down menu of employees.

- Mark tick for the download entire update option.

- Now select to download latest payroll tax table.

- Now sit a side and for the message updated successfully.

Method 9: Remove Junk Files from the System

Follow the following steps to remove junk files from the system and disk clean up.

- Click on the start button.

- In the search area type command and search for it but don’t hit enter wait for it.

- Now from the keyboard press Ctrl+shift key together.

- Once the permission dialog box opens hit the enter key.

- The black screen will open Infront of you and the cursor will blink continuously.

- Now type clean mgr. and hit the enter key.

- The disk space will start calculating for the disk space.

- Check the temporary files in order to disk clean up.

- Now press OK.

Method 10: Install and uninstall QuickBooks

Following steps are involved in uninstalling and reinstalling of QuickBooks related to the error 15243.

For Windows 7

- Click on the start button and open the programs on the start.

- Select the control panel from the menu.

- Click on the programs.

- In the name column look for the QuickBooks update error 15243.

- Click on the QuickBooks associated entry.

- From the top menu of QuickBooks option click on the uninstall/change button.

- Follow on screen instruction in order to finish the error 15243 QuickBooks uninstallation.

For Windows 8

- Click on the start menu.

- Select the programs and features.

- In the name column look for the QuickBooks Error 15243.

- Now select the QuickBooks related entry.

- Click on the uninstall option from the menu.

- Now follow-on screen instruction in order to complete QuickBooks Uninstallation.

QuickBooks is the accounting software which is providing all around services without failing. The solutions are better explained for the better understanding.

Apply above mentioned steps in order to fix QuickBooks Payroll Update Error 15243. Sometimes it happens that the user is unable to resolve the error with the above-mentioned steps. In that case you require support in order to fix the issue. If you face any issues while performing steps then you can connect with Dancing Numbers experts via LIVE CHAT and get immediate assistance.

Looking for a professional expert to get the right assistance for your problems? Here, we have a team of professional and experienced team members to fix your technical, functional, data transfer, installation, update, upgrade, or data migrations errors. We are here at Dancing Numbers available to assist you with all your queries. To fix these queries you can get in touch with us via a toll-free number

+1-800-596-0806 or chat with experts.

How Can I Fix QuickBooks Payroll Error in Desktop?

The steps of fixing QuickBooks payroll are:

Select Help menu.

Select Help menu. Select the option about QuickBooks.

Select the option about QuickBooks. Now, from the keyboard press Ctrl+Alt+Y all together.

Now, from the keyboard press Ctrl+Alt+Y all together. Now click on the next button.

Now click on the next button. Select for the employees who are underpaid from the employee’s summary information window.

Select for the employees who are underpaid from the employee’s summary information window. Now double click on the employee’s name.

Now double click on the employee’s name. Review the YTD adjustment details.

Review the YTD adjustment details. Now hit enter.

Now hit enter.

Why I am not Able to Install QuickBooks Payroll Updates.

This error is cause by the file when some of the file is missing from your computer. It is a payroll updates issue which is caused by the Internet explorer misconfiguration or incorrect SSL.

How Can I Fix Payroll Error?

Steps for fixing Payroll Error are:

Cancel the payroll imminently.

Cancel the payroll imminently. Now make the updates of payroll and reprocess it.

Now make the updates of payroll and reprocess it. Open and run the additionally payroll with all the necessary adjustments for the affected employees.

Open and run the additionally payroll with all the necessary adjustments for the affected employees. Now make all the adjustment on the next payroll in order to counteract previous mistakes and get all balanced.

Now make all the adjustment on the next payroll in order to counteract previous mistakes and get all balanced.

Why My QuickBooks is is not Updating?

Firstly, restart your system and open QuickBooks Desktop again. Select the install update now option in order to install it.

What are the Steps to Update QuickBooks Desktop Payroll?

Following are the steps of QuickBooks desktop payroll updates.

Click on the employees tab.

Click on the employees tab. Now select get payroll updates option.

Now select get payroll updates option. Now select for the Download entire update.

Now select for the Download entire update. Click on the download latest update.

Click on the download latest update. Once the download is completed the window will appear automatically.

Once the download is completed the window will appear automatically.

What do You mean by Payroll Error or Discrepancy?

The difference between the What should be calculated and what is included on the employee’s paycheck.

How Can I Reset my QuickBooks Updates?

Steps to be followed are:

Open the QuickBooks desktop and go to the help menu.

Open the QuickBooks desktop and go to the help menu. Now from the help menu options select update QuickBooks Desktop.

Now from the help menu options select update QuickBooks Desktop. Now, go to the Update now option.

Now, go to the Update now option. Tick the reset update checkbox.

Tick the reset update checkbox.

How Can I Fix Error Code?

Following are the steps of fixing any error code:

First of all close your QuickBooks Application.

First of all close your QuickBooks Application. Download and install QuickBooks Tool Hub.

Download and install QuickBooks Tool Hub. Now open and run the download file (QuickBooksToolHub.exe) in order to install it.

Now open and run the download file (QuickBooksToolHub.exe) in order to install it. Follow the instruction as the system is asking you to do so.

Follow the instruction as the system is asking you to do so. Once the installing is finished then in your windows desktop open too hub.

Once the installing is finished then in your windows desktop open too hub. Select the problems of your program.

Select the problems of your program. Now click Quick Fix my program.

Now click Quick Fix my program.

How Can I Update QuickBooks Desktop Payroll?

You can update QuickBooks desktop payroll by downloading the latest tax table in QuickBooks Desktop:

Click on the employee’s tab.

Click on the employee’s tab. Select get payrolls updates from the options.

Select get payrolls updates from the options. Now select the entire downloaded update checkbox.

Now select the entire downloaded update checkbox. Click on the latest update download.

Click on the latest update download. Once the download is completed, the message flashes on the screen that download is successfully completed.

Once the download is completed, the message flashes on the screen that download is successfully completed.

How Can I Reactive QuickBooks Payroll?

The basic steps of the QuickBooks desktop payroll enhance are:

In the company file of QuickBooks Desktop, click on the employees tab.

In the company file of QuickBooks Desktop, click on the employees tab. Now select my payroll service from the employee’s tab options.

Now select my payroll service from the employee’s tab options. Select for the account or billing info.

Select for the account or billing info. Sign in yours intuit account with account ID and Password.

Sign in yours intuit account with account ID and Password. Choose Resubscribe under the status tab.

Choose Resubscribe under the status tab. Now follow the on-screen instructions in order to reactivate your payroll services.

Now follow the on-screen instructions in order to reactivate your payroll services.

+1-800-596-0806

+1-800-596-0806