QuickBooks has taken its rightful place as one of the most popular accounting software among the business community. More and more businesses and professionals are availing the amazing tools and features of this software to good effect and managing their accounting activities with utmost ease. However, one thing we can’t ignore is that no software can be completely free of errors or bugs and QuickBooks is no exception either. One of the most common issues the QuickBooks users face is the QuickBooks Error PS077 or PS032. You may also have faced this issue and needless to say that the same may have been quite frustrating at times. Any time the payroll tax table update is not successfully installed, the software throws the error message associated with this payroll error.

Related Post: What is QuickBooks Payroll Error PS058?

Dancing Numbers helps small businesses, entrepreneurs, and CPAs to do smart transferring of data to and from QuickBooks Desktop. Utilize import, export, and delete services of Dancing Numbers software.

You don’t need to worry though! You are just at the right place. Yes, we will tell you some easy ways to resolve this issue. Simply go through this blog and implement the steps mentioned herein.

First things first! let’s get to know what this issue is all about:

What is QuickBooks Payroll PS077 or PS032?

As we previously mentioned, these payroll issues frequently occur during the payroll update download and result in the following warning message:

| Payroll Update | [PS032] Your payroll setup files cannot be read by QuickBooks, After taking note of the message number at the start of this message, click Help to get troubleshooting advice on how to fix the issue. |

Users of QuickBooks often encounter this error code when they try to download any payroll update. Please note that the prefix PS in this error code indicates a payroll error.

The following error message could appear on your desktop when payroll error code PS077 occurs:

| QuickBooks: Problem having trouble installation payroll tax table update. | Error PS077 When Payroll Updates Are Downloaded The QuickBooks program is either not registered by the user or the company file is damaged or damaged. |

After finding such an error, you might be able to update the tax table, but you wouldn’t be able to complete the remaining tasks. Users should be informed that in QuickBooks, any error code beginning with the letter PS denotes a payroll issue of this kind. The signs and symptoms listed below should help one easily identify this error.

- It is possible that this problem will prevent you from downloading the payroll updates.

- The tax table failing to update or becoming stuck in the middle of the process is another indication of PS032 or PS077.

- This problem may be easily identified by an error message that appears on the screen.

- Another simple sign of these payroll issues is the system freezing up.

What are the Causes of QuickBooks Payroll Error PS077 or PS032?

Many functional and technical issues contribute to the occurrence of this issue. Some of these are mentioned below:

- If there is an invalid file in the components/payroll folder or if the tax table file is corrupted, you may encounter this issue.

- If there is damage or corruption to the QuickBooks company files.

- The fact that you are not logged into QuickBooks could be another factor.

- The billing details may be corrupt and out of date.

Important Key points to consider

It is important to analyse the major points that will affect the measures you take to find a solution before delving deeper. Together, let’s examine the following points:

- Before proceeding with the solution steps, you must verify that your QuickBooks payroll subscription is active.

- It will be your responsibility to confirm that the billing data entered into the payroll account is accurate and suitable.

- Another important activity that you will need to complete is updating the QuickBooks software to the latest version.

- Verify that the system has just one installed copy of QuickBooks.

- To prevent any issues, try fixing the QuickBooks desktop program in addition to that.

- It’s also advised to backup the QuickBooks company file.

Error PS032, PS077, and Valid Causes While Updating Payroll in QuickBooks

The cause of an error frequently determines how to fix it. Thus, this is a thorough breakdown of the reasons behind QuickBooks payroll issue PS077 or PS032, along with solutions. Let’s get started together:

Condition 1: Damaged or Corrupted Tax Table File

Note: You can only use this solution if you have a single version of QuickBooks.

Solution: Downloading QuickBooks and latest payroll tax tables

- You will need to uninstall both the extra installations and the current one down below.

- Proceed to the assistance menu and select “Update QuickBooks” after that.

- It’s also advised to reset the QuickBooks update.

- Download the latest payroll tax table in addition to that.

- To use the verify data, reorder the lists.

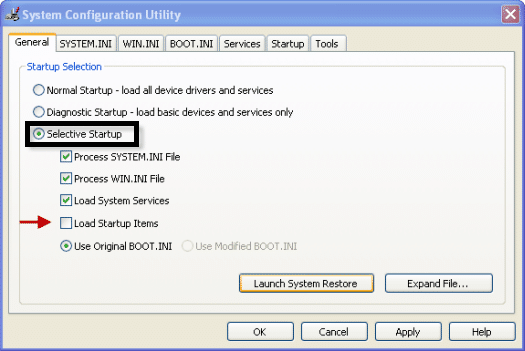

- Proceed by carrying out a clean uninstall, also in selective startup.

- Update the tax table last.

Condition 2: QuickBooks Company Files are Corrupted or Damaged

Solution: Running QuickBooks desktop software repair

This error may appear as a result of corrupted company files or as a result of a software malfunction. Under such situations, it is advised to attempt software repair. You are capable of performing the important required to launch the repair and resolve the software’s technical issues.

Condition 3: Billing details are out of date or incorrect

Solution: Note the billing information

Such an error can often be caused by entering inaccurate billing information, so it’s best to double-check that the billing information is accurate and relevant. Additionally, make a note of the QuickBooks license number by:

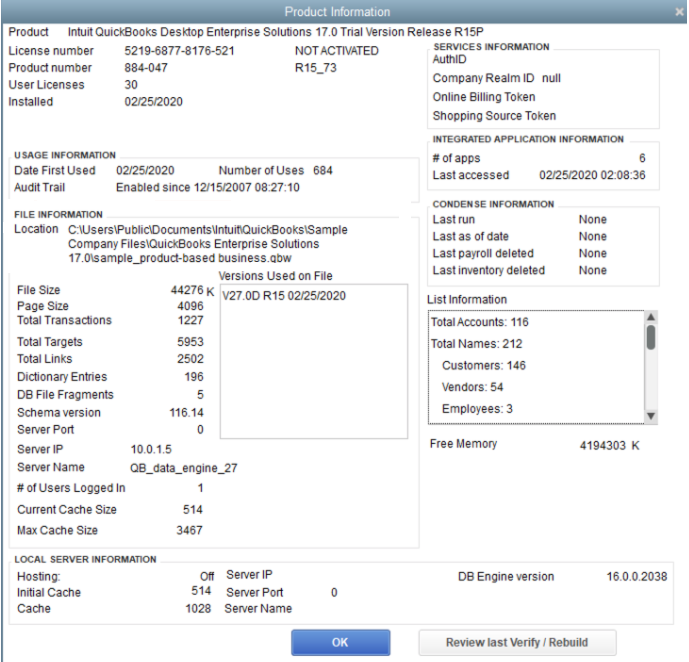

- You have to tap on the F2 key.

- Then you have to keep a note of the License number.

- Clicking the OK tab will close the product information window.

Various Solutions to QuickBooks Error PS077 or PS032: When Updating or Downloading Payroll

Here are a couple of options to fix the QuickBooks Error PS077 or PS032:

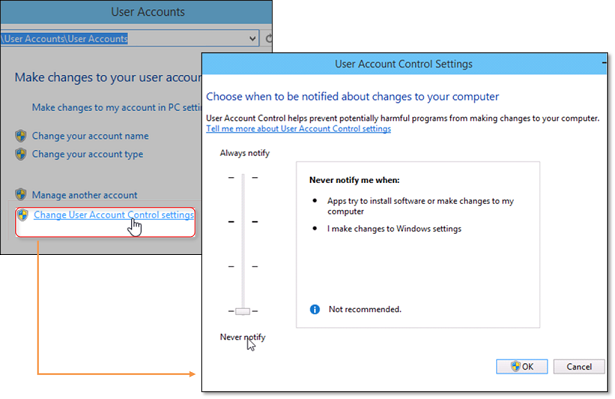

Solution 1: Turn off UAC

If you use Windows 7 or 8, disable the user account control (UAC) before updating the application.

Solutions 2: Verify Your QuickBooks License

- Log in to the Intuit account.

- Verify your QuickBooks License.

- Check if the most recent updates for the QuickBooks version has been installed in your system.

- Go to the Payroll service account information and check other details like the billing information dates.

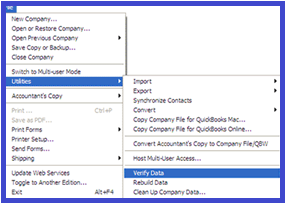

- Go to file.

- Click on utilities.

- Now check and / or create your QuickBooks data.

- If Windows 7 or 8 has been installed on your computer, you should temporarily disable the UAC(User account control).

- Try downloading the QB Payroll updates again

- Check if you are still getting the issue.

Soltuion 2: If You have Installed only One Version of QuickBooks Desktop

Here are the steps to follow

- Take a backup of all your QuickBooks company files.

- Shut down all the applications running in the background.

- Click on the Run Window.

For Windows Vista

- Click on Start

- Type Run on the command prompt

- Press Enter

For Windows 7 and XP

- Click Start, if you are not logging in as Admin

- Now click All Programs

- Click Accessories

- Click Run.

For Windows 8

- First of all, Go to the Window System section.

- Now click on Start

- Then right-click on background to All Apps

- Click on the Run option.

Soltuion 3: If You have Installed Multiple Versions of QuickBooks Desktop

- Firstly, remove all additional installations.

- Reset the QB update.

- Now download all the updated payroll tax tables.

- sort the lists again

- Click on the Verify Data/Rebuild Data process if you think it is necessary to rebuild the Data

- Finally, go to Selective Startup and carry out a clean Uninstall/Re-install.

Solutions 4: Download QuickBooks Payroll Update Again

- Logout from QuickBooks account.

- Now, close all the system windows. Have a check that none of the QuickBooks windows is open.

- Open Windows task manager to verify all the QB windows opened previously.

- Now, open QuickBooks.

- Download QuickBooks payroll updates once again.

- Check if you are still getting the issue. If so, do the following:

- Navigate to File

- Click on Utilities

- Click Repair QuickBooks

Both the remedies discussed above are pretty simple yet effective ones. You just need to provide a couple of minutes of your schedule and go through the procedure sequentially. If you are still not able to get rid of the QuickBooks Payroll Error PS077 or PS032, or, if you experience any difficulties in carrying out the above-mentioned steps, we would recommend you to speak to the experts.

Looking for a professional expert to get the right assistance for your problems? Here, we have a team of professional and experienced team members to fix your technical, functional, data transfer, installation, update, upgrade, or data migrations errors. We are here at Dancing Numbers available to assist you with all your queries. To fix these queries you can get in touch with us via a toll-free number

+1-800-596-0806 or chat with experts.

Frequently Asked Questions

How to Check if QuickBooks is Registered or Not?

Please execute the following steps:

Open the QuickBooks application

Open the QuickBooks application Press F2. The QuickBooks Product Information window will open up

Press F2. The QuickBooks Product Information window will open up Look towards the right of the product license number. You will see the registration number if the product is registered already.

Look towards the right of the product license number. You will see the registration number if the product is registered already.

Where can I find out the Version of QuickBooks I am using?

Start the QuickBooks Desktop.

Start the QuickBooks Desktop. Press F2 on your keyboard Or you may press Ctrl + 1 keys.

Press F2 on your keyboard Or you may press Ctrl + 1 keys. Navigate to the Product information window.

Navigate to the Product information window. Go to the file section. The version you have used will be displayed as shown below:

Go to the file section. The version you have used will be displayed as shown below:

What are the Steps to Perform if I want to update my QuickBooks software manually?

First, download the latest QB updates.

First, download the latest QB updates. close your company files.

close your company files. close the QuickBooks application.

close the QuickBooks application. Open the Windows Start menu.

Open the Windows Start menu. Search for the QuickBooks Desktop icon and right-click on it.

Search for the QuickBooks Desktop icon and right-click on it. Select the option Run as an Administrator.

Select the option Run as an Administrator. Visit the Help tab, go to No Company Open and select Update QuickBooks Desktop.

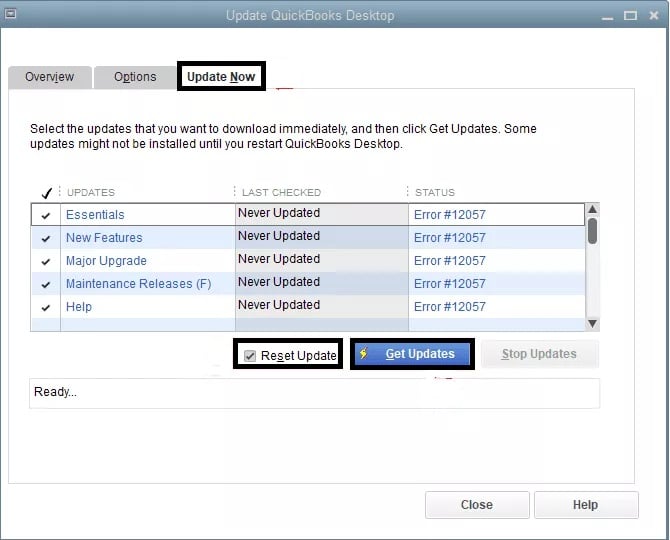

Visit the Help tab, go to No Company Open and select Update QuickBooks Desktop. Now, go to Options tab and select Mark All and Save.

Now, go to Options tab and select Mark All and Save. Then click the Update Now tab and then select the checkbox named Reset Update.

Then click the Update Now tab and then select the checkbox named Reset Update. Select the Get Updates tab when you are ready.

Select the Get Updates tab when you are ready. After the update finishes, restart QuickBooks Desktop.

After the update finishes, restart QuickBooks Desktop. To install the updates, select Yes.

To install the updates, select Yes. When the installation gets completed, restart your computer.

When the installation gets completed, restart your computer.

+1-800-596-0806

+1-800-596-0806